Understanding Bitcoin Halving

Bitcoin halving is a programmed event in the Bitcoin protocol that reduces the rate at which new Bitcoins are created. This occurs approximately every four years, or every 210,000 blocks mined, and is designed to control inflation and maintain the scarcity of Bitcoin. Understanding its mechanics and historical impact is crucial for comprehending Bitcoin’s long-term value proposition.

The mechanics of a Bitcoin halving involve a reduction in the block reward miners receive for verifying transactions and adding new blocks to the blockchain. Initially, the block reward was 50 BTC. After the first halving, it dropped to 25 BTC, then 12.5 BTC, and currently stands at 6.25 BTC. Each halving cuts the reward in half, leading to a slower increase in the total supply of Bitcoin. This controlled inflation is a key feature intended to mimic the scarcity of precious metals like gold.

Historical Impact of Bitcoin Halvings on Price and Market Sentiment

The historical impact of Bitcoin halvings on price and market sentiment has been significant, although not always immediately apparent. While there isn’t a guaranteed price surge immediately following a halving, a noticeable upward trend in price has been observed in the periods following the previous halvings. This is largely attributed to the decreased supply of newly mined Bitcoin, coupled with increased demand from investors anticipating future scarcity. The market sentiment often shifts towards bullishness leading up to and following a halving, fueled by speculation and anticipation. However, it’s important to note that other market factors, such as regulatory changes and overall economic conditions, also play a significant role in price movements.

Timeline of Past Bitcoin Halvings and Key Price Movements

The following table summarizes the past Bitcoin halvings, highlighting key price movements before and after each event. Note that these are simplified representations and actual price movements are complex and influenced by numerous factors.

| Halving Date | Block Reward Before | Block Reward After | Approximate Price Before (USD) | Approximate Price After (USD) (within a reasonable timeframe) |

|---|---|---|---|---|

| November 28, 2012 | 50 BTC | 25 BTC | ||

| July 9, 2016 | 25 BTC | 12.5 BTC | ||

| May 11, 2020 | 12.5 BTC | 6.25 BTC |

Comparison of Market Conditions Surrounding Previous Halvings and the Current Market Landscape

Comparing the market conditions surrounding previous halvings with the current landscape reveals both similarities and differences. Previous halvings occurred during periods of relatively nascent cryptocurrency adoption and market volatility. The current market is significantly more mature, with increased institutional investment, regulatory scrutiny, and a broader understanding of cryptocurrencies. While the decreased supply mechanism remains consistent, the broader macroeconomic environment and the level of overall market participation are key differentiating factors that make predicting the impact of the next halving more complex than in the past. The increased regulatory attention and macroeconomic uncertainty present today create a more unpredictable environment compared to the earlier, less regulated stages of Bitcoin’s development.

Predicting the Next Halving Date

Predicting the precise date of the next Bitcoin halving after 2025 requires understanding the core mechanism behind it: the reduction of the block reward. This reward, paid to miners for successfully adding new blocks to the blockchain, is halved approximately every four years. While seemingly straightforward, several factors introduce complexity and uncertainty into any prediction.

The Bitcoin halving algorithm is designed to reduce the block reward by 50% at approximately every 210,000 blocks. This is the fundamental rule. Therefore, to predict the next halving, we need to estimate when block 630,000 will be mined. Knowing the average block time is crucial. However, the average block time is not constant; it fluctuates due to various factors influencing the mining difficulty.

Bitcoin Halving Algorithm and Block Time Variability

The halving algorithm itself is relatively simple: it’s a predetermined schedule based on the block count. The complexity arises from the dynamic nature of Bitcoin’s mining difficulty adjustment. This adjustment ensures a relatively consistent block generation time (around 10 minutes), despite changes in the total computing power (hashrate) dedicated to mining. If the hashrate increases, the difficulty adjusts upward to maintain the target block time; conversely, if the hashrate decreases, the difficulty adjusts downward. This makes precise prediction challenging because fluctuations in hashrate directly impact the time it takes to mine 210,000 blocks.

Factors Influencing Halving Date Prediction

Several factors can influence the precise timing of the next halving. For instance, a sudden and significant increase in mining hashrate could accelerate block creation, potentially bringing the halving date slightly forward. Conversely, a decrease in hashrate would delay it. Furthermore, potential network upgrades or unforeseen technical issues could temporarily disrupt block generation, creating further deviations from the predicted schedule. The overall global economic climate can also play a role; a period of high Bitcoin price volatility could influence mining profitability and subsequently, hashrate. As an example, the 2021 halving saw a significant increase in hashrate leading up to the event, which, while not significantly changing the halving date, made it a more closely watched event.

