Bitcoin’s Role in the Financial Landscape of 2025

By 2025, Bitcoin’s influence on the global financial system is expected to be substantial, though its precise role remains subject to ongoing market dynamics and regulatory developments. Its integration will likely be a complex interplay of acceptance, resistance, and adaptation by various stakeholders.

Bitcoin 2025 Value – Several scenarios are plausible. Bitcoin could solidify its position as a significant store of value, attracting institutional investors seeking diversification and inflation hedging. Simultaneously, its use as a medium of exchange might expand, facilitated by advancements in payment processing and wider merchant adoption. However, widespread daily transactional use faces hurdles, including volatility and scalability challenges. The extent of Bitcoin’s integration will hinge on factors like regulatory clarity, technological improvements, and overall market sentiment.

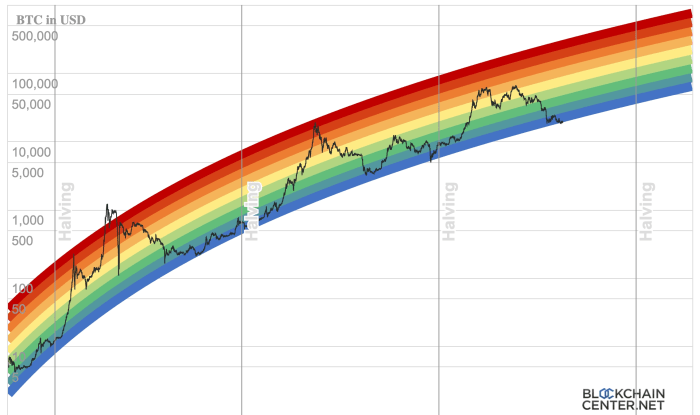

Speculating on Bitcoin’s 2025 value is a popular pastime, with many factors influencing the outcome. A key element to consider is the impact of the 2024 halving, which will significantly reduce the rate of new Bitcoin creation. For insightful analysis on how this event might affect price, check out this comprehensive resource on Bitcoin Price Prediction After Halving 2025.

Ultimately, predicting the precise Bitcoin 2025 value remains challenging, but understanding the halving’s influence is crucial for informed speculation.

Bitcoin’s Impact on Existing Financial Institutions

The rise of Bitcoin presents both opportunities and threats to traditional financial institutions. Some institutions are actively exploring Bitcoin’s potential, integrating it into their services to attract tech-savvy clients and diversify their offerings. Examples include banks offering Bitcoin custody services or investment products. Others are adopting a more cautious approach, viewing Bitcoin as a potential disruptor and focusing on regulatory compliance and risk mitigation strategies. The response varies significantly based on individual institutions’ risk tolerance, technological capabilities, and overall business strategy. This adaptation is crucial for their survival in a changing financial landscape.

Bitcoin’s Position Relative to Other Cryptocurrencies and Digital Assets

In 2025, Bitcoin’s position within the broader cryptocurrency market will likely remain dominant, though not unchallenged. While alternative cryptocurrencies offer various functionalities and technological advancements, Bitcoin maintains a significant first-mover advantage, established brand recognition, and a large, established network effect. The market capitalization of Bitcoin is likely to continue to exceed that of most other cryptocurrencies. However, the emergence of new, potentially disruptive technologies and regulatory shifts could influence the relative market share of Bitcoin and other digital assets. For example, the rise of decentralized finance (DeFi) protocols and stablecoins could potentially impact Bitcoin’s role as a store of value or medium of exchange. The competitive landscape will be dynamic and influenced by technological innovation and regulatory actions.

Risks and Opportunities Associated with Bitcoin in 2025

Predicting the future of Bitcoin is inherently speculative, but by analyzing current trends and understanding its underlying technology, we can reasonably assess potential risks and opportunities associated with the cryptocurrency by 2025. While the potential for substantial returns remains a significant draw, investors must carefully consider the inherent volatility and evolving regulatory landscape.

Potential Risks Associated with Bitcoin Investment in 2025

Bitcoin’s price volatility remains a significant concern. History shows periods of dramatic price swings, both upward and downward, making it a high-risk investment. While past performance doesn’t guarantee future results, the potential for substantial losses in short periods remains a real possibility. Furthermore, security breaches targeting exchanges or individual wallets represent a persistent threat. The decentralized nature of Bitcoin offers some protection, but sophisticated hacking attempts and phishing scams continue to pose a risk to investors’ funds. Finally, regulatory uncertainty presents a significant challenge. Governments worldwide are still grappling with how to regulate cryptocurrencies, and changes in policy could significantly impact Bitcoin’s value and usability. The lack of a unified global regulatory framework adds to the uncertainty.

