Bitcoin Halving 2025

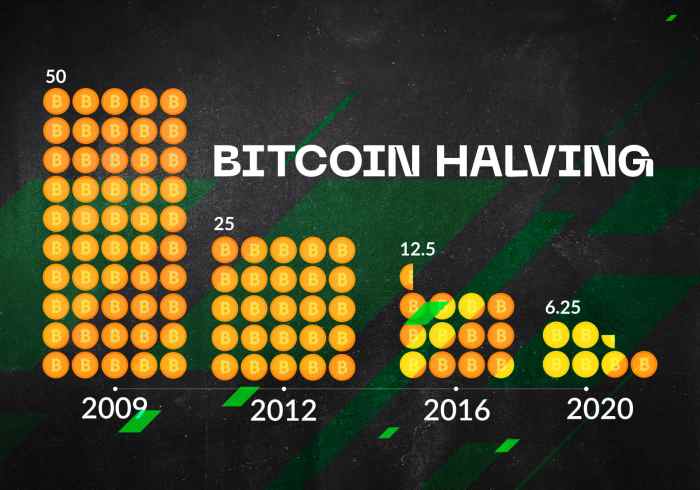

The Bitcoin halving is a programmed event in the Bitcoin protocol that reduces the rate at which new Bitcoins are created. This occurs approximately every four years, and significantly impacts the inflation rate of the cryptocurrency. Understanding the mechanics of this event and its historical impact is crucial for anyone interested in the future of Bitcoin.

Bitcoin Halving Mechanics

The Bitcoin halving reduces the block reward, the amount of Bitcoin miners receive for successfully adding a block of transactions to the blockchain. Initially, the block reward was 50 BTC. Each halving cuts this reward in half. Therefore, after the 2025 halving, the block reward will decrease from 6.25 BTC to 3.125 BTC. This reduction in the rate of new Bitcoin creation is designed to control inflation and maintain the scarcity of Bitcoin over time. The halving is a deterministic event, hardcoded into the Bitcoin protocol, ensuring its predictable occurrence.

Historical Impact of Bitcoin Halvings

Previous halvings have demonstrably influenced both Bitcoin’s price and network activity. While correlation doesn’t equal causation, a noticeable price surge typically follows each halving event, often preceded by a period of price anticipation. This can be attributed to several factors, including reduced inflation, increased scarcity, and heightened investor interest. Network activity, measured by metrics like hash rate (computational power securing the network) and transaction volume, has generally increased after halvings, reflecting a more robust and secure network.

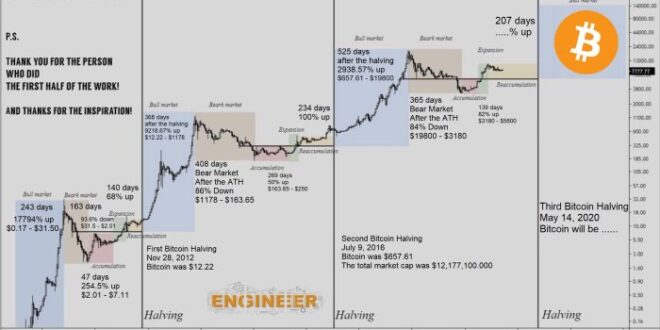

Timeline of Past Halvings and Market Effects

- November 2012 (First Halving): The block reward decreased from 50 BTC to 25 BTC. The price of Bitcoin subsequently saw a period of consolidation before a significant upward trend.

- July 2016 (Second Halving): The block reward halved from 25 BTC to 12.5 BTC. This was followed by a substantial price increase, leading to a significant bull market.

- May 2020 (Third Halving): The block reward reduced from 12.5 BTC to 6.25 BTC. This halving also coincided with a significant price increase, although the market experienced volatility before and after the event.

It’s important to note that other market factors, such as regulatory changes, technological advancements, and macroeconomic conditions, also significantly influence Bitcoin’s price. The halving’s effect is one factor among many.

Anticipated Impact of the 2025 Halving

Predicting the precise market reaction to the 2025 halving is inherently challenging. However, based on historical precedent, a price increase is a reasonable expectation. The reduced inflation rate and the continued scarcity of Bitcoin are likely to contribute to this. However, the magnitude of this price increase is highly uncertain and will depend on several factors.

