Bitcoin Price Prediction 2030

Bitcoin, the pioneering cryptocurrency, emerged in 2009 with the publication of a whitepaper by the pseudonymous Satoshi Nakamoto. Since then, it has experienced periods of explosive growth and dramatic crashes, establishing itself as a significant asset class, albeit one with considerable volatility. Currently, Bitcoin holds a dominant position in the cryptocurrency market, although its market share has fluctuated over time. Its price is influenced by a complex interplay of factors, making long-term predictions a challenging endeavor.

Bitcoin’s price volatility stems from several interacting elements. These include macroeconomic conditions (like inflation and interest rates), regulatory developments (governmental policies regarding cryptocurrencies), technological advancements (such as the development of layer-2 scaling solutions), and market sentiment (driven by news events, social media trends, and investor psychology). For example, a period of high inflation might drive investors towards Bitcoin as a hedge against inflation, leading to price increases. Conversely, negative regulatory news or a major security breach could trigger a significant price drop. The inherent scarcity of Bitcoin (a fixed supply of 21 million coins) also plays a crucial role in its long-term price potential.

Factors Affecting Bitcoin Price Prediction Accuracy

Accurately predicting the price of Bitcoin in 2030, or any long-term cryptocurrency price, is fraught with challenges. The cryptocurrency market is relatively young and its evolution is shaped by unpredictable technological breakthroughs, regulatory shifts, and changing investor perceptions. Historical price data, while informative, is not a reliable predictor of future performance, especially given the unique characteristics of Bitcoin and the broader crypto landscape. Furthermore, external factors such as global economic downturns, geopolitical events, and even unforeseen technological disruptions can significantly impact the price. For example, the 2022 cryptocurrency market crash, driven by a confluence of factors including rising interest rates and the collapse of TerraUSD, highlights the unpredictable nature of the market. Predictive models, while useful tools, often rely on assumptions that may not hold true in a rapidly evolving environment. Any prediction should therefore be viewed with a healthy dose of skepticism.

Factors Influencing Bitcoin’s Price in 2030

Predicting Bitcoin’s price in 2030 is inherently speculative, but analyzing key influencing factors provides a framework for understanding potential scenarios. Numerous interconnected elements will shape its trajectory, ranging from technological breakthroughs to global economic shifts and regulatory landscapes.

Technological Advancements and Bitcoin’s Value

Technological advancements will significantly impact Bitcoin’s value in 2030. Improvements in scalability solutions, such as the Lightning Network, could dramatically increase transaction speeds and reduce fees, making Bitcoin more practical for everyday use. Layer-2 solutions and advancements in consensus mechanisms might enhance security and efficiency, further boosting its appeal. Conversely, the emergence of superior cryptocurrencies with more advanced functionalities could potentially diminish Bitcoin’s dominance. For example, a hypothetical blockchain technology offering significantly faster transaction speeds and lower energy consumption could draw investment away from Bitcoin. The success of Bitcoin will depend, in part, on its ability to adapt and innovate to stay competitive within the evolving crypto landscape.

Regulation and Government Policies on Bitcoin’s Price

Government policies and regulations will play a crucial role in shaping Bitcoin’s price trajectory. Favorable regulatory frameworks, such as clear guidelines for taxation and legal recognition of Bitcoin as a legitimate asset class, could encourage widespread adoption and drive price increases. Conversely, restrictive regulations, including outright bans or excessive taxation, could stifle growth and suppress prices. The example of China’s crackdown on cryptocurrency mining in 2021 illustrates the potential for significant negative impact. A similar scenario on a global scale could severely depress Bitcoin’s value. Conversely, a globally coordinated approach to regulation that fosters innovation while mitigating risks could create a more stable and predictable market environment, potentially leading to price appreciation.

Macroeconomic Factors and Bitcoin’s Price

Macroeconomic conditions will significantly influence Bitcoin’s price. Periods of high inflation could drive investors towards Bitcoin as a hedge against currency devaluation, potentially increasing demand and price. Conversely, during economic recessions, investors might liquidate their Bitcoin holdings to cover losses in other asset classes, leading to price drops. The 2022 cryptocurrency market downturn, coinciding with rising inflation and interest rates, serves as a recent example of this correlation. Similarly, geopolitical instability or major global events could trigger significant volatility in Bitcoin’s price, regardless of underlying technological factors. Economic uncertainty often leads to a flight to safety, potentially driving investment into established assets rather than riskier cryptocurrencies.

