Bitcoin Halving

The Bitcoin halving is a programmed event in the Bitcoin protocol that reduces the rate at which new Bitcoins are created. This occurs approximately every four years, or every 210,000 blocks mined. It’s a crucial mechanism designed to control inflation and maintain the scarcity of Bitcoin over time.

Bitcoin Halving Mechanism and Impact on Supply and Demand

The Bitcoin halving mechanism directly affects the supply of Bitcoin. Before a halving, miners receive a certain number of Bitcoins as a reward for verifying and adding transactions to the blockchain. After the halving, this reward is cut in half. This reduction in the rate of new Bitcoin creation impacts the overall supply. While demand remains relatively consistent (or potentially increases due to the halving’s anticipated effects), a decreased supply generally leads to increased scarcity, potentially influencing its price. The halving doesn’t directly affect demand, but it influences the dynamics of supply and demand, creating a potential for price appreciation.

Historical Impact of Bitcoin Halvings on Price

Previous Bitcoin halvings have shown a correlation between the event and subsequent price increases, although the magnitude and timing of these increases have varied. It’s crucial to remember that correlation does not equal causation; other market factors influence Bitcoin’s price. However, the halving acts as a significant catalyst within the existing market dynamics. The reduced supply often leads to increased speculation and anticipation, driving up demand and potentially boosting the price. The exact price movement is unpredictable and influenced by various economic and geopolitical factors beyond the halving itself.

Timeline of Past Bitcoin Halvings and Market Reactions

The following table summarizes the past Bitcoin halvings and their approximate market reactions. Note that these are simplified representations, and the actual price movements were more complex, influenced by multiple factors.

| Halving Date | Block Height | Approximate Pre-Halving Price (USD) | Approximate Post-Halving Price (USD) (at peak) | Approximate Time to Peak Price |

|---|---|---|---|---|

| November 28, 2012 | 210,000 | ~$13 | ~$1,100 | ~1 year |

| July 9, 2016 | 420,000 | ~$650 | ~$20,000 | ~2 years |

| May 11, 2020 | 630,000 | ~$8,700 | ~$64,000 | ~1 year |

Predicting the 2025 Halving Date: When Will Bitcoin Halving Happen In 2025

Predicting the exact date of the Bitcoin halving in 2025 requires understanding the underlying mechanism of Bitcoin’s block reward reduction. This process is largely deterministic, relying on the consistent generation of new blocks. However, some factors can introduce minor variations.

Calculating the Halving Date

The Bitcoin protocol dictates that the block reward is halved approximately every 210,000 blocks. To predict the halving date, one needs to monitor the block generation rate and extrapolate from the last halving. The average block time is targeted at 10 minutes, but this fluctuates due to variations in mining difficulty adjustments. Calculating the precise date involves determining the block height at the time of the previous halving, adding 210,000 blocks, and then estimating the time required to mine those blocks based on the current average block generation time. For example, if the previous halving occurred at block height X and the current average block time is Y minutes, a simple calculation would be (210,000 blocks * Y minutes/block) / (60 minutes/hour * 24 hours/day) ≈ number of days until the next halving. This provides a rough estimate. More sophisticated predictions account for historical block time variability and apply statistical modeling to refine the estimate.

Factors Influencing the Halving Date

Several factors can subtly influence the precise date of the halving. The most significant is the variation in the average block generation time. Periods of increased or decreased miner participation and changes in overall network hash rate directly impact block generation time. A prolonged period of unusually fast block generation could slightly accelerate the halving, while a period of slower-than-average block generation could delay it. Furthermore, while unlikely, significant changes to the Bitcoin protocol (a hard fork) could theoretically impact the block reward schedule, though this is highly improbable given the community’s consensus around the halving mechanism.

Comparing Prediction Methods

Several methods exist for predicting the halving date, ranging from simple extrapolations based on average block time to more complex statistical models. Simple methods, relying solely on the average block time since the last halving, provide a quick estimate but are susceptible to greater error due to the inherent variability in block generation. More sophisticated methods employ time-series analysis and other statistical techniques to account for this variability, potentially offering a more accurate prediction. These more complex models, however, may require significant computational power and expertise. Ultimately, all prediction methods are estimates, and the actual halving date will only be known once the 210,000th block after the previous halving is mined. The difference between prediction and reality often falls within a relatively small window of days or even hours. Past halving predictions provide a good illustration of the accuracy of different methods, showcasing the limitations and strengths of simple versus complex approaches.

