Impact Beyond Price

The 2025 Bitcoin halving, while often discussed in terms of its potential price impact, will have far-reaching consequences extending beyond simple market fluctuations. Understanding these broader effects is crucial for a comprehensive assessment of the event’s significance for the Bitcoin ecosystem and its future. The reduction in new Bitcoin issuance will trigger a cascade of effects across various aspects of the network, influencing mining operations, network security, and overall investor sentiment.

The halving’s impact on Bitcoin mining profitability and hashrate is significant. A halving reduces the reward miners receive for successfully adding blocks to the blockchain. This directly impacts their profitability, potentially leading to a shakeout within the mining industry. Less profitable miners may be forced to shut down operations, leading to a decrease in the network’s hashrate – the computational power securing the blockchain. However, the extent of this decrease is debated, with some arguing that more efficient miners will remain, offsetting any significant drop. Past halvings have shown a temporary dip in hashrate followed by a recovery and often even an increase, driven by technological advancements and the anticipation of future price appreciation.

Mining Profitability and Hashrate

The halving will undoubtedly affect mining profitability. The reduced block reward means miners need to generate more revenue from transaction fees to maintain profitability. This could lead to increased competition and consolidation within the mining industry, with larger, more efficient mining operations potentially gaining market share at the expense of smaller players. The hashrate, a key indicator of network security, might experience a temporary decline, but historical data suggests a subsequent recovery, often exceeding pre-halving levels due to technological advancements and market dynamics. For example, the 2020 halving saw an initial dip in hashrate, followed by a significant rebound and new all-time highs.

Network Security and Decentralization

A decrease in hashrate following the halving could, theoretically, reduce Bitcoin’s network security and potentially increase its vulnerability to 51% attacks. However, the resilience of the Bitcoin network and the high cost of acquiring the computational power necessary for a successful attack usually mitigate this risk. Moreover, the decentralization of Bitcoin’s mining operations across various geographic locations and mining pools contributes to its robustness. A more concentrated mining landscape post-halving might raise concerns about decentralization, but the long-term impact on this aspect remains uncertain and dependent on various factors, including technological innovation and the emergence of new mining regions.

Bitcoin Adoption and Investor Sentiment

The halving often acts as a catalyst for increased media attention and renewed interest in Bitcoin, potentially boosting adoption. The narrative surrounding scarcity and the predictable nature of the halving can influence investor sentiment, leading to increased demand and price appreciation. However, the impact on adoption is not solely dependent on the halving itself; other factors, such as regulatory developments, technological advancements, and overall macroeconomic conditions, also play a crucial role. Past halvings have generally been followed by periods of increased price volatility, but the long-term impact on adoption is less predictable and subject to market forces.

Impact Across Bitcoin Market Segments

The halving’s effects will vary across different segments of the Bitcoin market. For example, large-scale miners with access to cheap energy and efficient hardware may be better positioned to weather the reduction in block rewards, while smaller miners might struggle to remain profitable. Similarly, long-term holders (“HODLers”) might be less affected by short-term price fluctuations, while short-term traders might experience greater volatility. The impact on Bitcoin derivatives markets, such as futures and options, could also be significant, reflecting the changing dynamics of supply and demand. This segmentation emphasizes the need for a nuanced understanding of the halving’s implications, recognizing that the consequences will not be uniform across the entire ecosystem.

Preparing for the 2025 Bitcoin Halving: When Is The 2025 Bitcoin Halving

The 2025 Bitcoin halving, a significant event in the cryptocurrency’s lifecycle, presents both opportunities and challenges for investors. Understanding the potential impact and proactively preparing a strategy is crucial for navigating the volatility likely to ensue. This section Artikels actionable steps to help investors prepare for this event.

Actionable Steps for Investors

Preparing for the Bitcoin halving requires a multifaceted approach encompassing risk management, opportunity assessment, and strategic investment planning. Investors should consider a range of factors to optimize their portfolio and mitigate potential losses.

