Bitcoin Halving 2025: When Is The Halving Of Bitcoin 2025

The Bitcoin halving, a programmed event occurring approximately every four years, significantly reduces the rate at which new Bitcoins are created. This event has historically been associated with periods of increased price volatility and long-term price appreciation, making it a focal point for investors and analysts alike. Understanding the mechanics of the halving and its historical impact is crucial for navigating the market leading up to and following the 2025 event.

Bitcoin Halving Mechanics and Historical Price Impact

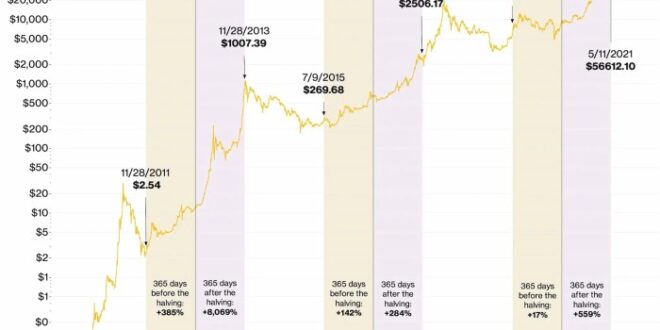

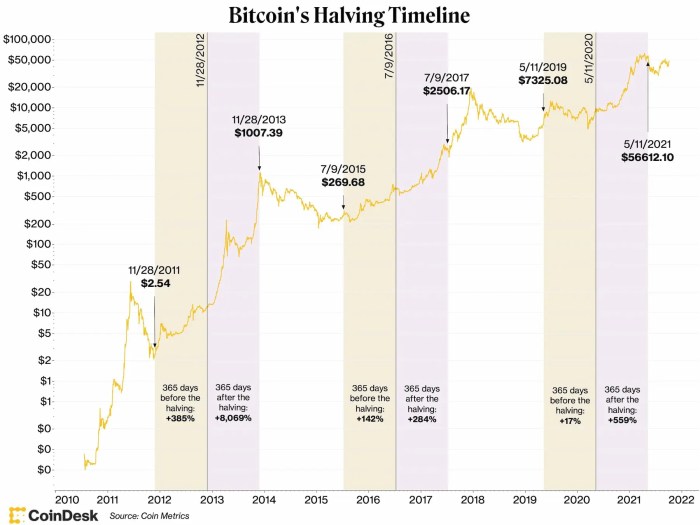

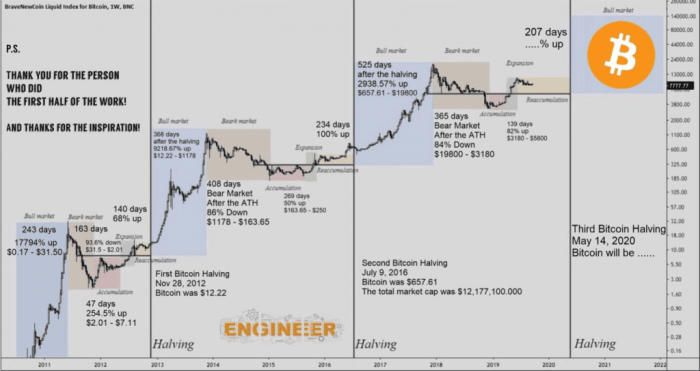

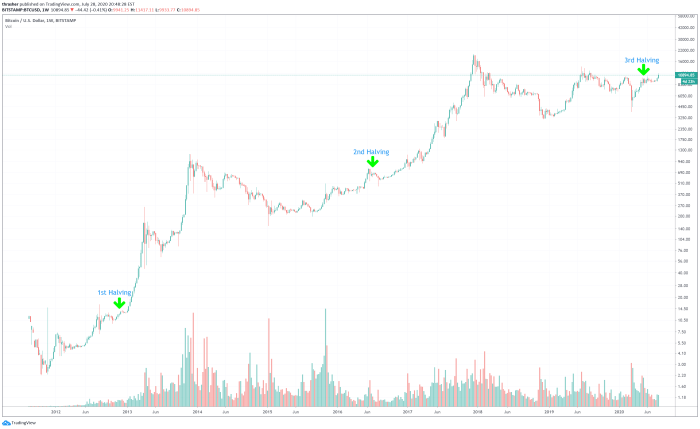

The Bitcoin halving mechanism is embedded within the Bitcoin protocol. It cuts the block reward, the amount of Bitcoin miners receive for verifying transactions and adding them to the blockchain, in half. This reduces the inflation rate of Bitcoin. Historically, the halvings in 2012, 2016, and 2020 were followed by significant price increases, although the timing and magnitude of these increases varied. The 2012 halving saw a gradual price increase over the following year, while the 2016 halving led to a more pronounced price surge, and the 2020 halving resulted in a significant price rally, albeit followed by a period of correction. These price movements are complex and influenced by various market factors beyond just the halving itself.

Timeline Leading to the 2025 Halving

The precise date of the 2025 halving depends on the block time, which can fluctuate slightly. However, based on historical data and current mining rates, the event is anticipated to occur sometime in the spring or early summer of 2025. Leading up to this date, we can expect increased market speculation and volatility as investors position themselves for the anticipated event. Key dates to watch for include announcements from major exchanges regarding their preparedness for the halving and any adjustments to their trading mechanisms. Increased media coverage and heightened discussion within the cryptocurrency community will also be notable leading indicators.

Potential Price Scenarios for Bitcoin in 2025

Predicting Bitcoin’s price behavior is inherently speculative. However, considering past halving cycles, several scenarios are plausible. A bullish scenario could see a gradual price increase leading up to the halving, followed by a significant surge in the months and years after. This could be fueled by anticipation, reduced supply, and increased institutional investment. A more moderate scenario might involve price fluctuations before the halving, with a less dramatic price increase following the event. A bearish scenario, though less likely given historical trends, could involve a prolonged period of price stagnation or even decline before and after the halving, influenced by broader macroeconomic factors or regulatory uncertainty. The 2020 halving, for instance, saw a significant price increase but was followed by a considerable correction.

