Bitcoin 2025 Price Prediction

Bitcoin’s price journey since its inception in 2009 has been nothing short of dramatic, marked by periods of explosive growth and significant corrections. From its humble beginnings worth mere cents, Bitcoin reached its first major milestone of $1,000 in 2017, fueled by increasing adoption and mainstream media attention. This was followed by a spectacular surge to nearly $20,000 by the end of that year, only to experience a sharp decline in the following years. Subsequent years saw further price volatility, with significant rallies and crashes influenced by various factors, including regulatory announcements, technological advancements, and macroeconomic conditions. Understanding this volatile history is crucial for any attempt to predict its future value.

Predicting Bitcoin’s price is inherently challenging due to its high volatility. Several factors contribute to this unpredictable nature. Firstly, Bitcoin’s relatively limited supply, capped at 21 million coins, creates scarcity, potentially driving up demand and price. Conversely, regulatory uncertainty across different jurisdictions significantly impacts investor confidence and trading volume. Furthermore, macroeconomic trends, such as inflation and global economic instability, can influence the attractiveness of Bitcoin as a safe haven asset or a speculative investment. Lastly, the sentiment within the crypto community and broader financial markets plays a considerable role, with periods of intense hype or fear leading to substantial price swings. The interplay of these factors makes accurate price prediction extremely difficult.

Factors Influencing Bitcoin Price Volatility

Bitcoin’s price volatility is a complex phenomenon influenced by a multitude of interconnected factors. These factors can be broadly categorized into technological, regulatory, macroeconomic, and market sentiment influences. Technological advancements, such as the implementation of the Lightning Network aimed at improving transaction speeds and reducing fees, can positively impact the price. Conversely, negative news regarding network security or scalability issues could trigger price drops. Regulatory actions, such as bans or stringent regulations imposed by governments, have historically led to significant price corrections. Conversely, positive regulatory developments or the adoption of Bitcoin by institutional investors can fuel price rallies. Macroeconomic conditions, including inflation rates, interest rate changes, and global economic uncertainty, significantly influence investor behavior and allocation of capital to Bitcoin. Finally, market sentiment, driven by news coverage, social media trends, and general investor psychology, creates a powerful force influencing Bitcoin’s price. For example, Elon Musk’s tweets have been known to cause significant price fluctuations. Understanding these intricate interactions is vital for informed price prediction.

The Importance of Market Trend Analysis in Price Prediction

Accurately predicting Bitcoin’s price in 2025 requires a deep understanding of current market trends and the factors driving them. Simply extrapolating past price movements is insufficient; a comprehensive analysis is needed. This involves studying the adoption rate of Bitcoin across various sectors, analyzing the growth of the cryptocurrency infrastructure, and assessing the overall regulatory landscape. Historical data provides valuable context, but it is not a predictor of future performance. For instance, while Bitcoin’s price has historically experienced significant corrections after periods of rapid growth, the magnitude and timing of these corrections are unpredictable. Therefore, a comprehensive analysis of current trends, coupled with a realistic assessment of potential future developments, forms the basis of a more informed price prediction. Focusing on these factors offers a more robust approach than relying solely on historical data or speculative narratives.

Factors Influencing Bitcoin’s Future Price

Predicting Bitcoin’s price is inherently complex, influenced by a confluence of factors ranging from regulatory landscapes and technological advancements to macroeconomic conditions and geopolitical events. Understanding these interconnected forces is crucial for navigating the volatility inherent in the cryptocurrency market. This section will explore key drivers shaping Bitcoin’s potential price trajectory.

Regulatory Changes and Bitcoin’s Value

Regulatory clarity significantly impacts Bitcoin’s price. Increased regulatory certainty, such as clear guidelines on taxation and trading, can boost investor confidence and lead to increased institutional adoption, driving price appreciation. Conversely, overly restrictive or inconsistent regulations can create uncertainty and suppress price growth. For example, a nation’s decision to fully embrace Bitcoin as legal tender could potentially trigger a significant price surge, while a blanket ban could result in a sharp decline. The ongoing evolution of regulatory frameworks globally will continue to be a major factor in Bitcoin’s price volatility.

Technological Advancements and Bitcoin Adoption

Technological improvements within the Bitcoin ecosystem play a vital role in fostering wider adoption. The Lightning Network, for instance, addresses Bitcoin’s scalability limitations by enabling faster and cheaper transactions off the main blockchain. Successful implementation and widespread use of the Lightning Network could significantly improve Bitcoin’s usability for everyday transactions, potentially increasing demand and driving price upward. Other advancements, such as improved wallet security and user-friendly interfaces, also contribute to greater accessibility and adoption.

