When is the Next Bitcoin Halving?

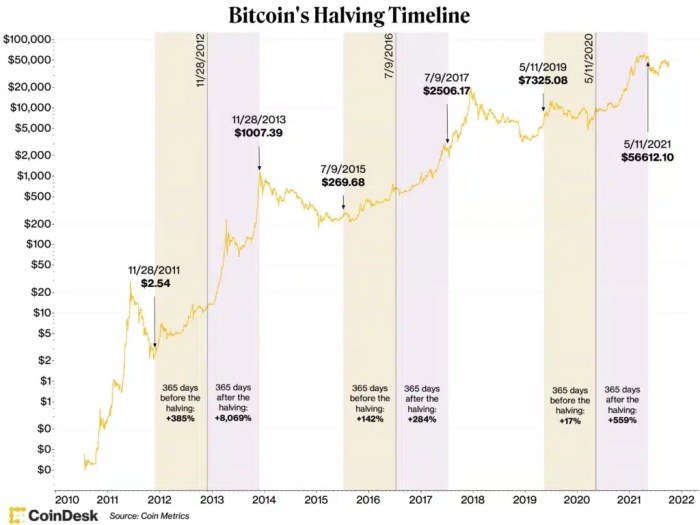

The Bitcoin halving is a programmed event in the Bitcoin protocol that reduces the rate at which new Bitcoins are created. This occurs approximately every four years, halving the block reward miners receive for verifying transactions and adding new blocks to the blockchain. This mechanism is designed to control inflation and maintain the scarcity of Bitcoin over time.

Bitcoin Halving Mechanism and Price Impact

The Bitcoin halving mechanism is integral to Bitcoin’s deflationary nature. Every 210,000 blocks mined, the reward paid to miners for successfully adding a block to the blockchain is cut in half. This directly impacts the supply of new Bitcoins entering circulation. Historically, halvings have been followed by periods of increased price volatility, often leading to significant price appreciation in the months and years following the event. This is largely attributed to the reduced supply coupled with consistent, or even increasing, demand. However, it’s crucial to remember that past performance is not indicative of future results. Many other factors influence Bitcoin’s price.

Precise Date of the Next Halving

Based on the consistent block time of approximately 10 minutes, and the predictable nature of the Bitcoin protocol, the next Bitcoin halving is expected to occur around April 2024. While the exact date can vary slightly due to fluctuations in block times, this timeframe is widely accepted within the cryptocurrency community and predicted by numerous blockchain explorers and analytical tools. This prediction is based on the publicly available and transparent nature of the Bitcoin blockchain.