Potential Opportunities Presented by Bitcoin in 2025

Despite the risks, Bitcoin also presents considerable opportunities. The potential for high returns, driven by increasing adoption and scarcity, remains a key attraction for investors. The limited supply of 21 million Bitcoins, coupled with growing institutional and retail demand, could lead to significant price appreciation. Moreover, Bitcoin’s role in decentralized finance (DeFi) is rapidly expanding. DeFi applications built on blockchain technology offer innovative financial services, bypassing traditional intermediaries. Bitcoin’s underlying technology continues to evolve, with potential advancements in scalability and transaction speed enhancing its practicality and usability. These innovations could further increase its adoption and value.

Comparative Risk Profile of Bitcoin and Other Investment Assets in 2025

The following table compares the risk profile of Bitcoin against other common investment assets, considering liquidity, volatility, and potential returns. It’s crucial to remember that these are estimations and actual outcomes may vary significantly. The data presented is based on historical trends and expert predictions, and does not constitute financial advice.

| Asset Class | Liquidity | Volatility | Potential Return |

|---|---|---|---|

| Bitcoin | Medium (can be illiquid in certain markets) | High | High (but also high risk of loss) |

| Stocks (S&P 500) | High | Medium | Medium |

| Bonds (Government Bonds) | High | Low | Low |

| Real Estate | Low | Low to Medium | Medium to High (depending on market conditions) |

| Gold | High | Low to Medium | Low to Medium |

Bitcoin’s Technological Evolution by 2025: Bitcoin 2025 Value

By 2025, Bitcoin’s technological landscape is expected to undergo significant transformations, driven by the need for enhanced scalability, security, and privacy. These advancements will play a crucial role in shaping Bitcoin’s adoption and, consequently, its value. While challenges remain, the projected improvements suggest a more robust and user-friendly system.

The anticipated technological advancements in Bitcoin’s infrastructure by 2025 are multifaceted. We can expect to see continued development and wider adoption of second-layer scaling solutions like the Lightning Network, allowing for faster and cheaper transactions. Improved privacy protocols, potentially incorporating advancements in techniques like CoinJoin and Confidential Transactions, will address concerns about transaction transparency. Furthermore, advancements in hardware security and cryptographic algorithms will likely enhance the overall security of the Bitcoin network, making it more resilient against attacks. These improvements could significantly boost Bitcoin’s adoption rate, particularly among businesses and institutions hesitant to embrace it due to previous limitations. Increased transaction speed and lower fees would make Bitcoin a more practical payment option, while improved privacy would appeal to individuals and organizations concerned about data security. These factors combined could lead to a higher demand for Bitcoin, potentially driving its value upward.

Scalability Improvements and their Impact

The Lightning Network, a layer-2 scaling solution, is projected to become increasingly mature and widely adopted by 2025. This would drastically reduce transaction fees and increase transaction speeds, addressing one of Bitcoin’s major limitations. For example, a merchant accepting Bitcoin via the Lightning Network could process thousands of transactions per second with negligible fees, making it comparable to traditional payment systems in terms of speed and cost-effectiveness. This improved scalability could lead to wider merchant adoption and increased user base, positively impacting Bitcoin’s value.

Enhanced Security Measures and their Implications

Security remains paramount for Bitcoin’s success. By 2025, we can anticipate improvements in hardware security modules (HSMs) used for securing private keys, and the wider adoption of multi-signature wallets. These advancements would make it considerably more difficult for attackers to compromise private keys and steal funds. Furthermore, ongoing research into more robust cryptographic algorithms will continue to bolster the network’s resistance to various attacks, including quantum computing threats. Increased security will instill greater confidence in Bitcoin, encouraging both individual and institutional investment, thereby potentially increasing its value.

Privacy Enhancements and their Influence on Adoption

Privacy concerns have often hindered Bitcoin’s mainstream adoption. However, advancements in privacy-enhancing technologies are expected to mitigate these concerns. Improved CoinJoin implementations, which combine multiple transactions to obscure the origin and destination of funds, are likely to become more prevalent and user-friendly. Similarly, the development and adoption of Confidential Transactions, which hide the transaction amounts, will further enhance user privacy. Increased privacy would attract a wider range of users, including those concerned about surveillance and financial transparency, ultimately contributing to higher demand and potentially higher value.

Potential Technological Hurdles

Despite the promising advancements, several technological hurdles could hinder Bitcoin’s growth by 2025.

The development and adoption of quantum-resistant cryptography is crucial to ensure Bitcoin’s long-term security. Failure to implement effective quantum-resistant cryptography before the advent of powerful quantum computers could compromise the entire network.

Regulatory uncertainty and inconsistent regulatory frameworks across different jurisdictions could also hinder Bitcoin’s adoption and growth. Lack of clear regulatory guidelines might discourage institutional investors and limit the development of Bitcoin-related services.

Finally, the inherent complexity of Bitcoin’s technology can be a barrier to wider adoption. User-friendly interfaces and educational resources are essential to make Bitcoin accessible to a broader audience. Without simplification and improved user experience, Bitcoin’s growth potential could be significantly hampered.