Macroeconomic Factors and Bitcoin’s Price

Bitcoin’s price is often correlated with macroeconomic factors such as inflation and recession. During periods of high inflation, Bitcoin, often perceived as a hedge against inflation, may see increased demand, leading to price increases. Conversely, during economic downturns or recessions, investors might liquidate Bitcoin holdings to cover losses in other assets, potentially resulting in price drops. The 2022 cryptocurrency market downturn, coinciding with global economic uncertainty, serves as a real-world example of this correlation. However, the relationship is not always straightforward, and other factors can influence the price regardless of macroeconomic trends.

Geopolitical Events and Bitcoin’s Price

Geopolitical instability can significantly influence Bitcoin’s price. Events such as wars, political upheavals, or sanctions can lead to increased demand for Bitcoin as a safe haven asset, potentially driving up its price. Investors may seek refuge in Bitcoin’s decentralized nature, viewing it as a less susceptible asset compared to traditional fiat currencies or stocks during periods of geopolitical turmoil. Conversely, periods of relative global stability might lead to decreased demand and potential price corrections. The impact of such events is often unpredictable and depends on the severity and duration of the instability.

Institutional Investment and Bitcoin’s Price Trajectory

The involvement of institutional investors, such as large corporations and investment firms, plays a crucial role in Bitcoin’s price trajectory. Significant institutional investment can inject substantial capital into the market, driving up demand and potentially leading to sustained price increases. Conversely, a significant sell-off by institutional investors can trigger price corrections. The entry of major players like MicroStrategy and Tesla into the Bitcoin market has demonstrably influenced its price in the past, highlighting the significant impact institutional involvement can have.

Analyzing Different Price Prediction Models

Predicting Bitcoin’s future price is a complex undertaking, fraught with uncertainty. However, several established methodologies attempt to forecast its trajectory. Understanding these models, their strengths, and limitations is crucial for informed decision-making in the cryptocurrency market. This section explores various approaches to Bitcoin price prediction, examining their comparative accuracy and effectiveness.

Technical Analysis in Bitcoin Price Prediction

Technical analysis relies on historical price and volume data to identify patterns and trends, predicting future price movements. Indicators like moving averages, relative strength index (RSI), and MACD are commonly used. For instance, a sustained upward trend in a moving average might suggest a bullish outlook. However, technical analysis is inherently reactive, relying on past performance which may not accurately predict future behavior. It also suffers from subjectivity, as different analysts might interpret the same chart data differently. Successful application often requires a deep understanding of chart patterns and indicator signals.

Fundamental Analysis in Bitcoin Price Prediction, Bitcoin 2025 Price Prediction

Fundamental analysis focuses on the underlying factors affecting Bitcoin’s value, such as adoption rate, regulatory developments, technological advancements, and macroeconomic conditions. A higher adoption rate, for example, generally leads to increased demand and price appreciation. Conversely, negative regulatory news could trigger a price decline. While providing a broader context than technical analysis, fundamental analysis faces challenges in accurately quantifying the impact of these factors and predicting their timing. Unforeseen events can significantly alter the outlook, rendering even well-informed predictions inaccurate.

Comparative Analysis of Prediction Models and Accuracy

Different models, combining aspects of technical and fundamental analysis, often yield varying predictions. For example, one model might predict a price of $100,000 based on an anticipated surge in institutional adoption (fundamental), while another might suggest $50,000 based on resistance levels identified on price charts (technical). The accuracy of these predictions is difficult to definitively assess, as the cryptocurrency market is inherently volatile and influenced by numerous unpredictable factors. Past performance of any prediction model is not indicative of future results.

