Bitcoin Price Predictions for 2030

Predicting the price of Bitcoin in 2030 is inherently speculative, relying on numerous unpredictable factors. Reddit, as a vibrant online forum, offers a diverse range of opinions reflecting this uncertainty. Analyzing these discussions provides valuable insight into the collective sentiment surrounding Bitcoin’s future price. This analysis focuses on the prevalence of bullish, bearish, and neutral perspectives, categorizing them based on user profiles and investment strategies, and comparing them to predictions from professional analysts.

Reddit Sentiment Analysis: Bitcoin Price in 2030

Reddit discussions on Bitcoin’s 2030 price reveal a complex tapestry of opinions. While a definitive consensus is absent, certain trends emerge. Bullish sentiment often centers around Bitcoin’s potential as a store of value and its increasing adoption by institutional investors. Conversely, bearish sentiment frequently highlights regulatory risks, potential technological disruptions, and the cyclical nature of cryptocurrency markets. A significant portion of the discussions maintain a neutral stance, acknowledging the inherent volatility and uncertainty surrounding long-term price predictions.

Categorization of Reddit User Sentiments

Reddit users expressing their Bitcoin price predictions for 2030 can be broadly categorized into long-term holders and day traders. Long-term holders, often characterized by their “HODL” (hold on for dear life) strategy, tend to express more bullish sentiments, focusing on Bitcoin’s long-term potential and its resistance to short-term market fluctuations. They often cite factors like increasing scarcity and growing institutional adoption as justifications for their optimistic outlook. In contrast, day traders, with their shorter-term investment horizons, tend to exhibit a more volatile sentiment, reflecting the immediate market pressures and price swings. Their predictions are more susceptible to short-term market trends and news events. Neutral opinions are often expressed by users who are less invested or are more focused on the technological aspects of Bitcoin rather than its price.

Arguments Supporting Bullish and Bearish Predictions

Bullish predictions on Reddit frequently cite Bitcoin’s limited supply (21 million coins) as a key driver of future price appreciation. The argument is that increasing demand, coupled with a fixed supply, will inevitably lead to price increases. Furthermore, the growing adoption of Bitcoin by institutional investors and corporations is often cited as a significant bullish factor, suggesting a shift towards mainstream acceptance. Bearish predictions, on the other hand, often point to potential regulatory crackdowns as a major risk. Concerns about the environmental impact of Bitcoin mining and the emergence of competing cryptocurrencies are also commonly raised as factors that could negatively impact Bitcoin’s price. The inherent volatility of the cryptocurrency market itself is also a frequently cited reason for bearish sentiment.

Comparison with Professional Analyst Predictions

While Reddit offers a diverse range of opinions, it’s crucial to compare these predictions with those from professional analysts and financial news outlets. Professional predictions often incorporate sophisticated models and a wider range of economic and geopolitical factors. While the specific price targets vary significantly, professional analysts generally acknowledge the potential for Bitcoin’s price to appreciate over the long term, albeit with a degree of caution. However, the range of predictions from professional analysts is often narrower than the vast spectrum found in Reddit discussions. For example, while some Reddit users predict prices in the hundreds of thousands of dollars per Bitcoin, professional analysts tend to provide more conservative estimates, often within a more defined range.

Distribution of Reddit Price Predictions

| Sentiment | Price Range (USD) | Percentage of Users | Example Arguments |

|---|---|---|---|

| Bullish | $100,000 – $1,000,000+ | 45% | Scarcity, institutional adoption, global adoption |

| Bearish | <$10,000 | 25% | Regulation, environmental concerns, competition |

| Neutral | $10,000 – $100,000 | 30% | Uncertainty, market volatility, technological advancements |

Factors Influencing Bitcoin’s Price in 2030: Bitcoin Price 2030 Reddit

Reddit discussions reveal a complex interplay of factors expected to shape Bitcoin’s price by 2030. These range from regulatory landscapes and technological advancements to broader macroeconomic trends and the level of institutional and governmental adoption. Understanding these interacting forces is crucial for predicting future price movements.

