White Bitcoin Price Prediction 2025

The cryptocurrency market in 2024 is characterized by significant volatility and ongoing regulatory scrutiny. Bitcoin, the leading cryptocurrency, has experienced periods of both substantial growth and sharp corrections, reflecting the inherent risks and rewards associated with this asset class. Overall trends suggest a growing, albeit fluctuating, level of institutional and retail investor interest, alongside increasing integration into traditional financial systems. However, macroeconomic factors, geopolitical events, and evolving regulatory landscapes continue to exert considerable influence.

White Bitcoin, a hypothetical cryptocurrency, represents a potential evolution or alternative to Bitcoin. The precise nature of White Bitcoin remains undefined, but its conceptualization likely revolves around improvements or modifications to existing Bitcoin technology or its underlying philosophy. This could involve enhancements to scalability, transaction speed, energy efficiency, or privacy features. The key differentiation from traditional Bitcoin would stem from these technological or structural advancements, potentially leading to a different market perception and valuation.

Factors Influencing White Bitcoin Price in 2025

Several factors could significantly impact the price of White Bitcoin in 2025, assuming its successful development and launch. Adoption rates will be crucial; widespread acceptance by businesses and consumers would drive demand and price appreciation. Conversely, limited adoption could stifle growth and limit price increases. Regulatory changes also play a vital role; supportive regulations could foster market confidence and attract investment, while restrictive policies could hinder growth. Technological advancements within White Bitcoin’s ecosystem, such as improvements to its consensus mechanism or the introduction of new functionalities, would likely influence its perceived value and therefore its price. Finally, macroeconomic conditions, such as global economic growth or recession, and the overall sentiment towards cryptocurrencies will inevitably impact the price. For example, if the global economy experiences significant growth and investors seek alternative assets, White Bitcoin could see substantial price increases, mirroring the positive correlation often seen between Bitcoin’s price and broader economic trends. Conversely, a global recession could lead to a decline in its value, as investors might shift their funds towards safer assets.

Factors Affecting White Bitcoin’s Price in 2025: White Bitcoin Price In 2025 Usd

Predicting the price of any cryptocurrency, including White Bitcoin, is inherently speculative. However, by analyzing various influencing factors, we can form a more informed perspective on potential price movements in 2025. Several macroeconomic, technological, and market-driven forces will play significant roles in shaping White Bitcoin’s value.

Macroeconomic Factors

Global economic conditions significantly impact cryptocurrency prices. High inflation, for example, can drive investors towards alternative assets like Bitcoin, potentially boosting demand. Conversely, rising interest rates often lead to a flight to safety, diverting investment away from riskier assets such as cryptocurrencies. Strong global economic growth might increase investor confidence across all asset classes, potentially benefiting White Bitcoin. However, a recessionary environment could lead to a sell-off in the cryptocurrency market, including White Bitcoin. The correlation between traditional markets and cryptocurrency markets is not always direct, but it’s undeniable that macroeconomic trends exert considerable influence. For instance, the 2022 bear market in cryptocurrencies coincided with rising inflation and interest rate hikes globally.

Technological Developments

Technological advancements within White Bitcoin’s ecosystem will be crucial. The implementation of scaling solutions, designed to increase transaction throughput and reduce fees, could attract more users and drive up demand. Similarly, the addition of new features, such as improved privacy protocols or decentralized finance (DeFi) integrations, can enhance White Bitcoin’s utility and appeal to a wider range of investors. Upgrades to the underlying blockchain, such as improved security or energy efficiency, could also positively impact its price. The success of projects like Lightning Network for Bitcoin demonstrates the significant impact of scaling solutions on price appreciation.

Market Sentiment and Investor Behavior

Market sentiment, encompassing investor confidence and overall market psychology, plays a crucial role in price fluctuations. Positive news, such as major partnerships or regulatory clarity, can fuel bullish sentiment and drive price increases. Conversely, negative news, such as security breaches or regulatory crackdowns, can trigger sell-offs and price declines. FOMO (Fear Of Missing Out) and FUD (Fear, Uncertainty, and Doubt) are powerful forces that can significantly impact short-term price volatility. The 2017 Bitcoin bull run, largely fueled by FOMO, serves as a prime example of how investor psychology can influence prices dramatically.