Frequently Asked Questions about Bitcoin’s 2025 Value

Predicting the future of Bitcoin is inherently speculative, but by analyzing current trends and technological developments, we can formulate informed opinions about its potential value and relevance in 2025. This section addresses some common questions regarding Bitcoin’s future, acknowledging the inherent uncertainties involved.

Bitcoin’s Relevance in 2025

Bitcoin’s relevance in 2025 hinges on several factors. Technological advancements, such as the Lightning Network’s improved scalability and the development of privacy-enhancing technologies, could significantly increase Bitcoin’s usability and adoption. Conversely, the emergence of competing cryptocurrencies with superior functionalities or regulatory crackdowns could diminish its prominence. Market trends, including investor sentiment and macroeconomic conditions, will also play a crucial role. If Bitcoin successfully addresses its scalability challenges and maintains its position as a store of value, its relevance will likely persist, even if its market dominance shifts. However, a failure to adapt to evolving technological landscapes or a significant regulatory setback could impact its long-term viability. For example, widespread adoption of central bank digital currencies (CBDCs) could potentially reduce the demand for Bitcoin as a form of digital currency.

Threats to Bitcoin’s Value in 2025

Several threats could negatively impact Bitcoin’s value in 2025. Stringent regulatory frameworks, such as those being considered by various governments globally, could stifle its growth and limit its accessibility. The emergence of more efficient and scalable blockchain technologies or alternative digital assets could divert investor interest. Furthermore, significant market fluctuations, triggered by events such as economic downturns or security breaches, could lead to substantial value drops. For instance, a major hacking incident targeting a significant Bitcoin exchange could erode investor confidence and depress the price. Another example would be a global recession significantly impacting investor risk appetite and causing a sell-off in all risk assets, including Bitcoin.

Bitcoin Investment in 2023 Considering 2025 Value, Bitcoin 2025 Value

Investing in Bitcoin in 2023, with a view to its 2025 value, presents both significant risks and potential rewards. The high volatility of Bitcoin makes it a risky investment; its price can fluctuate dramatically in short periods. However, its potential for significant returns has also attracted many investors. A well-diversified investment portfolio, incorporating only a small percentage allocated to Bitcoin, can help mitigate risk. Thorough research and understanding of the underlying technology and market dynamics are essential before investing. Consider factors such as your risk tolerance, investment timeline, and financial goals before making any decisions. Investing in Bitcoin should be considered only after careful consideration of all risks and only with capital that you can afford to lose.

Impact of Global Events on Bitcoin’s 2025 Value

Geopolitical instability, economic crises, and other global events can significantly influence Bitcoin’s value in 2025. Periods of political uncertainty or economic turmoil often lead investors to seek safe haven assets, potentially increasing demand for Bitcoin as a hedge against inflation or currency devaluation. However, such events can also trigger widespread risk aversion, leading to sell-offs in even traditionally safe-haven assets, including Bitcoin. For example, a major international conflict could lead to increased volatility in the cryptocurrency market, while a global recession might cause a significant decrease in Bitcoin’s value. Conversely, hyperinflation in a major economy could potentially drive increased demand for Bitcoin as a store of value.

Predicting the Bitcoin 2025 value is inherently speculative, depending on various market factors and technological advancements. To gain some insight into potential price ranges, it’s helpful to consult resources that explore this question, such as this article: How Much Is Bitcoin In 2025. Ultimately, understanding the potential of Bitcoin in 2025 requires a careful consideration of these projections and a comprehensive understanding of the cryptocurrency market.

Predicting the Bitcoin 2025 value is a complex endeavor, influenced by numerous factors including adoption rates and regulatory changes. To gain some insight into the diverse opinions circulating online, it’s helpful to explore discussions like those found on What Will Bitcoin Be Worth In 2025 Reddit. Ultimately, the future price of Bitcoin remains speculative, but examining community perspectives offers valuable context for understanding potential scenarios for Bitcoin 2025 value.

Predicting the Bitcoin 2025 value is challenging, requiring consideration of various factors influencing its price trajectory. A key element in this forecasting is understanding the short-term trends, and for that, checking out the projections in this article on Bitcoin Price Target 2024 can be quite insightful. Ultimately, the 2024 price will significantly influence the trajectory towards the 2025 value, making accurate prediction a complex endeavor.

Speculating on Bitcoin’s 2025 value is a popular pastime, with various predictions circulating. Understanding potential price movements requires considering factors like adoption rates and regulatory changes. For a detailed analysis of a potential bullish scenario, check out this insightful article on Bitcoin Price Prediction 2025 Bull Run , which offers valuable perspectives on future price action. Ultimately, the Bitcoin 2025 value remains uncertain, but informed speculation is key to navigating this volatile market.