Widespread Adoption versus Limited Adoption

The level of Bitcoin adoption will have a profound impact on its price. Widespread adoption, involving its integration into mainstream financial systems and everyday transactions, could lead to significant price appreciation driven by increased demand and scarcity. This scenario mirrors the historical growth of the internet and the subsequent rise in the value of internet-related companies. Conversely, limited adoption, confined to a niche community of investors and enthusiasts, would likely constrain price growth and potentially lead to greater price volatility. A limited adoption scenario might resemble the current market capitalization of less popular cryptocurrencies, with limited price growth and high volatility.

Hypothetical Bullish Bitcoin Market in 2030

In a bullish scenario, several factors could converge to drive Bitcoin’s price significantly higher. Imagine a future where major corporations and institutions widely adopt Bitcoin for payments and treasury management, coupled with supportive regulatory frameworks globally. Increased institutional investment, combined with the maturation of the Lightning Network and other scalability solutions, could result in mass adoption, making Bitcoin a common form of digital currency. This could drive the price to, for example, $500,000 or more per Bitcoin, fueled by scarcity and high demand.

Hypothetical Bearish Bitcoin Market in 2030, Bitcoin Price Target 2030

Conversely, a bearish scenario could involve a combination of unfavorable regulatory crackdowns, technological setbacks, and macroeconomic instability. Imagine a world where governments globally implement restrictive regulations, effectively stifling Bitcoin’s growth and discouraging adoption. Simultaneously, a new, superior cryptocurrency emerges, surpassing Bitcoin in terms of scalability, security, and efficiency, leading to a significant shift in market share. Coupled with a prolonged global recession, this scenario could drive Bitcoin’s price significantly lower, potentially below its current value.

Different Price Prediction Models

Predicting the price of Bitcoin in 2030, or any future date, is inherently speculative. Numerous methodologies exist, each with its strengths and weaknesses, and none offer guaranteed accuracy. Understanding these different approaches is crucial for interpreting various predictions and forming your own informed opinion. This section will explore some common models, their assumptions, and limitations.

Predicting Bitcoin’s future price involves analyzing both historical trends and projecting future market conditions. These predictions are often influenced by technological advancements, regulatory changes, and overall market sentiment. The accuracy of any prediction hinges on the reliability of the underlying assumptions and the model’s ability to capture complex market dynamics.

Technical Analysis

Technical analysis focuses on historical price and volume data to identify patterns and predict future price movements. This approach utilizes various indicators such as moving averages, relative strength index (RSI), and candlestick patterns to spot trends, support and resistance levels, and potential reversal points. For example, a strong upward trend, coupled with high trading volume, might suggest continued price appreciation. However, technical analysis is inherently backward-looking and doesn’t account for unforeseen events or fundamental changes in the market. Past performance is not indicative of future results.

Fundamental Analysis

Fundamental analysis assesses the intrinsic value of Bitcoin based on underlying factors like adoption rate, network security, regulatory landscape, and technological developments. This approach aims to determine whether the current price accurately reflects the asset’s true worth. For instance, widespread institutional adoption and improvements to the Lightning Network could positively influence Bitcoin’s value. Conversely, a significant regulatory crackdown could negatively impact its price. The limitation of fundamental analysis lies in the difficulty of quantifying these factors and accurately predicting their future impact. It’s also susceptible to subjective interpretations and biases.

