Bitcoin Price Predictions 2050: Bitcoin Price 2050 Reddit

Predicting the price of Bitcoin in 2050 is inherently speculative, given the volatile nature of the cryptocurrency market and the numerous unpredictable factors influencing its value. However, analyzing Reddit discussions offers a glimpse into the collective sentiment and reasoning behind various price predictions. This analysis focuses on identifying prevalent opinions, categorizing user sentiment, and highlighting the key factors driving these predictions.

Reddit Sentiment Analysis of Bitcoin Price Predictions in 2050, Bitcoin Price 2050 Reddit

Reddit discussions regarding Bitcoin’s future price reveal a diverse range of opinions, spanning bullish, bearish, and neutral perspectives. Bullish predictions often cite Bitcoin’s potential as a store of value, its limited supply, and widespread adoption as driving factors for substantial price appreciation. Bearish sentiment frequently points to potential regulatory crackdowns, technological disruptions, or macroeconomic instability as reasons for a decline or stagnation in Bitcoin’s price. Neutral perspectives often emphasize the inherent uncertainty and volatility of the cryptocurrency market, suggesting that predicting a specific price point is highly unreliable.

Categorization of Reddit User Sentiment and Supporting Arguments

Bullish sentiment on Reddit is often expressed through predictions of prices ranging from hundreds of thousands to millions of dollars per Bitcoin by 2050. Supporting arguments frequently involve comparisons to gold or other precious metals, highlighting Bitcoin’s scarcity and its potential to become a dominant global reserve asset. Conversely, bearish sentiment is often accompanied by warnings about potential regulatory risks, emphasizing the possibility of governments enacting policies that could significantly curb Bitcoin’s growth or even lead to its suppression. Neutral viewpoints frequently emphasize the unpredictability of the market, citing past volatility as evidence against attempting to predict a specific price target. These users often advocate for a diversified investment strategy, rather than relying on a single asset like Bitcoin.

Key Factors Influencing Bitcoin Price Predictions on Reddit

Several key factors consistently emerge in Reddit discussions as influencing Bitcoin price predictions for 2050. These include:

- Technological Advancements: Discussions frequently revolve around the potential impact of Layer-2 scaling solutions, improved transaction speeds, and the development of new use cases for Bitcoin. Positive advancements in this area are generally seen as bullish indicators.

- Regulatory Changes: The regulatory landscape is a major point of contention. Positive regulatory clarity and adoption are viewed as bullish, while overly restrictive regulations are seen as bearish. The example of China’s past Bitcoin ban is frequently cited as a cautionary tale.

- Macroeconomic Conditions: Global economic events, such as inflation, recessionary periods, and geopolitical instability, are frequently cited as influencing Bitcoin’s price. Periods of economic uncertainty can often lead to increased demand for Bitcoin as a hedge against inflation, while periods of economic stability might reduce this demand.

- Widespread Adoption: The level of mainstream adoption is another crucial factor. Increased usage by institutions and everyday users is generally considered a bullish sign, while limited adoption is seen as bearish.

Distribution of Bullish, Bearish, and Neutral Sentiments on Reddit

| Sentiment | Frequency (Estimate) | Example Prediction | Supporting Argument Example |