Market Expectations and Price Predictions

The Bitcoin halving event, occurring approximately every four years, significantly impacts market expectations and often triggers price volatility. Historically, halvings have been followed by periods of price appreciation, though the timing and magnitude of these increases vary considerably. Understanding the typical market reactions and considering various market conditions is crucial for navigating the period surrounding the 2025 halving.

Predicting Bitcoin’s price is inherently challenging, given the cryptocurrency’s volatility and susceptibility to various internal and external factors. However, analyzing historical trends and considering expert opinions can provide a framework for understanding potential scenarios.

Typical Market Reactions to Bitcoin Halvings

The anticipation leading up to a halving often creates a bullish sentiment. Investors speculate on the reduced supply of newly mined Bitcoin, leading to increased demand and potentially higher prices. This is often reflected in increased trading volume and a gradual price increase in the months prior to the event. Following the halving, the price reaction can be varied. Sometimes, the price continues its upward trajectory, driven by the reduced supply and continued demand. Other times, a period of consolidation or even a temporary price correction may occur before a subsequent price increase. The 2012 and 2016 halvings saw price increases following the event, although the timing and magnitude differed significantly. The 2020 halving also saw a price increase, though it was followed by a period of consolidation and then a substantial price surge in late 2020 and early 2021.

Potential Price Scenarios After the 2025 Halving

Several scenarios are plausible for Bitcoin’s price following the 2025 halving. A bullish scenario might see a significant price increase, potentially driven by sustained institutional adoption, positive regulatory developments, and continued scarcity of Bitcoin. In this case, the price could potentially reach new all-time highs, surpassing previous peaks. A neutral scenario might involve a period of consolidation, where the price fluctuates within a certain range, before eventually resuming an upward trend. A bearish scenario could involve a prolonged price correction or a bear market, potentially driven by macroeconomic factors, regulatory uncertainty, or a loss of investor confidence. The severity of such a correction would depend on the confluence of various market forces. For example, a global recession could significantly impact Bitcoin’s price, irrespective of the halving.

Expert Opinions and Market Analyses

Numerous analysts and experts offer varying predictions for Bitcoin’s price around the 2025 halving. Some analysts predict a significant price increase, potentially exceeding previous all-time highs, citing the reduced supply and growing institutional adoption. Others are more cautious, highlighting the potential for macroeconomic factors and regulatory risks to impact the price. These predictions often range widely, reflecting the inherent uncertainty associated with predicting cryptocurrency prices. For example, some analysts might base their predictions on historical price patterns following previous halvings, while others incorporate macroeconomic indicators and sentiment analysis into their models. The lack of a universally accepted valuation model for Bitcoin contributes to the divergence in these expert opinions.

Factors Influencing Bitcoin’s Price After the Halving

The Bitcoin halving, a pre-programmed event reducing the rate of new Bitcoin creation, significantly impacts the cryptocurrency’s supply and, consequently, its price. However, the price trajectory post-halving isn’t solely determined by this event. Several other intertwined factors play a crucial role in shaping Bitcoin’s value in the period following the halving. Understanding these factors is vital for navigating the often-volatile cryptocurrency market.

Adoption Rate’s Influence on Bitcoin Price

The rate at which Bitcoin is adopted by individuals, businesses, and institutions directly influences its price. Increased adoption leads to higher demand, pushing the price upwards. Conversely, decreased adoption or a slowdown in adoption can lead to price stagnation or even decline. For instance, the growing acceptance of Bitcoin as a payment method by major corporations, the increasing number of Bitcoin ATMs globally, and the expanding use of Bitcoin in decentralized finance (DeFi) applications all contribute to increased adoption and can positively impact its price after the halving. A significant increase in institutional investment, as seen in 2020 and 2021 with companies like MicroStrategy adding Bitcoin to their balance sheets, also demonstrates the impact of adoption on price. Conversely, a major regulatory crackdown or a significant negative news event could negatively impact adoption rates and subsequently, the price.

