Bitcoin Price Prediction 2025: Bitcoin Price Prediction 2025 After Halving

Bitcoin’s price is notoriously volatile, influenced by a complex interplay of factors. However, the halving event, a programmed reduction in Bitcoin’s block reward, has historically shown a strong correlation with subsequent price increases. Understanding this correlation and its potential impact on supply and demand is crucial for predicting Bitcoin’s price in 2025.

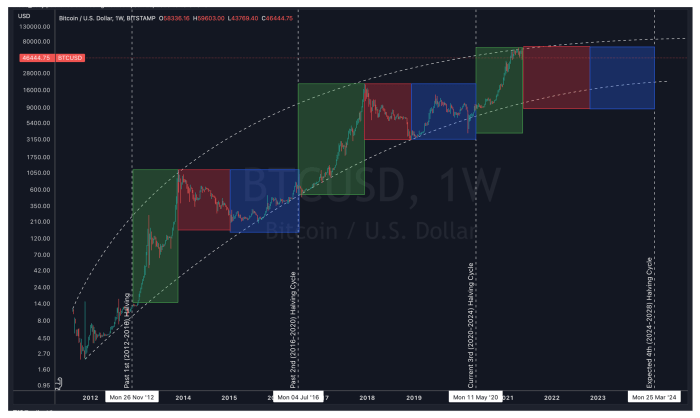

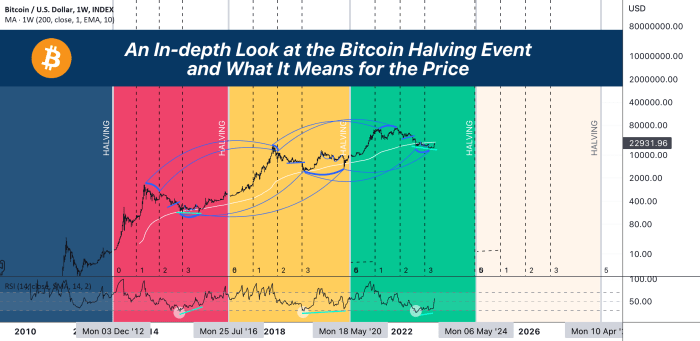

Bitcoin Halving’s Historical Impact on Price

The Bitcoin halving occurs approximately every four years, reducing the rate at which new Bitcoins are created. This reduction in supply, combined with generally increasing demand, has historically led to significant price increases in the months and years following each halving. The first halving in 2012 saw a gradual price increase, culminating in a significant rise in 2013. The second halving in 2016 preceded a massive bull run in 2017. The third halving in 2020 was followed by a substantial price surge in 2021, before a subsequent market correction. While not a guaranteed predictor of future price action, the historical data suggests a strong positive correlation between halving events and increased Bitcoin value.

The Anticipated Effects of the Next Halving on Bitcoin’s Supply and Demand

The next Bitcoin halving, expected in 2024, will further reduce the rate of new Bitcoin creation. This will exacerbate the inherent scarcity of Bitcoin, a key factor driving its value proposition. Reduced supply, coupled with potentially sustained or increased demand, is expected to create upward pressure on the price. The magnitude of this price increase will depend on several factors, including macroeconomic conditions, regulatory developments, and overall market sentiment. The increased scarcity will likely contribute to a higher floor price, meaning it may be more difficult for the price to drop significantly.

Market Predictions for Bitcoin’s Price in 2025

Various analysts and firms offer predictions for Bitcoin’s price in 2025, employing diverse methodologies and assumptions. These predictions vary widely, reflecting the inherent uncertainty in forecasting cryptocurrency markets. The following table summarizes some notable predictions, acknowledging that these are estimates and not guaranteed outcomes.

| Source | Prediction (USD) | Rationale |

|---|---|---|

| Analyst A (Example) | $150,000 | Based on historical halving cycles and adoption rate projections. |

| Analyst B (Example) | $200,000 | Utilizes a combination of on-chain metrics and macroeconomic forecasts. |

| Firm C (Example) | $100,000 | Employs a more conservative approach, factoring in potential regulatory risks. |

Factors Influencing Bitcoin’s Price After the Halving

Predicting Bitcoin’s price is inherently complex, involving a confluence of macroeconomic, technological, and psychological factors. The halving event, while significant in reducing the rate of new Bitcoin creation, is just one piece of this intricate puzzle. Understanding the interplay of these influences is crucial for navigating the potential price trajectory in 2025.

