Bitcoin Price After Bull Run

Bitcoin’s price history is characterized by dramatic cycles of explosive growth (bull runs) followed by significant corrections (bear markets). These cycles, while unpredictable in their precise timing and magnitude, exhibit recurring patterns in market sentiment and investor behavior. Past bull runs, such as those seen in late 2017 and late 2020/early 2021, were marked by intense speculation, media hype, and rapid price increases. Subsequently, these periods were followed by sharp declines, often accompanied by significant losses for investors who entered the market near the peak.

The typical market sentiment during a bull run is one of exuberance and optimism. Investors, both seasoned and new, are drawn to the potential for high returns, leading to a surge in demand and driving prices upward. This FOMO (fear of missing out) mentality can amplify price increases, creating a self-feeding cycle. However, after a bull run, the sentiment often shifts dramatically. Profit-taking by early investors, coupled with growing concerns about the sustainability of the price surge, leads to a sell-off. This can trigger a cascade effect, with further price declines reinforcing negative sentiment and prompting more selling. Investor behavior during and after bull runs reflects this shift, moving from aggressive buying to cautious selling or even panic selling in extreme cases.

Factors Influencing Bitcoin’s Price Volatility

Several factors contribute to Bitcoin’s notorious price volatility. These include macroeconomic conditions, regulatory developments, technological advancements, and market sentiment. Macroeconomic factors, such as inflation and interest rate changes, can significantly influence investor appetite for risk assets like Bitcoin. For example, periods of high inflation may drive investors towards Bitcoin as a hedge against inflation, increasing demand and price. Conversely, rising interest rates can make other investment options more attractive, potentially leading to a decrease in Bitcoin’s price. Regulatory uncertainty also plays a crucial role; changes in government policies regarding cryptocurrency can have a dramatic impact on market confidence and price. Technological advancements, such as improvements in scalability or the introduction of new features, can also influence investor perception and price. Finally, market sentiment, as discussed earlier, acts as a powerful driver of both bull and bear markets. News events, social media trends, and influencer opinions can all significantly affect investor confidence and ultimately, Bitcoin’s price.

Analyzing the Aftermath of a Bitcoin Bull Run

The aftermath of a Bitcoin bull run is a period of significant volatility and uncertainty. Understanding the historical patterns and key indicators can help investors navigate this complex phase and make more informed decisions. While past performance is not indicative of future results, studying previous cycles offers valuable insights into potential price trajectories and market sentiment.

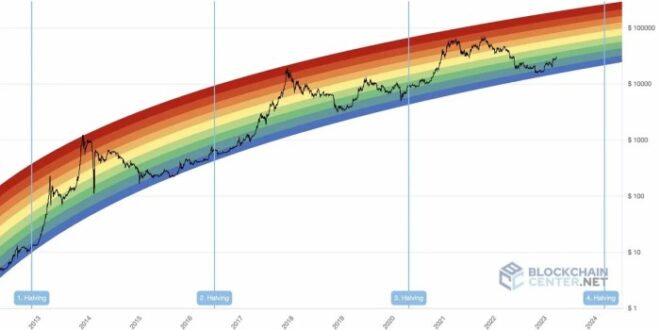

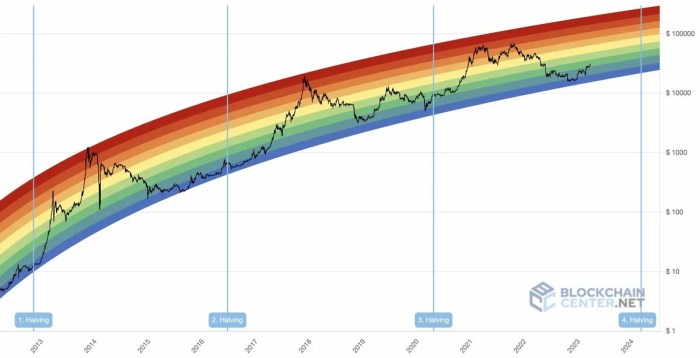

Bitcoin Price After Bull Run – Comparing the price movements of Bitcoin after previous bull runs reveals a consistent pattern of correction. Following the 2011, 2013, and 2017 bull runs, Bitcoin experienced substantial price declines, ranging from significant percentage drops to prolonged periods of sideways trading. The duration and severity of these bear markets varied, influenced by factors such as regulatory developments, technological advancements, and overall macroeconomic conditions. For instance, the 2017 bull run was followed by a protracted bear market lasting nearly two years, while the recovery after the 2013 bull run was relatively faster. This highlights the unpredictable nature of Bitcoin’s price action post-bull run.

