Long-Term Implications of the Halving

The Bitcoin halving, a pre-programmed event reducing the rate of newly minted Bitcoin by half, has significant long-term implications for the cryptocurrency’s scarcity, value, and overall adoption. Understanding these effects requires analyzing its impact on both the economic and social landscape surrounding Bitcoin.

Bitcoin’s Scarcity and Value

The halving directly impacts Bitcoin’s scarcity, a key driver of its value proposition. By reducing the supply of new Bitcoins entering circulation, each Bitcoin becomes relatively more scarce. This increased scarcity, coupled with potentially sustained or increasing demand, theoretically leads to a rise in price. Historical data suggests a correlation between halving events and subsequent price increases, although the magnitude and timing of these increases vary. For example, the halvings in 2012 and 2016 were followed by significant bull runs, though other market factors also played a role. The 2020 halving saw a less dramatic immediate price surge, highlighting the complex interplay of market forces beyond the halving itself. Predicting future price movements solely based on the halving is therefore unreliable, and it’s crucial to consider other macroeconomic factors.

Bitcoin Adoption and Store of Value

The halving contributes to Bitcoin’s positioning as a store of value. The predictable reduction in supply creates a sense of certainty and scarcity, attracting investors seeking to hedge against inflation or preserve wealth. Increased price appreciation, often following halvings, further reinforces this narrative. However, wider adoption depends on factors beyond price, including regulatory clarity, technological advancements, and the overall perception of Bitcoin’s utility and security. While the halving can be a catalyst for increased interest and investment, it doesn’t guarantee mass adoption on its own. Increased adoption, in turn, can create a positive feedback loop, further driving up demand and price.

Comparison with Other Cryptocurrencies

Unlike Bitcoin, many other cryptocurrencies don’t have a fixed halving schedule or a predetermined maximum supply. Some have no halving mechanism at all, while others might adjust their inflation rates differently. For instance, some cryptocurrencies utilize a burning mechanism, where a portion of the coins are permanently removed from circulation, leading to deflationary pressure. Others employ dynamic inflation rates that adjust based on network activity or other factors. The fixed, predictable nature of Bitcoin’s halving makes it unique among major cryptocurrencies and contributes to its perceived stability and long-term value proposition. The absence of a similar mechanism in many altcoins creates uncertainty and can impact their long-term price stability.

Bitcoin’s Deflationary Nature

Bitcoin’s deflationary nature is intrinsically linked to the halving. The finite supply of 21 million Bitcoins, combined with the halving mechanism, ensures that the rate of new Bitcoin creation steadily decreases over time. This controlled supply contrasts sharply with inflationary fiat currencies, where central banks can increase the money supply, potentially leading to currency devaluation. Bitcoin’s deflationary characteristics are seen by many as a hedge against inflation, making it an attractive asset in times of economic uncertainty. However, deflation can also have drawbacks, potentially slowing economic activity if individuals hoard Bitcoin rather than spending it. The long-term effects of Bitcoin’s deflationary nature are still subject to ongoing debate and research.

Frequently Asked Questions (FAQ): When Is The Bitcoin Halving 2025 Date

This section addresses common queries regarding the 2025 Bitcoin halving, providing clarity on its estimated date, price impact, potential differences from past halvings, and associated investment risks. Understanding these aspects is crucial for navigating the cryptocurrency market effectively.

Estimated Date for the 2025 Bitcoin Halving

The estimated date for the 2025 Bitcoin halving is around April 2025. This prediction is based on the Bitcoin protocol’s built-in halving mechanism, which reduces the block reward for miners approximately every four years. While the exact date can vary slightly due to block time fluctuations, April 2025 remains the most widely accepted projection among cryptocurrency analysts and tracking websites such as CoinGecko and CoinMarketCap. These predictions rely on the consistent average block time of approximately 10 minutes.

Bitcoin Halving’s Effect on Bitcoin Price

Historically, Bitcoin halvings have been followed by periods of significant price appreciation. The halving reduces the rate of new Bitcoin entering circulation, potentially creating a scarcity effect that drives up demand and price. The 2012 and 2016 halvings, for example, were followed by substantial price increases, though it’s important to note that other market factors also played a role. However, predicting the precise price impact of the 2025 halving is impossible, as various economic and geopolitical events can influence the market. It is crucial to remember that past performance is not indicative of future results.

Comparison of the 2025 Halving with Previous Halvings

While the core mechanism of the 2025 halving remains consistent with previous events—a reduction in the block reward—several factors might differentiate it. The increased institutional adoption of Bitcoin since the last halving could lead to a more pronounced price reaction. Furthermore, the overall macroeconomic environment and regulatory landscape significantly impact cryptocurrency markets, making it challenging to directly compare the 2025 halving with previous ones. The level of global adoption and the overall sentiment surrounding cryptocurrencies will also be influential factors.

Risks Associated with Investing in Bitcoin Around the Halving

Investing in Bitcoin around the halving carries inherent risks. Price volatility is a significant concern, as the market can experience sharp price swings before, during, and after the event. The anticipation of the halving can lead to speculative bubbles, resulting in potential price corrections. Furthermore, regulatory uncertainty and potential security breaches within exchanges or wallets remain significant risks. Investors should carefully assess their risk tolerance and conduct thorough due diligence before investing in Bitcoin, particularly during periods of heightened market activity.

