Bitcoin Price Prediction in December 2025

Bitcoin, since its inception in 2009, has experienced phenomenal growth, punctuated by periods of extreme volatility. Its price has fluctuated wildly, from near-zero to record highs, making it a highly speculative asset. Understanding its past performance, however, offers only limited insight into its future trajectory. Predicting the price of any asset, especially one as volatile as Bitcoin, is inherently challenging.

Bitcoin’s price is influenced by a complex interplay of factors. Market sentiment, driven by news events, social media trends, and overall investor confidence, plays a significant role. Regulatory changes, both at national and international levels, can drastically impact its adoption and therefore its price. Technological advancements, such as the development of layer-2 scaling solutions or improvements in mining efficiency, can also influence Bitcoin’s value. Furthermore, macroeconomic factors, such as inflation and global economic conditions, exert a considerable influence.

Factors Influencing Bitcoin’s Price

Several key factors contribute to the fluctuations in Bitcoin’s price. Market sentiment, for instance, can rapidly shift based on news coverage, influential figures’ opinions, or even viral social media trends. A positive news story could trigger a price surge, while negative news, such as a major exchange hack or regulatory crackdown, can lead to a sharp decline. For example, Elon Musk’s tweets about Bitcoin have historically shown a significant correlation with price movements. Similarly, regulatory developments, such as the adoption of Bitcoin as legal tender in El Salvador or stricter regulations in China, have had profound effects on the market. Technological improvements, such as the implementation of the Lightning Network, which aims to improve transaction speed and reduce fees, can increase Bitcoin’s utility and potentially boost its price. Finally, broader economic trends, like inflation or a recession, can influence investor behavior and the demand for Bitcoin as a hedge against inflation or a safe haven asset.

Challenges in Predicting Bitcoin’s Price

Accurately predicting Bitcoin’s price is exceptionally difficult due to its inherent volatility and the multitude of interconnected factors influencing it. The cryptocurrency market is still relatively young and lacks the historical data needed for robust predictive models. Furthermore, the influence of unpredictable events, such as unforeseen regulatory changes or major technological breakthroughs, adds significant uncertainty. The lack of a clear correlation between fundamental value and price adds another layer of complexity. Unlike traditional assets, Bitcoin’s value is not directly tied to earnings or tangible assets, making traditional valuation methods less effective. Finally, the influence of speculative trading and market manipulation adds further unpredictability. While some analysts attempt to forecast prices based on technical analysis or historical trends, these methods are far from foolproof and have often proven inaccurate. The inherent unpredictability of the market makes any prediction a high-risk endeavor.

Analyzing Historical Bitcoin Price Trends

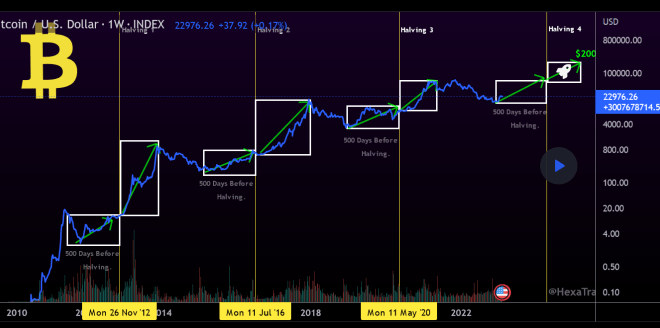

Understanding Bitcoin’s past price movements is crucial for informed speculation about its future. Analyzing historical data allows us to identify patterns, significant events, and correlations with other assets, providing a more nuanced perspective on potential future price trajectories. This analysis focuses on the last five years, examining both Bitcoin’s independent performance and its relationship to other market players.

Bitcoin’s price volatility is well-documented. However, a deeper dive into the data reveals periods of significant growth punctuated by sharp corrections. These fluctuations are often driven by a complex interplay of factors, including regulatory announcements, technological advancements, macroeconomic conditions, and market sentiment.