Factors Influencing Bitcoin’s Price Post-2025 Halving

Numerous factors beyond the halving itself will influence Bitcoin’s price. Bullish factors include continued institutional adoption, increasing demand from emerging markets, and the ongoing development of the Bitcoin ecosystem. Bearish factors include regulatory uncertainty, macroeconomic conditions (such as inflation and recessionary pressures), and potential competition from other cryptocurrencies. The overall adoption rate of Bitcoin, both by individuals and institutions, will play a significant role in determining its long-term price trajectory. For example, increased adoption by institutional investors, as seen in recent years, could exert upward pressure on the price. Conversely, increased regulatory scrutiny could lead to price suppression.

Comparative Analysis of Previous Halving Events

Comparing the three previous halvings reveals a pattern of increased price volatility and long-term price appreciation following each event. However, the timeframes and magnitudes of these price increases differed significantly. The 2012 halving resulted in a more gradual price increase, while the 2016 and 2020 halvings saw more pronounced and quicker price rallies. This suggests that while the halving itself is a significant event, other market forces play a substantial role in determining the ultimate price impact. Analyzing the interplay of these factors across different halving cycles offers valuable insights into potential outcomes for the 2025 event. For example, comparing the market conditions surrounding each halving—including regulatory landscapes, macroeconomic factors, and overall market sentiment—provides context for understanding the differing price responses.

Understanding Bitcoin’s Halving Cycle

Bitcoin’s halving is a crucial programmed event that fundamentally impacts the cryptocurrency’s inflation rate and, consequently, its long-term value proposition. This mechanism, hardcoded into Bitcoin’s source code, ensures a predictable reduction in the rate at which new Bitcoins are introduced into circulation.

The Programming Logic of Bitcoin Halving

The halving mechanism is embedded within Bitcoin’s core protocol. Every 210,000 blocks mined, the reward given to miners for successfully adding a new block to the blockchain is cut in half. This reward, initially set at 50 BTC per block, is the primary source of new Bitcoin entering circulation. The halving event is not a discretionary decision; it’s an automatic function triggered by the predetermined block count. This algorithmic approach ensures transparency and predictability, a key element in establishing trust within the Bitcoin network.