Historical Bitcoin Price Performance Following Halvings

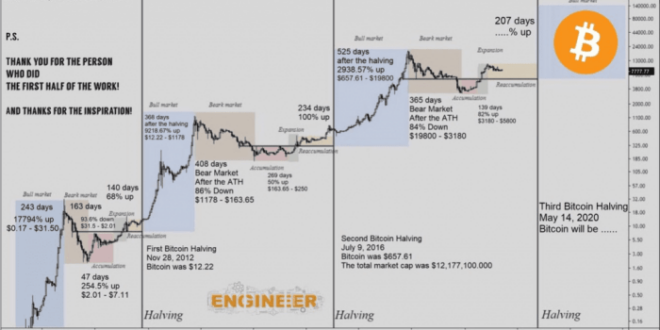

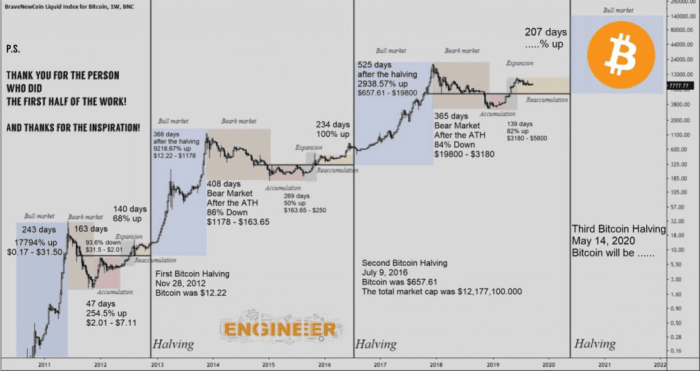

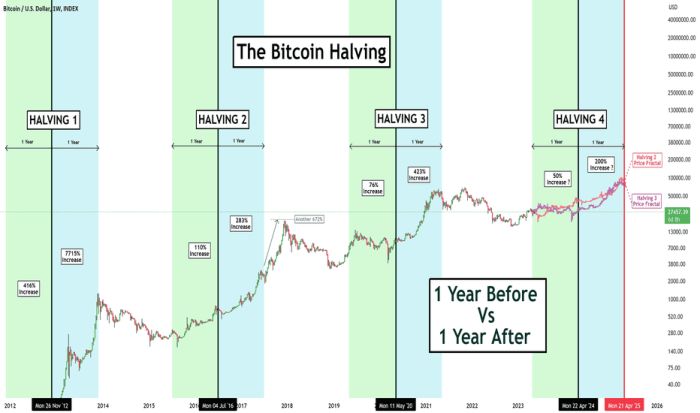

The previous three Bitcoin halvings have shown varying degrees of price appreciation following the event. While there’s no guarantee of a similar outcome in 2024, analyzing historical data offers valuable insight.

| Halving Date | Approximate Price Before Halving (USD) | Approximate Price 1 Year After Halving (USD) | Approximate Price Change (%) |

|---|---|---|---|

| November 2012 | ~13 | ~100 | ~669% |

| July 2016 | ~650 | ~4,000 | ~515% |

| May 2020 | ~8,700 | ~58,000 | ~567% |

*Note: These are approximate figures and may vary slightly depending on the data source and specific timeframes used. Prices are based on various reputable cryptocurrency exchange data.*

Factors Influencing Bitcoin’s Price After the 2024 Halving

Several factors beyond the halving itself could significantly impact Bitcoin’s price after April 2024. These include:

* Global macroeconomic conditions: Economic downturns or uncertainties can affect investor sentiment and the overall cryptocurrency market.

* Regulatory landscape: Changes in government regulations regarding cryptocurrencies could impact adoption and price.

* Technological advancements: Innovations in the Bitcoin ecosystem or the emergence of competing cryptocurrencies could influence demand.

* Adoption rates: Increased institutional and retail adoption can drive demand and price appreciation.

* Market sentiment: Overall investor sentiment towards Bitcoin plays a crucial role.

Long-Term Implications of the Halving on Bitcoin’s Scarcity and Value

The halving mechanism directly contributes to Bitcoin’s inherent scarcity. As the rate of new Bitcoin creation decreases, the total supply approaches its hard cap of 21 million coins. This scarcity, combined with increasing demand, is a fundamental driver of Bitcoin’s value proposition and long-term price potential. The halving reinforces this scarcity, making Bitcoin a potentially attractive asset for long-term investors. This scarcity is a key differentiator from fiat currencies, which are subject to inflationary pressures.

Understanding Bitcoin Halving’s Impact

Bitcoin halvings, events that reduce the rate at which new Bitcoins are created, have consistently generated significant discussion and speculation within the cryptocurrency community. Analyzing past halvings provides valuable insights into their potential impact on Bitcoin’s price and overall market dynamics. Understanding these impacts is crucial for informed participation in the Bitcoin ecosystem.

The effects of previous Bitcoin halvings on its price and market capitalization have been substantial, albeit complex and not always immediately apparent. While a direct causal link isn’t definitively proven, historical data suggests a strong correlation between halvings and subsequent price increases. However, the magnitude and timing of these price movements vary. External factors, such as regulatory changes, macroeconomic conditions, and overall market sentiment, significantly influence the price response to a halving event.