Following a bull run, Bitcoin’s price often experiences a period of consolidation or correction. Predicting its future trajectory is challenging, but understanding potential price targets can offer valuable insight. To explore various predictions, you might find the analysis at Bitcoin Price Target 2024 helpful. Ultimately, the post-bull run price depends on several factors, including market sentiment and technological advancements.

Key Indicators of Bull and Bear Market Transitions

Identifying the precise beginning and end of a bull or bear market is inherently challenging. However, several indicators can provide valuable clues. These indicators should be considered in conjunction, rather than in isolation, to form a comprehensive picture.

Indicators signaling the beginning of a bull market often include increasing on-chain activity (e.g., rising transaction volumes and network hash rate), positive media coverage, and growing institutional adoption. Conversely, indicators signaling the end of a bull market might include decreasing trading volume, negative media sentiment, and a significant divergence between price and on-chain metrics (e.g., a price increase not supported by increased network activity). Furthermore, the emergence of bearish chart patterns, such as head and shoulders formations, can also suggest a potential market reversal. Analyzing these indicators together helps in recognizing potential shifts in market sentiment and trajectory.

Predicting Bitcoin’s price after a bull run is always challenging, with many factors influencing its trajectory. Understanding future price projections requires considering various perspectives, and one interesting resource for such analysis is the discussion around Bitcoin Price Target 2025 Reddit , which offers a glimpse into community sentiment. Ultimately, the post-bull run price will depend on market adoption, regulatory changes, and overall economic conditions.

Potential for Prolonged Bear Market or Quick Recovery

The potential for a prolonged bear market or a quick recovery after a Bitcoin bull run depends on a multitude of interconnected factors. These include the severity of the preceding bull run, the overall state of the global economy, and regulatory changes impacting the cryptocurrency market.

A particularly exuberant bull run, characterized by rapid price appreciation and significant speculation, often leads to a more pronounced and prolonged correction. Conversely, a more gradual bull run might result in a less severe bear market. Macroeconomic conditions, such as recessions or periods of high inflation, can exacerbate bear markets by reducing investor risk appetite. Regulatory uncertainty or unfavorable regulatory developments can also negatively impact investor confidence and prolong the bear market. The 2018 bear market, for example, was partly attributed to increased regulatory scrutiny and concerns about the security of cryptocurrency exchanges. Conversely, positive regulatory developments or technological breakthroughs can potentially accelerate a recovery. Therefore, a holistic assessment of these factors is crucial in gauging the potential trajectory of Bitcoin’s price after a bull run.

Frequently Asked Questions (FAQs): Bitcoin Price After Bull Run

Navigating the cryptocurrency market, especially Bitcoin, requires understanding its cyclical nature. Bull runs are inevitably followed by bear markets, periods of price decline that can be unsettling for investors. This section addresses common questions about bear markets, risk mitigation, and identifying potential market turning points.

Bitcoin Bear Market Characteristics

Bitcoin bear markets are characterized by sustained price declines, often accompanied by decreased trading volume and negative sentiment within the crypto community. These corrections can vary significantly in duration and depth. Historically, bear markets have lasted anywhere from several months to over a year, with price drops ranging from 50% to over 80% from peak to trough. The 2018 bear market, for example, saw Bitcoin’s price plummet by approximately 80%, while the 2022 bear market resulted in a roughly 60% decline. The length and severity of a bear market are influenced by various factors, including macroeconomic conditions, regulatory changes, and overall market sentiment.

Protecting Bitcoin Investments During a Bear Market

Several strategies can help protect Bitcoin investments during a bear market. Risk management is crucial, and diversification is a key element. Holding a portion of your portfolio in stablecoins or other less volatile assets can help mitigate losses during a downturn. Dollar-cost averaging (DCA), a strategy involving investing a fixed amount of money at regular intervals regardless of price, can reduce the impact of market volatility. Furthermore, avoiding panic selling is vital; selling during a bear market can crystallize losses, while holding on can allow for potential recovery. Finally, thorough research and a well-defined investment plan are essential for navigating these periods.

Indicators of Bear Market End and Bull Run Beginning

Pinpointing the exact end of a bear market and the start of a new bull run is challenging, but several indicators can offer clues. A sustained increase in on-chain activity, such as the number of active addresses and transaction volume, often suggests growing interest and potential price recovery. Changes in market sentiment, as reflected in social media discussions and news coverage, can also be indicative. Technical analysis, using tools like moving averages and relative strength index (RSI), can help identify potential support levels and potential trend reversals. However, it is important to remember that these indicators are not foolproof and should be considered alongside fundamental analysis. For example, the halving event in Bitcoin’s history has often preceded a bull run, due to the reduced supply of newly mined Bitcoin.