Factors Influencing the 2025 Halving’s Market Reaction

Several factors could significantly influence the market’s response to the 2025 halving. These include:

- Global macroeconomic conditions: Recessions, inflation, and interest rate changes can significantly impact investor sentiment towards risk assets like Bitcoin.

- Regulatory developments: Clearer regulatory frameworks in major markets could increase institutional investment, while stricter regulations could dampen enthusiasm.

- Technological advancements: Innovations in the Bitcoin ecosystem, such as the Lightning Network, could influence adoption and network activity.

- Miner behavior: Miners’ decisions regarding their operational costs and their willingness to hold onto their Bitcoin rather than sell it immediately could impact price.

- Investor sentiment: Market psychology and the overall sentiment toward Bitcoin will play a crucial role in determining the price reaction.

The 2025 halving’s impact will likely be a complex interplay of these factors, making precise predictions difficult. Past performance is not indicative of future results.

Predicting the 2025 Bitcoin Halving’s Impact

The Bitcoin halving, a pre-programmed event reducing the rate of newly minted Bitcoin by half, is a significant event impacting the cryptocurrency’s supply and, consequently, its price. Predicting the precise impact of the 2025 halving is inherently challenging due to the volatility of the cryptocurrency market and the influence of numerous external factors. However, by developing a hypothetical model and analyzing expert opinions, we can explore potential scenarios and their implications.

A Hypothetical Price Prediction Model

A robust prediction model would incorporate several key variables. Firstly, the existing supply and demand dynamics must be considered, including the number of Bitcoin held by long-term holders versus short-term traders. Secondly, macroeconomic factors like inflation, interest rates, and global economic growth significantly influence investor sentiment towards risk assets, including Bitcoin. Thirdly, regulatory developments and their impact on institutional adoption need to be factored in. Finally, technological advancements and the evolution of the Bitcoin ecosystem, such as the growth of the Lightning Network, play a crucial role. A simplified model might involve assigning weights to these factors based on their historical correlation with Bitcoin price movements, and projecting their future values to arrive at a potential price range. For example, a model could predict a price range between $100,000 and $200,000 based on a weighted average of these factors, assuming moderate economic growth and continued institutional adoption. However, this is a highly simplified illustration, and a real-world model would be far more complex.

Comparison of Expert Opinions

Experts hold diverse views on the 2025 halving’s price impact. Some analysts predict a significant price surge due to the reduced supply, mirroring the price increases observed after previous halvings. Others are more cautious, citing the potential for bearish market sentiment or regulatory headwinds to offset the halving’s impact. For instance, some experts might point to the 2012 and 2016 halvings, which were followed by substantial price increases, as evidence supporting their bullish outlook. Conversely, others might emphasize the current macroeconomic uncertainty and the potential for increased regulatory scrutiny as factors that could dampen the positive effects of the halving. The divergence in opinions highlights the inherent uncertainty surrounding cryptocurrency markets.

Scenario Analysis: Potential Outcomes

Several scenarios could unfold after the 2025 halving. A bullish scenario could see a substantial price increase, driven by increased scarcity and renewed investor interest. A neutral scenario might involve a moderate price increase, with the halving’s effect offset by other market forces. A bearish scenario could see limited price movement or even a price decline, if negative external factors outweigh the halving’s impact. The probability of each scenario is difficult to assess with precision, as it depends on the interplay of numerous interconnected variables. Each scenario would necessitate a different strategic approach for investors, ranging from aggressive buying in a bullish scenario to cautious hedging in a bearish one.

Halving and Mining Difficulty Adjustment

The Bitcoin halving directly impacts the profitability of Bitcoin mining. As the block reward is halved, miners’ revenue decreases. This triggers an automatic adjustment mechanism, increasing the mining difficulty. The difficulty adjustment ensures that the average time to mine a block remains roughly constant, around 10 minutes. This adjustment prevents excessive centralization of mining power and maintains the integrity of the Bitcoin network. The relationship is inversely proportional: a lower block reward necessitates a higher mining difficulty to maintain the block generation rate. This means that the halving will not automatically lead to a price increase; rather, it impacts the cost of mining, which in turn can influence the overall supply dynamics.