Comparison with Other Cryptocurrencies

White Bitcoin’s price movements will be influenced by the performance of other cryptocurrencies, especially Bitcoin and Ethereum. A bull market in the broader cryptocurrency market is likely to benefit White Bitcoin, while a bear market could exert downward pressure. However, White Bitcoin’s unique features and technological advantages could allow it to outperform or underperform other cryptocurrencies depending on market trends and investor preferences. The relative performance of different cryptocurrencies often depends on the specific narrative and technological advancements within each project.

Regulatory Frameworks and Government Policies

Government regulations and policies can significantly impact the cryptocurrency market. Favorable regulations, such as clear legal frameworks and tax policies, could attract institutional investment and boost confidence, leading to price increases. Conversely, restrictive regulations, such as outright bans or heavy taxation, could suppress demand and lead to price declines. The regulatory landscape varies significantly across countries, and White Bitcoin’s price could be influenced differently depending on the policies adopted by major jurisdictions. For example, countries with supportive regulatory environments for cryptocurrencies tend to see higher levels of trading activity and price appreciation.

Potential Price Scenarios for White Bitcoin in 2025

Predicting the price of any cryptocurrency, including White Bitcoin, is inherently speculative. However, by considering various macroeconomic factors, technological advancements, and market sentiment, we can construct plausible price scenarios for 2025. These scenarios are not financial advice and should be considered for informational purposes only.

Bullish Scenario: Widespread Adoption and Technological Breakthroughs

This scenario assumes significant mainstream adoption of White Bitcoin, driven by technological advancements such as improved scalability and faster transaction speeds. Increased institutional investment and positive regulatory developments also contribute to this optimistic outlook. Imagine a situation similar to Bitcoin’s surge in 2021, but potentially even more pronounced due to White Bitcoin’s unique features (assuming these features deliver on their promises). This would lead to substantially higher demand, outpacing supply and driving up the price.

A key assumption here is the successful implementation of solutions addressing White Bitcoin’s current limitations, making it a more viable and attractive alternative to existing cryptocurrencies. For example, a successful layer-2 scaling solution could drastically increase transaction throughput, leading to greater usability and adoption.

Price Range (USD): $10,000 – $50,000

Neutral Scenario: Steady Growth and Market Consolidation

This scenario assumes a more moderate level of growth, reflecting a period of market consolidation and cautious investor sentiment. While White Bitcoin experiences gradual adoption, it doesn’t achieve the explosive growth seen in the bullish scenario. This could be due to several factors, including increased regulatory scrutiny, competition from other cryptocurrencies, or a general downturn in the broader cryptocurrency market. This scenario mirrors the more stable growth seen in established cryptocurrencies like Ethereum over extended periods.

The underlying assumption here is that White Bitcoin maintains its current position in the market without experiencing either significant breakthroughs or setbacks. Technological advancements are incremental, and regulatory uncertainty remains a significant factor.

Price Range (USD): $1,000 – $5,000

Bearish Scenario: Regulatory Crackdown and Market Decline, White Bitcoin Price In 2025 Usd

This scenario Artikels a pessimistic outlook, assuming a significant regulatory crackdown on cryptocurrencies, leading to decreased investor confidence and a general decline in the cryptocurrency market. Negative news, security breaches, or a major economic downturn could also contribute to a bearish trend for White Bitcoin. This scenario would be similar to the crypto winter of 2018-2020, where many cryptocurrencies experienced substantial price drops.

The key assumption here is a negative regulatory environment coupled with a lack of significant technological advancements or positive market catalysts. This scenario also considers the possibility of increased competition and a loss of investor interest in White Bitcoin.

