Bitcoin Halving 2025: When Was Bitcoin Halving 2025

The Bitcoin halving, a pre-programmed event in the Bitcoin protocol, is anticipated to occur in 2025. This event significantly impacts the cryptocurrency’s supply and has historically influenced its price and market sentiment. Understanding the mechanics and potential consequences of the 2025 halving is crucial for navigating the evolving cryptocurrency landscape.

Bitcoin Halving Mechanics and Supply Impact

The Bitcoin halving mechanism reduces the rate at which new Bitcoins are created and added to the circulating supply. This occurs approximately every four years, or every 210,000 blocks mined. The reward miners receive for validating transactions is cut in half. For example, after the 2020 halving, the reward dropped from 12.5 BTC per block to 6.25 BTC. The 2025 halving will further reduce this reward to 3.125 BTC per block. This controlled reduction in supply is a core element of Bitcoin’s deflationary design, intended to limit the total number of Bitcoins to 21 million.

Historical Impact of Previous Halvings

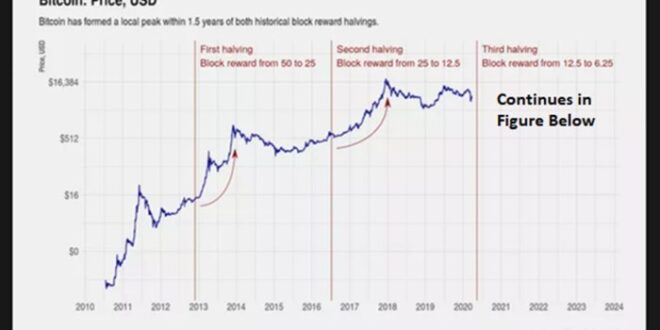

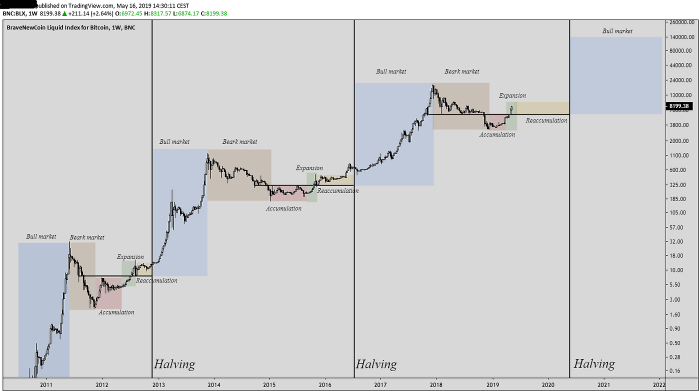

The previous two Bitcoin halvings (2012 and 2016) were followed by significant price increases. However, the timing and magnitude of these price increases varied. The 2012 halving was followed by a gradual price appreciation, while the 2016 halving led to a more pronounced bull run. These price movements were influenced by various factors, including increased adoption, regulatory developments, and overall market sentiment. It is important to note that correlation does not equal causation; while halvings have coincided with price increases, other market forces are undeniably at play.

Potential Market Reactions Leading Up To and Following the 2025 Halving

The period leading up to the 2025 halving is likely to witness increased speculation and volatility. Investors may anticipate the price increase associated with past halvings, potentially driving up demand and prices. However, the extent of this price increase will depend on various factors, including macroeconomic conditions, regulatory developments, and the overall state of the cryptocurrency market. Following the halving, a period of consolidation or further price appreciation is possible. A similar pattern to past halvings, where the price initially rises before experiencing a correction, is plausible. The strength of the bull market after the halving will largely depend on broader economic factors and the adoption rate of Bitcoin.

Comparison of 2025 Halving with Previous Halvings

The 2025 halving differs from previous halvings due to increased market maturity and a more established regulatory landscape. The cryptocurrency market is significantly larger and more sophisticated than in 2012 or 2016. Furthermore, increased regulatory scrutiny and evolving government policies around the globe will likely influence market behavior. This mature market and regulatory environment might dampen the immediate, explosive price reaction seen in previous cycles, resulting in a more gradual and less predictable price movement.

Hypothetical Price Fluctuation Scenario

Let’s consider a hypothetical scenario. In the six months leading up to the halving, Bitcoin’s price might see gradual increases, driven by anticipation. Assume a price of $30,000 at the start of this period, potentially reaching $40,000-$50,000 before the halving. Immediately following the halving, the price might experience a short-term surge, perhaps reaching $60,000-$70,000, fueled by short-term speculation. However, a subsequent correction could follow, with the price potentially dropping to $40,000-$50,000 before resuming a longer-term upward trend, influenced by factors beyond the halving itself, such as widespread adoption or significant regulatory changes. This is a purely hypothetical scenario and actual price movements could deviate significantly. This example mirrors the pattern seen after previous halvings, although the magnitude and duration of price fluctuations could vary considerably.

