Bitcoin Price After the 2025 Halving: Bitcoin Kurs Nach Halving 2025

Bitcoin halvings are a significant event in the cryptocurrency’s lifecycle, programmed into its code to reduce the rate of new Bitcoin creation by half approximately every four years. These events have historically been followed by periods of significant price appreciation, largely attributed to the resulting decrease in Bitcoin’s inflation rate and increased scarcity. The upcoming halving in 2025 is highly anticipated by investors and analysts alike, prompting speculation about its potential impact on the Bitcoin price.

The 2025 halving will reduce the block reward for Bitcoin miners from 6.25 BTC to 3.125 BTC. This reduction in the supply of newly minted Bitcoin will further restrict its availability, theoretically increasing its value based on the principles of supply and demand. Past halvings have shown a correlation between the halving event and subsequent price increases, though the magnitude and timing of these increases have varied. This article will explore the potential price movements following the 2025 halving, examining historical trends, market sentiment, and other influencing factors.

Historical Price Performance After Halvings

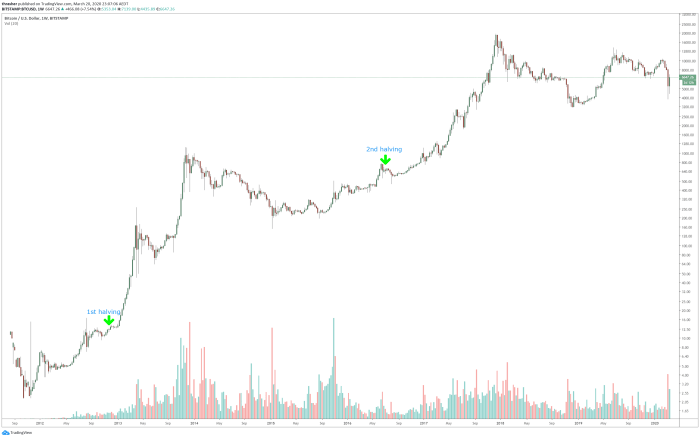

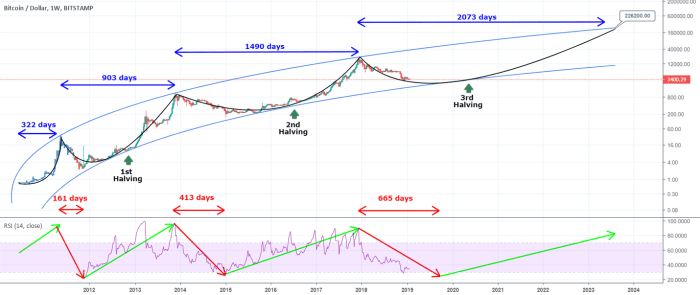

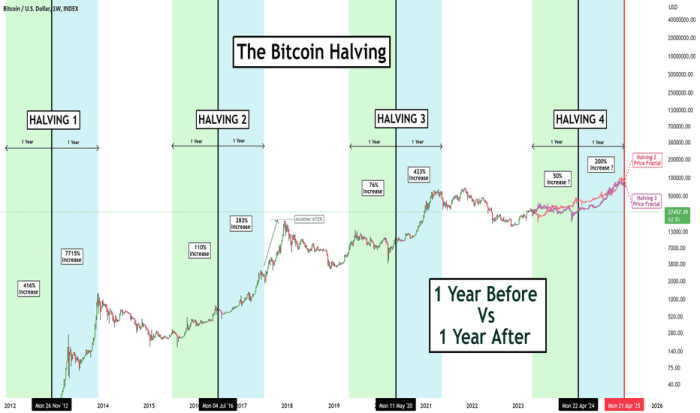

The previous two Bitcoin halvings, in 2012 and 2016, were followed by substantial price increases. Following the 2012 halving, Bitcoin’s price experienced a gradual rise, culminating in a significant bull market. Similarly, the 2016 halving preceded a period of strong price growth that peaked in late 2017. While past performance is not indicative of future results, the historical correlation between halvings and price appreciation suggests a potential for similar trends after the 2025 halving. It’s important to note that numerous other factors, including macroeconomic conditions, regulatory changes, and overall market sentiment, also significantly influence Bitcoin’s price.

Factors Influencing Bitcoin’s Price Post-Halving

Several key factors beyond the halving itself will play a crucial role in determining Bitcoin’s price trajectory following the 2025 event. These include the overall state of the global economy, the regulatory landscape surrounding cryptocurrencies, and the level of institutional and retail investor adoption. For example, a strong global economy might lead to increased investment in risk assets, including Bitcoin, while negative economic conditions could lead to decreased investment and price volatility. Similarly, favorable regulatory changes could boost investor confidence and drive price appreciation, whereas restrictive regulations could stifle growth. The level of adoption by institutional investors, such as large corporations and hedge funds, will also significantly influence the market.