|---|---|---|---|

| Bullish | 40% | $1,000,000+ per BTC | |

| Bearish | 30% | Below $100,000 per BTC | |

| Neutral | 30% | Unpredictable |

Historical Bitcoin Price Trends and Future Implications

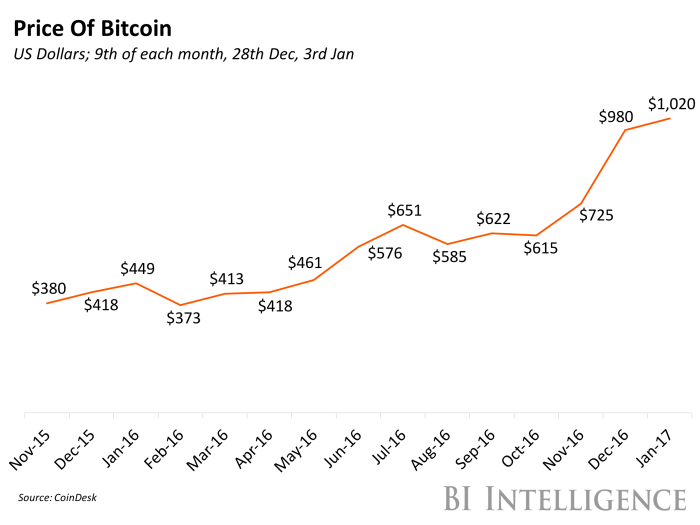

Bitcoin’s price history is characterized by extreme volatility and dramatic swings, reflecting its nascent nature as an asset class and its susceptibility to various internal and external factors. Understanding these past trends offers valuable insights into potential future price movements, though predicting the future with certainty remains impossible.

Bitcoin Price 2050 Reddit – Since its inception, Bitcoin has experienced several distinct bull and bear markets. The initial years saw gradual growth, followed by a period of explosive price increases in 2017, reaching almost $20,000. This was driven by increasing mainstream adoption, media attention, and speculative investment. The subsequent crash highlighted the inherent risk associated with Bitcoin, with the price plummeting to around $3,000 in 2018. Subsequent cycles have shown a similar pattern of rapid appreciation followed by significant corrections, albeit with generally increasing highs over time. These cycles are often influenced by factors such as regulatory announcements, technological advancements, and macroeconomic conditions.

Discussions around Bitcoin Price 2050 on Reddit often involve speculative estimations, ranging from wildly optimistic to cautiously bearish. Predicting that far out is inherently difficult, but understanding shorter-term projections can inform long-term views. To gain some perspective on intermediate-term growth, check out this insightful article on What Will Bitcoin Be Worth 2025 , which offers valuable context for those pondering Bitcoin’s price trajectory in 2050 and beyond.

Ultimately, the Bitcoin Price 2050 Reddit conversations highlight the uncertainty inherent in such long-term predictions.

Past Price Cycles and Potential Future Patterns

Bitcoin’s price cycles seem to follow a roughly four-year pattern, coinciding with the halving events – periodic reductions in the rate at which new Bitcoins are mined. These halvings reduce the supply of new Bitcoins entering the market, potentially creating upward pressure on price. The 2012, 2016, and 2020 halvings were each followed by significant bull runs, suggesting a correlation between halving events and price increases. However, it’s crucial to note that other factors also play a role. While extrapolating this pattern to 2050 suggests potential for further price increases around future halving events, external factors could significantly alter this trajectory. For instance, widespread adoption could lead to a smoother, less volatile price curve, while unforeseen regulatory crackdowns or technological disruptions could drastically alter the forecast. Predicting the exact price in 2050 is speculative, but understanding the historical pattern provides a framework for potential scenarios. For example, if the four-year cycle continues, and the historical trend of increasing highs after halvings persists, we might see a significantly higher price than today. However, this is a simplification and should not be taken as a guaranteed prediction.

Technological Advancements and Their Price Impact

Technological advancements within the Bitcoin ecosystem are expected to significantly influence its price in the long term. Layer-2 scaling solutions, such as the Lightning Network, aim to increase transaction speed and reduce fees, making Bitcoin more practical for everyday use. This increased usability could lead to broader adoption and consequently, higher demand and price. Improvements in security, including advancements in cryptographic techniques and wallet security, will enhance Bitcoin’s reliability and attract more institutional investors, further impacting its value. The development and adoption of more efficient mining hardware could also impact the network’s overall energy consumption and efficiency, potentially influencing its long-term viability and attractiveness.

Macroeconomic Factors and Bitcoin’s Price in 2050

Macroeconomic factors will play a crucial role in shaping Bitcoin’s price in 2050. High inflation could drive investors towards Bitcoin as a hedge against currency devaluation, potentially increasing its demand. Conversely, rising interest rates could make alternative investment options more attractive, potentially reducing demand for Bitcoin. Global economic stability or instability will also have a profound impact. A period of global economic uncertainty might see Bitcoin’s price surge as investors seek safe haven assets, while periods of stability might lead to more moderate price movements. The interplay of these factors, alongside regulatory changes and geopolitical events, will determine Bitcoin’s price trajectory in 2050. For example, a global economic crisis could significantly boost Bitcoin’s value as investors look for alternative stores of value, mirroring the increase in value during the 2008 financial crisis. Conversely, strong global economic growth and robust traditional financial markets could reduce Bitcoin’s appeal.