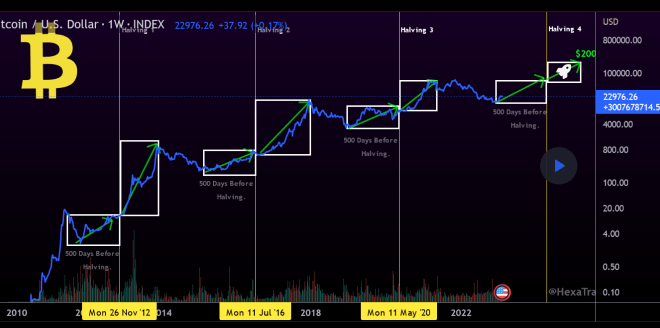

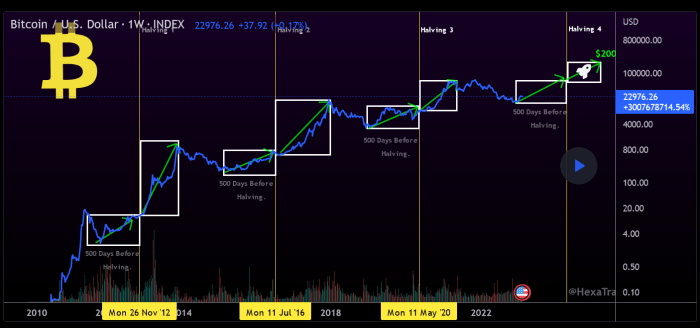

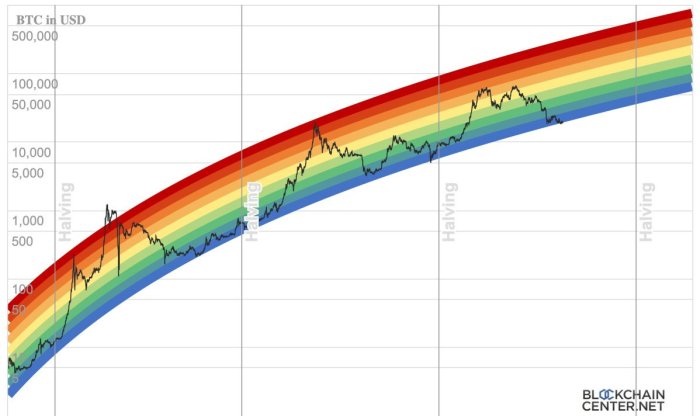

Interpreting Price Prediction Charts and Graphs

Price prediction charts and graphs visually represent potential price movements over time. They often incorporate technical indicators and projections based on various models. For example, a chart might display projected price ranges with confidence intervals, acknowledging the inherent uncertainty in forecasting. Effective interpretation requires understanding the methodology used to create the chart, the assumptions made, and the limitations of the model. Focusing solely on the projected price without considering the underlying assumptions can lead to misinterpretations and poor investment decisions. Analyzing multiple charts and models is recommended to gain a more comprehensive perspective.

Strengths and Weaknesses of Prediction Models

| Model | Strengths | Weaknesses | Example Application |

|---|---|---|---|

| Technical Analysis | Identifies patterns and trends; relatively easy to learn | Subjective; reactive; past performance is not indicative of future results | Using moving averages to identify potential support and resistance levels. |

| Fundamental Analysis | Considers underlying factors; provides broader context | Difficult to quantify factors; susceptible to unforeseen events | Assessing the impact of regulatory changes on Bitcoin’s price. |

| Combined Models | Combines strengths of technical and fundamental analysis | Complexity; requires expertise in both approaches | Using technical indicators to confirm predictions based on fundamental analysis. |

Bitcoin 2025 Price Prediction – Predicting the Bitcoin price in 2025 is a complex undertaking, influenced by various market factors and technological advancements. For a diverse range of opinions and speculative forecasts, it’s worthwhile checking out the discussions on Bitcoin Price Target 2025 Reddit , which offers a wealth of community insights. Ultimately, Bitcoin’s 2025 price will depend on a confluence of events, making any single prediction inherently uncertain.

Predicting the Bitcoin price in 2025 is a complex endeavor, with various models and opinions circulating. One interesting perspective to consider is Plan B’s model, detailed in this insightful analysis: Bitcoin Price 2025 Plan B. Understanding Plan B’s methodology helps contextualize Bitcoin 2025 price prediction discussions, offering a valuable framework for assessing potential future values.

Predicting the Bitcoin price in 2025 is a complex endeavor, influenced by numerous factors including adoption rates and regulatory changes. Understanding related altcoins can offer some insight, and for a perspective on a specific meme coin, you might find the analysis at Bitcoin Inu Price Prediction 2025 Usd helpful. Ultimately, though, these predictions only provide a limited view; the Bitcoin 2025 price will depend on a confluence of unpredictable market forces.

Predicting Bitcoin’s price in 2025 is a complex endeavor, with various factors influencing the outcome. For a glimpse into the collective wisdom of online crypto enthusiasts, you might find it useful to check out discussions on Bitcoin Price Prediction 2025 Reddit , which offers a range of perspectives. Ultimately, however, Bitcoin’s 2025 price will depend on market forces and technological advancements.

Predicting Bitcoin’s price in 2025 is a complex undertaking, with various factors influencing the outcome. A key element to consider is the impact of regional adoption, and a useful resource for understanding this is a focused analysis like the one provided by Bitcoin Price Prediction 2025 In India , which offers insights into the Indian market. Ultimately, the global Bitcoin 2025 price prediction will be shaped by the interplay of numerous international economic trends and regulatory decisions.