- Diversify your portfolio: Don’t put all your eggs in one basket. Diversification across different asset classes (including but not limited to Bitcoin, other cryptocurrencies, stocks, bonds, and real estate) can help cushion against significant losses in any single asset. A balanced portfolio is less susceptible to extreme market swings.

- Dollar-cost averaging (DCA): Instead of investing a lump sum, consider implementing a DCA strategy. This involves investing a fixed amount of money at regular intervals, regardless of price fluctuations. This reduces the risk of buying high and helps average out your purchase price over time.

- Develop a clear risk tolerance profile: Before making any investment decisions, it’s essential to define your risk tolerance. Are you comfortable with significant price volatility? Understanding your risk appetite will guide your investment choices and prevent impulsive decisions driven by fear or greed.

- Research and due diligence: Thoroughly research different investment strategies and Bitcoin’s historical performance around previous halving events. Analyze market trends and expert opinions to inform your decisions. This includes understanding the potential impact on mining profitability and network security.

- Secure your holdings: Prioritize the security of your Bitcoin holdings. Use secure hardware wallets and strong passwords to protect your investments from theft or loss. Consider spreading your holdings across multiple wallets for added security.

Managing Risk During Price Volatility, When Is The 2025 Bitcoin Halving

The period surrounding a Bitcoin halving is often characterized by heightened price volatility. Effective risk management strategies are essential to mitigate potential losses.

- Set stop-loss orders: Stop-loss orders automatically sell your Bitcoin if the price falls below a predetermined level, limiting potential losses. This strategy can help protect your investment from significant downturns.

- Avoid emotional decision-making: Market volatility can trigger emotional responses, leading to impulsive decisions. Stick to your investment plan and avoid making rash trades based on fear or speculation.

- Consider hedging strategies: Hedging involves using financial instruments to offset potential losses in one investment. For example, you might use options contracts to protect against a price drop in Bitcoin.

- Stay informed about market trends: Keep abreast of market news and developments to anticipate potential price fluctuations. This allows you to adjust your strategy as needed and react appropriately to changing market conditions.

- Regularly review and adjust your portfolio: Market conditions change, and your investment strategy should adapt accordingly. Regularly review your portfolio’s performance and make adjustments based on your risk tolerance and market trends.

Evaluating Potential Opportunities and Challenges

The Bitcoin halving presents both significant opportunities and potential challenges. A careful evaluation of these factors is crucial for informed decision-making.

When Is The 2025 Bitcoin Halving – The reduced supply of newly mined Bitcoin after the halving could potentially increase its scarcity and drive up demand, leading to price appreciation. However, the impact of a halving is not always immediate or guaranteed. Previous halvings have been followed by periods of both significant price increases and substantial price corrections. Furthermore, macroeconomic factors, regulatory changes, and overall market sentiment can significantly influence Bitcoin’s price.

Investment Approaches During the Halving

Different investment approaches can be employed during the lead-up to and after the halving. These strategies cater to varying risk tolerances and investment goals.

Some investors might choose to accumulate Bitcoin before the halving, anticipating a price increase. Others might adopt a wait-and-see approach, observing market trends before making significant investments. A third group might employ more sophisticated strategies, such as leveraging options or futures contracts to manage risk and capitalize on price fluctuations. The choice depends on individual circumstances and risk appetite. For instance, a long-term investor with a high risk tolerance might choose to accumulate more Bitcoin before the halving, while a more risk-averse investor might opt for a more conservative approach.

Frequently Asked Questions (FAQ)

The Bitcoin halving is a significant event in the cryptocurrency world, impacting both the supply and potential demand for Bitcoin. Understanding its implications is crucial for anyone involved in or considering investment in the cryptocurrency market. This section addresses common questions surrounding the 2025 halving.