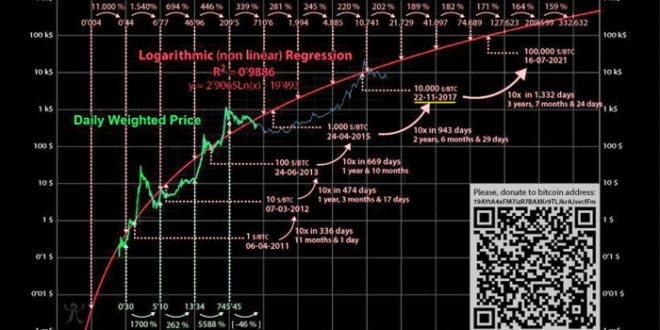

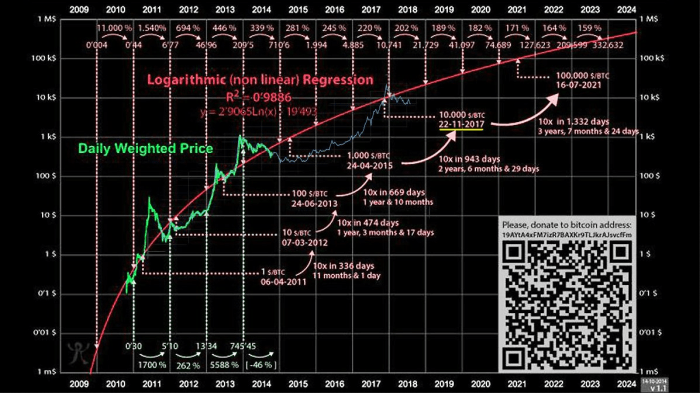

Past Bitcoin Price Predictions and Their Accuracy

Numerous predictions about Bitcoin’s price have been made over the years, with varying degrees of accuracy. For instance, some early predictions significantly underestimated Bitcoin’s growth, while others have been wildly optimistic and far off the mark. Many predictions made in 2017, during the peak of the last bull market, proved drastically inaccurate due to the subsequent market correction. The inherent volatility of Bitcoin and the influence of unpredictable external factors make accurate long-term predictions extremely challenging.

Limitations of Prediction Models

All price prediction models are inherently limited. They rely on assumptions about future events that are often uncertain or impossible to predict with precision. External factors, such as macroeconomic conditions, geopolitical events, and regulatory changes, can significantly impact Bitcoin’s price, often in unpredictable ways. Furthermore, the inherent volatility of the cryptocurrency market makes it difficult to accurately model price movements. Finally, biases in data selection and model construction can lead to inaccurate or misleading predictions.

Comparison of Price Prediction Models

| Model Type | Assumptions | Potential Outcomes | Limitations |

|---|---|---|---|

| Technical Analysis | Past price and volume data reveal predictable patterns. | Price targets based on chart patterns and indicators. | Backward-looking; ignores fundamental factors; susceptible to manipulation. |

| Fundamental Analysis | Intrinsic value is determined by underlying factors like adoption, network security, and regulation. | Price targets based on assessment of long-term value. | Difficult to quantify factors; susceptible to subjective interpretations; slow to reflect market changes. |

| Statistical Modeling (e.g., ARIMA) | Price follows a time series pattern that can be statistically modeled. | Probabilistic price forecasts. | Requires large datasets; assumptions about stationarity may not hold; sensitive to outliers. |

| Machine Learning | Complex relationships between various factors can be learned from historical data. | Price predictions based on complex algorithms. | Requires large, high-quality datasets; can be computationally expensive; prone to overfitting. |

Potential Bitcoin Price Targets for 2030

Predicting the price of Bitcoin in 2030 is inherently speculative, given the volatile nature of the cryptocurrency market and the numerous unpredictable factors at play. However, by analyzing various prediction models and considering key influencing factors, we can establish a range of potential price targets, understanding that these are estimations and not guarantees. These estimations rely on extrapolating current trends and incorporating assumptions about future adoption, regulatory changes, and technological advancements.

Several models exist for predicting Bitcoin’s future price. These range from simple extrapolations of past price movements to complex models that incorporate macroeconomic indicators, network adoption rates, and technological developments. The accuracy of each model is debatable, and the resulting price targets should be viewed with a healthy dose of skepticism. The inherent uncertainty in predicting future events necessitates a range of potential outcomes, rather than a single definitive prediction.

Price Target Ranges Based on Different Models

Different prediction models yield significantly varying price targets for Bitcoin in 2030. Simple extrapolation of historical price trends, while providing a baseline, often fails to account for unforeseen events. More sophisticated models, incorporating factors like network growth and market capitalization, generally produce higher price targets. For example, a model based solely on historical price appreciation might predict a price in the tens of thousands of dollars, while a model incorporating network effects and increasing institutional adoption might predict a price in the hundreds of thousands, or even millions of dollars. It’s important to note that these models rely on various assumptions, and their accuracy is limited.

Rationale Behind Price Target Variations

The wide range in price predictions stems from the different assumptions made by each model. Models focusing primarily on past price performance tend to yield lower price targets, often in the range of $100,000 to $250,000. These models often underestimate the potential impact of increased adoption, technological advancements (like the Lightning Network improving scalability), and positive regulatory developments. Conversely, models that incorporate these factors project significantly higher prices, potentially exceeding $1 million or even more. The uncertainty around regulatory clarity, the level of institutional adoption, and the overall macroeconomic environment significantly impacts these predictions.