Implications for Long-Term Adoption and Market Dominance

The 2025 halving could influence Bitcoin’s long-term adoption and market dominance in several ways. A significant price increase could attract new investors and bolster its position as the leading cryptocurrency. However, increased price volatility might also discourage some potential users. Furthermore, the halving’s impact on mining profitability might affect the decentralization of the network, depending on how miners adapt to the reduced rewards. Increased adoption, driven by a positive price movement, could lead to broader acceptance as a store of value and medium of exchange. Conversely, if the price remains stagnant or declines, the adoption rate might be slower, and competition from other cryptocurrencies could potentially erode Bitcoin’s market share.

The 2025 Halving and Bitcoin Mining: When Was The Bitcoin Halving In 2025

The Bitcoin halving, a pre-programmed event reducing the block reward paid to miners, significantly impacts the Bitcoin mining ecosystem. The 2025 halving, cutting the reward in half, will present both challenges and opportunities for miners, influencing their profitability, operational strategies, and environmental footprint.

Challenges Faced by Bitcoin Miners Before and After a Halving

Miners consistently face the challenge of balancing operational costs against the block reward. Before a halving, profitability is generally higher, leading to increased competition and potentially higher energy consumption as miners seek to maximize their earnings. After a halving, the reduced reward necessitates adjustments to maintain profitability. This can involve increased efficiency, switching to cheaper energy sources, or consolidating operations. The immediate post-halving period often sees a period of decreased profitability, potentially leading to some miners exiting the market. This is particularly true for those operating with less efficient hardware or higher energy costs.

Impact of the Halving on the Profitability of Bitcoin Mining

The halving directly impacts miner profitability by reducing the primary income source – the block reward. The extent of this impact depends on several factors including the Bitcoin price, the cost of electricity, the efficiency of mining hardware (hash rate per unit of energy consumed), and the difficulty of mining. A higher Bitcoin price can offset the reduced reward, maintaining or even increasing profitability. Conversely, a low Bitcoin price combined with high energy costs could render mining unprofitable for many operators. For example, a miner using older, less efficient ASICs might find their operations unsustainable after the halving, even with a stable Bitcoin price, unless electricity costs decrease substantially.

Miner Adaptation Strategies in Response to Reduced Block Rewards

To maintain profitability following a halving, miners employ several strategies. These include upgrading to more energy-efficient hardware, negotiating lower electricity prices (e.g., by moving operations to regions with cheaper energy), improving mining pool efficiency to reduce transaction fees, and diversifying revenue streams through services like Bitcoin node operation or custodial services. Some miners may also choose to consolidate their operations to achieve economies of scale, sharing resources and reducing overhead costs. The success of these strategies depends on market conditions and individual miner capabilities.

Environmental Impact of Bitcoin Mining and the Halving’s Influence, When Was The Bitcoin Halving In 2025

Bitcoin mining’s environmental impact is a significant concern, primarily due to its energy consumption. The halving might indirectly reduce this impact. As profitability decreases post-halving, less efficient miners may shut down, leading to a reduction in overall energy consumption. However, this effect is not guaranteed. The increase in mining efficiency due to hardware upgrades can offset the reduction in the number of miners, potentially maintaining or even increasing overall energy consumption. The net environmental impact depends on the balance between these competing forces, along with the adoption of renewable energy sources by miners.

Energy Consumption of Bitcoin Mining Before and After the 2025 Halving

Predicting the precise change in energy consumption is challenging. While the halving might lead to some miners exiting the market, the adoption of more efficient hardware and the potential for increased mining activity due to the long-term bullish sentiment surrounding halving events could offset this. Historically, Bitcoin’s hash rate (a measure of mining power) has generally increased over time, despite halvings. This suggests that energy consumption might not significantly decrease, or may even increase, depending on the aforementioned factors. Precise figures are difficult to obtain due to the decentralized and opaque nature of the Bitcoin mining industry, and accurate data on the energy mix used by miners is often unavailable.