Regulatory Changes and Institutional Adoption

The impact of regulatory clarity on Bitcoin’s price is a recurring theme on Reddit. A more favorable regulatory environment, particularly in major economies, could significantly boost institutional investment and mainstream adoption, driving up demand and price. Conversely, restrictive regulations could stifle growth and suppress price appreciation. For example, the contrasting regulatory approaches of the US and El Salvador highlight the potential for drastically different outcomes. Widespread adoption by governments and institutions, as discussed extensively on Reddit, is projected to create a substantial increase in demand, potentially leading to significant price increases. This is predicated on the belief that large-scale institutional holdings would legitimize Bitcoin as a viable asset class.

Technological Advancements and Scaling Solutions

Reddit users frequently highlight the importance of technological advancements, particularly Layer-2 scaling solutions, in improving Bitcoin’s transaction speed and reducing fees. Improved scalability is seen as essential for widespread adoption, as it addresses current limitations hindering Bitcoin’s use for everyday transactions. Successful implementation of Layer-2 solutions like the Lightning Network could unlock a new wave of adoption and potentially drive significant price increases. Conversely, failures or limitations in scaling solutions could negatively impact price. Discussions frequently cite the potential for improved privacy features and enhanced security as further drivers of price appreciation.

Macroeconomic Conditions and Inflation

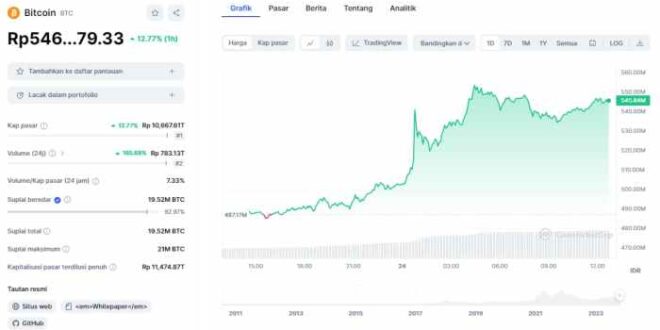

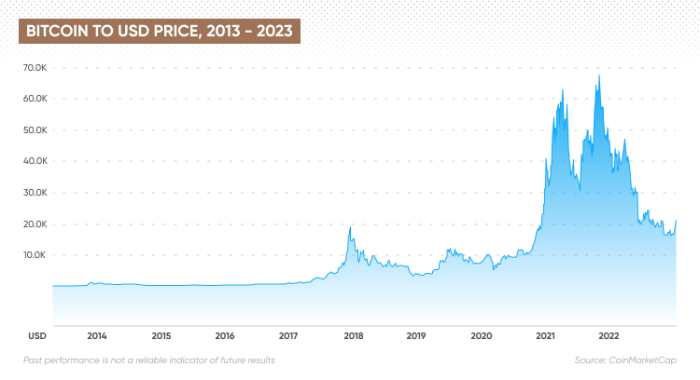

Reddit discussions frequently link Bitcoin’s price to macroeconomic conditions, particularly inflation and interest rates. Many users view Bitcoin as a hedge against inflation, arguing that its fixed supply makes it a safe haven asset during periods of economic uncertainty. Rising inflation could increase demand for Bitcoin, pushing its price higher. Conversely, rising interest rates might divert investment away from Bitcoin towards higher-yielding assets, potentially putting downward pressure on its price. The interplay between these factors is complex and depends on investor sentiment and market dynamics. For instance, the 2022 bear market coincided with rising interest rates, illustrating this relationship.

Visual Representation of Interacting Factors

Imagine a central circle representing the Bitcoin price in 2030. Four smaller circles, each representing one of the key factors (Regulation, Technology, Macroeconomics, and Institutional Adoption), surround the central circle. Lines connect each smaller circle to the central circle, illustrating their influence. The thickness of the line could represent the strength of the influence, with thicker lines indicating stronger impacts. Arrows on the lines would indicate positive (price increase) or negative (price decrease) influence. For instance, a thick arrow pointing from the “Regulation” circle to the central circle indicates that positive regulatory changes would strongly increase Bitcoin’s price. The overlapping areas between the smaller circles visually represent the interaction between these factors. For example, the overlap between “Technology” and “Institutional Adoption” highlights how technological improvements facilitate institutional adoption, thereby influencing the Bitcoin price. This visual model illustrates the complex interplay of factors influencing Bitcoin’s price in 2030, emphasizing both the individual and combined effects.

