Bitcoin Halving

The Bitcoin halving is a programmed event in the Bitcoin protocol that reduces the rate at which new Bitcoins are created. This occurs approximately every four years, or every 210,000 blocks mined. It’s a crucial mechanism designed to control inflation and maintain the scarcity of Bitcoin.

Bitcoin Halving: A Supply Reduction Mechanism

The Bitcoin halving directly impacts the supply of Bitcoin by cutting the reward miners receive for successfully adding new blocks to the blockchain in half. Initially, miners received 50 BTC per block. After the first halving, this dropped to 25 BTC, then to 12.5 BTC, and currently stands at 6.25 BTC. The next halving in 2025 will reduce this reward further to 3.125 BTC. This controlled reduction in the rate of new Bitcoin creation is intended to mimic the scarcity of precious metals like gold, contributing to Bitcoin’s perceived value proposition.

Historical Halvings and Their Price Effects, When Is Bitcoin Halving In 2025

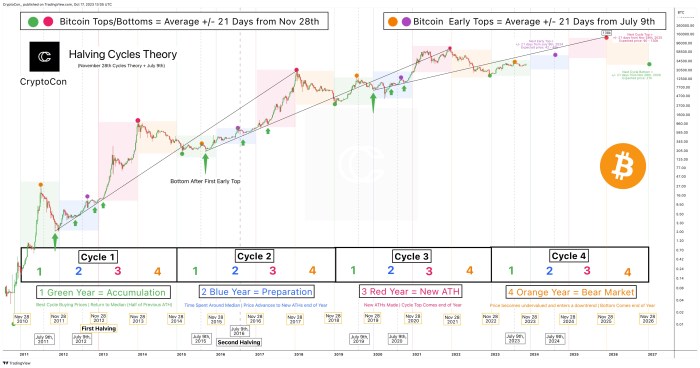

Bitcoin’s price has historically shown an upward trend following each halving event, although the time frame and magnitude of the price increase have varied. The first halving in November 2012 saw a price increase over the subsequent year. The second halving in July 2016 was followed by a significant price surge, culminating in the bull run of late 2017. The third halving in May 2020 was followed by another substantial price increase in 2021. It’s important to note that while these events correlate with price increases, they don’t guarantee it. Other factors, such as market sentiment, adoption rates, and regulatory developments, also play a crucial role in Bitcoin’s price fluctuations.

Comparing Past Halvings and Predicting the 2025 Event

While past performance is not indicative of future results, analyzing the previous halvings offers valuable insights. The time lag between the halving and the subsequent price surge has varied. Some suggest that the market anticipates the halving, leading to price increases before the event itself. Others argue that the reduced supply creates a scarcity that eventually drives up prices. The 2025 halving will likely be influenced by the prevailing macroeconomic conditions, the overall cryptocurrency market sentiment, and the level of institutional and retail adoption of Bitcoin. Predicting the exact outcome is challenging, but observing historical patterns and considering these external factors provides a framework for informed speculation.

Key Data Points from Past Bitcoin Halvings

| Date | Block Height | Price Before Halving (USD) | Price After Halving (USD) (approx. 1 year later) |

|---|---|---|---|

| November 28, 2012 | 210,000 | ~$13 | ~$100 |

| July 9, 2016 | 420,000 | ~$650 | ~$20,000 |

| May 11, 2020 | 630,000 | ~$8,700 | ~$64,000 |

Predicting the 2025 Bitcoin Halving Date

Predicting the exact date of the 2025 Bitcoin halving requires understanding the Bitcoin network’s block generation mechanism. The halving occurs approximately every four years, when the reward for mining a block is cut in half. This is determined by a target block time of approximately 10 minutes. However, achieving pinpoint accuracy is challenging due to inherent variability in the network’s hashing power.

Calculating the Halving Date Based on Block Generation Times

The Bitcoin protocol aims for a new block to be added to the blockchain roughly every 10 minutes. The halving event is triggered after a predetermined number of blocks have been mined (currently 210,000 blocks per halving cycle). By monitoring the average block time and extrapolating from the last halving, we can make a reasonable estimation. While precise calculation is impossible without knowing future network conditions, current data suggests a halving date around April 2025. However, this is merely an approximation, subject to change based on several factors. For instance, if the average block time consistently deviates from the target of 10 minutes, the halving date will shift accordingly. A faster block time would bring the halving forward, while a slower time would push it back.