Bitcoin Price Fluctuations (2019-2023)

Imagine a line graph charting Bitcoin’s price. The x-axis represents time (from January 2019 to December 2023), and the y-axis represents the Bitcoin price in USD. The line would show a generally upward trend, but with several dramatic peaks and valleys. For instance, a notable peak would be visible around the end of 2021, reflecting the price surge to near $70,000. Conversely, a significant dip would be evident in early 2022, showcasing the price correction that followed. Other noticeable peaks and troughs would reflect various bull and bear market cycles within this period. Precise data points for each month would be included, illustrating the price fluctuations throughout the five-year span. The overall picture would highlight Bitcoin’s considerable volatility.

Comparison with Other Cryptocurrencies and Traditional Assets

Bitcoin’s performance over the past five years can be compared and contrasted with other major cryptocurrencies, such as Ethereum and Solana, as well as traditional assets like gold and the S&P 500 index. While Bitcoin often leads the overall cryptocurrency market, its correlation with other cryptocurrencies varies. During bull markets, many altcoins tend to move in tandem with Bitcoin, though the degree of correlation differs. Conversely, during bear markets, the correlation may weaken, with some altcoins experiencing sharper declines than Bitcoin. Compared to traditional assets, Bitcoin demonstrates a much higher degree of volatility. Gold, often seen as a safe haven asset, typically shows less price fluctuation. Similarly, the S&P 500, while subject to market fluctuations, generally exhibits less volatility than Bitcoin. This comparison highlights Bitcoin’s unique risk profile compared to both other cryptocurrencies and traditional assets.

Key Events Impacting Bitcoin Price

Several key events significantly influenced Bitcoin’s price during the 2019-2023 period. The 2020-2021 bull run, fueled by institutional adoption and increasing mainstream awareness, significantly boosted Bitcoin’s price. Conversely, the collapse of the TerraUSD stablecoin in 2022 triggered a broader market downturn, impacting Bitcoin’s price negatively. Regulatory announcements from various governments, such as China’s ban on cryptocurrency trading in 2021, also caused significant price fluctuations. Furthermore, macroeconomic factors, including inflation and interest rate hikes, played a role in shaping Bitcoin’s price trajectory. These examples demonstrate the interplay of technological, regulatory, and macroeconomic factors influencing Bitcoin’s price.

Factors Influencing Bitcoin’s Future Price

Predicting Bitcoin’s price in 2025, or any future date, is inherently complex. Numerous interconnected factors, ranging from technological advancements to global economic shifts and regulatory decisions, will significantly shape its trajectory. Understanding these influential elements is crucial for any informed assessment.

Widespread Adoption by Businesses and Institutions

The increasing acceptance of Bitcoin by businesses and institutions is a powerful driver of price appreciation. As more corporations integrate Bitcoin into their operations, whether for treasury management, payments, or other applications, demand increases, pushing the price upward. For example, MicroStrategy’s significant Bitcoin holdings demonstrate a corporate commitment to the asset, influencing market sentiment and potentially driving up demand. This institutional adoption adds legitimacy and stability, attracting a broader range of investors who previously hesitated due to perceived volatility and lack of mainstream acceptance. The effect is compounded by the potential for larger transactions and increased liquidity within the market.

Technological Advancements: The Lightning Network and Scalability

Technological advancements, particularly improvements in Bitcoin’s scalability and transaction speed, are vital for its mass adoption. The Lightning Network, a second-layer scaling solution, addresses Bitcoin’s limitations by enabling faster and cheaper transactions off the main blockchain. Successful implementation and widespread adoption of the Lightning Network could significantly reduce transaction fees and increase the speed of transactions, making Bitcoin more practical for everyday use and further driving demand. This increased efficiency could lead to a surge in adoption, particularly in regions with high transaction costs or slow processing speeds. The success of the Lightning Network hinges on user adoption and integration within existing payment systems.

Macroeconomic Factors: Inflation and Interest Rates

Macroeconomic factors, such as inflation and interest rates, exert a considerable influence on Bitcoin’s price. During periods of high inflation, Bitcoin, often viewed as a hedge against inflation, tends to see increased demand. Investors may seek refuge in Bitcoin’s limited supply as a store of value, driving up its price. Conversely, rising interest rates can negatively impact Bitcoin’s price as investors may shift their capital towards higher-yielding assets. The correlation between inflation, interest rates, and Bitcoin’s price is not always straightforward and depends on various market conditions and investor sentiment. For instance, during periods of economic uncertainty, investors may flock to Bitcoin as a safe haven asset, irrespective of interest rate movements.

