Bitcoin Price Prediction

Bitcoin, the pioneering cryptocurrency, has captivated the world with its volatility and potential. Its price has swung wildly since its inception, experiencing periods of explosive growth followed by dramatic corrections. Predicting its future value, especially over a timeframe as long as January 16, 2025, presents a significant challenge. The inherent unpredictability of the market, coupled with the influence of global economic factors and technological advancements, makes any forecast inherently speculative. This article aims to explore some key factors that could potentially influence Bitcoin’s price on that date, providing a framework for understanding the complexities involved in such a prediction.

Bitcoin’s journey has been marked by several pivotal moments. Its early years saw a gradual increase in value, followed by a spectacular surge in 2017, reaching almost $20,000. This was quickly followed by a significant downturn, highlighting the inherent risk associated with this asset class. Subsequent years have seen further periods of growth and correction, demonstrating the volatile nature of the cryptocurrency market. Understanding this history is crucial when attempting to forecast its future.

Factors Influencing Bitcoin’s Price on January 16, 2025

Several factors will likely play a significant role in shaping Bitcoin’s price by January 16, 2025. These include macroeconomic conditions, regulatory developments, technological advancements within the Bitcoin network itself, and the overall sentiment within the cryptocurrency market. Each of these areas presents both opportunities and challenges for Bitcoin’s future valuation.

Macroeconomic Conditions and Their Impact

Global economic conditions will undoubtedly influence Bitcoin’s price. Periods of economic uncertainty, such as inflation or recession, often lead investors to seek alternative assets, potentially driving demand for Bitcoin as a hedge against inflation or a safe haven investment. Conversely, periods of strong economic growth might shift investor focus away from riskier assets like Bitcoin towards more traditional investments. For example, the 2020 economic downturn, partly caused by the COVID-19 pandemic, saw a surge in Bitcoin’s price as investors sought diversification. Conversely, periods of strong economic recovery can sometimes lead to a decline in Bitcoin’s price as investors move towards more traditional assets.

Regulatory Landscape and Its Influence

The regulatory landscape surrounding Bitcoin and cryptocurrencies in general is constantly evolving. Favorable regulations could lead to increased institutional adoption and mainstream acceptance, boosting demand and price. Conversely, stricter regulations or outright bans could significantly impact Bitcoin’s price negatively. The differing approaches of various governments worldwide create uncertainty and volatility. For instance, El Salvador’s adoption of Bitcoin as legal tender dramatically impacted its price, while China’s ban had a considerable opposite effect.

Technological Advancements and Network Upgrades

Technological improvements within the Bitcoin network, such as scaling solutions and increased transaction speeds, could enhance its usability and appeal, potentially driving up demand. Conversely, significant security breaches or vulnerabilities could severely damage investor confidence and negatively impact the price. Examples of such advancements include the Lightning Network, which aims to improve transaction speeds and reduce fees, and ongoing efforts to enhance the security and scalability of the Bitcoin blockchain.

Market Sentiment and Investor Behavior

Overall market sentiment and investor behavior play a crucial role in determining Bitcoin’s price. Periods of widespread optimism and bullish sentiment can lead to price increases, while fear and uncertainty can trigger sell-offs. This is heavily influenced by media coverage, influencer opinions, and broader trends in the financial markets. For example, Elon Musk’s tweets have repeatedly demonstrated the impact of influential figures on market sentiment and Bitcoin’s price.

Analyzing Historical Data and Trends: Bitcoin Price Prediction For 16 January 2025

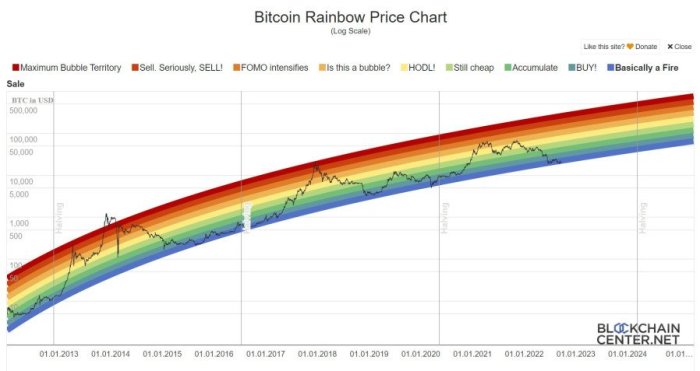

Bitcoin’s price history is characterized by extreme volatility and significant growth periods punctuated by sharp corrections. Understanding these historical trends is crucial for informed speculation and risk assessment. Analyzing this data alongside the performance of traditional assets like gold and stocks provides valuable context for evaluating Bitcoin’s potential future trajectory.

Bitcoin Price History Timeline

Bitcoin’s journey from its inception to the present day reveals a pattern of exponential growth followed by periods of consolidation and correction. The following timeline highlights key milestones and price movements:

- 2009-2010: Early adoption and minimal price action. Bitcoin traded at fractions of a dollar.

- 2011-2013: Increased awareness and adoption led to the first significant price surge, reaching over $1,000.