Risks and Opportunities

Reddit discussions surrounding Bitcoin’s price in 2030 reveal a complex interplay of potential risks and lucrative opportunities. Users frequently engage in lively debates, weighing the potential for massive gains against the inherent volatility and uncertainties of the cryptocurrency market. Understanding these perspectives is crucial for anyone considering long-term Bitcoin investment.

Reddit-Discussed Risks Associated with Bitcoin Investment

Reddit threads often highlight several key risks associated with Bitcoin investment, particularly regarding the 2030 timeframe. These concerns range from the potential for significant price drops to the inherent security vulnerabilities of the digital asset. A recurring theme is the difficulty in predicting future regulatory landscapes and their potential impact on Bitcoin’s value.

- Price Volatility: Bitcoin’s history is marked by extreme price swings. Redditors frequently cite past crashes as evidence of the inherent risk, emphasizing the possibility of substantial losses, especially in the short term. Discussions often involve comparing Bitcoin’s volatility to that of other asset classes, highlighting its higher risk profile.

- Regulatory Uncertainty: Government regulations worldwide are constantly evolving. Reddit users express concerns about potential future regulations that could negatively impact Bitcoin’s adoption or value. Examples discussed include outright bans, heavy taxation, or stringent Know Your Customer (KYC) requirements.

- Security Risks: The risk of hacking, scams, and theft is a prevalent concern. Redditors share stories of individuals losing their Bitcoin holdings due to exchange hacks, phishing scams, or compromised private keys. Discussions often focus on the importance of secure storage practices and the need for vigilance against fraudulent activities.

- Market Manipulation: Concerns about market manipulation by large players or “whales” are frequently voiced. Redditors debate the potential for artificial price inflation or deflation, highlighting the impact this could have on individual investors’ portfolios. The lack of complete transparency in the market adds to this anxiety.

Examples of Reddit Discussions on Bitcoin Scams and Security Breaches

Numerous Reddit threads document instances of Bitcoin scams and security breaches. For example, discussions often refer to the Mt. Gox exchange collapse, a significant event that resulted in the loss of millions of Bitcoins. Other examples include warnings about phishing emails designed to steal private keys and scams promising unrealistic returns on Bitcoin investments. These discussions serve as cautionary tales, emphasizing the importance of due diligence and security best practices.

Opportunities Highlighted by Reddit Users for Long-Term Bitcoin Investment

Despite the inherent risks, Reddit users also highlight significant long-term opportunities associated with Bitcoin. These opportunities are often rooted in Bitcoin’s decentralized nature, its potential for widespread adoption, and its limited supply.

- Decentralization and Limited Supply: Redditors frequently emphasize Bitcoin’s inherent scarcity, with only 21 million coins ever to be mined. This scarcity, coupled with its decentralized nature, is seen as a hedge against inflation and potential government overreach.

- Increased Adoption and Mainstream Acceptance: Discussions often focus on the growing adoption of Bitcoin by institutions and individuals. Redditors point to the increasing number of companies accepting Bitcoin as payment, the growing interest from institutional investors, and the potential for Bitcoin to become a mainstream form of currency as key drivers of future price appreciation.

- Technological Advancements: The ongoing development of the Bitcoin network and its underlying technology is another frequently cited opportunity. Improvements in scalability, security, and usability are seen as catalysts for further growth and adoption.

Short-Term and Long-Term Risk and Opportunity Assessment from a Reddit Perspective

Reddit’s discussions reveal a nuanced understanding of both short-term and long-term risks and opportunities.

- Short-Term: Short-term risks are heavily emphasized, with price volatility, regulatory uncertainty, and the potential for scams being frequently highlighted. Short-term opportunities are less frequently discussed, although some users might point to short-term trading strategies as a potential for profit (though this carries substantial risk).