Challenges in Accurate Prediction

Accurately predicting the exact date of the next halving is difficult due to the inherent variability in block generation times. While we can use historical data to estimate an average block time, this average is constantly shifting due to the difficulty adjustments. Predicting the precise hashrate for the extended period leading up to the next halving is also extremely challenging. Any significant unforeseen event, such as a major technological advancement in mining hardware or a significant regulatory shift, could significantly alter the hashrate and consequently the halving date. Therefore, while we can provide an approximate date based on current trends, pinpointing the exact date remains an exercise in probabilistic estimation rather than precise calculation. For example, if the average block time consistently deviates from 10 minutes for a sustained period, this will have a cumulative effect on the total time taken to reach the next halving block.

Market Anticipation and Price Volatility

The Bitcoin halving, a pre-programmed event reducing the rate of new Bitcoin creation, has historically been associated with significant shifts in market sentiment and price volatility. Understanding the interplay between market anticipation and price movements leading up to and following these events is crucial for navigating the cryptocurrency landscape. This section analyzes historical trends, key indicators, and potential future scenarios to illuminate this complex relationship.

Historical Price Trends Surrounding Halving Events

Analyzing the price action surrounding the previous halvings reveals a consistent pattern of increased price volatility. Prior to each halving, anticipation often builds, leading to a gradual price increase. This is fueled by the expectation of decreased supply driving up demand. Following the halving, the market typically experiences a period of consolidation, sometimes followed by a significant price surge or a period of correction. The 2012 halving saw a gradual price increase in the months leading up to the event, followed by a period of consolidation and then a significant bull run. Similarly, the 2016 halving was preceded by a period of price growth, and the post-halving period saw a considerable increase, albeit with periods of volatility. The 2020 halving followed a similar pattern, with price appreciation preceding the event and a subsequent bull market, though this was eventually followed by a significant correction. It’s important to note that while a price increase often follows, the magnitude and timing vary considerably.

Key Indicators of Market Anticipation

Several market indicators can signal the growing anticipation of a Bitcoin halving. Increased on-chain activity, such as rising transaction volumes and hash rate, can reflect growing investor interest. Changes in derivatives markets, such as increased open interest in Bitcoin futures contracts, can also indicate growing speculative activity. Finally, a surge in positive media coverage and social media discussions surrounding the halving can further contribute to the building anticipation. For instance, a noticeable increase in Google searches for “Bitcoin halving” in the months leading up to the event might be considered an indicator of rising public interest.

Potential Price Volatility Surrounding the Next Halving

The next halving is expected to trigger significant price volatility. The degree of volatility will depend on several interacting factors. Macroeconomic conditions, including overall market sentiment and regulatory developments, will play a crucial role. The level of investor confidence in Bitcoin and the cryptocurrency market as a whole will also influence price movements. Finally, the supply and demand dynamics in the Bitcoin market, impacted by factors like adoption rates and mining profitability, will be critical determinants of price fluctuations. A scenario where positive macroeconomic conditions coincide with strong investor sentiment could lead to a substantial price surge. Conversely, a scenario characterized by negative macroeconomic news and decreased investor confidence could result in a more muted response or even a price decline.

Scenario-Based Price Outcome Analysis

Let’s consider two contrasting scenarios. In a bullish scenario, strong macroeconomic conditions and positive investor sentiment converge, resulting in a significant price increase leading up to the halving. Post-halving, the price continues its upward trajectory, driven by decreased supply and sustained demand. This could result in a price significantly higher than the price at the time of the halving. For example, if the price is $30,000 at the halving, a bullish scenario could see it rise to $100,000 or more within a year or two. In a bearish scenario, negative macroeconomic conditions and decreased investor confidence dampen the price increase leading up to the halving. Post-halving, the price may experience a period of consolidation or even a decline, before eventually recovering. In this scenario, the price might remain relatively flat or even decline after the halving, perhaps falling to $20,000 or lower if the market sentiment remains negative. These scenarios illustrate the range of potential outcomes and emphasize the inherent uncertainty surrounding the halving’s impact on Bitcoin’s price.

Impact on Bitcoin Mining and Hash Rate: When Is The Next Bitcoin Halving After 2025

Bitcoin halvings, occurring approximately every four years, significantly impact the profitability of Bitcoin mining and, consequently, the network’s hash rate and security. The halving reduces the block reward miners receive for successfully adding new blocks to the blockchain, directly affecting their revenue stream. This event creates a ripple effect throughout the Bitcoin ecosystem, influencing technological advancements, energy consumption, and the overall health of the network.