The Significance of the Bitcoin Halving

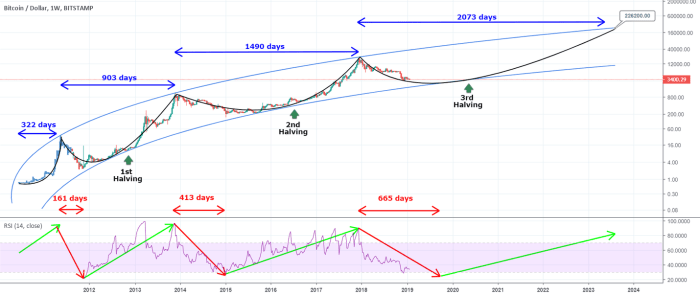

The Bitcoin halving is a programmed event in the Bitcoin protocol that reduces the rate at which new Bitcoins are created. This occurs approximately every four years, and it’s designed to control inflation by gradually decreasing the supply of new Bitcoin entering circulation. Historically, halvings have been followed by periods of significant price appreciation, although this is not guaranteed. The reduced supply, combined with continued (or increased) demand, can theoretically push the price higher.

The Timing of the 2025 Bitcoin Halving

While the exact date isn’t set in stone until the block height is reached, the 2025 Bitcoin halving is projected to occur in the Spring of 2025. The halving happens after a predetermined number of blocks are mined, and the timing depends on the rate at which miners successfully add new blocks to the blockchain. Minor variations around the predicted date are common.

The Halving’s Impact on Bitcoin’s Price

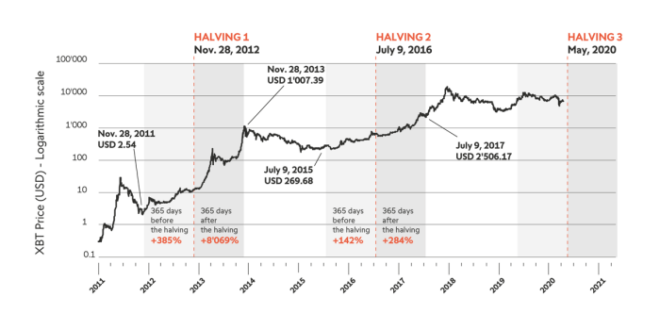

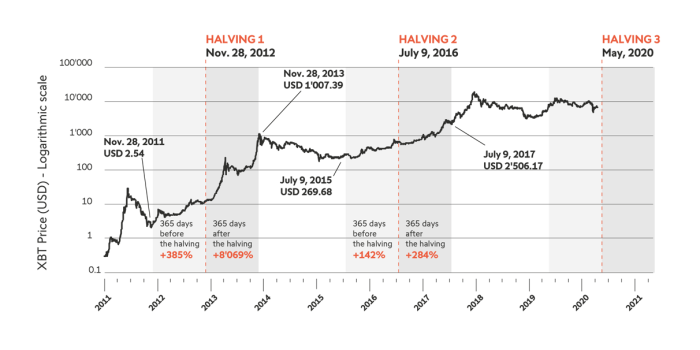

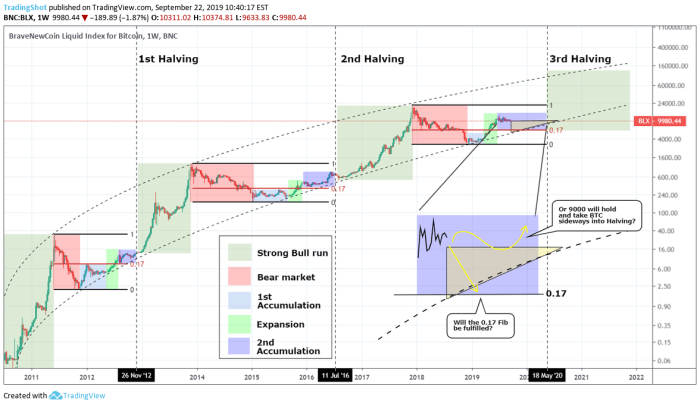

The impact of the halving on Bitcoin’s price is complex and unpredictable. Past halvings have been followed by substantial price increases, but this correlation doesn’t guarantee future performance. Several factors influence the price, including overall market sentiment, regulatory changes, technological advancements, and macroeconomic conditions. For example, the 2012 and 2016 halvings were followed by significant bull runs, but external factors also played a role in these price movements. Predicting the exact price impact of the 2025 halving is impossible.