Buying Bitcoin After a Significant Price Drop

Buying Bitcoin after a significant price drop can be a potentially rewarding strategy, but it also carries considerable risk. The potential for substantial gains exists if the market recovers, but there’s also the risk of further price declines. This strategy is best suited for investors with a long-term horizon and a high risk tolerance. Thorough due diligence, understanding your risk profile, and only investing what you can afford to lose are crucial considerations. Successful investors in this scenario often employ strategies like DCA to mitigate risk and maximize potential returns over time. The 2018 and 2022 bear markets offer real-world examples where buying during significant price drops eventually yielded substantial returns for those who held their investments through the recovery period.

Illustrative Examples

Understanding Bitcoin’s price movements after a bull run requires examining historical data and considering various influencing factors. Analyzing past cycles provides valuable insights into potential future scenarios, although it’s crucial to remember that past performance is not indicative of future results. The following examples illustrate key aspects of post-bull run market dynamics.

Bitcoin Performance After Previous Bull Runs, Bitcoin Price After Bull Run

The table below compares the performance of Bitcoin after three previous bull runs. It highlights the duration of the subsequent bear market, the percentage price drop, and the approximate time taken for recovery to previous all-time highs. Note that these figures are approximate and depend on the chosen timeframe for measuring the bear market and recovery.

| Bull Run Peak | Duration of Bear Market (Months) | Percentage Price Drop (%) | Recovery Time to Previous ATH (Months) |

|---|---|---|---|

| Late 2013 | ~18 | ~80 | ~24 |

| Late 2017 | ~12 | ~84 | ~18 |

| Late 2021 | ~18 | ~75 | (Ongoing as of October 26, 2023) |

Portfolio Diversification Strategy for Post-Bull Run Markets

A diversified portfolio is crucial to mitigate risk during the volatile post-bull run period. The following points Artikel a sample strategy, emphasizing the importance of balancing risk and potential reward. Remember to consult with a financial advisor before making any investment decisions.

- Reduce Bitcoin Exposure: After a bull run, it’s prudent to reduce your Bitcoin holdings to a level aligned with your risk tolerance. This minimizes potential losses during a bear market.

- Allocate to Stablecoins: A portion of your portfolio should be allocated to stablecoins like USDC or USDT, providing stability and liquidity during market downturns.

- Invest in Altcoins (with caution): While altcoins are inherently riskier, strategically selecting promising projects with strong fundamentals can offer potential growth opportunities during recovery phases. Thorough due diligence is essential.

- Explore Traditional Assets: Diversifying into traditional assets like gold, bonds, or index funds can provide a hedge against cryptocurrency market volatility.

- Dollar-Cost Averaging (DCA): Employing a DCA strategy involves investing fixed amounts of money at regular intervals, regardless of price fluctuations. This mitigates the risk of investing a large sum at a market peak.

Hypothetical Impact of Regulatory Change on Bitcoin’s Price

Regulatory changes can significantly impact Bitcoin’s price, especially in the post-bull run period when the market is already sensitive. This hypothetical scenario illustrates a potential impact.

- Scenario: A major global economy introduces stringent regulations on cryptocurrency exchanges, requiring strict KYC/AML compliance and limiting access for certain users.

- Immediate Impact: Increased regulatory scrutiny might initially cause a sharp price drop due to uncertainty and reduced liquidity. Investors might panic-sell, exacerbating the downturn.

- Long-Term Impact: While initially negative, the long-term impact could be positive if the regulations increase market integrity and attract institutional investors who value regulatory clarity. This could lead to a gradual price recovery and increased stability.

- Counter-Argument: Conversely, overly restrictive regulations could stifle innovation and adoption, potentially leading to a prolonged bear market and reduced investor confidence.

Bitcoin’s price often experiences a period of consolidation after a significant bull run, as investors take profits and the market adjusts. Understanding potential future price movements is crucial, and for insights into a possible scenario, you might find the projections at Bitcoin Price Prediction 2025 Walletinvestor helpful. This analysis can inform strategies for navigating the post-bull market phase and anticipating future price action for Bitcoin.

Understanding Bitcoin’s price after a bull run requires considering various factors, including market sentiment and technological advancements. To gain insight into potential future trajectories, exploring long-term forecasts is crucial; for example, checking out resources like this article on Bitcoin 2025 Predictions can offer valuable perspectives. Ultimately, the post-bull run price will depend on a complex interplay of these and other market forces.

Understanding Bitcoin’s price after a bull run involves analyzing various factors, including market sentiment and technological advancements. To gain insight into potential future trajectories, checking out discussions on sites like Bitcoin Price Prediction 2025 Reddit can be beneficial. These predictions, however, should be considered alongside broader market analysis when assessing the post-bull run Bitcoin price. Ultimately, predicting the cryptocurrency market remains challenging.