Factors Affecting the Halving Date

Several factors can influence the precise timing of the Bitcoin halving. Firstly, the overall computational power (hash rate) of the Bitcoin network is a crucial determinant. A significant increase in hash rate could lead to faster block generation and an earlier halving. Conversely, a decrease in hash rate would result in a delayed halving. Secondly, any major changes to the Bitcoin protocol or significant network upgrades could potentially impact block generation times. Finally, unforeseen events like major security breaches or regulatory changes could indirectly affect mining activity and consequently the halving date. For example, the 2021 China mining crackdown led to a temporary reduction in the hash rate, illustrating the impact of external factors.

Challenges in Accurate Prediction

Accurately predicting the halving date is inherently difficult due to the stochastic nature of the Bitcoin network. The time it takes to mine a block is not perfectly consistent; it fluctuates based on the collective computing power of the miners. This variability introduces uncertainty into any prediction based on the average block time. Moreover, unexpected events, such as sudden changes in miner participation or technological advancements, can disrupt the predictable pattern of block generation. Therefore, any predicted date should be viewed as an educated guess rather than a definitive statement. Past halving predictions have shown discrepancies, underscoring the challenges involved.

Timeline of Anticipated Events Surrounding the 2025 Halving

The period leading up to and following the 2025 halving is anticipated to be a period of significant market activity. The months preceding the halving are likely to see increased speculation and volatility as investors position themselves for the anticipated event. The halving itself is expected to trigger a period of decreased supply of newly mined Bitcoin, potentially influencing its price. The months following the halving will likely witness a period of price consolidation and adjustment as the market reacts to the reduced supply and overall market sentiment. This timeline, however, is merely a projection and does not account for unpredictable market forces or external events. It’s important to remember that market behavior is complex and influenced by many factors beyond the halving event itself. Past halvings have shown varying market responses, highlighting the unpredictability of the cryptocurrency market.

Market Impact of the 2025 Halving

The 2025 Bitcoin halving, a pre-programmed event reducing the rate of new Bitcoin creation, is anticipated to significantly influence the cryptocurrency market. While past halvings have generally been followed by periods of price appreciation, the complexity of the market makes predicting the precise outcome challenging. Several factors, including macroeconomic conditions and overall investor sentiment, will play crucial roles in shaping the market’s response. This section explores the potential positive and negative impacts, price volatility implications, and potential manipulation strategies surrounding this significant event.

Potential Market Reactions to the 2025 Halving

The reduced supply of newly mined Bitcoin following the halving is often cited as a bullish factor. This decreased supply, coupled with sustained or increased demand, can theoretically push the price upwards. However, this is not guaranteed. Conversely, a negative market reaction could stem from various factors, including broader economic downturns, regulatory uncertainty, or a lack of sustained investor interest. The halving itself doesn’t guarantee price increases; it merely alters the supply dynamics, creating a potentially favorable environment for price appreciation, but not a certainty. The market’s reaction will depend heavily on concurrent market forces. For example, if the overall crypto market is already bearish due to external factors, the halving’s positive impact might be muted or even completely overshadowed.

Bitcoin Price Volatility Following the Halving

Historically, Bitcoin price volatility has increased around halving events. The anticipation leading up to the event often creates a period of heightened price swings, driven by speculation and trading activity. Post-halving, the price may experience further volatility as the market adjusts to the new supply dynamics. For instance, the 2012 halving saw a period of relative calm followed by a substantial price increase, while the 2016 halving was followed by a more gradual price appreciation. The 2020 halving, however, showed a more complex pattern with periods of both significant gains and substantial drops. This demonstrates the unpredictable nature of market reactions. The degree of volatility will depend on several intertwined factors including the strength of overall market sentiment, investor confidence, and the prevailing macroeconomic climate.

Potential Market Manipulation Strategies Around the Halving

The halving event presents opportunities for market manipulation. Sophisticated traders might attempt to artificially inflate or deflate the price through coordinated buying or selling strategies. This could involve the use of large-scale trading bots or coordinated actions among influential market participants. The inherent volatility surrounding the halving makes it a particularly attractive target for such manipulation attempts. Regulatory oversight and market transparency are crucial to mitigate these risks. For instance, large-scale wash trading or the creation of artificial scarcity through hoarding could significantly impact price discovery. Furthermore, the spread of misinformation or the manipulation of social media sentiment could also influence investor behavior and potentially trigger market manipulation.