Macroeconomic Factors and Geopolitical Events

Macroeconomic conditions significantly impact Bitcoin’s price. High inflation, for instance, can drive investors towards Bitcoin as a hedge against inflation, increasing demand and potentially pushing the price upwards. Conversely, periods of economic stability or deflation could reduce this demand. Geopolitical instability, such as wars or significant shifts in global power dynamics, can also create uncertainty in traditional markets, leading investors to seek refuge in alternative assets like Bitcoin. For example, the 2022 Russian invasion of Ukraine saw a surge in Bitcoin’s price as investors sought safe havens amidst the geopolitical turmoil. Regulatory changes, particularly those concerning cryptocurrency adoption or restrictions, can also profoundly affect Bitcoin’s price. A positive regulatory framework in major economies could boost institutional investment and drive price appreciation, while overly restrictive regulations could stifle growth.

Technological Advancements and Institutional Adoption

Technological advancements play a pivotal role in Bitcoin’s long-term viability and price. Improvements to the Lightning Network, for instance, could significantly increase transaction speeds and reduce fees, making Bitcoin more practical for everyday use. This increased usability could lead to wider adoption and potentially higher demand. Institutional adoption, marked by increased investment from large financial institutions and corporations, adds legitimacy and stability to the market. This influx of capital can drive up prices and reduce volatility.

- Lightning Network Improvements: Enhanced scalability and lower transaction fees could attract a wider user base, increasing demand.

- Taproot Upgrade: Increased privacy and efficiency in transactions can boost adoption and attract more users.

- Increased Institutional Adoption: Gradual integration of Bitcoin into traditional financial systems can lead to increased liquidity and price stability.

- Development of Bitcoin ETFs: Approval of Bitcoin exchange-traded funds (ETFs) in major markets could significantly increase accessibility and investment.

Market Sentiment and Hype Cycles, Bitcoin Price Prediction 2025 After Halving

Market sentiment, encompassing fear, uncertainty, and doubt (FUD) as well as periods of intense hype, significantly influences Bitcoin’s price. Negative news, regulatory uncertainty, or security breaches can trigger FUD, leading to sell-offs and price drops. Conversely, positive news, technological breakthroughs, or endorsements from influential figures can create hype, driving price increases. The 2017 Bitcoin bubble, fueled by significant media attention and speculative investment, is a prime example of a hype cycle. The subsequent crash highlighted the volatility inherent in periods of intense speculation. The opposite occurred during the 2022 crypto winter, where prolonged bearish sentiment and negative news significantly depressed prices. Understanding these cyclical shifts is crucial for navigating the market effectively.

Potential Price Scenarios for Bitcoin in 2025

Predicting the price of Bitcoin is inherently speculative, but by analyzing historical trends, market sentiment, and technological advancements, we can construct plausible scenarios for its value in 2025, post-halving. These scenarios represent a range of possibilities, from highly optimistic to pessimistic, acknowledging the significant uncertainties involved.

Bullish Scenario: Bitcoin Surges to New Heights

This scenario assumes a confluence of positive factors driving Bitcoin’s price significantly higher. Increased institutional adoption, coupled with growing mainstream acceptance and positive regulatory developments, could fuel a substantial rally. Furthermore, a successful scaling solution mitigating transaction fees and improving network speed would attract more users and investors. The halving event, reducing the rate of new Bitcoin creation, would contribute to a scarcity-driven price increase. This scenario anticipates a robust global economy and continued technological innovation within the cryptocurrency space. A bullish market cycle, driven by increased demand and limited supply, could easily push Bitcoin’s price to unprecedented levels.