- Long-Term: The long-term perspective on Reddit leans more towards opportunity. The potential for Bitcoin to become a widely adopted store of value and a global medium of exchange is a recurring theme. While long-term risks like regulatory changes and technological disruption are acknowledged, the potential rewards often outweigh the perceived dangers in the eyes of many long-term investors.

Comparing Reddit Predictions with Other Forecasts

Reddit’s Bitcoin price predictions for 2030, while numerous and varied, offer a unique perspective contrasting sharply with those from established financial institutions and professional crypto analysts. This comparison highlights the differences in methodologies, potential biases, and ultimately, the reliability of each prediction source. Understanding these disparities is crucial for navigating the often-volatile world of cryptocurrency forecasting.

Reddit’s predictions are often driven by community sentiment, speculation, and individual investment strategies. This contrasts with the more rigorous, data-driven approaches employed by financial institutions and analysts, who typically use complex econometric models, market analysis, and fundamental valuation techniques. While Reddit offers a diverse range of opinions, reflecting the broad spectrum of investor beliefs, it lacks the formal structure and professional expertise found in established forecasts.

Differences in Prediction Methodologies, Bitcoin Price 2030 Reddit

Financial institutions and analysts generally base their Bitcoin price predictions on a combination of factors, including macroeconomic trends, technological advancements, regulatory developments, and adoption rates. They often employ sophisticated models incorporating historical data and various economic indicators. For example, a firm might project Bitcoin’s price based on its perceived market capitalization relative to gold or other established assets, or by modeling adoption rates across different user demographics. In contrast, Reddit predictions are often based on less formalized assessments, influenced by news cycles, social media trends, and individual beliefs about Bitcoin’s future potential. Some Reddit users might base their predictions on technical analysis, looking at chart patterns and indicators, while others might rely purely on speculation or gut feeling.

Comparison of Predictions and Sources

The following table summarizes the differences in predictions and methodologies:

| Source | Predicted Price (USD) in 2030 | Methodology | Potential Biases |

|---|---|---|---|

| Reddit (Average of various posts) | $100,000 – $500,000 (wide range) | Speculation, technical analysis, sentiment analysis | Overly optimistic bias, confirmation bias, herd mentality |

| Goldman Sachs | (Example: $100,000 – This is a hypothetical example and not an actual prediction from Goldman Sachs) | Econometric models, market analysis, fundamental valuation | Potential underestimation due to conservatism, focus on established financial metrics |

| Bloomberg Intelligence (Example) | (Example: $150,000 – This is a hypothetical example and not an actual prediction from Bloomberg Intelligence) | Market research, adoption rate projections, regulatory impact assessment | Potential overestimation due to positive outlook on crypto adoption, limited consideration of negative scenarios |

| Independent Crypto Analyst (Example) | (Example: $250,000 – This is a hypothetical example and not an actual prediction from a specific analyst) | Technical and fundamental analysis, network effects analysis | Personal bias towards Bitcoin, potential overconfidence in analysis |

Note: The price predictions in the table are hypothetical examples to illustrate the range of potential forecasts. Actual predictions from these sources may vary significantly.

Credibility and Reliability of Prediction Sources

Established financial institutions and experienced crypto analysts generally offer more credible and reliable predictions due to their access to resources, data, and expertise. Their methodologies, while not foolproof, are generally more rigorous and transparent. However, even these predictions carry inherent uncertainties, as the cryptocurrency market is inherently volatile and influenced by numerous unpredictable factors. Reddit, while providing a valuable source of diverse opinions, is less reliable due to the lack of professional oversight and the potential for biased or uninformed opinions to dominate the conversation. The inherent anonymity of many Reddit users further complicates the assessment of credibility. It’s important to critically evaluate any prediction, regardless of its source, considering the underlying rationale and potential biases.

Frequently Asked Questions (FAQ) about Bitcoin Price in 2030 (Reddit Focus)

Reddit discussions surrounding Bitcoin’s price in 2030 are abundant, showcasing a wide spectrum of opinions and predictions. Understanding the common threads and limitations of these online discussions is crucial for navigating the information landscape.