Government Regulations and Their Impact

Government regulations play a critical role in shaping Bitcoin’s future price. Favorable regulatory frameworks can foster growth and adoption, while restrictive policies can hinder its development and suppress its price. Clear and consistent regulations that balance innovation with consumer protection are crucial for building investor confidence and encouraging wider participation. Conversely, inconsistent or overly restrictive regulations can create uncertainty and potentially discourage investment, leading to price volatility or decline. The regulatory landscape varies significantly across jurisdictions, influencing Bitcoin’s adoption rate and price differently in various regions. For example, countries with supportive regulatory environments tend to attract more Bitcoin-related businesses and investors, potentially leading to higher demand and price appreciation in those regions.

Expert Opinions and Predictions: Bitcoin Price Prediction In December 2025

Predicting the price of Bitcoin, a notoriously volatile asset, is inherently challenging. However, several reputable financial analysts and cryptocurrency experts offer predictions, providing a range of potential outcomes for December 2025. These predictions often differ significantly, reflecting varying methodologies and underlying assumptions about factors influencing Bitcoin’s price. Examining these diverse perspectives offers valuable insight into the potential price trajectory.

Analyzing expert predictions requires careful consideration of their methodologies. Some analysts rely heavily on technical analysis, studying chart patterns and historical price movements to identify potential future trends. Others incorporate fundamental analysis, evaluating factors like Bitcoin’s adoption rate, regulatory landscape, and macroeconomic conditions. The weighting given to these different factors, along with the specific data used, contributes to the divergence in predictions.

Summary of Expert Price Predictions

Several sources offer Bitcoin price predictions, although it’s crucial to remember these are speculative and should not be considered financial advice. For instance, some analysts, leveraging technical analysis, might predict a price based on past cycles and anticipated halving events. These models often project a significant price increase, potentially reaching tens of thousands or even hundreds of thousands of dollars per Bitcoin by December 2025. Conversely, analysts emphasizing macroeconomic factors, such as potential regulatory crackdowns or broader economic downturns, might forecast more conservative price targets, perhaps in the tens of thousands of dollars. Unfortunately, specific named predictions are difficult to cite due to the rapidly changing nature of these forecasts and the lack of consistently archived predictions for such a long timeframe. Many predictions are found on less-than-credible sources, and verifiable, long-term forecasts from well-known financial institutions are rare. It is crucial to approach all price predictions with a healthy dose of skepticism.

Comparison of Prediction Methodologies

The divergence in Bitcoin price predictions stems from differing methodologies and assumptions. Technical analysis, focusing on chart patterns and indicators, often yields optimistic predictions, assuming historical trends will continue. However, this approach ignores potential unforeseen events or shifts in market sentiment. Fundamental analysis, considering factors like adoption, regulation, and macroeconomic conditions, provides a more nuanced perspective. For example, a prediction factoring in increased institutional adoption might project a higher price than one assuming widespread regulatory restrictions. The lack of a universally accepted model further complicates the comparison, as each analyst uses a unique combination of factors and weighting schemes. This makes direct comparison challenging, but highlights the range of potential outcomes.

Potential Price Range in December 2025

Based on the available, albeit limited and unverifiable, expert opinions, the potential price range for Bitcoin in December 2025 is extremely broad. While some optimistic predictions reach into the hundreds of thousands of dollars per Bitcoin, others offer more conservative estimates in the tens of thousands. This significant disparity underscores the inherent uncertainty surrounding Bitcoin’s future price. The actual price will likely depend on the interplay of numerous factors, many of which are difficult, if not impossible, to predict accurately. The absence of readily available, consistently archived, and verifiable predictions from reputable sources limits the ability to provide a precise numerical range.

Potential Risks and Uncertainties

Investing in Bitcoin, while potentially lucrative, carries significant risks. Its price volatility, susceptibility to manipulation, and the uncertainties surrounding its future regulation and widespread adoption all contribute to a high-risk investment profile. Understanding these potential downsides is crucial before committing any capital.