Bearish Scenario: Bitcoin Experiences a Significant Correction

Conversely, a bearish scenario assumes a less favorable market environment. Negative regulatory actions, a global economic downturn, or a major security breach impacting Bitcoin’s network could trigger a significant price correction. Increased competition from alternative cryptocurrencies, offering superior functionality or scalability, could also lead to a decline in Bitcoin’s market dominance and price. This scenario assumes a lack of widespread institutional adoption and continued uncertainty surrounding Bitcoin’s long-term viability as a store of value. The halving, while impacting supply, might not be sufficient to offset the negative factors impacting demand. In this scenario, we see a substantial drop from current prices.

Neutral Scenario: Bitcoin Consolidates and Experiences Moderate Growth

This scenario represents a more moderate outlook, anticipating neither a dramatic surge nor a significant crash. It assumes a period of consolidation, where Bitcoin’s price fluctuates within a defined range, reflecting a balance between bullish and bearish pressures. While the halving event would likely exert some upward pressure, other factors, such as regulatory uncertainty or market volatility, would limit the extent of price appreciation. This scenario reflects a more cautious approach, acknowledging the inherent risks and uncertainties associated with Bitcoin’s price. Moderate growth would occur, driven by gradual adoption and sustained interest, but without the dramatic price swings seen in the bullish or bearish scenarios.

Visual Representation of Price Scenarios

Imagine a line graph charting Bitcoin’s price over time, extending to 2025. The x-axis represents time (from the present to 2025), and the y-axis represents Bitcoin’s price in USD.

* Bullish Scenario: This line would show a steep upward trajectory, potentially exceeding previous all-time highs significantly, possibly reaching a price of $200,000 or more by the end of 2025. Key price points could be marked to illustrate significant milestones in the price increase.

* Bearish Scenario: This line would exhibit a downward trend, potentially falling below current levels and reaching a price point considerably lower, perhaps around $20,000 or even lower, by 2025. Key price points would mark significant drops and potential support levels.

* Neutral Scenario: This line would show a relatively flat trajectory with some moderate upward movement, potentially reaching a price around $60,000-$80,000 by the end of 2025, with fluctuations within a defined range throughout the period. Key price points would represent periods of consolidation and minor price increases.

Likelihood of Each Scenario

Assigning probabilities to these scenarios is inherently subjective. However, considering a balanced perspective:

* Bullish Scenario (25%): This scenario requires a confluence of highly favorable events, making it less likely than the neutral scenario. However, the potential for significant gains attracts many investors, supporting a degree of probability.

* Bearish Scenario (25%): Similar to the bullish scenario, a significant downturn requires a confluence of negative events, making it equally unlikely. However, the inherent volatility of cryptocurrencies and potential for unforeseen circumstances necessitates acknowledging this possibility.

* Neutral Scenario (50%): This scenario represents the most probable outcome, reflecting a balance of potential risks and rewards. Gradual adoption, coupled with market volatility, makes a period of consolidation the most likely outcome. This scenario balances optimistic and pessimistic viewpoints, recognizing the uncertainty inherent in predicting Bitcoin’s price.

Risks and Uncertainties in Bitcoin Price Prediction

Predicting Bitcoin’s price with any degree of certainty is inherently challenging due to the cryptocurrency market’s unique characteristics and the multitude of factors influencing its value. The inherent volatility and susceptibility to unforeseen events make long-term predictions a risky endeavor, even for seasoned market analysts. While historical data provides some insights, relying solely on it for future price projections is fundamentally flawed.

The volatility of the cryptocurrency market is a significant hurdle. Bitcoin’s price has historically experienced dramatic swings, often exceeding 10% in a single day. These fluctuations are driven by a complex interplay of factors, including investor sentiment, regulatory announcements, technological developments, and macroeconomic conditions. This inherent instability makes accurate price forecasting extremely difficult, as even small shifts in these factors can have a disproportionate impact on the price. For example, a single negative tweet from a prominent figure can trigger a significant sell-off, while positive news about institutional adoption can rapidly drive the price upwards.