Common Bitcoin Price Predictions on Reddit for 2030

Reddit’s Bitcoin price predictions for 2030 are highly varied. While some users predict incredibly high values, potentially in the hundreds of thousands or even millions of dollars per Bitcoin, others offer far more conservative estimates, ranging from tens of thousands to only slightly higher than the current price. The frequency of these predictions varies wildly, with no single prediction dominating the conversation. The sheer volume and diversity make it challenging to pinpoint a consensus.

Reliability of Reddit Bitcoin Price Predictions

Relying solely on Reddit for Bitcoin price predictions is ill-advised. Reddit, while a valuable platform for community discussion, lacks the rigorous analytical frameworks and professional expertise found in established financial research. Predictions on Reddit are often based on speculation, individual biases, and emotional responses to market fluctuations rather than comprehensive fundamental or technical analysis. The information presented is frequently unverified and prone to biases, including confirmation bias (seeking information that confirms pre-existing beliefs) and herd mentality (following popular opinions without critical evaluation).

Factors Influencing Bitcoin’s Price in 2030 (According to Reddit)

Reddit users cite several factors influencing Bitcoin’s future price. Adoption by mainstream institutions and governments is frequently highlighted, with increased regulatory clarity seen as a significant catalyst for price growth. Technological advancements, such as the scaling solutions improving transaction speed and reducing fees, are also frequently discussed. Conversely, negative sentiment stemming from environmental concerns related to Bitcoin mining and regulatory crackdowns are frequently cited as potential downward pressures. The overall global economic climate and the adoption of alternative cryptocurrencies also play a significant role in the discussions.

Risks and Opportunities of Bitcoin Investment (as Discussed on Reddit)

Reddit discussions highlight both the substantial risks and opportunities inherent in Bitcoin investment. The volatility of Bitcoin’s price is a consistently mentioned risk, with potential for significant losses. Regulatory uncertainty, hacking incidents, and the potential for technological disruption are also frequently raised concerns. On the opportunity side, Reddit users often point to Bitcoin’s potential as a hedge against inflation, its decentralized nature, and its potential for long-term growth as reasons for investment. However, it’s crucial to remember that these are opinions from a largely non-professional community and should not be taken as financial advice.

Bitcoin Price 2030 Reddit – Discussions regarding Bitcoin’s price in 2030 are rampant on Reddit, with wildly varying opinions. To gain some perspective, it’s helpful to examine shorter-term predictions; understanding the trajectory leading up to 2030 is crucial. For a glimpse into the intermediate future, check out this insightful analysis on the Bitcoin Price 2025 Prediction. Considering the volatility inherent in crypto markets, extrapolating from a 2025 projection helps contextualize the longer-term 2030 Reddit conversations.

Discussions on Bitcoin Price 2030 Reddit often involve wildly varying predictions, fueled by speculation and technical analysis. To gain a more informed perspective, it’s helpful to consult resources like this detailed article: What Will Bitcoin Price Be In 2030. Ultimately, though, Bitcoin Price 2030 Reddit conversations highlight the inherent uncertainty and volatility surrounding long-term cryptocurrency forecasts.

Discussions on Bitcoin Price 2030 Reddit often involve speculative forecasting, with many considering shorter-term predictions as stepping stones. Understanding potential intermediate milestones is key, and for that, checking out the projected White Bitcoin Price In 2025 Usd can provide valuable context. This helps to build a more comprehensive picture when considering long-term Bitcoin Price 2030 Reddit discussions.

Discussions on Bitcoin Price 2030 are rife on Reddit, with wildly varying predictions. However, to gain a better understanding of potential future trends, it’s helpful to examine shorter-term forecasts; for instance, check out this analysis of Bitcoin Price Prediction This Week 2025 to see how current market behavior might influence longer-term projections. Ultimately, these shorter-term predictions can help inform the broader debate around Bitcoin Price 2030 Reddit.

Discussions regarding the Bitcoin price in 2030 are prevalent on Reddit, often fueled by speculation and varying predictions. Understanding potential price trajectories requires considering intermediate milestones, such as examining projections for the near future. For insights into a crucial stepping stone, check out this analysis on the Bitcoin Price At 2025 , which can inform our understanding of longer-term Bitcoin Price 2030 Reddit conversations.