Predicting Bitcoin’s Price After the 2025 Halving

Predicting the exact price of Bitcoin after the 2025 halving is inherently challenging and speculative. Various analysts employ different models and methodologies to estimate potential price movements, leading to a wide range of predictions. Some models focus on historical price trends and extrapolate these trends to forecast future prices. Others incorporate macroeconomic indicators and market sentiment to generate more comprehensive forecasts. However, it is important to remember that these are merely estimations, and the actual price will depend on a complex interplay of numerous unpredictable factors. For example, the price of Bitcoin in the years following the 2016 halving ultimately exceeded initial predictions by a significant margin, highlighting the uncertainty inherent in these estimations. The 2017 bull run, while partially attributed to the halving, was also fueled by increased media attention, growing institutional interest, and a general increase in cryptocurrency adoption.

Historical Bitcoin Halving Events and Price Movements

Bitcoin’s halving events, occurring approximately every four years, significantly reduce the rate at which new bitcoins are mined. This reduction in supply is often cited as a key factor influencing Bitcoin’s price, although the actual impact is complex and influenced by numerous other market forces. Analyzing past halvings provides valuable insight into potential price movements following the 2025 event.

Bitcoin Halving 2012: Price Movements and Contributing Factors

The first Bitcoin halving occurred in November 2012, reducing the block reward from 50 BTC to 25 BTC. Prior to the halving, Bitcoin’s price had been relatively stable, trading in a range of a few dollars. Following the halving, the price experienced a gradual but significant increase over the subsequent months and years, ultimately reaching several hundred dollars. This price surge can be attributed to a confluence of factors including increased adoption by early investors and enthusiasts, growing media attention, and the inherent scarcity introduced by the halving itself. A chart depicting this would show a relatively flat price before the halving, followed by a gradual upward trend extending over several years. Short-term fluctuations would be evident, but the long-term trend would clearly indicate upward momentum. Mid-term analysis would reveal a period of consolidation after the initial price spike, followed by another leg higher.

Bitcoin Halving 2016: Price Movements and Contributing Factors

The second halving in July 2016 reduced the block reward further to 12.5 BTC. In the lead-up to this event, Bitcoin’s price was significantly lower than in 2012, fluctuating in the range of $400-$600. Following the halving, the price initially consolidated before embarking on a dramatic bull run, reaching over $20,000 by late 2017. This surge was driven by factors including increased institutional interest, the rise of Bitcoin exchanges and trading platforms, and growing acceptance of cryptocurrencies as an asset class. A visual representation would show a period of price stagnation before the halving, followed by a significant period of consolidation, then a sharp, parabolic increase in price over a relatively short time frame. Short-term charts would show considerable volatility during the bull run, while long-term charts would highlight the dramatic price appreciation.

Bitcoin Halving 2020: Price Movements and Contributing Factors

The third halving in May 2020 reduced the block reward to 6.25 BTC. Leading up to the event, Bitcoin’s price had been relatively stable around $9,000. Post-halving, the price experienced a significant increase, ultimately exceeding $60,000 by late 2021. Several factors contributed to this price movement, including increasing institutional investment, growing mainstream media coverage, and the impact of the COVID-19 pandemic on global markets, which fueled interest in alternative assets. A chart of this period would illustrate a relatively flat price leading up to the halving, followed by a significant price surge that, while not as parabolic as 2016, was still very substantial. Short-term volatility would be evident, but the long-term trend would showcase strong upward momentum. Mid-term charts would display periods of consolidation within the overall upward trend.

Factors Influencing Bitcoin’s Price Post-2025 Halving

Predicting Bitcoin’s price after the 2025 halving is inherently challenging, as numerous interconnected factors will play a crucial role. While the halving itself reduces the rate of new Bitcoin entering circulation, its impact on price is not guaranteed and depends heavily on other market forces. Understanding these forces is key to forming a reasoned perspective on potential price movements.

The price of Bitcoin post-2025 halving will be a complex interplay of macroeconomic conditions, technological advancements, regulatory decisions, and institutional adoption levels. These factors, along with the fundamental supply and demand dynamics, will collectively determine the trajectory of Bitcoin’s price.