Comparative Analysis of Market Response to Previous Halvings

Analyzing the market’s response to previous Bitcoin halvings provides valuable insights. The 2012 halving saw a gradual price increase following the event, while the 2016 halving led to a more prolonged period of price appreciation. The 2020 halving showed a more complex and less predictable price movement. Comparing these events reveals that while a general upward trend often follows, the timing and magnitude of price changes vary significantly. This underscores the importance of considering other factors beyond the halving itself when predicting market reactions. The differences in the market’s response highlight the evolving nature of the cryptocurrency market and the influence of external factors such as regulatory developments, technological advancements, and overall economic conditions. These differences illustrate the importance of considering a holistic view, rather than solely relying on the halving as a predictive factor.

Long-Term Implications of the Halving

The Bitcoin halving, a pre-programmed event reducing the rate of new Bitcoin creation, has profound long-term implications for the cryptocurrency’s scarcity, value, and overall position within the global financial system. Understanding these implications requires analyzing its impact on supply and demand dynamics, comparing it to past Bitcoin events, and assessing its potential to solidify Bitcoin’s role as a store of value.

The halving directly impacts Bitcoin’s scarcity by reducing the rate at which new coins enter circulation. This controlled inflation, built into Bitcoin’s protocol, is designed to mimic the scarcity of precious metals like gold. As the supply growth slows, assuming demand remains relatively constant or increases, the price is expected to rise due to fundamental economic principles. This effect is amplified by the belief that Bitcoin’s fixed supply of 21 million coins will create a deflationary pressure over time. The reduced supply, therefore, acts as a powerful catalyst, potentially driving long-term price appreciation.

Bitcoin’s Position in the Broader Financial Landscape

The halving’s impact on Bitcoin’s position within the broader financial landscape is multifaceted. A sustained price increase following a halving could attract further institutional investment, increasing Bitcoin’s legitimacy and acceptance as an asset class. This increased institutional participation could, in turn, lead to greater integration with existing financial systems, potentially paving the way for Bitcoin-based financial products and services. Conversely, a lack of significant price movement after a halving might temporarily dampen enthusiasm and hinder broader adoption. However, the long-term scarcity inherent in Bitcoin’s design remains a significant factor, irrespective of short-term price fluctuations. The 2012 and 2016 halvings, for example, were followed by significant price increases, albeit with periods of volatility, ultimately contributing to Bitcoin’s growing prominence.

Comparison with Past Events

The 2012 and 2016 halvings serve as crucial case studies for assessing the long-term implications of the 2025 event. Both previous halvings were followed by substantial price increases, though the timing and magnitude of these increases varied. The 2012 halving led to a gradual price appreciation, while the 2016 halving saw a more pronounced surge. These differences highlight the complex interplay of various factors, including macroeconomic conditions, regulatory developments, and overall market sentiment, which influence Bitcoin’s price trajectory beyond the direct impact of the halving itself. Analyzing these past events provides valuable insights but doesn’t guarantee a similar outcome in 2025, underscoring the inherent uncertainty in predicting cryptocurrency markets.

Bitcoin as a Store of Value

The halving significantly contributes to Bitcoin’s potential as a store of value. Its deflationary nature, coupled with its limited supply, makes it an attractive alternative to traditional fiat currencies prone to inflation. The scarcity created by the halving reinforces Bitcoin’s appeal to investors seeking to hedge against inflation and preserve their purchasing power. This is analogous to gold, a traditional store of value whose scarcity drives its price. The long-term effect of successive halvings is a progressively decreasing rate of new Bitcoin entering circulation, further strengthening its position as a potentially scarce and valuable asset over the long term. Increased adoption as a store of value will likely depend on factors like regulatory clarity, wider institutional acceptance, and the continued stability of the Bitcoin network.

The Role of Mining in the Halving

Bitcoin mining plays a crucial role in securing the network and processing transactions. The halving event, which reduces the block reward paid to miners, directly impacts their profitability and, consequently, their operations. Understanding this relationship is key to anticipating potential shifts in the Bitcoin ecosystem.

The halving mechanism directly affects Bitcoin miners by reducing the amount of newly minted Bitcoin they receive as a reward for successfully adding blocks to the blockchain. Before the halving, miners are rewarded with a certain number of Bitcoins for each block they mine. After the halving, this reward is cut in half. This reduction in block reward significantly alters the economics of mining, impacting profitability and potentially influencing the overall hash rate of the network.