Bitcoin Halving and Inflation Rate

The halving directly influences Bitcoin’s inflation rate. By reducing the rate of new Bitcoin creation, each halving event contributes to a decrease in inflation. While Bitcoin’s inflation is not zero (it approaches zero asymptotically), the halving events significantly slow down the rate at which new coins enter the market. For example, the initial inflation rate was significantly higher than after the first halving, and continues to decrease with each subsequent halving. This controlled inflation contrasts sharply with fiat currencies where inflation rates are often subject to more volatile and less predictable central bank policies.

Supply Dynamics of Bitcoin Compared to Other Cryptocurrencies

Bitcoin’s fixed supply of 21 million coins is a defining characteristic that sets it apart from most other cryptocurrencies. Many altcoins have either an unlimited supply or a much larger maximum supply than Bitcoin. This inherent scarcity contributes to Bitcoin’s perceived value proposition as a store of value. In contrast, cryptocurrencies with unlimited supply, or very large maximum supplies, face the risk of devaluation through increased supply. The fixed supply of Bitcoin creates a deflationary pressure, particularly in the long run, as demand increases.

Bitcoin Scarcity and Long-Term Value

The scarcity of Bitcoin is a central argument underpinning its potential for long-term value appreciation. As the supply remains fixed, increased demand naturally leads to price appreciation. This scarcity is often compared to precious metals like gold, which also possess limited supply and are considered valuable stores of value. The predictable nature of Bitcoin’s halving schedule further reinforces this scarcity, as it provides a clear roadmap for the future supply of Bitcoin. Historical data shows a general upward trend in Bitcoin’s price following each halving event, although this is not guaranteed to continue indefinitely.

Visual Representation of the Halving Cycle

Imagine a graph with the x-axis representing time (in years) and the y-axis representing the cumulative supply of Bitcoin. The graph starts at zero. Initially, the line rises steeply, reflecting the rapid increase in Bitcoin supply in the early years. After approximately four years, the line’s slope noticeably decreases, representing the first halving. This pattern repeats approximately every four years with each subsequent halving. The line continues to rise, but at a progressively slower rate, eventually approaching the 21 million Bitcoin limit asymptotically. The graph clearly illustrates how the halving events progressively reduce the rate at which new Bitcoins enter circulation, leading to a slower increase in the total supply. The difference in slope between consecutive halvings visually demonstrates the impact of the halving mechanism on the rate of Bitcoin’s supply increase.

Market Predictions and Analyst Opinions

Predicting Bitcoin’s price after the 2025 halving is a complex undertaking, fraught with uncertainty. Numerous factors, from macroeconomic conditions to regulatory changes and the overall sentiment within the cryptocurrency market, influence the price. While no one can definitively predict the future, analyzing the perspectives of prominent analysts and the range of predictions within the community offers valuable insight.

Prominent Analyst Predictions

Several prominent analysts have offered predictions regarding Bitcoin’s price post-halving. These predictions vary significantly, reflecting the inherent uncertainties involved. For instance, some analysts, basing their predictions on historical halving cycles and network fundamentals, suggest a price surge to levels exceeding $100,000 or even higher. Others, more cautious, consider macroeconomic factors and potential regulatory headwinds, suggesting more modest price increases or even a period of sideways trading. It’s crucial to remember that these are just predictions, not guarantees. The actual price will depend on a multitude of interacting factors. For example, PlanB, a well-known on-chain analyst, has historically used the Stock-to-Flow model to predict Bitcoin’s price, but these predictions have not always been accurate.

Halving’s Impact: Bull Run or Bear Market?

The impact of the halving on Bitcoin’s price trajectory is a hotly debated topic. The historical precedent suggests a bull run following each halving, attributed to the reduced supply of newly minted Bitcoin. However, some analysts argue that this time might be different. They point to macroeconomic headwinds, such as high inflation and potential recessions, which could dampen the positive impact of the halving. Others emphasize the increasing institutional adoption of Bitcoin as a hedge against inflation, suggesting that this factor could outweigh the macroeconomic uncertainties. The interplay between these opposing forces will determine whether the 2025 halving triggers a bull run or a more subdued market reaction.