The halving’s effect on miners’ profitability is immediate and substantial. With a reduced block reward, miners must either increase their efficiency (lowering their operating costs) or face reduced profit margins. This pressure often leads to a period of consolidation within the mining industry, with less profitable operations shutting down. This process, while seemingly negative, is actually a crucial part of maintaining the network’s security by weeding out inefficient miners.

Miner Profitability and Responses to Halving, When Is The Next Bitcoin Halving After 2025

Miners respond to reduced profitability in several ways. Some may choose to upgrade their mining hardware to improve efficiency and maintain competitiveness. Others might seek cheaper energy sources, relocate to regions with more favorable regulatory environments and lower electricity costs, or consolidate operations to reduce overhead. The 2016 halving, for example, saw a significant increase in the adoption of more energy-efficient ASICs (Application-Specific Integrated Circuits) as miners sought to maintain profitability. Those who couldn’t adapt were forced to cease operations, leading to a temporary decrease in the network’s hash rate before it rebounded.

Impact on Bitcoin Network Hash Rate and Security

The hash rate, a measure of the total computational power dedicated to securing the Bitcoin network, is directly correlated with miner profitability. A drop in profitability can lead to a temporary decline in the hash rate as less profitable miners exit the market. However, this decline is usually short-lived. The long-term effect of a halving is often a strengthening of the network, as only the most efficient and well-capitalized miners remain. This results in a more resilient and secure network, less vulnerable to attacks. The 2020 halving saw a temporary dip in hash rate, followed by a rapid recovery and subsequent increase as new, more efficient mining hardware became prevalent and the Bitcoin price increased.

Mining Landscape Before and After Previous Halvings

Comparing the mining landscape before and after previous halvings reveals a clear trend towards increased efficiency and consolidation. Early Bitcoin mining was dominated by individuals and small operations using readily available hardware. Subsequent halvings have driven the industry towards large-scale, specialized operations utilizing highly efficient ASICs and benefiting from economies of scale in energy procurement. This shift has also led to a significant increase in energy consumption, raising environmental concerns that the industry is actively addressing through renewable energy initiatives. The increase in energy consumption is a direct consequence of the ever-increasing difficulty of mining and the desire to maintain a high hash rate for network security.

Hypothetical Model: Halving, Mining Profitability, and Hash Rate

We can represent the relationship between halving, mining profitability, and hash rate with a simplified model. Let’s assume:

Profitability = (Block Reward + Transaction Fees) – (Operating Costs)

A halving reduces the block reward, directly impacting profitability. The hash rate, in turn, is influenced by profitability:

Hash Rate ∝ Profitability

This means that a decrease in profitability (due to halving) will initially lead to a decrease in the hash rate. However, factors such as technological advancements (more efficient hardware), price increases of Bitcoin, and adaptation to lower profit margins by miners can offset this initial decline, eventually leading to an increase in hash rate over time. This model is a simplification; other factors like regulatory changes and market sentiment also influence the final outcome. For example, if the price of Bitcoin increases significantly after a halving, miners’ profitability might even exceed pre-halving levels, leading to a surge in the hash rate.

Long-Term Implications and Investment Strategies

Bitcoin halvings, occurring approximately every four years, significantly impact the cryptocurrency’s supply and, consequently, its long-term value and adoption. Understanding these effects is crucial for investors formulating effective strategies. The reduced supply, coupled with sustained or increased demand, theoretically drives price appreciation. However, other market forces also play a role, making predictions complex.

Long-Term Effects of Halving on Bitcoin’s Value and Adoption

The halving mechanism, inherent to Bitcoin’s design, is intended to control inflation. By reducing the rate at which new Bitcoins enter circulation, each halving creates a scarcity effect. Historically, this has been followed by periods of price appreciation, though the magnitude and duration vary. Beyond price, halvings can influence adoption by increasing the attractiveness of Bitcoin as a store of value, potentially attracting new investors and driving wider acceptance. However, it’s important to note that adoption isn’t solely determined by halving events; factors like regulatory developments, technological advancements, and overall market sentiment also play crucial roles. The long-term effects are therefore complex and depend on the interplay of multiple factors.

