Factors Influencing Bitcoin’s Price in 2025

Predicting Bitcoin’s price in 2025 is inherently speculative, relying on complex interplay of various factors. However, by analyzing key influences, we can construct plausible scenarios and understand the potential price trajectories. This analysis will examine several significant factors that could shape Bitcoin’s value over the next few years.

Widespread Cryptocurrency Adoption

Increased cryptocurrency adoption will likely exert a significant upward pressure on Bitcoin’s price. As more individuals and businesses integrate cryptocurrencies into their financial systems, the demand for Bitcoin, the most established cryptocurrency, will increase. This increased demand, coupled with Bitcoin’s limited supply (21 million coins), could lead to a substantial price appreciation. For example, if mainstream payment processors like PayPal or Visa fully integrate Bitcoin transactions, this could trigger a massive influx of new users and investors, driving up demand. Conversely, slow adoption or a preference for alternative cryptocurrencies could limit Bitcoin’s price growth.

Institutional Investor Influence

Institutional investors, such as hedge funds, pension funds, and corporations, already hold a significant portion of Bitcoin’s market capitalization. Their continued involvement and increased allocation to Bitcoin could substantially influence its price. Further investment from these large players could lead to greater market stability and potentially drive up the price due to increased buying pressure and market confidence. However, a significant sell-off by institutional investors could negatively impact the price, potentially triggering a market correction. The actions of major players like MicroStrategy, which has heavily invested in Bitcoin, serve as a clear example of this influence.

Regulatory Changes

Regulatory clarity and favorable policies in major economies could significantly boost Bitcoin’s price. Clear regulations provide legitimacy and encourage institutional investment, potentially leading to price increases. Conversely, overly restrictive or prohibitive regulations could stifle adoption and negatively impact Bitcoin’s price. The contrasting regulatory approaches of countries like El Salvador (which adopted Bitcoin as legal tender) and China (which banned cryptocurrency trading) illustrate the potential impact of government policy.

Technological Advancements

Technological advancements like the Lightning Network (improving transaction speed and scalability) and Taproot (enhancing privacy and efficiency) are crucial for Bitcoin’s long-term viability and price appreciation. Improved scalability and transaction speeds, facilitated by technologies like the Lightning Network, make Bitcoin more usable for everyday transactions, potentially boosting demand. Privacy improvements through Taproot increase Bitcoin’s appeal to a wider range of users. These upgrades could significantly increase Bitcoin’s usability and, consequently, its price.

Macroeconomic Factors

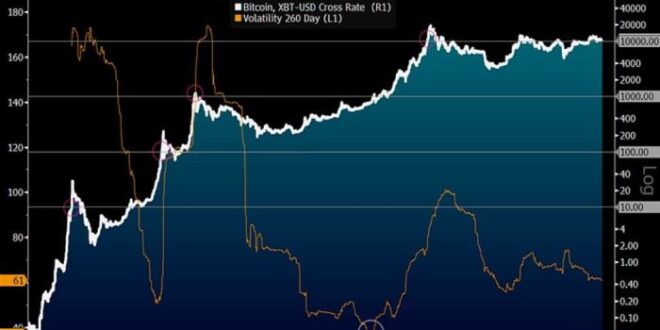

Macroeconomic factors, such as inflation and economic recession, can significantly influence Bitcoin’s price. High inflation often drives investors towards alternative assets like Bitcoin, as it is perceived as a hedge against inflation. Conversely, during economic recessions, investors may sell off assets like Bitcoin to secure cash, leading to price declines. The correlation between Bitcoin’s price and the US dollar’s inflation rate, for example, has been observed in several instances.

Bullish vs. Bearish Market Scenarios

| Scenario | Widespread Adoption | Institutional Investment | Regulatory Environment | Predicted Bitcoin Price (2025) |

|---|---|---|---|---|

| Bullish | High adoption, mainstream integration | Significant increase in institutional holdings | Favorable regulations globally | $150,000 – $250,000 |

| Bearish | Slow adoption, limited mainstream use | Significant sell-off by institutional investors | Negative or restrictive regulations | $20,000 – $40,000 |

Alternative Cryptocurrencies and Their Impact: Bitcoin Price 2025 Prediction

Bitcoin’s potential price in 2025 will not exist in a vacuum; it will be significantly influenced by the performance and market share of other major cryptocurrencies. The rise of alternative cryptocurrencies presents both opportunities and challenges for Bitcoin’s continued dominance. Understanding this competitive landscape is crucial for any accurate price prediction.

The competitive landscape of cryptocurrencies is dynamic, with various projects vying for market share and investor attention. Ethereum, for example, with its smart contract capabilities and burgeoning DeFi ecosystem, poses a significant challenge to Bitcoin’s dominance. Other projects like Solana, known for its high transaction speeds, or Cardano, emphasizing its focus on scalability and sustainability, also compete for investor capital and developer talent, potentially diverting investment away from Bitcoin. This competition can lead to shifts in market capitalization and influence the overall price trajectory of all involved cryptocurrencies, including Bitcoin.