Macroeconomic Factors and Bitcoin’s Price

Macroeconomic factors exert a significant influence on Bitcoin’s price, regardless of the halving. Factors like inflation rates, interest rate hikes, and overall economic growth significantly impact investor sentiment and risk appetite. For example, during periods of high inflation, Bitcoin’s price tends to rise as investors seek alternative stores of value. Conversely, during periods of economic uncertainty, investors may sell off riskier assets like Bitcoin, leading to price declines. The overall health of the global economy will therefore play a crucial role in shaping Bitcoin’s price trajectory after the 2025 halving.

Institutional Investors and Price Volatility

The increasing involvement of institutional investors in the Bitcoin market has added another layer of complexity. Large institutional players can significantly influence price volatility through their buying and selling activities. Their actions can amplify both upward and downward price movements, creating significant short-term fluctuations. However, their long-term involvement also contributes to greater market stability and maturity. The balance between their short-term trading activities and long-term investment strategies will be a critical determinant of price volatility post-halving.

Range of Price Predictions within the Community, When Is The Halving Of Bitcoin 2025

The range of price predictions within the cryptocurrency community is vast, spanning from extremely bullish forecasts exceeding $1 million to more conservative predictions in the tens of thousands of dollars. This wide disparity reflects the diverse perspectives and analytical approaches within the community. Some base their predictions on technical analysis, others on fundamental analysis, while some rely on speculative sentiment. The lack of consensus underscores the uncertainty surrounding Bitcoin’s future price, highlighting the need for caution and independent research. It’s crucial to approach all predictions with a critical eye, acknowledging the limitations and potential biases involved.

The Impact of the Halving on Mining

The Bitcoin halving, a programmed event that reduces the block reward miners receive by half, significantly impacts the economics of Bitcoin mining. This reduction directly affects miners’ profitability, leading to various consequences for the network’s security and the industry as a whole. Understanding these impacts is crucial for predicting the future trajectory of Bitcoin’s price and network health.

Miners’ Profitability and Operational Costs

The halving directly cuts the revenue stream for Bitcoin miners. Prior to the halving, miners receive a certain number of newly minted bitcoins for successfully adding a block to the blockchain. After the halving, this reward is halved, meaning miners earn less Bitcoin for the same amount of work. This decrease in revenue, combined with relatively stable operational costs (electricity, hardware maintenance, and facility costs), directly reduces miners’ profitability margins. The profitability is further influenced by the Bitcoin price; a higher Bitcoin price can offset the reduced block reward, while a lower price exacerbates the impact of the halving. For example, if the price of Bitcoin remains stagnant after a halving, miners will experience a significant drop in profitability. Conversely, a price surge can offset the halving’s negative impact.

Mining Shakeout Potential

A halving often leads to a “mining shakeout,” where less profitable mining operations are forced to shut down. This occurs because miners with higher operational costs, less efficient hardware, or less access to cheap energy become unprofitable. The less profitable miners are forced to cease operations, leading to a consolidation within the mining industry. This shakeout is not necessarily a negative event; it can lead to a more efficient and resilient network, as less-efficient miners are removed. The 2016 halving, for example, saw a significant drop in the number of active miners, but the network remained secure.

Impact on Hash Rate and Network Security

The hash rate, a measure of the total computational power dedicated to securing the Bitcoin network, is directly related to the number of active miners. A significant drop in mining profitability after a halving can cause a temporary decline in the hash rate, as some miners shut down. This could, theoretically, make the network more vulnerable to attacks. However, historically, the Bitcoin network has proven remarkably resilient, and the hash rate tends to recover relatively quickly as the price adjusts and more efficient miners enter the market. The increased difficulty, a measure of how hard it is to mine a block, adjusts automatically to maintain a roughly 10-minute block time, mitigating the immediate impact on security.