Bitcoin’s Future After the 2025 Halving

The 2025 Bitcoin halving, reducing the block reward for miners by half, is a significant event with potentially far-reaching consequences for Bitcoin’s price, adoption, and overall impact on the global financial landscape. Predicting the future is inherently uncertain, but analyzing historical trends and current market dynamics allows for informed speculation about the post-halving landscape.

The year following the 2025 halving will likely be a period of significant volatility and adjustment for Bitcoin.

Bitcoin’s Price Trajectory Post-Halving

Historically, Bitcoin’s price has shown a tendency to rise in the periods following previous halvings. This is attributed to the reduced supply of newly mined Bitcoin, creating a potential scarcity effect. However, this effect is not guaranteed and other factors such as macroeconomic conditions, regulatory changes, and overall market sentiment will significantly influence the price. For example, the period after the 2020 halving saw a significant price increase, culminating in a peak in late 2021, before a considerable correction. A similar pattern, albeit with different magnitude, could unfold after the 2025 halving. A conservative estimate might suggest a price range of $100,000 to $200,000 within the year following the halving, contingent on favorable market conditions. However, a more bearish scenario could see prices remain relatively flat or even experience a temporary decline before resuming an upward trend.

Institutional Investor Adoption Post-Halving

Increased scarcity due to the halving, coupled with potential regulatory clarity in key jurisdictions, could further incentivize institutional investment in Bitcoin. Large financial institutions, already holding significant amounts of Bitcoin, might increase their holdings, viewing it as a hedge against inflation and a potential store of value. This increased institutional demand could contribute to upward price pressure. The example of MicroStrategy’s significant Bitcoin purchases demonstrates the growing acceptance of Bitcoin as an asset class among institutional investors. Further institutional adoption post-halving could lead to greater market stability and liquidity.

Regulatory Developments and Bitcoin’s Future

Regulatory developments will play a crucial role in shaping Bitcoin’s trajectory after the 2025 halving. Clearer and more consistent regulatory frameworks globally could foster greater institutional confidence and wider adoption. Conversely, restrictive regulations could stifle growth and limit price appreciation. The regulatory landscape is constantly evolving, and the actions of key regulatory bodies in the US, Europe, and Asia will have a significant impact. A positive regulatory environment, promoting clarity and innovation, would likely be beneficial for Bitcoin’s long-term growth.

Societal Impact of Bitcoin’s Continued Growth

Continued growth in Bitcoin’s adoption could have a profound societal impact. Increased financial inclusion through Bitcoin’s decentralized nature could empower individuals in underserved communities, providing access to financial services previously unavailable. The potential for cross-border payments without intermediaries could also reduce transaction costs and enhance efficiency. However, concerns regarding environmental impact from Bitcoin mining and the potential for misuse in illicit activities need to be addressed. Balancing the benefits of increased financial accessibility and innovation with the mitigation of risks is a key challenge for the future.

Bitcoin’s Potential Market Position: A Visual Representation

Imagine a graph depicting Bitcoin’s market capitalization. The pre-halving period shows a relatively stable, albeit fluctuating, growth trajectory. Immediately following the halving, the line shows a sharp upward incline, representing increased price and market dominance. While some temporary corrections are depicted by slight dips, the overall trend remains bullish, showing Bitcoin solidifying its position as a major asset class, surpassing other cryptocurrencies and potentially challenging established financial instruments in terms of market capitalization. The graph visually represents Bitcoin’s increased market share and influence within the broader financial ecosystem. The overall visual impression is one of growth and establishment as a significant global asset.

Frequently Asked Questions about the 2025 Bitcoin Halving

The Bitcoin halving is a significant event in the cryptocurrency’s lifecycle, impacting various aspects of the Bitcoin ecosystem. Understanding its mechanics and potential consequences is crucial for anyone involved in or interested in the cryptocurrency market. This section addresses some of the most frequently asked questions surrounding the anticipated 2025 halving.