Limitations of Historical Data in Price Prediction

Using past performance as a predictor of future outcomes in the Bitcoin market is fraught with limitations. While historical trends can offer some guidance, the cryptocurrency market is relatively young and has undergone periods of rapid and unprecedented change. Relying solely on historical data ignores the possibility of disruptive events that could drastically alter the market landscape. The 2022 crypto winter, triggered by a combination of factors including rising interest rates, the collapse of TerraUSD, and the FTX bankruptcy, serves as a stark reminder of the market’s unpredictable nature. This period saw Bitcoin’s price plummet significantly, demonstrating the limitations of relying on historical trends alone. Another example is the unforeseen impact of China’s 2021 crackdown on cryptocurrency mining, which significantly affected Bitcoin’s price and demonstrated the vulnerability of the market to regulatory actions.

Challenges in Forecasting Regulatory and Technological Impacts

Accurately predicting the impact of regulatory changes and technological disruptions on Bitcoin’s price is exceptionally challenging. Governments worldwide are still grappling with how to regulate cryptocurrencies, leading to a constantly evolving regulatory landscape. Changes in regulations, even minor ones, can significantly affect investor confidence and trading activity, leading to price volatility. The potential for future regulatory crackdowns or the introduction of supportive legislation remains a significant source of uncertainty. Similarly, technological advancements, such as the development of new cryptocurrencies or improvements in blockchain technology, can drastically reshape the market. The emergence of layer-2 scaling solutions, for example, could significantly improve Bitcoin’s transaction speed and reduce fees, potentially impacting its price. Predicting the adoption rate and overall impact of such innovations is difficult, adding another layer of uncertainty to price forecasting.

Investing in Bitcoin

Investing in Bitcoin presents both significant opportunities and substantial risks. The cryptocurrency’s volatile nature necessitates a well-defined strategy and a thorough understanding of the market dynamics before committing any capital. Successful Bitcoin investment relies heavily on risk management and a realistic assessment of personal financial goals.

Bitcoin Investment Strategies

Different investment approaches cater to varying risk tolerances and time horizons. Choosing the right strategy depends on your individual circumstances and financial goals.

- Long-Term Holding (HODLing): This strategy involves buying Bitcoin and holding it for an extended period, typically years, regardless of short-term price fluctuations. The core belief is that Bitcoin’s value will appreciate significantly over the long run. Rewards include potential high returns, but risks include substantial losses if the market undergoes a prolonged bear market. For example, investors who bought Bitcoin in 2011 and held onto it until 2021 experienced substantial gains, while those who bought near the peak in 2021 and held during the subsequent downturn faced significant losses.

- Short-Term Trading: This involves frequent buying and selling of Bitcoin based on short-term price movements. Traders aim to profit from price fluctuations, often using technical analysis and market timing. While potentially lucrative, short-term trading carries significantly higher risk due to the volatility of Bitcoin’s price. High frequency trading, a more sophisticated form of short-term trading, requires advanced technical skills and significant resources. Successful short-term trading necessitates a deep understanding of market trends and the ability to quickly adapt to changing conditions. Conversely, unsuccessful short-term trading can lead to rapid capital loss.

- Dollar-Cost Averaging (DCA): This strategy involves investing a fixed amount of money at regular intervals, regardless of the price. This mitigates the risk of investing a lump sum at a market peak. DCA reduces the impact of volatility and allows for a more consistent investment approach over time. While it may not maximize returns in a consistently rising market, it significantly reduces the risk of substantial losses.

Risk Management in Bitcoin Investments

Effective risk management is crucial for navigating the volatility inherent in the Bitcoin market. It’s essential to protect your investment and prevent significant losses.