Miner Adaptations to Remain Profitable

To maintain profitability after a halving, miners often adopt several strategies. These include upgrading to more energy-efficient hardware (ASICs), securing cheaper energy sources (e.g., hydropower or renewable energy), optimizing mining operations for efficiency, and diversifying revenue streams (e.g., offering hosting services). Some miners might also shift their focus to alternative cryptocurrencies with higher profitability. The success of these adaptations depends on factors such as the Bitcoin price and the overall market conditions.

Hypothetical Scenario: Significant Drop in Mining Profitability

Let’s consider a hypothetical scenario where the Bitcoin price remains flat or declines slightly after the 2025 halving. In this case, many smaller, less efficient mining operations would become unprofitable and shut down. This could lead to a temporary decrease in the hash rate, potentially increasing the risk of a 51% attack (although highly unlikely given Bitcoin’s established network effect). However, the price of Bitcoin could subsequently rise due to reduced supply and increased scarcity, eventually making mining profitable again for the remaining miners. Conversely, if the price of Bitcoin falls significantly, a prolonged period of low profitability could lead to a more substantial and sustained decline in the hash rate, which would have more severe implications for network security. This scenario highlights the interconnectedness of Bitcoin price, mining profitability, and network security.

FAQs about the Bitcoin Halving in 2025

This section addresses frequently asked questions regarding the anticipated Bitcoin halving event in 2025, providing clarity on its mechanics, historical impact, and potential implications for investors. Understanding these aspects is crucial for navigating the complexities of the cryptocurrency market.

Expected Date of the Bitcoin Halving in 2025

The Bitcoin halving is expected to occur around April 2025. The precise date depends on the exact block time, which can fluctuate slightly. The calculation is based on the Bitcoin network’s target block time of approximately 10 minutes. Halvings occur after every 210,000 blocks are mined. By tracking the block count and the average block time, developers and analysts can make a reasonably accurate prediction. While the date may shift by a day or two, April 2025 remains the strong consensus.

Effect of the Halving on Bitcoin Supply

The halving mechanism directly impacts Bitcoin’s supply by reducing the block reward paid to miners for successfully adding new blocks to the blockchain. Before the halving, miners receive a certain amount of Bitcoin for each block they mine. After the halving, this reward is cut in half. This systematic reduction in the rate of new Bitcoin entering circulation is a core feature of Bitcoin’s design, intended to control inflation and maintain scarcity. For example, if the reward before a halving was 6.25 BTC per block, it would become 3.125 BTC after the halving. This directly affects the overall rate of Bitcoin supply increase.

Historical Impact of Previous Halvings on Bitcoin Price

Historically, Bitcoin’s price has shown a tendency to increase in the period following a halving. The 2012 and 2016 halvings were followed by significant price rallies, although the timing and magnitude of these rallies varied. It’s important to note, however, that correlation doesn’t equal causation. Other market factors, such as increased adoption, regulatory changes, and macroeconomic conditions, also play significant roles in price movements. The price surge following a halving is often attributed to the decreased supply of newly mined Bitcoin, potentially increasing its scarcity and demand.

Potential Risks Associated with Investing in Bitcoin Around the Halving

Investing in Bitcoin, particularly around a halving event, carries inherent risks. Price volatility is a defining characteristic of the cryptocurrency market, and the period surrounding a halving can be particularly turbulent. Market speculation and anticipation can lead to significant price swings, both upward and downward. Investors should be prepared for potentially sharp price fluctuations and avoid making investment decisions based solely on the halving’s anticipated impact. The market is influenced by a multitude of factors beyond just the halving.

Alternative Investment Strategies During the Bitcoin Halving

Diversification is a key strategy for mitigating risk in any investment portfolio. During periods of high volatility, like those surrounding a Bitcoin halving, considering alternative investments can help reduce exposure to a single asset’s price fluctuations. This could include investing in other cryptocurrencies (with thorough research and understanding of their risks), traditional assets like stocks and bonds, or even real estate. A balanced portfolio tailored to individual risk tolerance and financial goals is crucial. Remember, all investments carry risk, and it’s essential to thoroughly research and understand those risks before committing capital.