Bitcoin Halving Explained

A Bitcoin halving is a programmed event in the Bitcoin protocol that reduces the rate at which new Bitcoins are created and added to the circulating supply. This occurs approximately every four years, or every 210,000 blocks mined. The halving mechanism is designed to control inflation and maintain the scarcity of Bitcoin over time. Essentially, the reward miners receive for successfully adding a block to the blockchain is cut in half. For example, the reward went from 50 BTC per block to 25 BTC, then to 12.5 BTC, and the next halving will reduce it to 6.25 BTC.

Expected Date of the 2025 Bitcoin Halving

While the halving is roughly every four years, the exact date fluctuates slightly due to variations in the time it takes to mine blocks. Block mining time is influenced by the overall network hash rate (the computational power dedicated to mining). As of late 2023, predictions point towards the 2025 halving occurring sometime in the spring or early summer of 2025. Precise prediction requires monitoring the block creation rate leading up to the event. Historical data can provide a general timeframe, but precise timing remains uncertain until the event nears.

Impact of a Halving on Bitcoin Price

Historically, Bitcoin’s price has tended to increase in the periods following a halving. This is often attributed to the reduced supply of newly mined Bitcoin, creating a potential scenario of increased scarcity and potentially driving up demand. The 2012 and 2016 halvings were followed by significant price rallies, although other market factors were also at play. It’s important to note that this correlation doesn’t guarantee a price increase after the 2025 halving; other economic conditions, regulatory changes, and market sentiment will play a significant role. The 2020 halving, for example, saw a price increase but not as dramatic as the previous ones.

Implications for Bitcoin Miners

A halving directly impacts Bitcoin miners’ profitability. With fewer newly minted Bitcoins awarded per block, mining revenue decreases. This can lead to miners adjusting their operations, potentially by increasing efficiency, upgrading equipment, or consolidating operations to maintain profitability. Some less efficient miners might be forced to shut down, while others may seek alternative revenue streams, such as transaction fees. The overall effect on the mining landscape could involve consolidation and increased efficiency.

Is the 2025 Halving Already Priced Into the Market?

The concept of a halving being “priced in” refers to the market’s anticipation of the event and its potential impact on the price. If the market fully anticipates a price increase, the price might already reflect this expectation. This means that the actual price increase after the halving might be less dramatic than historical trends suggest, or even nonexistent, as the anticipated price rise has already occurred. However, determining the extent to which the market has already factored in the halving is difficult and speculative, as various factors influencing Bitcoin’s price are constantly at play. The degree to which the market anticipates the halving is an ongoing debate among analysts.

Illustrative Data Representation (using descriptive text)

Understanding the impact of Bitcoin halvings requires analyzing historical data and visualizing trends. By examining past halvings and their subsequent market effects, we can gain valuable insights into potential future scenarios. This section presents two illustrative representations of this data: a table summarizing key statistics and a chart depicting the relationship between halvings and price volatility.

Past Bitcoin Halving Statistics and Market Effects

A table summarizing past Bitcoin halvings would be incredibly useful for analysis. The table would have columns for the Halving Date, the Block Reward before the Halving, the Block Reward after the Halving, the Bitcoin Price (USD) before the Halving, the Bitcoin Price (USD) approximately one year after the Halving, and the Percentage Change in Price. Each row would represent a single Bitcoin halving event. This allows for a direct comparison of the halving’s timing, its immediate effect on miner reward, and its longer-term impact on Bitcoin’s market price. The percentage change in price would highlight the magnitude of price movements following each halving. Reliable sources for the Bitcoin price data would be essential for accuracy.

Historical Relationship Between Bitcoin Halvings and Price Volatility

A line chart would effectively illustrate the relationship between Bitcoin halvings and price volatility. The x-axis would represent time, showing the dates of past halvings clearly marked. The y-axis would represent Bitcoin price volatility, potentially measured using the standard deviation of daily price changes over a defined period (e.g., one year) before and after each halving. For each halving event, the chart would show a data point representing the volatility level both before and after the event. The line connecting these data points would visually represent the trend in volatility around each halving. The chart would visually demonstrate whether price volatility generally increases or decreases in the periods following a halving, helping to identify patterns and trends. A clear legend would explain the data presented, ensuring easy interpretation.