Factors Influencing Bitcoin’s Long-Term Value

Predicting Bitcoin’s price in 2050 requires considering a complex interplay of factors, both positive and negative. While its future is inherently uncertain, analyzing these influences offers valuable insight into potential price trajectories. This analysis will examine the drivers of potential upward momentum, significant risks, comparative value propositions against other assets, and a hypothetical scenario illustrating a possible future price.

Upward Price Drivers for Bitcoin in 2050

Several factors could significantly contribute to Bitcoin’s price appreciation by 2050. Increased adoption, driven by wider acceptance among individuals and businesses, is paramount. The inherent scarcity of Bitcoin, with a fixed supply of 21 million coins, acts as a powerful deflationary force, potentially increasing its value over time, mirroring the behavior of precious metals like gold. Furthermore, continued institutional investment, as more large financial institutions and corporations integrate Bitcoin into their portfolios, will likely boost demand and, consequently, price. Growing global macroeconomic instability, coupled with a potential loss of faith in fiat currencies, could also push investors towards Bitcoin as a hedge against inflation and economic uncertainty. Finally, technological advancements in the Bitcoin ecosystem, such as the Lightning Network improving transaction speed and scalability, could enhance its usability and attractiveness to a broader user base.

Potential Risks and Challenges to Bitcoin’s Price

Despite the bullish factors, significant risks could negatively impact Bitcoin’s price. Regulatory uncertainty remains a major concern; inconsistent or overly restrictive government regulations in various jurisdictions could stifle adoption and reduce demand. Technological disruptions, such as the emergence of a superior cryptocurrency or a major security vulnerability within the Bitcoin network, could undermine its dominance and price. Security breaches, targeting exchanges or individual wallets, could erode investor confidence and lead to price corrections. Furthermore, increased competition from other cryptocurrencies, offering potentially faster transaction speeds or improved functionalities, could divert investment away from Bitcoin. Lastly, significant market manipulation, though theoretically less impactful as the market matures, could still lead to short-term volatility and price swings.

Bitcoin’s Long-Term Value Proposition Compared to Other Assets

Bitcoin’s value proposition differs significantly from traditional assets like gold, stocks, and real estate. Unlike gold, which has inherent industrial applications and is a tangible asset, Bitcoin is a purely digital asset, with its value derived from its scarcity and perceived utility as a store of value and medium of exchange. Compared to stocks, Bitcoin’s value isn’t tied to the performance of a specific company or industry, making it a less correlated asset, potentially offering diversification benefits in an investment portfolio. Unlike real estate, which is illiquid and geographically bound, Bitcoin is easily transferable across borders, offering a higher degree of liquidity. The long-term value of Bitcoin, therefore, depends on its continued acceptance as a decentralized, secure, and transparent store of value and medium of exchange, independent of traditional financial systems.

Hypothetical Scenario: Bitcoin Reaching $1 Million in 2050

One hypothetical scenario envisions Bitcoin reaching $1 million by 2050. This scenario assumes widespread global adoption, with Bitcoin integrated into mainstream financial systems and used for everyday transactions. Continued institutional investment, coupled with increasing macroeconomic instability, drives substantial demand. Technological improvements enhance scalability and usability, addressing existing limitations. Crucially, regulatory clarity emerges globally, fostering trust and reducing uncertainty. This positive confluence of factors, alongside Bitcoin’s inherent scarcity, could push its price to the $1 million mark. This scenario, however, assumes the absence of significant negative events, such as a major security breach or the emergence of a superior competitor. The example of gold, which has maintained its value over centuries due to its scarcity and perceived value, provides a potential parallel, albeit with different underlying characteristics. The scenario relies on the successful transition of Bitcoin from a niche asset to a globally accepted store of value and medium of exchange, similar to the widespread adoption of the internet in previous decades.