Bitcoin’s price is notoriously volatile, experiencing dramatic swings in value over short periods. This inherent volatility stems from several factors, including market sentiment, regulatory changes, and technological developments. For example, the price of Bitcoin has historically seen significant drops following periods of rapid growth, highlighting the risk of substantial losses for investors. This unpredictability makes it challenging to accurately predict future prices and necessitates a high tolerance for risk.

Bitcoin’s Volatility and Market Manipulation

The decentralized nature of Bitcoin, while a strength in some aspects, also makes it vulnerable to manipulation. Large holders, or “whales,” can influence the price through coordinated buying or selling, creating artificial price swings. Furthermore, the lack of a central authority makes it difficult to regulate such activities effectively. The Mt. Gox exchange collapse in 2014, resulting from a significant security breach and subsequent theft of Bitcoin, serves as a stark reminder of the risks associated with market manipulation and exchange security. The event significantly impacted Bitcoin’s price and eroded investor confidence.

Regulatory Uncertainty and Long-Term Adoption

The regulatory landscape surrounding Bitcoin remains uncertain globally. Different jurisdictions have adopted varying approaches, ranging from outright bans to regulatory frameworks that seek to balance innovation with consumer protection. This regulatory uncertainty creates instability, impacting investor confidence and potentially affecting Bitcoin’s price. The lack of a universally accepted regulatory framework also hinders mainstream adoption. Wide-scale adoption is crucial for Bitcoin’s long-term price stability, as it would increase demand and reduce its volatility. The future success of Bitcoin depends significantly on how governments worldwide choose to regulate it.

Impact of Unforeseen Events

Bitcoin’s price is susceptible to unforeseen events that could significantly impact its value. A major security breach, similar to the Mt. Gox incident, could erode trust and trigger a price decline. Significant technological disruptions, such as the development of a superior cryptocurrency or a catastrophic flaw in the Bitcoin protocol itself, could also negatively affect its price. Furthermore, geopolitical events and macroeconomic factors, such as global economic downturns or significant changes in monetary policy, can also influence Bitcoin’s price unpredictably. The 2022 crypto winter, triggered by a combination of factors including rising interest rates and macroeconomic instability, serves as an example of how external factors can significantly impact the Bitcoin market.

Investment Strategies and Considerations

Investing in Bitcoin, like any other asset class, requires careful consideration of risk tolerance and financial goals. Different strategies cater to various investor profiles, ranging from the highly risk-averse to those comfortable with significant volatility. Understanding these strategies and their inherent risks is crucial for making informed investment decisions.

Different investment approaches exist for Bitcoin, each carrying a unique risk-reward profile. Choosing the right strategy depends heavily on your individual circumstances and financial objectives. It’s vital to remember that past performance is not indicative of future results, and Bitcoin’s price is notoriously volatile.

Bitcoin Investment Strategies

The primary strategies for Bitcoin investment broadly fall into long-term holding (HODLing), short-term trading, and dollar-cost averaging. Long-term holding involves buying and holding Bitcoin for an extended period, regardless of short-term price fluctuations. Short-term trading, on the other hand, focuses on profiting from short-term price movements, requiring active monitoring and a higher risk tolerance. Dollar-cost averaging involves investing a fixed amount of money at regular intervals, mitigating the risk of investing a lump sum at a market peak.

Diversification in Cryptocurrency Portfolios

Diversification is paramount in managing risk within a cryptocurrency portfolio. Investing solely in Bitcoin exposes you to significant volatility. A diversified portfolio might include other cryptocurrencies with different market capitalizations and use cases, as well as traditional assets like stocks and bonds. This approach reduces the impact of a single asset’s price decline on the overall portfolio value. For example, an investor might allocate 60% to Bitcoin, 20% to Ethereum, and 20% to a mix of stablecoins and traditional assets. This approach reduces the overall risk compared to holding only Bitcoin.

Risk and Reward Comparison of Bitcoin Investment Approaches

| Investment Approach | Risk | Potential Reward |

|---|---|---|

| Long-Term Holding (HODLing) | High initial investment risk, potential for long periods of low or no returns, susceptible to market crashes. | High potential for significant returns over the long term if Bitcoin’s price appreciates. Lower stress and transaction costs compared to active trading. |

| Short-Term Trading | Very high risk, requires significant market knowledge and technical analysis skills, potential for substantial losses. Higher transaction costs due to frequent trading. | Potential for high short-term profits if market predictions are accurate. |

| Dollar-Cost Averaging | Lower risk than lump-sum investing, mitigates the impact of market volatility. | Moderate potential for returns, less susceptible to market timing errors. Requires consistent discipline. |

Frequently Asked Questions (FAQs)

This section addresses common questions regarding Bitcoin’s price prediction for December 2025 and the broader implications of investing in this volatile cryptocurrency market. Understanding these key aspects is crucial for informed decision-making.

