Bitcoin Price 2025

Predicting the price of Bitcoin in 2025 is a notoriously challenging task. Its value has historically demonstrated extreme volatility, swinging wildly from dramatic highs to significant lows, making any forecast inherently speculative. While analysts and enthusiasts offer various projections, it’s crucial to remember that these are educated guesses, not certainties. The inherent unpredictability of the cryptocurrency market makes precise predictions nearly impossible.

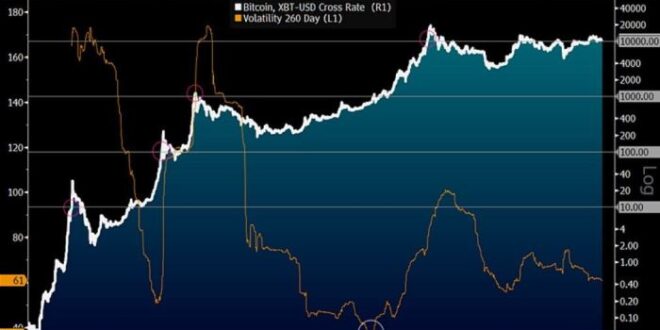

Bitcoin’s price journey has been marked by significant ups and downs. Its initial years saw slow growth, followed by a period of explosive expansion in 2017, culminating in a peak near $20,000. Subsequent years witnessed considerable price corrections, with periods of both substantial gains and steep losses. Major events, such as regulatory announcements, technological upgrades, and macroeconomic shifts, have all profoundly impacted its price. For instance, the 2020 halving event, which reduced the rate of new Bitcoin creation, contributed to a subsequent price surge. Conversely, negative regulatory actions in certain countries have often resulted in price dips.

Factors Influencing Bitcoin’s Price

Several interconnected factors contribute to Bitcoin’s price fluctuations. Market sentiment plays a crucial role, with periods of intense investor enthusiasm driving prices upward and periods of fear or uncertainty leading to sell-offs. Regulatory changes, both globally and within specific jurisdictions, can significantly impact investor confidence and trading activity. Technological advancements, such as the development of the Lightning Network, aimed at improving transaction speeds and reducing fees, can also influence price movements. Finally, macroeconomic conditions, including inflation rates, interest rates, and overall economic stability, can affect the demand for Bitcoin as an alternative asset or a hedge against inflation. The interplay of these factors creates a complex and dynamic environment, making accurate price prediction extremely difficult. For example, the increased institutional investment in Bitcoin in recent years has been a key driver of price increases, while periods of economic uncertainty have sometimes led to increased demand, pushing prices higher. Conversely, regulatory crackdowns in specific regions have often resulted in temporary price drops.

Factors Influencing Bitcoin’s Price in 2025: Bitcoin Price 2025 Prediction

Predicting Bitcoin’s price in 2025 is inherently complex, depending on a confluence of factors ranging from macroeconomic trends to technological advancements and regulatory shifts. While no single factor definitively dictates its value, understanding their interplay offers a clearer perspective on potential price movements.

Institutional Investor Adoption

Widespread adoption by institutional investors will likely exert significant upward pressure on Bitcoin’s price. As large financial institutions, such as hedge funds and asset management firms, allocate a greater portion of their portfolios to Bitcoin, demand will increase, driving up the price. This increased demand is driven by the diversification benefits Bitcoin offers, its potential for high returns, and the growing recognition of its role as a store of value, particularly in times of economic uncertainty. For example, the entry of MicroStrategy and Tesla into the Bitcoin market significantly impacted its price in previous years. Further institutional adoption could trigger similar, though potentially larger, price increases.

Global Economic Trends

Global economic trends, such as inflation and recession, can profoundly influence Bitcoin’s value. During periods of high inflation, Bitcoin, often perceived as a hedge against inflation, may see increased demand, driving its price upwards. Conversely, a global recession might lead to risk-aversion among investors, potentially causing a sell-off and price decline as investors liquidate assets to cover losses in other markets. The 2008 financial crisis, followed by the subsequent quantitative easing policies, offers a historical parallel to the potential impact of macroeconomic factors on Bitcoin’s price trajectory. The correlation isn’t always direct, but the interplay is significant.

Technological Advancements

Technological advancements, particularly layer-2 scaling solutions like the Lightning Network, play a crucial role in Bitcoin’s future price. These solutions aim to improve transaction speed and reduce fees, addressing current limitations that hinder widespread adoption. As these technologies mature and become more user-friendly, transaction volumes are expected to increase, potentially boosting demand and price. The success of layer-2 solutions in making Bitcoin more efficient and scalable is directly tied to its potential for broader adoption and increased value.