Reddit User Demographics and Bitcoin Price Opinions

Analyzing Reddit’s Bitcoin price discussion threads reveals a diverse user base with varying opinions shaped by their unique backgrounds and experiences. Understanding these demographic factors and their correlation with price predictions offers valuable insights into the sentiment surrounding Bitcoin’s future. While precise demographic data on Reddit users is limited due to anonymity, we can extrapolate from observable trends and available information.

Reddit’s cryptocurrency communities, such as r/Bitcoin and r/CryptoCurrency, attract a global audience. However, significant participation likely comes from users in regions with established cryptocurrency markets and higher internet penetration. Age ranges are broad, with younger users often showing higher risk tolerance and a longer-term outlook, while older users may display more cautious approaches, influenced by established financial models. Investment experience varies greatly, from seasoned traders and investors to newcomers exploring the space.

Age and Investment Experience Influence on Bitcoin Price Predictions

Younger Reddit users (generally under 35), often characterized by a higher risk tolerance and longer time horizons, tend to express more bullish predictions for Bitcoin’s price in 2050. They frequently cite technological advancements, increased adoption, and potential for Bitcoin to become a dominant store of value as reasons for their optimism. Examples of these predictions often involve projections exceeding $1 million per Bitcoin. Conversely, older users (generally over 45), often with more established investment portfolios and potentially greater exposure to traditional financial markets, may express more conservative price predictions, influenced by concerns about regulatory uncertainty, market volatility, and potential competing technologies. Their predictions might center around more moderate increases, or even potential price stagnation. The experience level also plays a significant role; experienced investors may base their predictions on historical price trends and market cycles, while newer investors may rely more on speculative enthusiasm or broader technological projections.

Geographic Location and Bitcoin Price Perspectives

Geographic location influences both access to information and exposure to regulatory frameworks, thereby affecting Bitcoin price opinions. Users from regions with favorable regulatory environments and robust cryptocurrency infrastructure (such as the United States, certain parts of Europe, and some areas of Asia) might exhibit a more optimistic outlook compared to users from regions with stricter regulations or limited access to cryptocurrency exchanges. For example, users from jurisdictions where Bitcoin is legally recognized as a form of payment or investment might express more bullish price predictions than users from jurisdictions where it faces legal uncertainty or outright bans. This is further influenced by the economic conditions of their respective countries. Users from countries with high inflation rates or unstable currencies may hold a more bullish view, seeing Bitcoin as a hedge against economic uncertainty.

Correlation Between Demographics and Bitcoin Price Predictions

While establishing a precise correlation requires extensive data analysis, anecdotal evidence suggests a clear link between user demographics and Bitcoin price predictions. Younger users with limited investment experience tend to lean towards significantly higher price targets, reflecting a higher risk tolerance and a belief in Bitcoin’s long-term potential. Conversely, older users with extensive investment experience often offer more conservative predictions, reflecting a greater awareness of market risks and a more cautious approach to investment. Geographic location also plays a crucial role; users from regions with supportive regulatory environments and high levels of cryptocurrency adoption tend to display more bullish sentiments. However, it’s important to note that these are broad generalizations and individual opinions within each demographic group can vary significantly. For example, some younger users may be skeptical of Bitcoin’s long-term value due to environmental concerns or security vulnerabilities.

Alternative Investment Perspectives and Bitcoin’s Role

Predicting Bitcoin’s price in 2050 requires considering its position within a broader investment landscape. Alternative asset classes, each with its own risk profile and potential return, will inevitably influence Bitcoin’s trajectory. Understanding these competing investment strategies is crucial for assessing Bitcoin’s long-term value.

The potential for significant returns in alternative investments, such as venture capital, private equity, or real estate, will always draw some investment away from Bitcoin. Conversely, periods of instability in traditional markets might drive investors towards Bitcoin’s perceived safety and decentralization. The interplay between these factors will be a major determinant of Bitcoin’s price.