Regulatory Changes and Their Impact on Bitcoin Price

Government regulations play a pivotal role in shaping the Bitcoin market. Favorable regulatory frameworks can boost investor confidence, leading to increased investment and higher prices. Conversely, restrictive regulations or outright bans can severely limit Bitcoin’s accessibility and adoption, potentially causing price drops. The varying regulatory landscapes across different countries highlight this volatility. For example, countries with clear and supportive regulatory frameworks often see higher Bitcoin adoption rates compared to countries with uncertain or hostile regulatory environments. A sudden shift in regulatory stance in a major market could cause significant price fluctuations, irrespective of the halving’s influence.

Macroeconomic Factors Affecting Bitcoin’s Price

Bitcoin’s price is also susceptible to broader macroeconomic trends. Inflation, interest rates, and economic recessions can all influence investor sentiment towards riskier assets like Bitcoin. During periods of high inflation, investors may seek refuge in Bitcoin as a hedge against inflation, driving up demand and price. Conversely, rising interest rates can make other investment options more attractive, potentially leading to a decrease in Bitcoin investment and a price drop. The 2022 bear market, for example, coincided with rising interest rates and increased inflation globally, illustrating the impact of macroeconomic factors. Similarly, a global recession could negatively impact risk appetite, affecting Bitcoin’s price irrespective of the halving.

Risk Assessment and Investment Strategies

Investing in Bitcoin, especially around a halving event, presents both significant opportunities and considerable risks. Understanding these risks and developing appropriate investment strategies based on your risk tolerance is crucial for navigating the volatile cryptocurrency market. The following analysis explores these aspects, offering a framework for informed decision-making.

Risk and Reward Assessment Before and After the 2025 Halving

The table below compares the risks and potential rewards associated with Bitcoin investment before and after the anticipated 2025 halving. It’s important to remember that these are estimations, and actual outcomes can vary significantly. Market sentiment, regulatory changes, and unforeseen technological developments all play a role.

| Risk Factor | Probability (Before Halving) | Potential Reward (Before Halving) | Mitigation Strategy |

|---|---|---|---|

| Price Volatility | High | High (potential for significant price increases leading up to the halving) | Dollar-cost averaging, diversification across other asset classes. |

| Regulatory Uncertainty | Moderate | N/A (primarily a risk, not a reward) | Staying informed about regulatory developments and choosing compliant exchanges. |

| Security Risks (Hacking, Loss of Keys) | Low (with proper security measures) | N/A (primarily a risk, not a reward) | Using secure hardware wallets, strong passwords, and reputable exchanges. |

| Market Manipulation | Moderate | N/A (primarily a risk, not a reward) | Diversification, avoiding impulsive trades based on short-term market movements. |

| Price Volatility | High (potentially higher after halving, depending on market reaction) | High (potential for significant price increases after the halving due to reduced supply) | Holding long-term, having a clear exit strategy. |

| Regulatory Uncertainty | Moderate (potential for increased scrutiny after halving) | N/A (primarily a risk, not a reward) | Same as before halving. |

| Security Risks (Hacking, Loss of Keys) | Low (with proper security measures) | N/A (primarily a risk, not a reward) | Same as before halving. |

| Market Manipulation | Moderate (potential for increased manipulation attempts after halving) | N/A (primarily a risk, not a reward) | Same as before halving. |

Investment Strategies Based on Risk Tolerance

The following investment strategies cater to different risk tolerance levels, taking into account the 2025 Bitcoin halving. Remember that past performance is not indicative of future results.

When Will Bitcoin Halving Happen In 2025 – Choosing the right strategy depends heavily on your individual financial situation, investment goals, and comfort level with risk. Consider seeking advice from a qualified financial advisor before making any investment decisions.

- Conservative Strategy (Low Risk Tolerance): This approach involves a small allocation to Bitcoin, perhaps 5-10% of your investment portfolio. The focus is on long-term holding, minimizing exposure to price volatility. Dollar-cost averaging is employed to reduce the impact of market fluctuations.

- Moderate Strategy (Medium Risk Tolerance): This strategy involves a larger allocation to Bitcoin, potentially 15-30% of your portfolio. It incorporates a combination of long-term holding and strategic trading opportunities around the halving event. Thorough research and risk management are crucial.