Predicting the 2025 Bitcoin Halving’s Impact

The 2025 Bitcoin halving, reducing the rate of new Bitcoin creation by half, is a significant event anticipated to impact Bitcoin’s price. However, predicting the precise effect is complex, influenced by numerous interacting factors beyond the halving itself. Understanding these contributing elements is crucial for a realistic assessment of potential price movements.

Factors Influencing Bitcoin’s Price Beyond Halving Events

Bitcoin’s price is a dynamic reflection of supply and demand, shaped by a complex interplay of factors. While halving events reduce the supply of newly mined Bitcoin, demand-side elements significantly influence the ultimate price impact. These include the rate of adoption by individuals and institutions, regulatory developments globally impacting the cryptocurrency market, and broader macroeconomic conditions such as inflation, interest rates, and overall economic sentiment. For example, increased institutional investment despite a halving could drive prices upwards, whereas negative regulatory changes could offset any bullish effect. Similarly, a global recession might dampen demand regardless of the halving.

Expert Opinions on the 2025 Halving’s Price Impact

Predicting the precise price impact of the 2025 halving is speculative, with experts holding diverse views. These can be broadly categorized as bullish, bearish, or neutral.

Bullish predictions often cite the historical precedent of price increases following previous halvings. Analysts supporting this viewpoint suggest that the reduced supply, coupled with sustained or increased demand, will inevitably lead to price appreciation. They might point to the scarcity of Bitcoin and its increasing adoption as drivers of future price growth.

Bearish perspectives emphasize the potential for macroeconomic headwinds or regulatory crackdowns to overshadow the halving’s impact. These analysts might argue that the halving’s effect is already priced into the market, or that other factors will outweigh the supply reduction. They may cite examples of past halvings where the price surge wasn’t immediate or as significant as some had predicted.

Neutral viewpoints acknowledge the halving’s significance but highlight the uncertainty surrounding other market forces. These analysts suggest that the price movement will depend on the balance of these competing factors, and a neutral outcome, with modest price changes or even sideways movement, is equally plausible.

Potential for Unexpected Events

The cryptocurrency market is known for its volatility and susceptibility to unforeseen events. A major security breach, a significant technological development, or a sudden shift in regulatory policy could significantly alter the trajectory of Bitcoin’s price following the halving. For example, the emergence of a superior competing cryptocurrency or a major geopolitical event could drastically impact market sentiment and Bitcoin’s price regardless of the halving.

Timeline of Key Events Surrounding the 2025 Halving

Predicting precise price movements is impossible, but a plausible timeline might look like this:

* Pre-Halving (2023-2025): Anticipation builds, potentially leading to price increases or decreases depending on prevailing market sentiment and news.

* Halving Event (Early 2025): The halving itself occurs, potentially triggering short-term volatility.

* Post-Halving (2025-2026): Price movements depend on the interaction of supply reduction and other market factors. A gradual price increase might occur if demand remains strong, or a period of consolidation or even decline is possible depending on other market dynamics.

Impact on the Broader Cryptocurrency Market

The 2025 Bitcoin halving is likely to have a ripple effect across the broader cryptocurrency market. Bitcoin often serves as a benchmark for other cryptocurrencies, and its price movements can influence the performance of altcoins. A significant price increase in Bitcoin might lead to increased interest and investment in the broader crypto market, while a decline could have the opposite effect. The correlation between Bitcoin’s price and the performance of altcoins varies over time, making it difficult to predict the precise nature of this ripple effect.

The 2025 Halving and Bitcoin Mining

The 2025 Bitcoin halving, scheduled for sometime in April, will significantly impact Bitcoin mining profitability, network security, and the global distribution of mining power. Understanding these effects is crucial for assessing the future trajectory of the Bitcoin network. This section explores the interplay between the halving and Bitcoin mining, drawing parallels with past events to anticipate potential outcomes in 2025.

Halving’s Impact on Mining Profitability and Network Security

The halving reduces the block reward miners receive for validating transactions on the Bitcoin blockchain. This directly affects profitability, as miners’ revenue is halved. Consequently, less profitable miners might be forced to shut down operations, leading to a decrease in the overall hash rate (the computational power securing the network). However, a reduced hash rate could potentially make the network more vulnerable to attacks. The Bitcoin network’s security relies on the collective computational power of its miners; a significant drop in hash rate could theoretically lower the cost for a malicious actor to attempt a 51% attack. However, historical data suggests that the Bitcoin price typically increases following a halving, offsetting the reduced block reward and potentially maintaining or even increasing profitability for efficient miners. This price increase often results from anticipation of the halving and the resulting scarcity of newly mined Bitcoin.