- 2014-2016: A period of consolidation and price decline, reflecting regulatory uncertainty and market corrections.

- 2017: The year of the “Bitcoin bubble,” with prices reaching nearly $20,000, driven by increased media attention and speculative investment.

- 2018-2019: A significant price correction, falling to below $4,000, reflecting the bursting of the speculative bubble and increased regulatory scrutiny.

- 2020-2021: Another significant price surge, driven by institutional investment and renewed interest in digital assets, reaching an all-time high above $60,000.

- 2022-Present: A period of volatility and price decline, influenced by macroeconomic factors like inflation and interest rate hikes.

Comparison with Gold and Stocks, Bitcoin Price Prediction For 16 January 2025

A comparison of Bitcoin’s performance with traditional assets like gold and major stock indices reveals both similarities and significant differences. While gold often serves as a hedge against inflation, and stocks represent ownership in companies with potential for growth, Bitcoin exhibits unique characteristics.

| Asset Class | Volatility | Inflation Hedge | Growth Potential |

|---|---|---|---|

| Bitcoin | High | Potentially, but unproven | High, but highly volatile |

| Gold | Moderate | Historically strong | Moderate, relatively stable |

| Stocks (S&P 500) | Moderate to High | Mixed results | High, but subject to market cycles |

A chart depicting the price movements of Bitcoin, gold (represented by the gold price), and a major stock index (e.g., the S&P 500) over the past decade would visually demonstrate these differences. The chart would show Bitcoin’s significantly higher volatility compared to gold and stocks, highlighting periods of dramatic price swings not seen in the other asset classes.

Significant Historical Events Impacting Bitcoin Price

Several events have profoundly impacted Bitcoin’s price. For example, the 2017 price surge was fueled by increased media coverage, regulatory uncertainty in some jurisdictions, and the entry of institutional investors. Conversely, the 2018-2019 correction was partly attributed to regulatory crackdowns in certain countries and the bursting of the speculative bubble. The 2020-2021 bull run was driven by institutional adoption, increased acceptance by payment processors, and a flight to alternative assets amidst macroeconomic uncertainty. The recent decline can be linked to increased interest rates globally and a general risk-off sentiment in the market. These events underscore the sensitivity of Bitcoin’s price to both market sentiment and regulatory developments.

Disclaimer and Conclusion

It is crucial to understand that predicting the price of Bitcoin, or any cryptocurrency for that matter, is inherently speculative. The cryptocurrency market is exceptionally volatile and influenced by a multitude of factors, ranging from regulatory changes and technological advancements to broader macroeconomic conditions and public sentiment. Any prediction, including those presented in this analysis, should be considered as a potential outcome based on current trends and historical data, not a guaranteed future event. Investing in Bitcoin carries significant risk, and potential losses could be substantial. This analysis should not be interpreted as financial advice.

This analysis explored potential Bitcoin price scenarios for January 16th, 2025, leveraging historical data and identified trends. Our examination considered factors such as Bitcoin’s adoption rate, technological developments within the cryptocurrency space, and the overall state of the global economy. We analyzed various potential price trajectories, ranging from conservative estimations based on historical volatility to more optimistic projections that consider the potential for widespread adoption and institutional investment. The analysis presented a range of possible outcomes, highlighting the inherent uncertainty involved in predicting the future price of Bitcoin. The key takeaway is that while certain trends suggest potential price movements, the actual price on January 16th, 2025, will depend on a complex interplay of unpredictable events. Investors should conduct thorough research and understand the risks involved before making any investment decisions.

Potential Price Scenarios Summary

Based on our analysis of historical data and current market trends, several potential price scenarios emerged for Bitcoin on January 16th, 2025. A conservative scenario suggests a price range that reflects moderate growth, accounting for potential market corrections and periods of stagnation. This scenario might align with a more cautious outlook on Bitcoin’s future, considering factors such as increased regulatory scrutiny or slower-than-anticipated adoption rates. Conversely, a more optimistic scenario, based on assumptions of widespread adoption and continued technological advancements, projected significantly higher price points. This optimistic scenario considers factors such as the increasing integration of Bitcoin into mainstream financial systems and the potential for large-scale institutional investment. A middle-ground scenario represents a balanced perspective, incorporating elements of both conservative and optimistic projections, providing a more moderate estimate of Bitcoin’s potential value. It’s important to remember that these are just potential scenarios, and the actual price could fall outside of these ranges. The significant volatility inherent in the cryptocurrency market necessitates a comprehensive understanding of the risks involved before making any investment decisions.

Frequently Asked Questions (FAQ)

This section addresses common questions regarding Bitcoin’s price and the broader cryptocurrency market, drawing on the analysis presented earlier. Understanding these factors is crucial for informed decision-making in this volatile investment landscape.