Price Range (USD): $100 – $1,000

| Scenario | Price Range (USD) | Justification |

|---|---|---|

| Bullish | $10,000 – $50,000 | Widespread adoption, technological breakthroughs, significant institutional investment, and positive regulatory developments. |

| Neutral | $1,000 – $5,000 | Gradual adoption, market consolidation, incremental technological advancements, and persistent regulatory uncertainty. |

| Bearish | $100 – $1,000 | Significant regulatory crackdown, decreased investor confidence, negative news, and a general decline in the cryptocurrency market. |

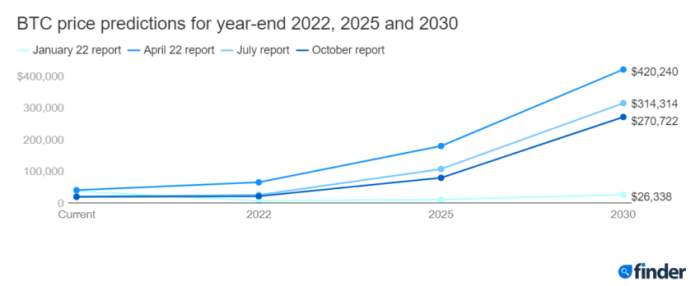

White Bitcoin Price In 2025 Usd – Predicting the White Bitcoin price in USD for 2025 is challenging, given the cryptocurrency’s volatility. However, understanding broader Bitcoin market trends is crucial; for a UK-centric perspective, check out this insightful analysis on Bitcoin Price Prediction 2025 Uk. This data can offer valuable context when considering potential White Bitcoin valuations in USD, as global market movements often influence individual altcoin performance.

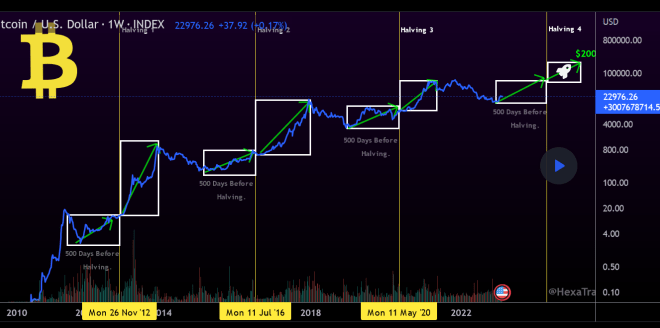

Predicting the White Bitcoin price in 2025 USD is challenging, hinging significantly on broader market trends. A key factor influencing this prediction is the potential for a substantial Bitcoin Price 2025 Bull Run, as discussed in this insightful article: Bitcoin Price 2025 Bull Run. The strength of this bull run will directly impact the value of White Bitcoin, potentially driving its USD price significantly higher or lower depending on its correlation with Bitcoin’s performance.

Predicting the White Bitcoin price in 2025 USD is challenging, requiring consideration of various market factors. To gain further insight into potential Bitcoin price movements, it’s helpful to consult expert analyses such as those found in the article, Ai Bitcoin Price Prediction 2025 Forbes , which offers AI-driven predictions. Understanding these broader predictions can help contextualize potential White Bitcoin price fluctuations in 2025.

Predicting the white Bitcoin price in 2025 in USD is challenging, given the inherent volatility of the cryptocurrency market. However, understanding various prediction models can offer some insight. For example, a comprehensive analysis of potential price trajectories is offered by the model presented in Bitcoin Price 2025 Plan B , which helps contextualize potential future values. Ultimately, though, the white Bitcoin price in 2025 remains speculative and dependent on numerous market factors.

Predicting the White Bitcoin price in 2025 USD is challenging, as it’s a relatively new asset. However, understanding the broader cryptocurrency market trends is crucial; a helpful resource for general Bitcoin price predictions is this analysis of Bitcoin Price In 2025. Ultimately, the White Bitcoin price will likely be influenced by the overall performance of Bitcoin and the broader adoption of cryptocurrencies.

Therefore, keeping an eye on the general Bitcoin market is key to understanding White Bitcoin’s potential value in 2025.