Bitcoin’s Long-Term Return on Investment Compared to Other Asset Classes

Comparing Bitcoin’s potential long-term ROI to other asset classes presents a complex challenge. While historical data shows Bitcoin’s volatility and potential for explosive growth, predicting its future performance against established assets like stocks, bonds, or gold remains speculative. However, we can examine past performance as a starting point. For example, while the S&P 500 has historically offered a relatively stable average annual return, Bitcoin has exhibited periods of far greater growth, albeit with significantly higher risk. The same is true when comparing it to gold, a traditional safe haven asset. Gold has provided a hedge against inflation but has historically delivered lower returns than Bitcoin during periods of rapid growth. The key difference lies in the underlying nature of each asset and the investor’s risk tolerance.

Bitcoin as a Hedge Against Inflation and Economic Uncertainty in 2050

Bitcoin’s potential role as an inflation hedge in 2050 hinges on several factors. Its fixed supply of 21 million coins is a key argument for its scarcity and potential to retain value during inflationary periods. However, widespread adoption and regulatory changes could impact its effectiveness. Historically, during periods of high inflation, investors have sought refuge in assets perceived as holding their value, such as gold. Whether Bitcoin will successfully replicate this role depends on its perceived stability and acceptance within the broader financial system. The potential for increased regulation, technological disruptions, or even the emergence of competing cryptocurrencies could all influence Bitcoin’s ability to serve as a reliable inflation hedge.

The Impact of Decentralized Finance (DeFi) on Bitcoin’s Price and Market Position

The rise of DeFi presents both opportunities and challenges for Bitcoin. DeFi protocols, built on blockchain technology, offer a range of financial services without intermediaries, potentially increasing efficiency and accessibility. Some DeFi platforms use Bitcoin as collateral or integrate it into their systems, which could boost demand. However, the emergence of alternative cryptocurrencies and DeFi tokens could also divert investment away from Bitcoin, potentially impacting its market dominance. The interplay between Bitcoin’s established position and the innovative potential of DeFi will be a significant factor shaping its future price. For instance, the growth of stablecoins pegged to Bitcoin could create a more stable and accessible ecosystem around Bitcoin, increasing its usability and appeal to a wider range of investors. Conversely, the emergence of superior blockchain technologies or DeFi platforms could challenge Bitcoin’s dominance.

Speculation about the Bitcoin price in 2050 is rampant on Reddit, with wildly varying predictions. However, to even begin to approach such long-term forecasting, understanding more near-term projections is crucial. A good starting point might be to examine predictions for the Bitcoin price in 2025, which you can find detailed here: Bitcoin Price In 2025 Year.

Analyzing these shorter-term forecasts can offer insights into the factors that might influence Bitcoin’s price trajectory towards 2050 and beyond, informing the Reddit discussions.

Discussions on Bitcoin Price 2050 Reddit often involve wildly speculative figures. However, to even begin forming a reasonable long-term outlook, it’s helpful to consider shorter-term predictions. For a more grounded perspective, check out this analysis on the Bitcoin Price Prediction November 2025: Bitcoin Price Prediction November 2025. Extrapolating from near-term forecasts can offer a more realistic, albeit still uncertain, path towards understanding those Reddit discussions about Bitcoin’s value in 2050.

Discussions on Bitcoin Price 2050 Reddit often involve wildly speculative figures. However, to even begin forming a reasonable long-term outlook, it’s helpful to consider shorter-term predictions. For a more grounded perspective, check out this analysis on the Bitcoin Price Prediction November 2025: Bitcoin Price Prediction November 2025. Extrapolating from near-term forecasts can offer a more realistic, albeit still uncertain, path towards understanding those Reddit discussions about Bitcoin’s value in 2050.

Speculating on Bitcoin’s price in 2050 is a popular pastime on Reddit, with wildly varying predictions. To even begin to formulate an informed guess, however, it’s crucial to understand more near-term projections. A good starting point is considering the likely price in 2025, as detailed in this helpful analysis: How Much Is Bitcoin Worth In 2025.

Understanding shorter-term trends helps contextualize the longer-term, more uncertain forecasts for Bitcoin’s value by 2050 found on Reddit.