Major Factors Influencing Bitcoin’s Price

Bitcoin’s price is influenced by a complex interplay of factors. Supply and demand dynamics, driven by investor sentiment and market speculation, play a significant role. Regulatory developments, both positive and negative, can significantly impact price volatility. Adoption by businesses and institutions, technological advancements within the Bitcoin network, and macroeconomic conditions, such as inflation and global economic uncertainty, all contribute to price fluctuations. News events, such as major hacks or regulatory announcements, can also trigger dramatic short-term price swings. For example, the 2021 bull run was partly fueled by increased institutional adoption and positive media coverage, while regulatory crackdowns in China have historically led to price drops.

Accuracy of Bitcoin Price Prediction

Accurately predicting Bitcoin’s price is exceptionally challenging, if not impossible. The cryptocurrency market is highly speculative and susceptible to unpredictable events. While historical data and trend analysis can offer insights, they cannot account for unforeseen circumstances such as regulatory changes, technological disruptions, or shifts in investor sentiment. Any prediction should be viewed with extreme caution, and it’s crucial to remember that past performance is not indicative of future results. Consider the numerous price predictions made for Bitcoin over the years, many of which have proven wildly inaccurate. This highlights the inherent uncertainty associated with attempting to forecast its future price.

Risks Associated with Investing in Bitcoin

Investing in Bitcoin carries substantial risks. Price volatility is a primary concern; Bitcoin’s price can fluctuate dramatically in short periods, leading to significant losses. The cryptocurrency market is relatively unregulated in many jurisdictions, increasing the risk of fraud and scams. Security risks, such as hacking and theft from exchanges or personal wallets, are also present. Furthermore, the long-term viability of Bitcoin, and cryptocurrencies in general, remains uncertain. Effective risk management strategies include diversification (avoiding putting all your investment eggs in one basket), thorough research, only investing what you can afford to lose, and utilizing secure storage methods for your Bitcoin holdings.

Alternative Cryptocurrencies

Beyond Bitcoin, a diverse range of cryptocurrencies exist, each with its own characteristics, potential, and risks. Ethereum, for instance, is a platform for decentralized applications (dApps) and smart contracts, offering a different use case than Bitcoin’s primary role as a store of value. However, Ethereum’s price is also highly volatile. Other cryptocurrencies, such as Solana and Cardano, aim to address scalability and transaction speed limitations present in Bitcoin and Ethereum. However, each alternative cryptocurrency carries its own set of risks, including technological vulnerabilities, regulatory uncertainty, and market volatility. It is vital to conduct thorough research before investing in any cryptocurrency beyond Bitcoin.

Bitcoin Price Prediction For 16 January 2025 – Predicting the Bitcoin price for January 16th, 2025, requires considering various factors, including market sentiment and technological advancements. To gain a broader perspective on potential long-term trends, it’s helpful to examine predictions further out; for example, you might find the insights from this analysis of the Bitcoin Price Prediction In December 2025 useful. Ultimately, understanding the predicted price trajectory in December 2025 can inform a more nuanced prediction for January 16th, 2025.

Accurately predicting the Bitcoin price for January 16th, 2025, is challenging, requiring consideration of various market factors. To gain some perspective on potential future trends, examining longer-term forecasts can be helpful, such as those offered by reputable sources like Forbes; for instance, you might find insights in their analysis on Bitcoin Prediction April 2025 Forbes. Ultimately, however, the Bitcoin price on January 16th, 2025 will depend on a confluence of unpredictable events.

Accurately predicting the Bitcoin price for January 16th, 2025, is challenging, requiring analysis of various market factors. Understanding potential price movements later in the year is also crucial; for insights into the broader picture, check out this analysis on Bitcoin Prediction July 2025. This provides context for formulating a more comprehensive prediction for Bitcoin’s value on January 16th, 2025, considering potential market shifts throughout the year.

Predicting the Bitcoin price for January 16th, 2025, is inherently speculative, but various models attempt to forecast its trajectory. One influential perspective comes from analyzing Plan B Bitcoin Prediction 2025 , which offers a different framework for estimating future values. Understanding these different models is crucial for developing a comprehensive Bitcoin price prediction for 16 January 2025, and for considering the inherent uncertainties involved.

Predicting the Bitcoin price for a specific date like January 16th, 2025, is inherently challenging. However, understanding broader market trends is crucial; for a comprehensive overview of potential price movements throughout the year, you might find the 2025 Bitcoin Prediction resource helpful. This broader perspective can inform more nuanced predictions about the Bitcoin price on January 16th, 2025, though it won’t offer a precise figure.

Predicting the Bitcoin price for January 16th, 2025, is inherently speculative, but understanding future market dynamics is key. A significant factor influencing long-term price projections is the Bitcoin halving schedule; to learn more about the halving dates after 2025, check out this resource: Bitcoin Halving Date After 2025. These halvings, reducing the rate of new Bitcoin creation, historically impact price, thus impacting our 2025 prediction significantly.

Predicting the Bitcoin price for January 16th, 2025, is inherently speculative, but various factors influence the forecast. To effectively reach potential investors interested in such predictions, a robust marketing strategy is crucial; consider optimizing your campaign with a well-managed Google Ads Account to target your audience. This will allow for more precise targeting and ultimately, better results when analyzing the Bitcoin Price Prediction For 16 January 2025.