Investment Strategies in Anticipation of the Next Halving

Investors employ various strategies to capitalize on the anticipated price increase leading up to and following a halving. These range from relatively conservative approaches, like dollar-cost averaging (DCA), to more aggressive strategies involving leveraged trading or options contracts. The choice depends on individual risk tolerance and investment goals. Some investors prefer to accumulate Bitcoin gradually over a prolonged period, while others might opt for short-term, high-risk trades to potentially maximize profits. Careful risk management is paramount regardless of the chosen strategy.

Examples of Historical Investment Strategies Used Around Previous Halving Events

The 2012 and 2016 halvings provide valuable case studies. In both instances, we observed price increases following the halving, though the timing and extent of the increases differed. Some investors who held Bitcoin throughout these periods experienced substantial gains. Others who attempted to time the market perfectly—buying just before the halving and selling immediately after—often missed out on significant upside or experienced losses due to unexpected market volatility. For example, those who bought Bitcoin at the beginning of 2016 and held it until late 2017 experienced enormous gains, while those who tried to trade based on short-term predictions may have lost money due to the market’s fluctuations.

Comparison of Different Investment Approaches

Conservative strategies, such as DCA, involve consistently investing a fixed amount of money at regular intervals, regardless of price fluctuations. This mitigates the risk of buying high and selling low. More aggressive strategies, such as leveraged trading or options trading, offer higher potential returns but also carry significantly higher risk. Leveraged trading magnifies both profits and losses, while options trading involves buying or selling contracts that give the holder the right, but not the obligation, to buy or sell Bitcoin at a specific price on or before a certain date. The optimal approach depends on an investor’s risk tolerance, investment timeline, and financial goals. A long-term investor with a high risk tolerance might consider a more aggressive approach, while a risk-averse investor might prefer a more conservative strategy.

Frequently Asked Questions (FAQs)

This section addresses common queries regarding Bitcoin halving, its impact on the cryptocurrency’s price, miners, and the broader market. Understanding these aspects is crucial for anyone interested in Bitcoin’s long-term prospects.

Bitcoin Halving Timing

The next Bitcoin halving is projected to occur around the year 2028. The exact date depends on the block generation time, which can fluctuate slightly. Bitcoin’s code dictates that a new block is added to the blockchain approximately every 10 minutes, and a halving happens after every 210,000 blocks are mined. Predicting the precise date requires monitoring the blockchain’s activity leading up to the event. Historical data from previous halvings can provide a general timeframe, but minor variations are expected due to the inherent randomness in block generation times.

Bitcoin Halving’s Price Effect

Bitcoin halving events have historically been associated with periods of increased price volatility and, in some cases, significant price appreciation. The halving reduces the rate at which new Bitcoins are created, leading to a decrease in the supply entering the market. This reduced supply, coupled with continued or increased demand, can exert upward pressure on the price. However, it’s important to remember that numerous other factors, including regulatory changes, macroeconomic conditions, and market sentiment, also play significant roles in determining Bitcoin’s price. The 2012 and 2016 halvings were followed by substantial price increases, though the market conditions and technological landscape differed significantly from today’s. It is therefore not guaranteed that the same price action will repeat.

Risks and Rewards of Investing Around a Halving

Investing in Bitcoin around a halving event presents both significant risks and potential rewards. The anticipation leading up to the event can create a speculative bubble, leading to inflated prices. If the anticipated price surge doesn’t materialize, investors could experience substantial losses. Conversely, a successful post-halving price increase could generate significant profits. Risk management strategies, such as diversification and careful consideration of one’s risk tolerance, are essential for navigating this period of heightened market volatility. It is vital to remember that past performance is not indicative of future results.

Halving’s Impact on Bitcoin Miners

Bitcoin halving directly impacts Bitcoin miners by reducing their revenue per block mined. Since the reward for mining a block is halved, miners need to adjust their operations to maintain profitability. This might involve increasing mining efficiency, consolidating operations, or upgrading their hardware. Those miners who cannot adapt to the reduced revenue might be forced to cease operations, potentially leading to a decrease in the overall network hash rate in the short term. However, technological advancements and the potential for increased price may eventually offset this initial impact.

Long-Term Significance of Bitcoin Halving

Bitcoin halving is a fundamental part of Bitcoin’s design, contributing to its deflationary nature. The predictable halving schedule is intended to control the supply of Bitcoin, limiting its total quantity to 21 million. This controlled supply is a key aspect of Bitcoin’s value proposition, contributing to its scarcity and potential as a store of value. The long-term impact of halving events is a subject of ongoing debate and analysis within the cryptocurrency community. The historical trend shows that the scarcity created by halvings could drive future price appreciation, but other economic and technological factors must also be considered.