Bitcoin Halving’s Effect on Key Economic Indicators

Several key economic indicators are typically affected by Bitcoin halving events. These include, but are not limited to, Bitcoin’s price, its market capitalization, trading volume, miner revenue, and network hashrate. The reduction in new Bitcoin supply creates a scarcity effect, potentially driving up demand and, consequently, the price. However, the extent of this effect depends on the interplay of various market forces. For example, a decrease in miner revenue following a halving could potentially lead to a reduction in the network hashrate, if miners find it unprofitable to continue operating. Conversely, an increase in Bitcoin’s price can offset the reduced block reward, maintaining or even increasing the hashrate.

Supply and Demand Dynamics Post-Halving

The halving mechanism directly impacts the supply side of the Bitcoin equation. By reducing the rate of new Bitcoin creation, the halving inherently decreases the influx of new coins into the market. This reduced supply, coupled with relatively stable or increasing demand, often leads to upward pressure on the price. However, demand is not guaranteed to remain constant or increase. Bearish market sentiment, regulatory uncertainty, or competing investment opportunities can all offset the impact of reduced supply. The interplay between supply and demand remains the primary determinant of Bitcoin’s price fluctuations after a halving.

Timeline of Events Surrounding Previous Halvings

To illustrate the typical events surrounding previous Bitcoin halvings, let’s consider a generalized timeline:

- Pre-Halving (6-12 months): Anticipation builds, leading to increased speculation and price volatility. The market often experiences a period of price appreciation in the lead-up to the event.

- Halving Event: The halving occurs, marking a significant reduction in the block reward received by Bitcoin miners.

- Post-Halving (3-6 months): Initial price reaction can be mixed, with potential short-term corrections. However, a longer-term upward trend often emerges as the reduced supply starts to exert its influence.

- Post-Halving (6-18 months): The impact of the reduced supply becomes more pronounced, potentially leading to substantial price increases. This period often sees increased market activity and investor interest.

- Post-Halving (Beyond 18 months): The long-term effects of the halving are realized, although external factors continue to play a significant role in shaping Bitcoin’s price trajectory.

Visual Representation of Halvings and Price Fluctuations

Imagine a graph with time on the x-axis and Bitcoin price on the y-axis. Three distinct points on the x-axis represent the three previous halving events. At each of these points, you’d see a sharp drop in the slope of the supply curve (a curve depicting the amount of Bitcoin entering the market over time), representing the sudden reduction in the rate of new Bitcoin creation. Following each halving point, the graph would generally show a gradual increase in the Bitcoin price over time, though the rate of increase varies. The graph wouldn’t show a perfectly linear increase; it would feature periods of volatility and price corrections, reflecting the influence of market sentiment and other external factors. The overall trend, however, would illustrate a positive correlation between halving events and long-term price appreciation.

Factors Affecting Bitcoin’s Price Post-Halving: When Is Next Bitcoin Halving 2025

The Bitcoin halving, a programmed reduction in the rate of new Bitcoin creation, is a significant event that historically has preceded periods of price volatility. However, the price movement after a halving isn’t solely determined by the reduced supply; numerous other factors play crucial roles in shaping Bitcoin’s price trajectory. Understanding these interconnected influences is key to navigating the post-halving market landscape.

Regulatory Changes Influence on Bitcoin’s Price

Regulatory clarity and changes significantly impact investor confidence and market participation. Favorable regulations, such as clear guidelines on Bitcoin’s legal status and taxation, can attract institutional investment and boost price. Conversely, stricter regulations or outright bans can lead to price declines due to reduced accessibility and increased uncertainty. For instance, the fluctuating regulatory landscape in various countries has historically demonstrated a direct correlation between regulatory clarity and Bitcoin’s price performance. A clear regulatory framework in a major market like the United States could potentially drive significant price increases, while uncertainty or restrictive measures in other jurisdictions could cause temporary dips.

Institutional Investment’s Role in Shaping Bitcoin’s Price

The involvement of institutional investors, such as large corporations, hedge funds, and pension funds, has become increasingly important in Bitcoin’s price dynamics. Their substantial capital inflows can create significant upward pressure on the price. Conversely, large-scale institutional selling can trigger considerable price corrections. For example, the entry of MicroStrategy and Tesla into the Bitcoin market significantly influenced price increases. Their actions signal a shift in perception from a speculative asset to a potential store of value for institutional portfolios. However, future institutional selling could potentially lead to price volatility.