Impact of Halving on Mining Profitability

The halving’s effect on profitability is multifaceted. The immediate impact is a decrease in revenue per block mined. Miners must then consider whether their operational costs—including electricity, hardware maintenance, and facility expenses—remain sustainable given the reduced income. If the price of Bitcoin doesn’t rise sufficiently to offset the reduced block reward, many miners might find their operations unprofitable, leading to a potential reduction in the overall mining activity. This could be mitigated, however, by increased efficiency in mining operations or a rise in the price of Bitcoin. For example, the 2021 halving saw a period of reduced profitability initially, but the subsequent rise in Bitcoin’s price ultimately helped sustain mining operations.

Potential Changes in Mining Strategies Following the Halving

Following a halving, miners may adopt various strategies to maintain profitability. These strategies could include upgrading to more energy-efficient mining hardware, consolidating mining operations to reduce overhead costs, or diversifying revenue streams. Some miners might choose to relocate to regions with lower electricity costs, while others might explore alternative mining pools or algorithms. The adoption of these strategies will depend on the individual circumstances of each miner and the overall market conditions. For instance, some larger mining operations might be better positioned to weather the reduced profitability due to economies of scale, while smaller operations may be forced to shut down or consolidate.

Relationship Between Block Rewards, Mining Difficulty, and the Halving

The halving’s impact is interconnected with mining difficulty and block rewards. A flowchart can effectively illustrate this relationship:

“`

[Start] –> [Block Reward Halved] –> [Reduced Miner Revenue] –> [Potential Decrease in Hash Rate] –> [Mining Difficulty Adjustment (Potential Decrease)] –> [Network Security Assessment] –> [Potential Increase in Bitcoin Price (Market Driven)] –> [Increased Miner Profitability (Potential)] –> [Increased Mining Activity (Potential)] –> [Mining Difficulty Adjustment (Potential Increase)] –> [Cycle Repeats]

“`

This flowchart demonstrates the cyclical nature of the relationship. The halving initiates a chain reaction affecting mining revenue, hash rate, mining difficulty, and ultimately, the price of Bitcoin. The adjustments in mining difficulty are an inherent feature of the Bitcoin protocol designed to maintain a consistent block generation time, approximately 10 minutes. The difficulty automatically adjusts to ensure this, regardless of the number of miners participating in the network. Therefore, while a halving might initially reduce the hash rate, the network’s difficulty will adjust to compensate, maintaining network security.

Frequently Asked Questions (FAQs): When Is Bitcoin Halving In 2025

This section addresses common queries regarding the 2025 Bitcoin halving, covering its expected date, price impact, investment risks, and effects on mining profitability. Understanding these aspects is crucial for navigating the cryptocurrency market effectively around this significant event.

Expected Date of the Next Bitcoin Halving

The next Bitcoin halving is expected to occur sometime in April 2025. The precise date depends on the exact block time, which can fluctuate slightly. However, based on historical data and current block generation rates, April 2025 is the strongly anticipated timeframe.

Bitcoin Halving’s Effect on Price

The Bitcoin halving historically correlates with an increase in Bitcoin’s price. This is because the halving reduces the rate of new Bitcoin entering circulation, potentially creating scarcity and driving up demand. However, it’s important to note that the price effect isn’t immediate or guaranteed. Market sentiment, regulatory changes, and broader economic factors also significantly influence Bitcoin’s price. For example, the halving in 2020 saw a gradual price increase leading up to the event and a more substantial surge afterward, though the market later experienced a correction. The 2016 halving also saw a similar pattern, although the timing and magnitude of price movements vary considerably.

Potential Risks Associated with Investing in Bitcoin Around the Halving

Investing in Bitcoin around a halving carries inherent risks. Volatility is a primary concern; prices can fluctuate dramatically before, during, and after the event. Market manipulation and speculative bubbles are also potential risks, as heightened anticipation can lead to inflated prices susceptible to sharp corrections. Furthermore, regulatory uncertainty and the inherent volatility of cryptocurrencies in general remain significant factors to consider. Investors should be prepared for potential losses and only invest what they can afford to lose. The 2012 halving, for instance, saw a period of relative price stability following the event, but this is not a guaranteed outcome.

Halving’s Impact on Bitcoin Mining Profitability

The Bitcoin halving directly impacts mining profitability. The halving cuts the reward miners receive for successfully validating transactions in half. This reduction necessitates either a rise in Bitcoin’s price to maintain profitability or increased mining efficiency through upgrades to hardware and optimization of operations. Miners with high operational costs might become unprofitable and exit the market, potentially leading to a consolidation of the mining industry. Conversely, efficient miners with low operational costs can benefit from reduced competition. The 2020 halving, for example, saw a period of increased mining difficulty and reduced profitability for some miners, leading to some industry consolidation.