Regulatory Frameworks and Government Policies

Regulatory frameworks and government policies significantly impact Bitcoin’s price. Clear, consistent, and investor-friendly regulations can foster confidence and attract more institutional investment, driving price appreciation. Conversely, overly restrictive or unclear regulations can create uncertainty and hinder adoption, potentially depressing prices. The differing regulatory approaches adopted by various governments globally will continue to shape Bitcoin’s price trajectory, influencing investor sentiment and market liquidity. Examples include the differing regulatory stances in the US, EU, and China.

Bitcoin Price Prediction Models

Various models exist for predicting Bitcoin’s price, each employing different methodologies. Some models utilize technical analysis, focusing on historical price patterns and trading volume to forecast future price movements. Others employ fundamental analysis, assessing factors such as adoption rate, market capitalization, and network effects. Quantitative models, incorporating statistical methods and algorithms, also exist. The accuracy of these models varies significantly, and relying on a single model is generally considered risky. Comparing and contrasting these models, understanding their limitations, and considering a range of predictions provide a more balanced and realistic perspective. No single model has consistently proven highly accurate in predicting Bitcoin’s long-term price.

Potential Price Scenarios for Bitcoin in 2025

Predicting the price of Bitcoin in 2025 is inherently speculative, given the cryptocurrency’s volatile nature and the numerous factors influencing its value. However, by considering various economic and technological trends, we can Artikel three plausible scenarios: a bullish scenario, a bearish scenario, and a neutral scenario. These scenarios represent a range of possibilities, and the actual price may fall outside these projections.

Bullish Scenario: Bitcoin Surges to New Heights

This scenario assumes continued mainstream adoption of Bitcoin, coupled with positive regulatory developments and sustained technological advancements. We’re envisioning a world where institutional investors increasingly allocate a significant portion of their portfolios to Bitcoin, driven by its perceived value as a hedge against inflation and a store of value. Furthermore, the development and implementation of second-layer scaling solutions could significantly enhance Bitcoin’s transaction speed and reduce fees, making it more practical for everyday use. This increased utility, combined with growing scarcity as Bitcoin’s supply approaches its 21 million coin limit, could drive demand and propel the price significantly higher.

Bearish Scenario: Bitcoin Faces Significant Challenges, Bitcoin Price 2025 Prediction

This scenario explores a less optimistic outlook, where Bitcoin’s price experiences a substantial decline. This could be triggered by several factors, including increased regulatory scrutiny leading to stricter limitations on trading or usage, a major security breach impacting user confidence, or a broader economic downturn significantly impacting investor risk appetite. A prolonged period of negative sentiment and lack of substantial technological advancements could further contribute to a price decrease. The bearish scenario assumes a significant loss of confidence in the cryptocurrency market as a whole. This could be mirrored by events such as a major collapse of another large cryptocurrency or a prolonged bear market in traditional financial markets.

Neutral Scenario: Bitcoin Consolidates and Stabilizes

This scenario assumes a period of relative stability and consolidation for Bitcoin’s price. While not experiencing dramatic price increases as in the bullish scenario, neither does it suffer significant losses as in the bearish scenario. This could be the result of a balance between positive and negative factors, with mainstream adoption continuing at a moderate pace, regulatory uncertainty remaining, and technological advancements occurring incrementally. This scenario suggests a market that is less volatile and more predictable, with price fluctuations within a relatively narrow range.

Comparison of Price Scenarios

| Scenario | Price Range (USD) | Key Contributing Factors | Market Conditions |

|---|---|---|---|

| Bullish | $150,000 – $250,000 | Increased institutional adoption, positive regulatory developments, technological advancements, scarcity | Strong economic growth, positive investor sentiment, widespread adoption of cryptocurrencies. Similar to the 2021 bull run, but potentially more sustained due to increased institutional involvement. |

| Bearish | $10,000 – $30,000 | Increased regulatory scrutiny, negative economic conditions, security breaches, lack of technological progress | Global recession, decreased investor confidence, negative media coverage, potential for regulatory crackdowns similar to the China 2021 ban. |

| Neutral | $40,000 – $70,000 | Moderate adoption, regulatory uncertainty, incremental technological progress | Stable economic conditions, moderate investor sentiment, gradual integration of cryptocurrencies into the mainstream financial system. Similar to a period of consolidation after a bull run. |

Risks and Uncertainties Associated with Bitcoin Price Predictions

Predicting the price of Bitcoin, or any cryptocurrency for that matter, is inherently fraught with risk and uncertainty. Numerous factors influence its volatile nature, making accurate long-term forecasting exceptionally challenging, if not impossible. While various models attempt to quantify these influences, their limitations and susceptibility to unforeseen events are significant.