Market Sentiment and News Events’ Impact on Bitcoin’s Price

Market sentiment, driven by news events, media coverage, and overall investor psychology, significantly impacts Bitcoin’s price. Positive news, such as adoption by major companies or positive regulatory developments, tends to boost investor confidence and drive prices up. Conversely, negative news, such as security breaches or regulatory crackdowns, can trigger sell-offs and price drops. The 2021 bull run, for example, was fueled by positive media coverage and growing institutional adoption, while the subsequent market correction was partially attributed to regulatory concerns and negative news cycles.

Technological Advancements Impact on Bitcoin’s Value

Technological advancements within the Bitcoin ecosystem, such as improvements in scalability, security, and transaction speed, can have a positive impact on Bitcoin’s long-term value. Increased efficiency and reduced transaction costs make Bitcoin more attractive to both individual and institutional investors. The ongoing development of the Lightning Network, for example, aims to address scalability issues and improve transaction speed, which could potentially increase Bitcoin’s adoption and value. Conversely, significant technological setbacks or vulnerabilities could negatively impact investor confidence and price.

Correlation Between Bitcoin Halving and the Overall Cryptocurrency Market

While Bitcoin halvings have historically been associated with price increases, the correlation between the halving and the overall cryptocurrency market is not always direct or immediate. While Bitcoin often leads the market, other cryptocurrencies can experience independent price fluctuations based on their own specific factors. For example, the 2020 halving saw a period of price increase for Bitcoin, but the broader cryptocurrency market experienced varied responses, with some altcoins outperforming Bitcoin and others lagging behind. The impact on the overall market is therefore complex and not entirely predictable.

Predicting Bitcoin’s Price After the 2025 Halving

Predicting the price of Bitcoin, or any cryptocurrency for that matter, after the 2025 halving is inherently fraught with uncertainty. Numerous factors influence Bitcoin’s price, making accurate prediction exceptionally challenging. While historical data and various models can offer insights, they cannot definitively predict future price movements. The cryptocurrency market is notoriously volatile and susceptible to unexpected events.

Limitations of Price Prediction and Inherent Risks

The cryptocurrency market is characterized by high volatility and susceptibility to speculative bubbles. Past performance is not indicative of future results, a crucial caveat when considering price predictions. External factors, such as regulatory changes, macroeconomic conditions, and technological advancements, can significantly impact Bitcoin’s price, often in unpredictable ways. Investing in Bitcoin carries significant risk, and potential losses can be substantial. No model can perfectly account for the unpredictable nature of market sentiment and unforeseen events. For example, the 2022 cryptocurrency market crash demonstrated the fragility of even seemingly established market trends.

Bitcoin Price Prediction Models and Their Accuracy, When Is Next Bitcoin Halving 2025

Various models attempt to predict Bitcoin’s price, each with its limitations. These include technical analysis, which studies price charts and trading volume to identify patterns; fundamental analysis, which examines factors like Bitcoin’s adoption rate and network security; and quantitative models, which utilize statistical methods and algorithms to forecast price movements. However, the accuracy of these models varies significantly, and none guarantee precise predictions. For instance, a technical analysis model might predict a price surge based on historical price patterns, but this prediction could be invalidated by a sudden regulatory crackdown or a major security breach. The inherent complexity and volatility of the cryptocurrency market make it difficult for any model to consistently provide accurate forecasts.

Hypothetical Price Outcomes After the 2025 Halving

Several scenarios are possible after the 2025 halving. A bullish scenario might see Bitcoin’s price significantly increase due to reduced supply and increased demand. For example, if institutional adoption accelerates and positive regulatory developments occur, the price could potentially reach $100,000 or more. Conversely, a bearish scenario could see the price remain relatively flat or even decline, especially if negative macroeconomic conditions prevail or if investor sentiment turns negative. A more moderate scenario might see a gradual price increase, reflecting a balance between supply and demand dynamics. It’s crucial to remember that these are hypothetical scenarios, and the actual outcome could be significantly different.