Illustrative Examples

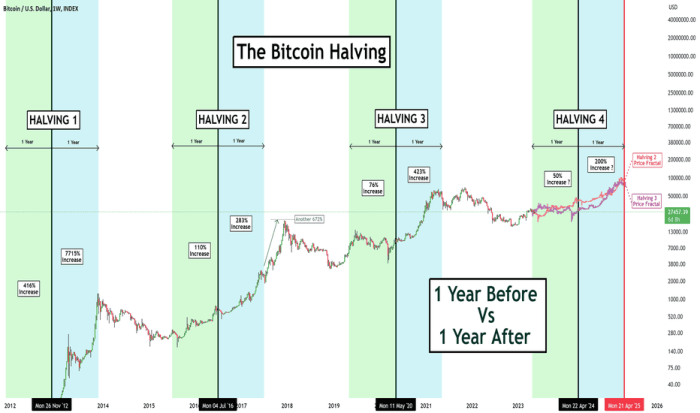

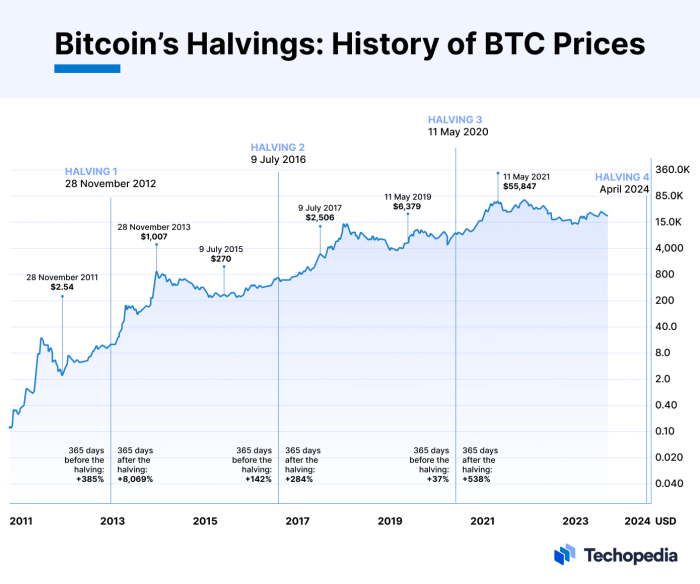

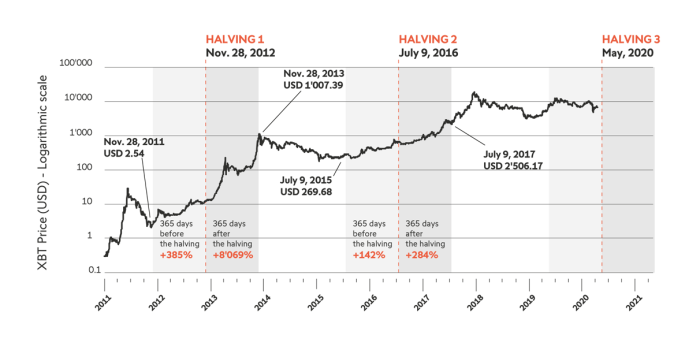

Visual representations of data can significantly enhance understanding of complex concepts like Bitcoin halving and its impact on price. Charts and infographics offer clear, concise summaries of historical trends and the mechanics of the halving process, making the information more accessible to a wider audience.

Using visual aids helps to contextualize the often-abstract nature of cryptocurrency economics and allows for a more intuitive grasp of the relationship between halving events and Bitcoin’s price trajectory. This section will describe two such visuals: a historical price chart and an infographic explaining the halving mechanism.

Bitcoin Price Around Previous Halving Events

This chart would depict the Bitcoin price over a period encompassing the three previous halving events (2012, 2016, and 2020). The x-axis would represent time, clearly marked with the halving dates and significant periods before and after each event. The y-axis would represent the Bitcoin price in US dollars, using a logarithmic scale to better visualize the large price fluctuations. Data points would be plotted for the Bitcoin price on a regular interval (e.g., monthly averages) to show the overall trend.

The chart would use a line graph, with different colored lines potentially representing the price leading up to, during, and after each halving event. Key price points, such as all-time highs and lows around each halving, would be highlighted. Vertical lines could mark the precise dates of the halvings themselves. A legend would clearly label each line and provide context for the data displayed. The overall aesthetic would be clean and uncluttered, focusing on clear data presentation. The chart aims to illustrate the historical correlation (not causation) between halving events and subsequent price movements, allowing for visual comparison across different halving cycles.

Infographic Explaining the Bitcoin Halving Process, When Is The Bitcoin Halving 2025 Date

This infographic would employ a visually engaging layout to explain the halving process in a simplified manner. The infographic would be divided into distinct sections, each addressing a key aspect of the halving.

The first section would introduce the concept of Bitcoin mining and the reward miners receive for verifying transactions and adding new blocks to the blockchain. This section might use an illustration depicting miners competing to solve complex cryptographic puzzles. The second section would explain the halving mechanism itself – the reduction of the block reward by half every 210,000 blocks. This could be represented with a simple diagram showing the halving schedule, perhaps visually representing the decreasing block rewards over time.

The third section would discuss the long-term implications of halving, focusing on the impact on inflation and the overall supply of Bitcoin. This section could include a comparison of Bitcoin’s supply with that of traditional currencies, highlighting Bitcoin’s scarcity. The final section could summarize the key takeaways and offer a concise explanation of why the halving is considered a significant event in the Bitcoin ecosystem. The infographic would use a combination of icons, text, and potentially short, captions to make the information easily digestible and visually appealing. A consistent color scheme and clear typography would ensure readability and visual coherence. The goal is to provide a quick, accessible understanding of the halving mechanism and its broader context.