- Aggressive Strategy (High Risk Tolerance): This strategy allocates a significant portion of the portfolio (30% or more) to Bitcoin. It involves active trading, leveraging potential price swings before and after the halving. This strategy requires a deep understanding of market dynamics and a high risk tolerance. It’s crucial to have a clear exit strategy to avoid significant losses.

Alternative Cryptocurrencies and the Halving Event

The Bitcoin halving, a significant event in the cryptocurrency world, doesn’t exist in isolation. Its impact ripples across the broader crypto market, influencing the performance of alternative cryptocurrencies (altcoins). While Bitcoin’s halving directly affects its own supply and potentially its price, the interconnected nature of the crypto market means this event can have both direct and indirect consequences for other digital assets.

The impact of halving events on altcoins is multifaceted and less predictable than their effect on Bitcoin. Unlike Bitcoin, which has a clearly defined halving schedule, many altcoins employ different mechanisms for controlling their supply, and some don’t have a built-in halving mechanism at all. Therefore, the correlation between Bitcoin’s halving and altcoin price movements is complex and varies depending on various factors, including market sentiment, the specific altcoin’s characteristics, and its relationship with Bitcoin.

Comparison of Halving Impacts

Bitcoin’s halving events have historically been associated with periods of increased price volatility, often followed by substantial price increases in the months and years following the event. This is primarily attributed to the reduced supply of newly mined Bitcoin, creating a potential scarcity effect. However, altcoin halvings haven’t always shown the same dramatic price reactions. For example, Litecoin, with its similar halving mechanism to Bitcoin, has experienced price fluctuations around its halving events, but the magnitude of these fluctuations has been less pronounced compared to Bitcoin’s. This difference highlights the influence of factors beyond the halving itself, such as market capitalization, adoption rate, and overall market sentiment. The effect of a halving is not solely dependent on the halving event itself, but also on a complex interplay of market forces.

Potential Benefits for Altcoins from Bitcoin Halving

The Bitcoin halving can indirectly benefit altcoins in several ways. Firstly, increased investor interest in Bitcoin often leads to a broader increase in interest in the cryptocurrency market as a whole. This heightened interest can spill over into altcoins, driving up their prices. Secondly, the increased volatility surrounding Bitcoin’s halving can create opportunities for traders to profit from price swings in altcoins. Finally, some investors might choose to diversify their holdings by investing in altcoins during periods of uncertainty in the Bitcoin market. For instance, during the 2020 Bitcoin halving, while Bitcoin experienced a price increase, many altcoins also saw substantial gains, showcasing the interconnectedness of the crypto market. However, it’s crucial to note that this is not always the case, and some altcoins might experience negative price movements during this period.

Correlation Between Bitcoin and Altcoin Prices

Bitcoin often acts as a bellwether for the entire cryptocurrency market. Its price movements tend to influence the prices of other cryptocurrencies, a phenomenon often referred to as “Bitcoin dominance.” A strong positive correlation exists between Bitcoin’s price and the prices of many altcoins. When Bitcoin’s price rises, altcoin prices often follow suit, and vice-versa. However, this correlation is not always perfect, and the strength of the relationship can vary depending on several factors, including the overall market sentiment, regulatory developments, and the specific characteristics of each altcoin. During periods of high Bitcoin volatility, like those surrounding halving events, the correlation can become even more pronounced, but it’s not a guaranteed outcome. The extent of this correlation is dynamic and dependent on various market factors, highlighting the unpredictable nature of the crypto market.

Long-Term Implications of the Bitcoin Halving

The Bitcoin halving, a programmed event reducing the rate of new Bitcoin creation, has profound long-term implications for the cryptocurrency’s scarcity and its role in the broader financial landscape. Understanding these implications is crucial for investors and those interested in the future of digital currencies. The halving’s impact extends beyond immediate price fluctuations, shaping the narrative around Bitcoin’s value proposition and its potential for mainstream adoption.

The halving directly impacts Bitcoin’s scarcity by reducing the supply of newly mined coins. This controlled deflationary mechanism is central to Bitcoin’s design, intended to mimic the scarcity of precious metals like gold. As the supply decreases while demand potentially remains strong or increases, the fundamental economic principle of supply and demand suggests that the price of Bitcoin could rise. However, the actual impact is complex and depends on several interacting factors, including market sentiment, regulatory changes, and technological advancements within the cryptocurrency space.