The inherent volatility of Bitcoin’s price is a primary source of uncertainty. Unlike traditional assets with established valuation models, Bitcoin’s price is heavily influenced by speculation, market sentiment, regulatory changes, and technological advancements. These factors are often unpredictable and can lead to dramatic price swings in short periods. Furthermore, the relatively young age of Bitcoin and the cryptocurrency market as a whole means there’s limited historical data to draw upon for robust predictive models. This lack of a long, established track record makes it difficult to accurately assess long-term trends and potential risks.

Limitations of Prediction Models

Numerous prediction models exist, ranging from simple technical analysis to complex econometric models. However, these models rely on assumptions about future market conditions and human behavior, which are inherently unpredictable. Technical analysis, for instance, relies on past price patterns to predict future movements, but these patterns are not always reliable, particularly in a market as volatile as Bitcoin’s. Econometric models, while more sophisticated, often require numerous inputs and assumptions, making them susceptible to errors if these inputs are inaccurate or if unforeseen events occur. For example, a model predicting Bitcoin’s price based on adoption rates might fail to account for a sudden regulatory crackdown or a major security breach, both of which could significantly impact the price.

Examples of Inaccurate Bitcoin Price Predictions

Numerous past predictions of Bitcoin’s price have proven wildly inaccurate. Many analysts predicted Bitcoin would reach $100,000 or even higher by the end of 2021, a prediction that didn’t materialize. These failures often stemmed from over-reliance on short-term trends, neglecting the influence of unpredictable events such as regulatory uncertainty or shifts in investor sentiment. For instance, a prediction based solely on increasing adoption rates might not account for a sudden drop in investor confidence due to a major exchange hack or a negative news cycle. The lack of a robust theoretical framework for valuing Bitcoin also contributes to inaccurate predictions.

Potential “Black Swan” Events

Several potential “black swan” events – highly improbable but potentially impactful occurrences – could significantly affect Bitcoin’s price. These include: a major regulatory crackdown leading to a significant decrease in trading volume or outright bans in major markets; a successful, large-scale attack compromising the Bitcoin network’s security; the emergence of a superior competing cryptocurrency with significantly better technology or adoption; or a major global financial crisis impacting investor risk appetite across all asset classes, including cryptocurrencies. The unpredictable nature of these events makes accurate price forecasting extremely difficult. The 2008 financial crisis, for example, while not directly related to Bitcoin (which didn’t exist then), illustrates how unexpected macroeconomic events can trigger widespread market volatility.

Investing in Bitcoin

Investing in Bitcoin, like any other asset class, requires a cautious and informed approach. The cryptocurrency market is notoriously volatile, and its price can fluctuate dramatically in short periods. Understanding the inherent risks is crucial before committing any capital. This section Artikels key considerations for investors looking to navigate the complexities of Bitcoin investment.

Bitcoin’s potential for high returns is undeniable, attracting many investors. However, this potential is intrinsically linked to significant risks. A well-defined investment strategy that incorporates diversification and risk management is paramount to mitigating potential losses.

Risk Management Strategies

Effective risk management is vital when investing in Bitcoin. This involves carefully assessing your risk tolerance and only investing an amount you can afford to lose. Strategies such as dollar-cost averaging (DCA), where you invest a fixed amount at regular intervals regardless of price, can help mitigate the impact of volatility. Stop-loss orders, which automatically sell your Bitcoin if the price falls below a predetermined level, offer another layer of protection against significant losses. Furthermore, diversifying your portfolio beyond Bitcoin into other asset classes like stocks, bonds, or real estate can reduce overall portfolio risk. For example, an investor might allocate 5% of their portfolio to Bitcoin, 40% to stocks, 35% to bonds, and 20% to real estate to achieve a balanced approach.

Due Diligence and Research

Thorough research is paramount before investing in Bitcoin. Understanding the technology behind Bitcoin, its potential use cases, and the regulatory landscape is essential. This includes staying informed about market trends, analyzing price charts, and understanding the factors that influence Bitcoin’s price. Consider consulting with a qualified financial advisor who understands the complexities of cryptocurrency investments before making any decisions. Independent research and a critical evaluation of information from various sources are critical to forming your own informed opinion.

Potential Benefits and Drawbacks

Investing in Bitcoin presents both significant benefits and drawbacks. The potential for high returns is a major draw, with Bitcoin’s price having experienced substantial growth in the past. Its decentralized nature and resistance to censorship are also attractive features. However, the high volatility and regulatory uncertainty associated with Bitcoin represent significant risks. The potential for scams and hacks also necessitates caution. Furthermore, the lack of intrinsic value, unlike traditional assets, adds to the uncertainty. For instance, while some view Bitcoin as digital gold, others argue its value is entirely speculative and driven by market sentiment. A balanced perspective, considering both the upside potential and the inherent risks, is essential for making informed investment decisions.