Major Factors Contributing to Bitcoin Price Increases

Several factors could significantly boost Bitcoin’s price by December 2025. Increased institutional adoption, for example, could lead to substantial price appreciation as large financial institutions allocate more capital to Bitcoin, increasing demand. Widespread global adoption as a legitimate form of payment and store of value would also contribute to higher prices. Furthermore, technological advancements, such as the Lightning Network improving transaction speeds and scalability, could drive greater usability and attract new investors. Finally, macroeconomic factors like inflation and geopolitical instability could make Bitcoin a more attractive safe haven asset, increasing its value. The successful implementation of Bitcoin’s Taproot upgrade, enhancing privacy and scalability, is another example of a technological advancement that could influence price positively.

Major Risks Associated with Bitcoin Investment

Investing in Bitcoin carries substantial risks. Its price volatility is notorious; sharp price swings are common, leading to significant potential losses. Regulatory uncertainty remains a significant concern, with governments worldwide still grappling with how to regulate cryptocurrencies. Security risks, such as hacking and theft from exchanges or personal wallets, pose a constant threat. Furthermore, the inherent speculative nature of Bitcoin makes it vulnerable to market manipulation and speculative bubbles, potentially leading to dramatic price crashes. Finally, the lack of intrinsic value, unlike traditional assets like gold or real estate, contributes to the overall risk profile. The collapse of FTX in 2022 serves as a stark reminder of the risks involved in cryptocurrency investments.

Reliability of Bitcoin Price Predictions and Difficulties in Accurate Prediction

Bitcoin price predictions are inherently unreliable. The cryptocurrency market is influenced by a complex interplay of factors, including technological developments, regulatory changes, market sentiment, and macroeconomic conditions, making accurate predictions exceptionally challenging. Past performance is not indicative of future results, and attempts to extrapolate historical trends often fail to account for unforeseen events. Many predictions are based on speculation, technical analysis, or subjective opinions, rather than on robust quantitative models. Therefore, it’s crucial to approach all predictions with a healthy dose of skepticism and recognize their inherent limitations. The wide range of predictions for Bitcoin’s price in 2025 itself highlights the uncertainty involved.

Alternative Cryptocurrencies to Consider

Beyond Bitcoin, investors may explore alternative cryptocurrencies, each with its unique characteristics, risks, and potential. Ethereum, for example, is a leading platform for decentralized applications (dApps) and smart contracts, offering distinct investment opportunities. Other prominent cryptocurrencies include Solana, Cardano, and Polkadot, each focusing on different technological approaches and functionalities. However, it’s crucial to conduct thorough research before investing in any alternative cryptocurrency, as they also carry significant risks. Diversification across different cryptocurrencies does not eliminate risk, but it can help manage it.

Reliable Information Sources for Bitcoin Price and Market Trends

Reliable information on Bitcoin’s price and market trends can be found from various sources. Reputable cryptocurrency exchanges, such as Coinbase and Binance, provide real-time price data. Financial news outlets like Bloomberg and Reuters offer analysis and reporting on the cryptocurrency market. Specialized cryptocurrency news websites and blogs often provide insightful commentary and analysis, although it’s crucial to evaluate the source’s credibility and potential biases. Finally, blockchain explorers, such as Blockchain.com, offer transparent and verifiable data on Bitcoin transactions and network activity. Always cross-reference information from multiple reliable sources to gain a comprehensive understanding of the market.

Disclaimer and Conclusion

This section clarifies the limitations of the preceding Bitcoin price prediction analysis and summarizes the key findings. It is crucial to understand that predicting the future price of any asset, especially a volatile one like Bitcoin, is inherently uncertain. The information presented should not be interpreted as financial advice. Instead, it aims to provide a comprehensive overview of various factors influencing Bitcoin’s price, facilitating informed decision-making for those interested in the cryptocurrency market.