Bitcoin Price Prediction 2025 After Halving – Diversification is a key component of risk management. Instead of allocating all your investment capital to Bitcoin, consider diversifying your portfolio across other asset classes, such as stocks, bonds, or real estate. This helps to reduce overall portfolio risk and mitigate potential losses from Bitcoin’s price fluctuations. A well-diversified portfolio can weather market downturns more effectively.

Setting stop-loss orders is another vital risk management technique. A stop-loss order automatically sells your Bitcoin if the price drops to a predetermined level, limiting potential losses. This helps to prevent substantial losses in a rapidly falling market. The placement of stop-loss orders requires careful consideration, balancing the need to limit losses with the risk of premature selling.

Due Diligence Before Investing in Bitcoin

Before investing in Bitcoin, conducting thorough due diligence is paramount. This involves carefully evaluating the trustworthiness of sources and platforms.

Verify the legitimacy of Bitcoin exchanges and wallets before using them. Research their reputation, security measures, and customer support. Read reviews and check for any red flags. Choosing reputable platforms significantly reduces the risk of fraud or theft. Examples of factors to consider include the exchange’s regulatory compliance, security protocols (like two-factor authentication), and history of successful operations.

Assess the credibility of information sources. Be wary of unsubstantiated claims or overly optimistic predictions. Rely on reputable news outlets, financial analysts, and independent research to form your own informed opinion. Cross-referencing information from multiple sources helps to ensure accuracy and avoid misinformation. For example, consulting reports from established financial institutions, alongside independent cryptocurrency analysis, can provide a more balanced perspective.

Predicting the Bitcoin price in 2025 after the halving is a complex task, influenced by numerous factors. A key element in these predictions is understanding the upcoming halving event itself, and you can find detailed information about that on this helpful resource: Halving Bitcoin 2025. Ultimately, the impact of the 2025 halving on Bitcoin’s price remains a subject of ongoing discussion and analysis within the cryptocurrency community.

Predicting the Bitcoin price in 2025 after the halving is a complex undertaking, heavily influenced by the halving event itself. To understand the potential impact, it’s crucial to know the precise timing; you can find details on the exact date at Bitcoin Halving When 2025. This information is key to any accurate forecast, as the reduced Bitcoin supply post-halving usually affects market dynamics and price predictions.

Therefore, understanding the halving’s timing is a foundational element in analyzing Bitcoin’s future price.

Predicting the Bitcoin price in 2025 after the halving is a complex task, influenced by numerous factors. Understanding the long-term implications requires considering the subsequent halving events, and to help with that, you might find this resource useful: Next Bitcoin Halving After 2025. This information is crucial for formulating a more comprehensive Bitcoin price prediction for 2025, as the impact of reduced supply extends beyond the immediate post-halving period.

Predicting the Bitcoin price in 2025 after the halving is a complex task, heavily influenced by the halving’s impact on supply. To accurately gauge this impact, understanding the timing is crucial; check out this resource to find out When Is The Next Bitcoin Halving 2025 as this date significantly influences price prediction models and market sentiment surrounding Bitcoin’s future value.

Therefore, knowing the exact halving date is paramount for any serious Bitcoin price prediction in 2025.

Predicting the Bitcoin price in 2025 after the halving is a complex task, influenced by numerous factors. A key element to consider is the upcoming reduction in Bitcoin’s reward, which is precisely tracked by the 2025 Bitcoin Halving Countdown. This event historically has led to increased scarcity and, consequently, potential price appreciation. Therefore, understanding the halving’s timing is crucial for any accurate Bitcoin price prediction for 2025.

Predicting the Bitcoin price in 2025 after the halving is a complex task, heavily influenced by the halving’s timing itself. To accurately assess potential price movements, understanding the exact date is crucial; determining this requires knowing when the next halving will occur, which is detailed in this article: When In 2025 Is The Next Bitcoin Halving?.

This date significantly impacts the supply dynamics and, consequently, influences the Bitcoin price prediction for 2025.