Illustrative Example: Bitcoin Halving Impact on Price

Predicting the precise impact of a Bitcoin halving on its price is inherently difficult due to the complex interplay of market forces. However, we can explore hypothetical scenarios to illustrate potential outcomes under different market conditions. These scenarios are for illustrative purposes only and should not be interpreted as financial advice.

The following examples consider the 2025 Bitcoin halving and its potential effects on price, assuming a simplified model that focuses solely on the halving’s impact on the supply of newly minted Bitcoin. Real-world effects are significantly more nuanced and influenced by a wider array of factors, including regulatory changes, macroeconomic conditions, technological advancements, and overall investor sentiment.

Bitcoin Price Response Under Varying Market Conditions

The impact of the 2025 halving on Bitcoin’s price will depend heavily on the prevailing market sentiment leading up to and following the event. Let’s consider three scenarios: a bullish market, a bearish market, and a neutral market.

- Bullish Market: Assume a period of sustained positive growth leading up to the halving. Increased demand and positive investor sentiment could drive prices significantly higher *before* the halving occurs. The halving itself, by reducing the rate of new Bitcoin entering circulation, could act as a catalyst, further accelerating the upward price movement. In this scenario, we might see a price increase from, say, $50,000 before the halving to $100,000 or more within a year post-halving. This surge would be fueled by both anticipation of the halving and the subsequent reduction in supply. The reduced supply creates a scarcity effect, driving up demand and price. This scenario mirrors the price action seen in the aftermath of previous halvings, though the magnitude of the price increase can vary considerably.

- Bearish Market: Conversely, imagine a prolonged period of bearish sentiment and declining prices before the halving. In this case, the halving might not immediately trigger a significant price increase. The reduced supply could act as a floor, preventing further drastic price drops, but the overall market sentiment might still outweigh the halving’s effect. The price might remain depressed for an extended period, perhaps even experiencing a slight dip immediately after the halving before slowly recovering. For example, if the price is at $25,000 before the halving, it might only reach $30,000-$35,000 a year later, reflecting the lack of bullish momentum.

- Neutral Market: A neutral market, characterized by relatively stable prices and moderate trading volume, would likely see a more muted response to the halving. The reduced supply could lead to a gradual price increase, but this increase would be less dramatic than in a bullish market. The price might slowly rise over time, possibly reaching a level slightly above the pre-halving price within a year. For instance, if the price is at $40,000 before the halving, it might reach $45,000-$50,000 within a year post-halving. This scenario demonstrates that the halving’s impact is less pronounced when market sentiment is neither strongly positive nor negative.

It is crucial to remember that these are highly simplified examples. The actual price movement will be influenced by numerous other factors beyond the scope of this illustration.

Visual Representation: Halving’s Effect on Supply

Understanding the impact of Bitcoin halvings on its circulating supply requires visualizing the cumulative effect over time. The following table illustrates the approximate cumulative supply of Bitcoin before and after each halving event, highlighting the decreasing rate of new Bitcoin entering circulation. Note that these figures are approximate and may vary slightly depending on the exact block time of each halving.

Cumulative Bitcoin Supply After Each Halving

| Halving Event | Approximate Date | Cumulative Supply Before Halving (approx.) | Cumulative Supply After Halving (approx.) |

|---|---|---|---|

| 1st Halving | November 28, 2012 | 10,500,000 BTC | 10,500,000 BTC (initially) |

| 2nd Halving | July 9, 2016 | 15,750,000 BTC | 15,750,000 BTC (initially) |

| 3rd Halving | May 11, 2020 | 17,850,000 BTC | 17,850,000 BTC (initially) |

| 4th Halving (Projected) | April 2024 | 18,900,000 BTC | 18,900,000 BTC (initially) |

| 5th Halving (Projected) | April 2028 | 19,450,000 BTC | 19,450,000 BTC (initially) |

The table shows a gradual increase in the total supply of Bitcoin over time, but importantly, the *rate* of increase slows significantly after each halving. This reduction in new Bitcoin entering circulation is a core element of Bitcoin’s deflationary monetary policy. The figures presented are approximations, as the exact block time of each halving and subsequent mining can vary.