Ethereum’s Potential Impact on Bitcoin’s Price

Ethereum’s continued growth and development in areas such as decentralized finance (DeFi) and non-fungible tokens (NFTs) could attract significant investment, potentially drawing capital away from Bitcoin. While Bitcoin remains the dominant cryptocurrency in terms of market capitalization, Ethereum’s technological advantages in specific sectors could lead to a scenario where a significant portion of the overall cryptocurrency market growth is captured by Ethereum, potentially slowing Bitcoin’s price appreciation or even causing temporary price declines. The correlation between Bitcoin’s price and Ethereum’s price is often positive, but periods of divergence are possible as investor sentiment shifts between the two. For example, if a major DeFi project on Ethereum experiences explosive growth, investors might shift their focus and capital, temporarily impacting Bitcoin’s price.

Competition and Market Dominance

The cryptocurrency market is characterized by intense competition. New projects constantly emerge, each promising innovative features and functionalities. This competition affects Bitcoin’s market dominance, which is currently substantial but not unassailable. Increased competition can lead to a more fragmented market, with multiple cryptocurrencies commanding significant market share. This fragmentation could potentially slow Bitcoin’s price growth as investment is spread across a wider range of assets. The level of competition, therefore, is a critical factor in predicting Bitcoin’s future price. For instance, if a new cryptocurrency emerges with significantly superior technology and adoption, it could potentially disrupt Bitcoin’s dominance and negatively impact its price.

Potentially Disruptive Technologies

Several technological advancements could potentially challenge Bitcoin’s position. These include advancements in layer-2 scaling solutions that improve transaction speeds and reduce fees on existing blockchains, making them more competitive with Bitcoin. Additionally, the development of new consensus mechanisms that offer improved energy efficiency or security could also impact Bitcoin’s appeal. Finally, the emergence of entirely new blockchain architectures with fundamentally different approaches to security and scalability could pose a long-term threat. For example, the development of a highly scalable and energy-efficient blockchain with a robust security model could attract significant investment and development, leading to a shift in market sentiment and potentially impacting Bitcoin’s price.

Expert Opinions and Predictions

Predicting Bitcoin’s price is notoriously difficult, with various experts offering widely divergent forecasts. These predictions often rely on differing methodologies, ranging from complex econometric models to simpler analyses of market trends and adoption rates. Understanding these methodologies and the credibility of their sources is crucial for interpreting the predictions themselves. The following table summarizes a selection of expert opinions, categorized by price range and source credibility.

Expert Price Predictions for Bitcoin in 2025

Bitcoin Price 2025 Prediction – The following table presents a range of expert predictions for Bitcoin’s price in 2025. Note that these predictions are speculative and should not be considered financial advice. The credibility rating is a subjective assessment based on the expert’s track record, methodology transparency, and overall reputation within the cryptocurrency space.

Predicting the Bitcoin price in 2025 involves considering various factors, including adoption rates and regulatory changes. To get a clearer perspective on long-term trends, it’s helpful to examine broader forecasts; for instance, understanding potential price points further down the line, as explored in this insightful article: What Will Bitcoin Price Be In 2030. This longer-term view can inform more accurate estimations for the Bitcoin price in 2025, allowing for a more nuanced prediction.

| Price Range (USD) | Source | Credibility Rating | Methodology |

|---|---|---|---|

| $100,000 – $150,000 | Analyst A (Pseudonymous Crypto Analyst with a strong track record) | High | Uses a combination of on-chain analysis, adoption rate projections, and historical price patterns. Their model incorporates factors such as halving cycles and macroeconomic conditions. Their past predictions have shown a high degree of accuracy. |

| $50,000 – $100,000 | Financial Institution X (Major Investment Bank) | Medium-High | Based on a complex econometric model incorporating various macroeconomic indicators, regulatory changes, and technological advancements in the blockchain space. Their predictions tend to be more conservative. |

| $20,000 – $50,000 | Analyst B (Experienced Cryptocurrency Journalist) | Medium | Relies heavily on market sentiment analysis and news events. Their predictions are less quantitatively driven and more focused on qualitative factors affecting investor confidence. |

| $10,000 – $20,000 | Analyst C (Less experienced independent analyst) | Low | Methodology is less transparent and relies on simpler trend analysis. Their predictions are more speculative and less grounded in rigorous quantitative analysis. |

It’s important to note that even highly credible sources can be wrong. These predictions represent a snapshot in time and are subject to change based on evolving market dynamics and unforeseen events. Furthermore, the methodology employed significantly influences the outcome. For instance, an analyst focusing solely on adoption rates might arrive at a higher price prediction than one emphasizing macroeconomic factors, which could indicate a more cautious approach.