Expert and Analyst Viewpoints on the 2025 Halving

Experts and analysts hold diverse opinions on the 2025 halving’s impact. Some are bullish, anticipating a significant price surge due to the reduced supply of new Bitcoin. Others are more cautious, highlighting the importance of macroeconomic factors and potential regulatory risks. The divergence in opinions underscores the uncertainty surrounding Bitcoin’s future price. For example, some analysts point to the historical correlation between Bitcoin halvings and subsequent price increases, while others argue that this correlation may not hold in the future due to changing market dynamics. This diversity of viewpoints reflects the complexity of predicting future market behavior.

Risks and Opportunities Associated with Investing Around the 2025 Halving

Investing in Bitcoin around the 2025 halving presents both significant risks and opportunities. The potential for substantial price appreciation is a major draw, but the possibility of significant losses also exists. Investors should carefully assess their risk tolerance and diversify their portfolios accordingly. Opportunities include capitalizing on potential price increases, but risks include market volatility, regulatory uncertainty, and the potential for unforeseen events to negatively impact Bitcoin’s price. Thorough due diligence and a well-defined investment strategy are crucial for navigating the uncertainties surrounding the 2025 halving.

Frequently Asked Questions (FAQ)

This section addresses common queries surrounding Bitcoin halving, providing clarity on its mechanics, impact, and implications for investors. Understanding these points is crucial for navigating the complexities of Bitcoin’s cyclical nature and its potential future price movements.

Bitcoin Halving Explained

A Bitcoin halving is a programmed event in the Bitcoin protocol that reduces the rate at which new Bitcoins are created (mined) by half. This occurs approximately every four years, or every 210,000 blocks mined. The halving is designed to control inflation and maintain Bitcoin’s scarcity, a key element of its value proposition. Essentially, miners receive fewer bitcoins as a reward for verifying transactions on the blockchain.

Timing of the Next Bitcoin Halving

The next Bitcoin halving is projected to occur in early April 2024. The exact date is determined by the time it takes for miners to add 210,000 blocks to the blockchain, a process that is influenced by the computational power (hash rate) dedicated to mining. While an approximate date can be predicted, the precise date can only be confirmed shortly before the event itself.

Bitcoin Halving’s Effect on Price

Historically, Bitcoin halvings have been followed by periods of significant price appreciation. The halvings in 2012, 2016, and 2020 all preceded substantial bull markets. This is often attributed to the reduced supply of new Bitcoins entering the market, creating a potential scarcity effect that drives demand. However, it’s crucial to remember that other factors, such as macroeconomic conditions and regulatory changes, also significantly influence Bitcoin’s price. For example, the 2020 halving was followed by a significant bull run, but other factors like increased institutional adoption also contributed.

Investing in Bitcoin Before a Halving

Investing in Bitcoin before a halving presents both risks and rewards. The potential for significant price increases is a compelling incentive, as seen in the historical data. However, it’s crucial to understand that the cryptocurrency market is highly volatile, and prices can fluctuate dramatically. Investing only what you can afford to lose is paramount. Moreover, the price increase isn’t guaranteed; numerous other factors can impact the market, potentially negating any halving-related price increase. Thorough research and risk assessment are crucial before making any investment decisions.

Long-Term Implications of Bitcoin Halving

The long-term impact of Bitcoin halvings is primarily focused on increasing its scarcity. As the rate of new Bitcoin creation decreases, the overall supply remains limited (capped at 21 million). This inherent scarcity is a fundamental aspect of Bitcoin’s value proposition, contributing to its potential as a store of value. Over time, as demand continues to grow and supply remains constrained, this scarcity could theoretically drive Bitcoin’s price upwards. However, the actual impact will depend on various factors including technological advancements, regulatory frameworks, and overall market sentiment.