Bitcoin’s Scarcity and Value Proposition

The halving reinforces Bitcoin’s core value proposition as a deflationary, scarce asset. This scarcity, coupled with its decentralized nature and transparent blockchain technology, positions Bitcoin as a potential store of value, similar to gold. Historically, halving events have been followed by periods of increased Bitcoin price volatility, often leading to significant price appreciation over the long term. For example, the 2012 and 2016 halvings were followed by substantial price increases, although it’s important to note that other market factors also contributed to these price movements. The 2020 halving, while not immediately resulting in a dramatic price surge, saw a gradual increase in Bitcoin’s value over the following year. This illustrates the complex interplay between the halving and broader market forces.

The Halving’s Influence on the Cryptocurrency Market

The Bitcoin halving doesn’t exist in isolation; it significantly influences the broader cryptocurrency market. The event often serves as a catalyst for increased investor interest in the entire sector, leading to price movements in altcoins as well. Investors might shift their portfolios, allocating funds to other cryptocurrencies perceived as having growth potential, resulting in a ripple effect across the market. The halving’s impact on investor sentiment can also affect the development and adoption of alternative cryptocurrencies, potentially stimulating innovation and competition within the space. For example, the 2017 bull market, which followed the 2016 halving, saw a surge in the popularity and market capitalization of many altcoins, demonstrating the interconnectedness of Bitcoin’s performance with the wider crypto ecosystem.

Bitcoin Adoption as a Mainstream Asset

The halving’s long-term effect on Bitcoin’s mainstream adoption is less direct. While increased scarcity might enhance Bitcoin’s appeal as a store of value, its adoption as a medium of exchange depends on factors beyond supply constraints. These include regulatory clarity, user-friendliness, transaction speed, and the overall acceptance by businesses and individuals. A successful halving, resulting in a sustained price increase, could potentially boost investor confidence and increase the likelihood of wider adoption. Conversely, if the halving fails to produce significant price appreciation or is followed by a prolonged period of low market activity, it could potentially hinder mainstream adoption by reducing investor enthusiasm and market momentum. The narrative around Bitcoin’s utility as a payment method or a store of value is constantly evolving and shaped by many factors, not just the halving itself.

Frequently Asked Questions (FAQ)

This section addresses common queries regarding the Bitcoin halving event, its impact on price, associated risks, and comparisons to other significant events within the Bitcoin ecosystem. Understanding these points is crucial for informed decision-making regarding Bitcoin investments.

Bitcoin Halving and its Price Impact, When Will Bitcoin Halving Happen In 2025

The Bitcoin halving is a programmed event in the Bitcoin protocol that reduces the rate at which new Bitcoins are created (mined) by half. This occurs approximately every four years. The reduction in the supply of new Bitcoins entering circulation is often theorized to create upward pressure on the price due to basic supply and demand economics. Historically, Bitcoin’s price has shown an increase following previous halving events, though this is not guaranteed. The actual price impact is complex and influenced by numerous other market factors.

The Exact Date of the 2025 Bitcoin Halving

While the halving is approximately every four years, the precise date is determined by the block height at which it occurs. Bitcoin miners work to solve complex cryptographic problems to add blocks to the blockchain. The time it takes to mine a block varies slightly, leading to some uncertainty in the precise date. However, based on current block mining times, predictions point to the 2025 halving occurring sometime in the Spring or early Summer of 2025. Precise predictions require constant monitoring of the block generation rate leading up to the event.

Guaranteed Price Rise After Halving

No, a price increase after the halving is not guaranteed. While historical data suggests a correlation between halvings and subsequent price increases, numerous factors influence Bitcoin’s price. These include macroeconomic conditions, regulatory changes, technological advancements, market sentiment, and overall adoption rates. The halving primarily affects the supply side of the equation; demand remains a crucial, and often unpredictable, factor. The 2012 and 2016 halvings saw significant price increases following the events, but the market dynamics were vastly different then compared to the current environment.