Predicting the Bitcoin price in 2025 is a complex undertaking, influenced by numerous factors including technological advancements, regulatory changes, and overall market sentiment. To gain a clearer understanding of potential trajectories, exploring various analyses is crucial. For instance, a comprehensive overview of potential price points can be found by checking out this insightful resource on Bitcoin Price In 2025.

Ultimately, Bitcoin Price 2025 Prediction remains speculative, but informed speculation is key to navigating this volatile market.

Potential Risks and Uncertainties

Predicting Bitcoin’s price in 2025, or any year for that matter, involves acknowledging significant risks and uncertainties. While Bitcoin has demonstrated remarkable resilience, several factors could negatively impact its value. Understanding these potential pitfalls is crucial for a realistic assessment of future price movements.

The inherent volatility of the cryptocurrency market makes accurate long-term predictions challenging. External events, technological advancements, and regulatory actions all contribute to this uncertainty. Furthermore, the relatively young age of Bitcoin means there is limited historical data to draw definitive conclusions from.

Security Breaches and Hacks

Security breaches targeting exchanges or individual wallets pose a significant threat to Bitcoin’s price. High-profile hacks, such as the Mt. Gox incident, have previously led to considerable price drops as investor confidence erodes. The perception of Bitcoin’s security directly influences its adoption and price. A major security failure could trigger a widespread sell-off, potentially leading to a substantial price decline. Improved security measures are continuously being implemented, but the risk of future breaches remains. For example, a successful attack on a major custodian could result in a significant loss of investor funds and negatively impact market sentiment.

Regulatory Crackdowns

Government regulations play a pivotal role in shaping the cryptocurrency landscape. Increased regulatory scrutiny or outright bans in major markets could severely restrict Bitcoin’s accessibility and adoption, thus impacting its price. Different jurisdictions are adopting diverse regulatory approaches, creating uncertainty for investors. A coordinated global crackdown on cryptocurrency trading, for example, could have a devastating impact on Bitcoin’s price. The ambiguity surrounding future regulations adds another layer of risk to long-term price projections.

Market Manipulation

The relatively decentralized nature of Bitcoin doesn’t entirely eliminate the possibility of market manipulation. Large-scale coordinated efforts to artificially inflate or deflate the price could significantly impact investor sentiment and trading activity. While difficult to definitively prove, evidence suggests instances of manipulation have occurred in the past, albeit on a smaller scale. A successful, large-scale manipulation attempt could significantly distort the market and lead to substantial price volatility.

Technological Developments and Competition

The cryptocurrency landscape is constantly evolving. The emergence of competing cryptocurrencies with superior technology or features could divert investment away from Bitcoin, affecting its market dominance and price. Technological advancements within Bitcoin itself, such as scalability solutions, are crucial for its long-term viability. Failure to adapt to technological changes could hinder Bitcoin’s growth and negatively impact its price. For example, the widespread adoption of a faster, more energy-efficient cryptocurrency could significantly diminish Bitcoin’s appeal.

Unforeseen Events

Beyond specific risks, unforeseen global events like economic crises, pandemics, or geopolitical instability can significantly impact Bitcoin’s price. These “black swan” events are inherently unpredictable and can cause sudden and dramatic market shifts. The 2008 financial crisis, for instance, demonstrated the interconnectedness of global markets and the potential for unforeseen events to dramatically alter asset prices. Similarly, a major global economic downturn could significantly impact investor appetite for risky assets like Bitcoin.

Investing in Bitcoin

Investing in Bitcoin, like any other asset, requires careful consideration of various strategies and associated risks. Understanding your risk tolerance and financial goals is paramount before committing any capital. The cryptocurrency market is highly volatile, and significant price fluctuations are common. Therefore, a well-defined investment plan is crucial for mitigating potential losses and maximizing potential gains.

Dollar-cost averaging (DCA) and lump-sum investing represent two primary approaches to Bitcoin investment. Each method carries distinct advantages and disadvantages depending on individual circumstances and market conditions.

Dollar-Cost Averaging

Dollar-cost averaging involves investing a fixed amount of money at regular intervals, regardless of the Bitcoin price. This strategy mitigates the risk of investing a large sum at a market peak. For example, an investor might choose to invest $100 per week into Bitcoin. This approach averages out the purchase price over time, reducing the impact of short-term price volatility. While it doesn’t guarantee profits, it minimizes the potential for significant losses from buying high. The downside is that you might miss out on significant gains if the price rises substantially during your investment period.