Sensitivity Analysis of Price Predictions

A sensitivity analysis reveals how changes in key factors influence the predicted Bitcoin price. For instance, increased regulatory clarity leading to greater institutional investment could dramatically boost the price. Conversely, a major security breach or significant negative regulatory intervention could severely depress the price. Similarly, the rate of Bitcoin adoption among individuals and businesses plays a critical role. Higher adoption rates typically translate to higher prices, while slower adoption could lead to lower price targets. The analysis should also consider technological advancements that may improve Bitcoin’s efficiency and scalability, potentially leading to increased adoption and higher prices. A model that assumes widespread adoption of the Lightning Network, for example, would likely project a much higher price than one that assumes continued scalability challenges. Finally, macroeconomic factors such as inflation and the performance of traditional asset classes also play a crucial role, and unexpected shifts in these factors can significantly alter the predicted price. Therefore, the potential price range should be interpreted as a reflection of these various uncertainties and sensitivities.

Risks and Uncertainties

Predicting Bitcoin’s price in 2030, or any future date, inherently involves significant risks and uncertainties. Numerous factors, both predictable and unpredictable, can drastically alter the trajectory of its price. While various models attempt to forecast future value, it’s crucial to acknowledge the limitations and potential for substantial deviation from any projected figure.

The inherent volatility of the cryptocurrency market makes accurate long-term predictions extremely challenging. Unforeseen events, technological advancements, regulatory shifts, and even coordinated market manipulation can significantly impact Bitcoin’s price, potentially rendering even the most sophisticated models inaccurate. Considering these uncertainties is paramount for anyone assessing the potential risks associated with Bitcoin investments.

Technological Advancements and Disruptions

Technological breakthroughs, both within and outside the cryptocurrency space, pose significant uncertainties. For example, the development of a superior blockchain technology could render Bitcoin obsolete, causing a dramatic price drop. Conversely, innovations improving Bitcoin’s scalability and transaction speed could drive its price upwards. The emergence of quantum computing also presents a potential risk, as its processing power could theoretically compromise Bitcoin’s cryptographic security. A successful attack on the Bitcoin network, though unlikely given current technology, could have catastrophic consequences for its price. The development of more energy-efficient mining techniques could also alter the economic dynamics of Bitcoin, potentially influencing its price.

Regulatory Changes and Legal Challenges

Government regulations play a crucial role in shaping the cryptocurrency landscape. Stringent regulations could stifle Bitcoin adoption and negatively impact its price, while favorable regulatory frameworks could boost its value. Different jurisdictions have adopted varying approaches, creating uncertainty and potential for regulatory arbitrage. A sudden crackdown on cryptocurrency trading in major markets, or the imposition of heavy taxes, could lead to significant price volatility. Conversely, widespread regulatory clarity and acceptance could contribute to price stability and growth. The legal battles surrounding Bitcoin’s classification as a security, commodity, or currency also introduce uncertainty into the equation. A court ruling deeming Bitcoin a security, for example, could significantly alter its market dynamics.

Market Manipulation and Security Breaches

The decentralized nature of Bitcoin doesn’t eliminate the risk of market manipulation. Large-scale coordinated trading activities, “whale” manipulations, or even sophisticated hacking attempts could artificially inflate or deflate the price. The history of cryptocurrency markets shows instances of significant price swings driven by such activities. Security breaches affecting major exchanges or wallets could erode investor confidence, leading to price drops. A significant security flaw in the Bitcoin protocol itself, though unlikely, would have devastating consequences. The potential for insider trading and other forms of market abuse also contributes to the uncertainty surrounding Bitcoin’s price.

Black Swan Events

Several “black swan” events – highly improbable but potentially impactful occurrences – could significantly affect Bitcoin’s price. These include: a major global financial crisis triggering a flight to safety (potentially benefiting Bitcoin), a large-scale adoption by institutional investors (driving up demand), or a significant technological advancement rendering Bitcoin obsolete. Conversely, a successful attack compromising the Bitcoin blockchain, a major regulatory crackdown across multiple jurisdictions, or a complete loss of public confidence could lead to a catastrophic price collapse. These scenarios are unlikely, but their potential impact underscores the inherent risk in long-term Bitcoin price predictions.