Changes in Mining Hardware and Energy Consumption

Following a halving, there’s often a period of adjustment in the mining industry. Miners may seek more energy-efficient hardware to maintain profitability in the face of reduced block rewards. This could lead to an acceleration in the adoption of newer, more efficient Application-Specific Integrated Circuits (ASICs). While this enhances efficiency, it might also temporarily increase the demand for specialized hardware, potentially impacting prices. Furthermore, the search for cheaper energy sources will likely intensify. Miners will continue to favor regions with low electricity costs, such as those with abundant hydropower or geothermal energy. The overall energy consumption of the Bitcoin network might initially decrease due to less profitable miners exiting the market, but could potentially increase again as more efficient hardware is deployed.

Distribution of Mining Power Across Regions

The halving’s effect on mining power distribution is complex. Regions with lower electricity costs and favorable regulatory environments will likely attract more mining operations. This could lead to a shift in the geographic concentration of mining power. For example, we might see a further consolidation of mining activity in countries like Kazakhstan, the United States (particularly in states with abundant hydropower), and potentially other regions with competitive energy prices. Conversely, regions with stricter regulations or higher energy costs could experience a decline in mining activity. This shift in geographical distribution will influence geopolitical factors and the overall resilience of the Bitcoin network.

Comparison with Previous Halvings

Analyzing past halvings provides valuable insights. The first halving in 2012 saw a relatively modest price increase, while the second halving in 2016 led to a more significant price surge. The third halving in 2020 was followed by a substantial price rally, demonstrating the potential impact on Bitcoin’s value. However, it’s crucial to remember that numerous other factors influence Bitcoin’s price, and attributing price movements solely to the halving would be an oversimplification. The upcoming 2025 halving could potentially follow a similar pattern, with an initial period of adjustment followed by a potential price increase driven by decreased supply and increased demand. However, the specific outcome will depend on various macroeconomic and market conditions.

Historical Bitcoin Halving Data

| Halving Date | Block Reward Change | Mining Difficulty Adjustment (approx.) | Price Movement (approx. 1 year post-halving) |

|---|---|---|---|

| November 28, 2012 | 50 BTC to 25 BTC | Increased | ~8x |

| July 9, 2016 | 25 BTC to 12.5 BTC | Increased | ~14x |

| May 11, 2020 | 12.5 BTC to 6.25 BTC | Increased | ~3x |

Investing and Trading Strategies Around the 2025 Halving

The 2025 Bitcoin halving is a significant event anticipated to impact Bitcoin’s price and market volatility. Understanding this impact is crucial for investors and traders to develop effective strategies for navigating the potentially turbulent period leading up to and following the halving. This section explores various investment approaches, trading opportunities, risk management techniques, and contrasts long-term and short-term strategies within the context of this major event.

Investment Strategies for Navigating Market Volatility

The halving typically precedes a period of increased price volatility. Investors can employ several strategies to mitigate risk and potentially capitalize on price fluctuations. These include dollar-cost averaging (DCA), which involves investing a fixed amount of money at regular intervals regardless of price, reducing the impact of volatility. Another strategy is to diversify one’s portfolio, allocating funds to other asset classes alongside Bitcoin to reduce overall portfolio risk. Finally, employing a long-term holding strategy (HODLing) minimizes the impact of short-term price swings.

Potential Trading Opportunities Presented by the Halving

The halving often creates unique trading opportunities. For example, traders might employ technical analysis to identify potential price breakouts or reversals. They could use indicators like moving averages and Relative Strength Index (RSI) to time entries and exits. Another strategy involves identifying support and resistance levels on price charts to execute trades based on anticipated price reactions. However, it’s important to acknowledge that technical analysis is not foolproof, and market sentiment can significantly influence price movements.

Risk Management Techniques for Bitcoin Investments

Effective risk management is paramount during periods of uncertainty like those surrounding a halving. One key technique is to only invest capital that one can afford to lose. Setting stop-loss orders can help limit potential losses if the market moves against one’s position. Furthermore, diversifying investments across different asset classes and avoiding over-leveraging are crucial steps in minimizing risk. Regularly reviewing and adjusting one’s investment strategy based on market conditions is also essential.

Long-Term versus Short-Term Bitcoin Investment Strategies

Long-term investors often view the halving as a positive catalyst for long-term price appreciation, believing that reduced supply will ultimately drive up demand. Their strategy typically involves accumulating Bitcoin over time and holding it for an extended period, weathering short-term price fluctuations. In contrast, short-term traders aim to profit from price swings in the shorter term, often using leverage and technical analysis. This approach carries higher risk but also offers the potential for greater returns (or losses) in a shorter timeframe.