Illustrative Data Representation (Table)

Understanding the Bitcoin halving events requires examining historical data. The table below presents key information from past halvings and a projection for the next one, offering a clear visualization of the halving’s impact on block rewards. While the projected date for the next halving is an estimate based on current block generation times, it’s subject to minor variations depending on the actual mining activity.

When Is The Next Bitcoin Halving After 2025 – The data highlights the consistent reduction in block rewards, a core mechanism designed to control Bitcoin’s inflation rate. Note that the block height is an approximation, as the exact block height will only be known once the halving event occurs.

Bitcoin Halving Data

| Halving Date | Block Height at Halving (approx.) | Block Reward Before Halving (BTC) | Block Reward After Halving (BTC) |

|---|---|---|---|

| November 28, 2012 | 210,000 | 50 | 25 |

| July 9, 2016 | 420,000 | 25 | 12.5 |

| May 11, 2020 | 630,000 | 12.5 | 6.25 |

| April 2024 (Projected) | 840,000 | 6.25 | 3.125 |

| April 2028 (Projected) | 1,050,000 | 3.125 | 1.5625 |

Illustrative Data Representation (Image Description)

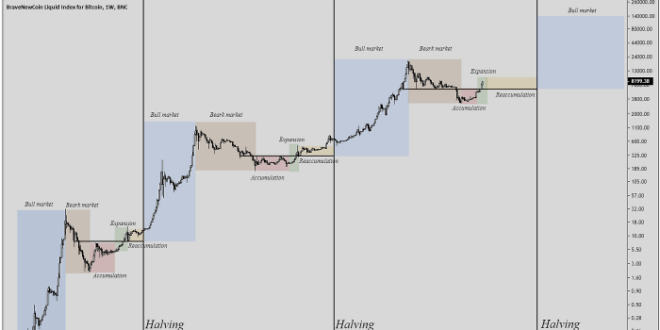

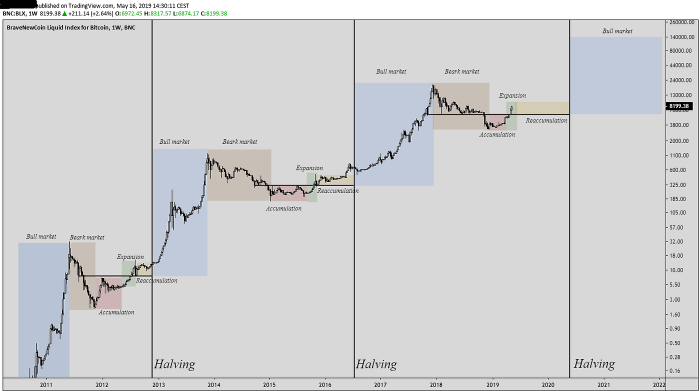

A hypothetical chart visualizing Bitcoin’s price behavior surrounding past halving events would provide valuable insights into market reactions. The chart would effectively demonstrate the correlation, or lack thereof, between halving events and subsequent price movements. Careful consideration of the data’s visual representation is crucial for accurate interpretation.

The horizontal axis of the chart would represent time, spanning several years encompassing at least the three previous Bitcoin halvings (2012, 2016, and 2020). Each halving event would be clearly marked with a vertical line. The vertical axis would represent the price of Bitcoin, plotted on a logarithmic scale to accommodate the wide range of price fluctuations. This logarithmic scale allows for a clearer visualization of percentage changes rather than absolute changes in price.

Price Action Around Halving Events

The chart would depict Bitcoin’s price trajectory in the years leading up to each halving event. We would expect to see a period of relative price stability or even decline before the event, followed by a period of increased volatility immediately after the halving. Key price points, such as the price at the time of each halving and the subsequent price highs and lows, would be clearly labeled. These key points would be connected with lines to illustrate the overall price trend. Areas of significant price increases or decreases would be highlighted with shaded regions or annotations, providing context for the observed price movements. For instance, the period following the 2017 halving could be highlighted to show the dramatic price surge to its all-time high, followed by a significant correction. Similarly, the period after the 2020 halving could be shown to illustrate a different pattern, with a more gradual increase, perhaps reaching a new all-time high later. The annotations would specify the approximate percentage change and duration of these movements, aiding in comparison across different halving events. The visual representation would clearly show the varying degrees of price reaction following each halving, illustrating the complexities of the market and the difficulty of predicting future price movements based solely on the halving event.