Risks Associated with Bitcoin Investment Around the Halving

Investing in Bitcoin, particularly around a halving event, carries significant risks. Volatility is inherent to the cryptocurrency market, and the anticipation of a halving can lead to speculative bubbles and subsequent crashes. Market manipulation is also a possibility. Furthermore, the regulatory landscape surrounding cryptocurrencies remains uncertain in many jurisdictions, adding another layer of risk. Diversification of investments and careful risk assessment are crucial before investing in Bitcoin or any other cryptocurrency.

Comparison to Other Significant Bitcoin Events

The Bitcoin halving is arguably the most significant programmed event in the Bitcoin ecosystem. Unlike other events like upgrades or forks, the halving directly impacts the fundamental mechanics of Bitcoin’s supply. While other events, such as the launch of the Lightning Network or significant regulatory changes, can have substantial impacts on the price and adoption of Bitcoin, the halving has a more predictable and arguably more profound long-term effect on Bitcoin’s scarcity. It is a key event that shapes the narrative and expectations surrounding the cryptocurrency.

Illustrative Example: Bitcoin Halving Impact Visualization

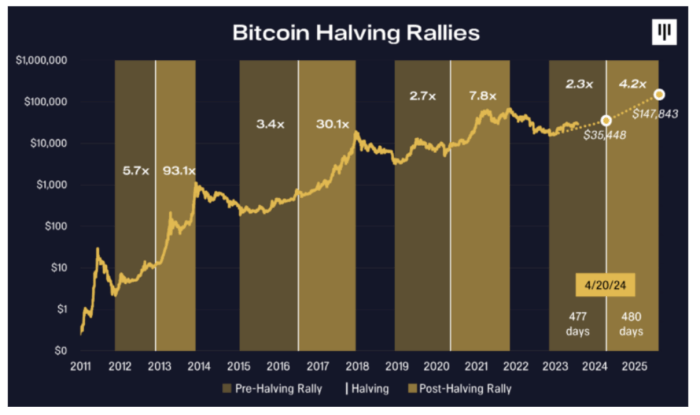

A visual representation of Bitcoin’s price behavior around its halving events offers valuable insights into the potential impact of the 2025 halving. Analyzing historical data allows us to identify trends and patterns that might inform expectations, although it’s crucial to remember that past performance is not indicative of future results. The visualization would ideally be a line chart, with the x-axis representing time and the y-axis representing Bitcoin’s price.

The chart would plot Bitcoin’s price over several years, clearly marking the dates of the previous halving events (2012, 2016, and 2020). Each halving would be highlighted, perhaps with a vertical line and annotation. The period leading up to each halving, the halving event itself, and the subsequent period would be visually distinct. This allows for a direct comparison of price movements across different halving cycles.

Bitcoin Halving Price Action Over Time

The chart would reveal several key features. First, it would show a general upward trend in Bitcoin’s price over the long term. However, the price trajectory is not consistently linear; rather, it exhibits periods of significant volatility, both upward and downward. Crucially, the chart would illustrate that while the halvings have generally been followed by periods of price appreciation, the magnitude and duration of these increases have varied considerably. For example, the 2012 halving was followed by a period of substantial price growth, culminating in the 2013 bull market. The 2016 halving also saw subsequent price increases, although the timeline and magnitude differed from the 2012 cycle. The 2020 halving led to a significant bull run in 2021, but the market later experienced a significant correction. This variation highlights the complexity of predicting future price movements based solely on halving events. Other factors, such as macroeconomic conditions, regulatory changes, and overall market sentiment, significantly influence Bitcoin’s price.

Significant Data Points and Trends

Specific data points to highlight on the chart include the price of Bitcoin immediately before and after each halving, the peak price reached in the subsequent bull market, and the duration of the bull market. Connecting these points visually would help illustrate the time lag between the halving and the peak price, as well as the varying intensity of the subsequent bull runs. Trends to analyze include the average time it took for the price to reach its peak after each halving, the percentage increase in price following each halving, and the length of subsequent bear markets. By comparing these metrics across the three previous halvings, we can gain a better understanding of the potential range of outcomes for the 2025 halving. This analysis, however, must be interpreted cautiously, as it’s based on past data and doesn’t account for unforeseen circumstances that might influence the market.