Risks Associated with Investing Around the Halving

Investing in Bitcoin, especially around a halving event, carries inherent risks. Market volatility is expected to increase leading up to and following the halving. Price fluctuations can be dramatic, leading to potential significant losses. Furthermore, the cryptocurrency market is susceptible to manipulation and speculative bubbles. Regulatory uncertainty also adds to the risk profile. Investors should always conduct thorough research and understand the risks before investing any capital.

Strategies for Navigating Market Volatility

Several strategies can help mitigate the risks associated with Bitcoin’s price volatility around the halving. These include diversification of investment portfolios, dollar-cost averaging (investing a fixed amount regularly regardless of price), and employing stop-loss orders to limit potential losses. Thorough due diligence, understanding your risk tolerance, and having a long-term investment horizon can also improve your chances of navigating the market successfully. Remember that no strategy guarantees profit, and losses are a possibility.

Illustrative Examples and Data Visualization

Understanding the impact of Bitcoin halvings requires analyzing historical data and visualizing potential future scenarios. This section provides illustrative examples and data visualizations to aid in comprehension. While predicting future price movements is inherently speculative, analyzing past trends and considering various market factors can offer valuable insights.

Past Bitcoin Halving Metrics

The following table compares key metrics from previous Bitcoin halvings. Note that these figures are approximations and may vary slightly depending on the data source and methodology used. Price data reflects the price around the halving event and not necessarily the peak or trough prices in the following period.

| Halving Date | Price Before Halving (USD) | Price After Halving (USD) | % Change (approx.) |

|---|---|---|---|

| November 28, 2012 | $13 | ~$100 | ~669% |

| July 9, 2016 | ~$650 | ~$20,000 | ~3000% |

| May 11, 2020 | ~$8,700 | ~$64,000 | ~640% |

Predicted Bitcoin Price Trajectory

This chart depicts a hypothetical Bitcoin price trajectory leading up to and following the 2025 halving. It’s crucial to understand that this is a *prediction* based on historical trends and market analysis, not a guaranteed outcome. The chart would utilize a line graph. The X-axis represents time (months or years leading up to and following the 2025 halving), and the Y-axis represents the Bitcoin price in USD. The line would show a gradual price increase in the months leading up to the halving, driven by anticipation. Following the halving, the line would depict a potential sharp increase, followed by a period of consolidation or potential volatility before potentially resuming a longer-term upward trend. Different scenarios (bullish, bearish, neutral) could be overlaid on the same chart to illustrate the range of possible outcomes. The data used would be based on various price prediction models, including on-chain metrics, market sentiment analysis, and historical halving price patterns. Key price points (e.g., pre-halving price, predicted post-halving price range) would be clearly labeled.

Impact on Different Investor Profiles

Several hypothetical scenarios illustrate the potential impact of the 2025 halving on various investor profiles:

A long-term holder, invested since 2018, might experience significant gains due to the halving’s deflationary effect and sustained price appreciation. Their strategy, focused on long-term value growth, would likely benefit.

Conversely, a short-term trader, entering the market shortly before the halving, might face higher risk. If the anticipated price surge doesn’t materialize immediately, they could incur losses if they need to sell quickly. Their strategy relies on short-term price fluctuations, making them vulnerable to market volatility.

An investor with a medium-term strategy (holding for 1-2 years) could see moderate gains depending on the timing of their entry and exit. Their success would depend on accurately predicting the market’s reaction to the halving’s impact.

These are just illustrative examples; individual experiences will vary depending on the specific investment strategy, risk tolerance, and market conditions.