Macroeconomic Conditions

Global economic conditions significantly influence investor sentiment towards risk assets like Bitcoin. Periods of economic uncertainty or inflation might drive investors to seek refuge in Bitcoin, potentially increasing demand and pushing prices upward. Conversely, strong economic growth and low inflation could lead investors to favor traditional assets, potentially decreasing demand for Bitcoin. For example, the 2022 bear market coincided with rising inflation and interest rates globally, impacting investor confidence in riskier assets.

Technological Advancements

Technological advancements within the Bitcoin ecosystem, such as improvements in scalability, transaction speed, and security, can positively influence Bitcoin’s price. The development of the Lightning Network, for example, aims to address scalability issues and make Bitcoin more suitable for everyday transactions. Increased adoption of layer-2 solutions could lead to wider usage and potentially higher demand. Conversely, any significant technological vulnerabilities or security breaches could negatively impact investor confidence and price.

Regulatory Changes

Regulatory clarity and acceptance of Bitcoin by governments and financial institutions are crucial for its long-term growth. Favorable regulatory frameworks could encourage institutional investment and broader adoption, potentially boosting demand. Conversely, stricter regulations or outright bans could severely restrict market participation and negatively affect price. The ongoing debate surrounding Bitcoin ETFs in the US illustrates this point: approval could significantly increase institutional investment and liquidity, potentially driving prices higher.

Institutional Adoption

The increasing involvement of institutional investors, such as hedge funds and corporations, is a significant factor influencing Bitcoin’s price. Large-scale institutional adoption can inject substantial liquidity into the market, increasing demand and potentially leading to significant price appreciation. However, a decrease in institutional interest or large-scale sell-offs could exert downward pressure on the price. Grayscale Bitcoin Trust’s holdings, for instance, are a major indicator of institutional investment in Bitcoin.

Supply and Demand Dynamics

The halving event directly impacts the supply side of the equation. By reducing the rate of new Bitcoin creation, the halving creates a scarcity effect. This, in theory, should increase the value of Bitcoin if demand remains constant or increases. However, the actual impact depends on the interplay between supply reduction and prevailing market demand. If demand significantly weakens post-halving, the scarcity effect might be less pronounced, resulting in a muted price response.

Impact of Potential Bitcoin ETF Approvals, Bitcoin Kurs Nach Halving 2025

The approval of a Bitcoin ETF in major markets, particularly the US, is widely anticipated to significantly impact Bitcoin’s price volatility. Approval could lead to a substantial influx of institutional capital, boosting liquidity and potentially causing significant price increases. Conversely, rejection could lead to disappointment and potentially a temporary price correction. The uncertainty surrounding ETF approval itself contributes to the existing volatility, with price fluctuations often mirroring the progress of regulatory discussions.

Predicting Bitcoin’s Price in 2025 and Beyond

Predicting the price of Bitcoin, a highly volatile asset influenced by numerous factors, is inherently challenging. While no model guarantees accuracy, several approaches attempt to forecast future price movements, each with its strengths and limitations. These models offer a range of potential outcomes, highlighting the significant uncertainty inherent in long-term cryptocurrency price predictions.

Forecasting Models for Bitcoin Price Prediction

Several methodologies are employed to predict Bitcoin’s price. These range from relatively simple technical analysis to complex econometric models, each with inherent assumptions and limitations. The accuracy of these models is heavily dependent on the quality of input data and the validity of the underlying assumptions.

- Technical Analysis: This approach focuses on historical price and volume data to identify patterns and trends. Indicators like moving averages, relative strength index (RSI), and support/resistance levels are used to predict future price movements. Limitations include the subjective interpretation of charts and the potential for self-fulfilling prophecies. For example, a predicted price increase might lead to increased buying, driving the price up, thus confirming the prediction. Conversely, a predicted decline could trigger selling pressure, resulting in a price drop.

- Fundamental Analysis: This method evaluates factors impacting Bitcoin’s intrinsic value, such as adoption rate, network effects, regulatory developments, and macroeconomic conditions. For example, a significant increase in institutional adoption could be considered a bullish factor, while negative regulatory actions might be bearish. The challenge lies in quantifying the impact of these qualitative factors and predicting future events with certainty.

- Econometric Models: These sophisticated statistical models attempt to quantify the relationships between Bitcoin’s price and various macroeconomic and market factors. These models often incorporate variables such as inflation rates, stock market performance, and the adoption of cryptocurrencies in different regions. However, the complexity of these models and the potential for unforeseen events to significantly alter the relationships between variables limit their predictive power. For instance, the emergence of a new, competing cryptocurrency could significantly disrupt existing relationships and render the model inaccurate.