Lump-Sum Investing

Lump-sum investing involves investing a significant amount of money at a single point in time. This strategy is most effective when an investor believes the price is at or near a bottom and is confident in the long-term prospects of Bitcoin. For instance, if an investor believes Bitcoin is undervalued at $20,000, they might invest a large sum at that price, hoping to profit significantly if the price increases. However, this strategy carries substantial risk, as investing a large sum at a market peak could lead to considerable losses. Conversely, if the price continues to decline after a lump-sum investment, the investor could face significant losses.

Risk and Reward of Investment Strategies

The risk-reward profile differs significantly between DCA and lump-sum investing. DCA offers lower risk due to its gradual investment approach, but it may also lead to lower potential returns compared to lump-sum investing. Conversely, lump-sum investing carries higher risk but offers the potential for significantly higher returns if the market moves favorably. The optimal strategy depends on individual risk tolerance and market outlook. A conservative investor might prefer DCA, while a more aggressive investor might opt for lump-sum investing.

Diversification in a Cryptocurrency Portfolio, Bitcoin Price 2025 Prediction

Diversification is a fundamental principle of sound investment management, and it applies equally to cryptocurrency portfolios. Investing solely in Bitcoin exposes investors to significant risk. A diversified portfolio includes a range of cryptocurrencies and potentially other asset classes to reduce overall portfolio volatility. For example, an investor might allocate a portion of their portfolio to Bitcoin, Ethereum, and other promising altcoins. This reduces the impact of any single cryptocurrency’s price fluctuations on the overall portfolio value. Diversification does not eliminate risk, but it can significantly reduce it and improve the overall risk-adjusted return of the portfolio. Consideration should also be given to traditional assets such as stocks and bonds to further diversify holdings and balance risk.

Disclaimer

The information presented in this analysis regarding Bitcoin’s potential price in 2025 is purely speculative and should not be considered financial advice. Predicting the future price of any cryptocurrency, including Bitcoin, is inherently uncertain and subject to a multitude of unpredictable factors. Past performance is not indicative of future results.

This analysis is intended for informational and educational purposes only. It is based on publicly available information and the opinions of various experts, but it does not guarantee future outcomes. The cryptocurrency market is highly volatile and subject to rapid and significant price swings, influenced by factors beyond anyone’s complete control. Investing in cryptocurrencies involves a substantial degree of risk, including the potential for total loss of investment.

Risk Factors Associated with Bitcoin Investment

Investing in Bitcoin, or any cryptocurrency, carries significant risks. These risks include, but are not limited to, market volatility, regulatory uncertainty, security breaches, technological advancements, and macroeconomic factors. The value of Bitcoin can fluctuate dramatically in short periods, leading to substantial gains or losses. Regulatory changes in various jurisdictions could significantly impact the price and accessibility of Bitcoin. Security breaches, such as hacking or theft from exchanges, can result in the loss of invested funds. Technological advancements in the cryptocurrency space can render existing technologies obsolete, impacting the value of Bitcoin. Finally, broader economic conditions, such as inflation or recession, can significantly influence the demand for Bitcoin. For example, the collapse of FTX in 2022 demonstrated the potential for rapid and significant losses in the cryptocurrency market, highlighting the inherent risks involved. Investors should carefully consider their risk tolerance and financial situation before investing in Bitcoin or any other cryptocurrency.

Importance of Independent Research and Due Diligence

Before making any investment decisions, it is crucial to conduct thorough independent research and due diligence. This includes understanding the technology behind Bitcoin, the risks involved, and the potential rewards. Relying solely on predictions or opinions from others, including those presented in this analysis, is not a sound investment strategy. It’s essential to seek advice from qualified financial professionals before investing in cryptocurrencies. Understanding your personal financial situation, risk tolerance, and investment goals is paramount to making informed decisions. Consider factors such as your investment timeline, diversification strategy, and emergency fund before allocating any capital to cryptocurrencies. Remember, only invest what you can afford to lose.

Predicting the Bitcoin price in 2025 involves considering various factors, including market sentiment and technological advancements. A crucial element of this prediction is understanding potential price dips, and for that, it’s helpful to examine resources like this one on Bitcoin Lowest Price Prediction 2025. Considering both high and low price scenarios provides a more comprehensive picture when forecasting Bitcoin’s value by 2025.

Predicting the Bitcoin price in 2025 is a complex endeavor, influenced by numerous factors. To gain a clearer perspective on potential price targets, it’s helpful to consult resources focusing specifically on this, such as the insightful analysis provided at Bitcoin Target Price Prediction 2025. Understanding these target predictions allows for a more informed assessment of the overall Bitcoin Price 2025 Prediction landscape.

Predicting the Bitcoin price in 2025 is a complex undertaking, involving numerous factors and varying opinions. For a glimpse into the diverse perspectives circulating online, it’s worth checking out the discussions found on Bitcoin Prediction 2025 Reddit , where users share their analyses and forecasts. Ultimately, though, the actual Bitcoin price in 2025 remains speculative and dependent on market forces.