Frequently Asked Questions (FAQs)

Predicting the future price of Bitcoin is inherently challenging due to its volatility and the influence of numerous interconnected factors. While no one can definitively state the Bitcoin price in 2025, exploring potential scenarios and understanding the underlying influences can provide a more informed perspective. This section addresses some common questions surrounding Bitcoin’s future price and investment strategies.

Bitcoin’s Most Likely Price in 2025

Predicting a single “most likely” price for Bitcoin in 2025 is impossible. However, based on various analyses considering factors like adoption rates, regulatory developments, and macroeconomic conditions, a broad price range can be suggested. Some analysts predict a price well above $100,000, fueled by widespread adoption and institutional investment. Conversely, others foresee a lower price, perhaps in the tens of thousands of dollars, citing potential regulatory hurdles or market corrections. The actual price will likely fall somewhere within this spectrum, influenced by the interplay of these unpredictable factors. For example, a scenario of significant global adoption and positive regulatory developments could lead to a higher price, while a major economic downturn or increased regulatory scrutiny might depress the price significantly.

Investing in Bitcoin: Is it Too Late?

The question of whether it’s “too late” to invest in Bitcoin is a subject of ongoing debate. While Bitcoin has experienced significant price appreciation, its long-term potential remains a topic of discussion among investors. The argument for late entry hinges on the idea that Bitcoin’s growth trajectory may have peaked. However, counterarguments highlight Bitcoin’s potential for continued growth as a store of value and a decentralized alternative to traditional financial systems. The decision to invest depends on individual risk tolerance and investment horizon. Those with a long-term perspective and a high-risk tolerance might view the current price as a potential entry point, while those seeking lower-risk investments may prefer to stay away. Past performance is not indicative of future results, and significant price volatility remains a key risk factor.

Protecting Against Bitcoin Price Volatility

Bitcoin’s price volatility presents significant risks to investors. Several strategies can help mitigate these risks. Diversification is crucial; don’t put all your investment eggs in one basket. Allocating a portion of your portfolio to Bitcoin while investing in other asset classes (stocks, bonds, real estate) can reduce overall portfolio risk. Dollar-cost averaging, a strategy involving regular investments regardless of price fluctuations, helps to reduce the impact of buying high and selling low. Finally, setting stop-loss orders, which automatically sell your Bitcoin when it reaches a predetermined price, can limit potential losses if the market takes a downturn.

Major Factors Determining Bitcoin’s Price in 2025

Several key factors will influence Bitcoin’s price in 2025. Regulatory clarity and acceptance from governments worldwide will play a significant role. Increased adoption by institutions and mainstream consumers will also drive price appreciation. Macroeconomic conditions, such as inflation rates and overall economic growth, will impact investor sentiment and demand for Bitcoin as a hedge against inflation. Technological advancements within the Bitcoin ecosystem, such as the Lightning Network’s improvement in transaction speed and scalability, will also contribute to its appeal and potential price growth. Finally, events such as halving, which reduces the rate of new Bitcoin creation, can impact its scarcity and potentially influence its price.

Predicting the Bitcoin price in 2025 is a complex undertaking, influenced by numerous factors. For a diverse range of opinions and speculative analyses, it’s worth checking out the discussions on Bitcoin Price Prediction 2025 Reddit , a platform known for its lively community engagement. Ultimately, however, any Bitcoin Price 2025 Prediction remains just that – a prediction, subject to the inherent volatility of the cryptocurrency market.

Predicting the Bitcoin price in 2025 is a complex endeavor, with various models and opinions circulating. One interesting perspective to consider is the analysis presented in Bitcoin Price 2025 Plan B , which offers a unique framework for forecasting. Ultimately, though, Bitcoin’s future price remains speculative, depending on numerous factors influencing market dynamics.

Predicting the Bitcoin price in 2025 involves considering various factors, including technological advancements and regulatory changes. To gain a longer-term perspective, it’s helpful to examine discussions surrounding future price points, such as those found on the Bitcoin Price 2030 Reddit thread. Understanding these longer-term projections can inform a more nuanced approach to forecasting the Bitcoin price in 2025, offering a broader context for analysis.

Predicting the Bitcoin price in 2025 involves considering various factors, including adoption rates and regulatory changes. To gain a longer-term perspective, understanding future price trajectories is crucial; for example, checking out this detailed analysis on the Bitcoin Price Target 2030 can offer valuable insights. Ultimately, extrapolating from the 2030 projections can help refine our 2025 Bitcoin price prediction, though significant volatility remains a key factor.

Predicting the Bitcoin price in 2025 is a complex undertaking, influenced by numerous factors including technological advancements and regulatory changes. To gain further insight into potential future valuations, it’s helpful to explore resources dedicated to forecasting, such as this article on What Will Bitcoin Be Worth 2025. Ultimately, Bitcoin Price 2025 Prediction remains speculative, yet informed analysis can provide a more educated guess.