The analysis explored historical trends, influential factors, expert opinions, potential risks, and investment strategies. While specific price targets were discussed, it’s essential to remember that these are merely projections based on current data and analyses, and the actual price may differ significantly. Market conditions are dynamic, and unforeseen events can drastically alter the trajectory of Bitcoin’s price.

Disclaimer

The Bitcoin price predictions and analyses presented in this document are for educational purposes only and should not be considered as financial advice. Investing in cryptocurrencies, including Bitcoin, carries significant risk, and you could lose some or all of your invested capital. Before making any investment decisions, it is crucial to conduct your own thorough research, consult with a qualified financial advisor, and carefully consider your personal risk tolerance and financial situation. The authors and publishers are not responsible for any losses incurred as a result of relying on the information provided in this document.

Key Takeaways, Bitcoin Price Prediction In December 2025

This section summarizes the main points discussed regarding Bitcoin’s potential price in December 2025. Understanding these takeaways is crucial for a comprehensive understanding of the analysis and its implications.

- Bitcoin’s price is influenced by a complex interplay of factors, including technological advancements, regulatory developments, market sentiment, and macroeconomic conditions.

- Historical price trends, while informative, are not reliable predictors of future price movements due to the inherent volatility of the cryptocurrency market.

- Expert opinions on Bitcoin’s future price vary widely, reflecting the uncertainty inherent in predicting long-term price movements.

- Significant risks and uncertainties are associated with investing in Bitcoin, including price volatility, regulatory changes, security breaches, and technological disruptions.

- Successful investment strategies require careful consideration of risk tolerance, diversification, and thorough due diligence.

Bitcoin Price Prediction In December 2025 – Predicting the Bitcoin price in December 2025 is challenging, involving numerous factors. A key element influencing this prediction is the Bitcoin halving event, scheduled for sometime in 2024; to understand the timing precisely, check out this resource on Halving Bitcoin 2025 When. This halving will significantly impact the rate of new Bitcoin entering circulation, ultimately playing a role in shaping the price trajectory by December 2025.

Accurately predicting the Bitcoin price in December 2025 is challenging, given the cryptocurrency’s volatility. However, understanding broader predictions for the year is crucial; a helpful resource for this is the comprehensive overview provided by 2025 Bitcoin Prediction. This analysis can inform a more nuanced perspective on the potential Bitcoin price fluctuations we might see specifically that December.

Therefore, reviewing yearly predictions offers valuable context for more precise monthly estimations.

Accurately predicting the Bitcoin price in December 2025 is challenging, given the cryptocurrency’s volatility. However, understanding broader predictions for the year is crucial; a helpful resource for this is the comprehensive overview provided by 2025 Bitcoin Prediction. This analysis can inform a more nuanced perspective on the potential Bitcoin price fluctuations we might see specifically that December.

Therefore, reviewing yearly predictions offers valuable context for more precise monthly estimations.

Accurately predicting the Bitcoin price in December 2025 is challenging, given the cryptocurrency’s volatility. However, understanding broader predictions for the year is crucial; a helpful resource for this is the comprehensive overview provided by 2025 Bitcoin Prediction. This analysis can inform a more nuanced perspective on the potential Bitcoin price fluctuations we might see specifically that December.

Therefore, reviewing yearly predictions offers valuable context for more precise monthly estimations.

Accurately predicting the Bitcoin price in December 2025 is challenging, given the cryptocurrency’s volatility. However, understanding broader predictions for the year is crucial; a helpful resource for this is the comprehensive overview provided by 2025 Bitcoin Prediction. This analysis can inform a more nuanced perspective on the potential Bitcoin price fluctuations we might see specifically that December.

Therefore, reviewing yearly predictions offers valuable context for more precise monthly estimations.

Accurately predicting the Bitcoin price in December 2025 is challenging, given the cryptocurrency’s volatility. However, understanding broader predictions for the year is crucial; a helpful resource for this is the comprehensive overview provided by 2025 Bitcoin Prediction. This analysis can inform a more nuanced perspective on the potential Bitcoin price fluctuations we might see specifically that December.

Therefore, reviewing yearly predictions offers valuable context for more precise monthly estimations.