- Machine Learning Algorithms: These algorithms analyze vast datasets to identify patterns and predict future price movements. They can incorporate various factors, including those considered in technical and fundamental analysis. However, these models are susceptible to overfitting (performing well on past data but poorly on new data) and require substantial computational resources. Furthermore, the accuracy depends heavily on the quality and representativeness of the training data.

Comparison of Bitcoin Price Predictions

Numerous reputable sources, including financial analysts, research firms, and cryptocurrency prediction websites, offer Bitcoin price predictions. These predictions vary significantly, reflecting the uncertainty inherent in forecasting long-term price movements. For example, some analysts might predict a price of $100,000 by 2025, while others might suggest a more conservative estimate of $50,000 or even a lower figure. The discrepancies arise from differences in methodologies, assumptions, and the interpretation of underlying market data. It’s crucial to remember that these are just predictions, not guarantees.

Challenges and Uncertainties in Long-Term Bitcoin Price Predictions

Predicting Bitcoin’s price over the long term is extremely challenging due to several factors:

- Volatility: Bitcoin’s price is notoriously volatile, making accurate long-term predictions difficult. Short-term price swings can be dramatic, influenced by news events, market sentiment, and speculative trading.

- Regulatory Uncertainty: The regulatory landscape for cryptocurrencies is constantly evolving, and changes in regulations can significantly impact Bitcoin’s price. Unforeseen regulatory actions could trigger sudden price movements, making long-term forecasting challenging.

- Technological Developments: The cryptocurrency landscape is constantly evolving, with new technologies and innovations emerging regularly. The introduction of new cryptocurrencies or significant technological advancements in Bitcoin itself could alter its price trajectory.

- Market Sentiment: Investor sentiment and market psychology play a significant role in Bitcoin’s price. Sudden shifts in investor confidence can lead to dramatic price swings, making long-term predictions highly speculative.

- Macroeconomic Factors: Global macroeconomic conditions, such as inflation, interest rates, and economic growth, can also influence Bitcoin’s price. Unforeseen economic events can significantly impact the price, making long-term predictions uncertain.

Predicting the Bitcoin Kurs Nach Halving 2025 is a complex endeavor, heavily influenced by the upcoming halving event. Understanding the precise timing is crucial; for the definitive date, check out this resource on the 2025 Bitcoin Halving Date. This date will significantly impact the subsequent price action, as the reduced supply typically affects market dynamics and influences the Bitcoin Kurs Nach Halving 2025 considerably.

Predicting the Bitcoin Kurs Nach Halving 2025 is a complex endeavor, heavily influenced by the precise timing of the halving event. To accurately assess potential price movements, understanding the exact date is crucial, which you can find by checking the Bitcoin Halving Date 2025 resource. Knowing this date allows for more informed speculation about the subsequent market reaction and the potential impact on the Bitcoin Kurs Nach Halving 2025.

Predicting the Bitcoin Kurs Nach Halving 2025 is a complex endeavor, relying heavily on understanding the impact of reduced block rewards. To visualize this reduction and its potential effects, a helpful resource is the Bitcoin Halving Chart 2025 , which clearly illustrates the halving schedule. Analyzing this chart can provide valuable insights into potential future price movements of Bitcoin after the 2025 halving, though of course, no prediction is guaranteed.

Predicting the Bitcoin Kurs Nach Halving 2025 requires understanding the halving event itself. To accurately analyze potential price movements, it’s crucial to know the precise date, which you can find by checking this resource: When Was The 2025 Bitcoin Halving. This date serves as a key benchmark for forecasting the Bitcoin Kurs Nach Halving 2025, as the reduced supply often influences market dynamics.

Predicting the Bitcoin Kurs Nach Halving 2025 is a complex undertaking, involving numerous factors influencing its price. Understanding past trends and analyzing market sentiment are crucial, and a key aspect to consider is the anticipated impact of the reduced Bitcoin supply. For in-depth analysis on this, you might find the article on Bitcoin Price After Halving 2025 helpful.

Ultimately, the Bitcoin Kurs Nach Halving 2025 will depend on a convergence of economic conditions and market behavior.

Predicting the Bitcoin Kurs Nach Halving 2025 is a complex undertaking, influenced by numerous factors beyond the halving event itself. Understanding the historical impact of previous halvings is crucial; for detailed analysis of the anticipated price movements, you might find the information at Bitcoin Price Halving 2025 helpful. Ultimately, the Bitcoin Kurs Nach Halving 2025 will depend on market sentiment and broader economic conditions.