Illustrative Investment Scenarios

Consider two investors: Investor A adopts a long-term HODLing strategy, accumulating Bitcoin gradually over several years leading up to the halving. They remain unfazed by short-term price drops, confident in the long-term potential of Bitcoin. Investor B, a short-term trader, attempts to profit from the anticipated price volatility around the halving. They employ leverage and technical analysis, aiming for quick gains. If the price increases significantly after the halving, Investor A will see substantial gains, while Investor B’s profits depend on their ability to time the market accurately. However, if the price experiences a sharp correction, Investor B faces significant losses, while Investor A’s losses are limited by their long-term strategy. These contrasting outcomes highlight the importance of aligning one’s investment strategy with their risk tolerance and investment horizon.

Frequently Asked Questions about the 2025 Bitcoin Halving

The Bitcoin halving is a significant event in the cryptocurrency’s lifecycle, impacting its supply and potentially its price. Understanding this event is crucial for anyone invested in or interested in Bitcoin. This section addresses common questions surrounding the 2025 halving.

Bitcoin Halving Explained

The Bitcoin halving is a programmed event that reduces the rate at which new Bitcoins are created. This occurs approximately every four years, or every 210,000 blocks mined. The halving mechanism cuts the block reward paid to Bitcoin miners in half. Initially, the block reward was 50 BTC. After the first halving, it became 25 BTC, then 12.5 BTC, and after the 2024 halving, it is currently 6.25 BTC. The 2025 halving will further reduce this reward to 3.125 BTC. This controlled reduction in the rate of new Bitcoin creation is a key feature of Bitcoin’s design, intended to create scarcity and manage inflation. The total supply of Bitcoin is capped at 21 million.

Expected Date of the 2025 Bitcoin Halving

Predicting the precise date of the 2025 halving requires monitoring the block generation time. While theoretically every 10 minutes, the actual time can fluctuate. Based on the current block generation rate, a reasonable estimate places the 2025 halving sometime in the spring or early summer of 2025. A more precise date can only be determined as the halving approaches by closely tracking the blockchain. For example, if the average block time remains stable around 10 minutes, the halving could occur within a few weeks of a predicted date. However, fluctuations in mining difficulty can affect the actual date.

Bitcoin Halving’s Effect on Price, When Was Bitcoin Halving 2025

Historically, Bitcoin’s price has tended to increase in the period leading up to and following a halving. This is largely attributed to the reduced supply of newly minted Bitcoin. However, it’s crucial to remember that correlation doesn’t equal causation. Other market factors, such as regulatory changes, overall market sentiment, and technological advancements, also significantly influence Bitcoin’s price. The price increases seen after previous halvings may not be repeated exactly, and other factors could override the halving’s effect. For instance, the 2012 halving saw a significant price increase following the event, while the 2020 halving saw a less dramatic, though still positive, effect.

Risks of Investing Around the Halving

Investing in Bitcoin around a halving carries inherent risks. The price volatility of Bitcoin is well-documented, and the anticipation surrounding a halving can exacerbate this volatility. The price could rise significantly, but it could also fall sharply, leading to substantial losses. Furthermore, external factors unrelated to the halving itself, such as macroeconomic conditions or regulatory actions, could negatively impact the price regardless of the halving’s occurrence. It’s also important to be aware of the risk of scams and fraudulent activities that often increase around major events like a halving.

Strategies for Managing Risk During the Halving

Managing risk during the halving period involves a multi-faceted approach. Diversification is key; don’t put all your investment eggs in one basket. Investing only a portion of your portfolio in Bitcoin and allocating the rest to other asset classes can help mitigate potential losses. Dollar-cost averaging (DCA) is another effective strategy. Instead of investing a lump sum, DCA involves regularly investing smaller amounts over time, regardless of the price fluctuations. This reduces the impact of volatility. Thorough research, understanding your risk tolerance, and only investing what you can afford to lose are also crucial aspects of responsible investing. Finally, staying informed about market trends and news affecting Bitcoin can help you make more informed decisions.

When Was Bitcoin Halving 2025 – Determining the precise date for the Bitcoin halving in 2025 requires careful analysis of the blockchain. However, planning your marketing strategy around this event is crucial, and efficiently managing that requires a well-structured Google Ads Account. A robust advertising campaign can capitalize on the increased interest surrounding the Bitcoin halving, ensuring your message reaches the right audience at the right time.

Therefore, understanding the halving’s projected impact is key to effective advertising.