Investment Strategies and Considerations

Investing in Bitcoin, like any other asset class, requires a thoughtful approach that aligns with individual risk tolerance and financial goals. Understanding different investment strategies and the inherent risks is crucial for making informed decisions. This section Artikels various strategies and emphasizes the importance of diversification and risk management within a cryptocurrency portfolio.

Bitcoin Investment Strategies Based on Risk Tolerance

Investors can adopt several strategies depending on their risk appetite. Conservative investors might opt for dollar-cost averaging (DCA), a strategy that involves investing a fixed amount of money at regular intervals, regardless of price fluctuations. This mitigates the risk of investing a large sum at a market peak. Moderate risk-tolerant investors could consider a more active approach, buying when the market dips and selling when it rises, requiring more market analysis and timing skills. Aggressive investors might leverage trading on margin, a high-risk strategy involving borrowing funds to amplify potential returns, but also significantly increasing potential losses. It’s important to note that no strategy guarantees profit, and each carries a different level of risk. For instance, a conservative DCA strategy may yield lower returns but protects against significant losses compared to a highly leveraged trading approach.

Diversification in a Cryptocurrency Portfolio

Diversification is a cornerstone of sound investment strategy. Concentrating solely on Bitcoin exposes investors to significant risk, as the cryptocurrency market is volatile and influenced by various factors. A diversified portfolio includes investments in different cryptocurrencies with varying market capitalizations and use cases. For example, an investor might allocate a portion of their portfolio to Bitcoin, Ethereum (a platform for decentralized applications), and Solana (a high-performance blockchain), aiming for a balance between established and emerging cryptocurrencies. This reduces the impact of a single cryptocurrency’s price decline on the overall portfolio value. Diversification does not eliminate risk but aims to mitigate it by spreading investments across different assets that are not perfectly correlated.

Risks Associated with Bitcoin and Cryptocurrency Investments

Investing in Bitcoin and other cryptocurrencies involves substantial risks. Market volatility is a primary concern, with prices experiencing significant fluctuations in short periods. Regulatory uncertainty poses another risk, as governments worldwide are still developing frameworks for regulating cryptocurrencies. Security risks, such as hacking and theft from exchanges or personal wallets, are also significant. Furthermore, the decentralized nature of cryptocurrencies makes it difficult to resolve disputes or recover losses in case of fraud. Technological advancements could also render certain cryptocurrencies obsolete, impacting their value. It is crucial to understand these risks before investing and to only invest funds that one can afford to lose. For example, the collapse of FTX, a major cryptocurrency exchange, in 2022 highlighted the significant risks associated with centralized exchanges and the importance of careful due diligence before entrusting funds to any platform.

Bitcoin’s Role in the Future of Finance

Bitcoin’s emergence has challenged the established financial order, prompting discussions about its potential to reshape the future of finance. Its decentralized nature, coupled with its cryptographic security, offers a compelling alternative to traditional systems, potentially fostering greater financial inclusion and transparency. However, its volatility and regulatory uncertainties present significant hurdles to widespread adoption.

Bitcoin’s disruptive potential stems from its ability to bypass intermediaries, reducing transaction costs and increasing efficiency. This directly challenges the established banking system and payment processors, which traditionally control and profit from these processes. The inherent transparency of the blockchain also promises to increase accountability and reduce fraud.

Bitcoin’s Role in Decentralized Finance (DeFi)

Bitcoin, while not a DeFi protocol itself, acts as a foundational asset within the broader DeFi ecosystem. Its scarcity and established market capitalization make it a valuable collateral asset for various DeFi applications, such as lending platforms and decentralized exchanges. For example, users can lock up Bitcoin as collateral to borrow other cryptocurrencies or stablecoins, accessing liquidity without relying on traditional financial institutions. This demonstrates how Bitcoin’s inherent value underpins a growing landscape of decentralized financial services.

Potential Benefits of Widespread Bitcoin Adoption

Widespread Bitcoin adoption could bring several benefits. Increased financial inclusion is a key potential advantage, as Bitcoin can be accessed by individuals without traditional banking access, particularly in underserved regions. Furthermore, reduced transaction fees and faster processing times could lead to significant cost savings for businesses and individuals alike. The increased transparency of transactions could also aid in combating financial crime. Consider, for example, the potential for faster and cheaper cross-border payments, removing reliance on slow and expensive international banking systems.

Potential Drawbacks of Widespread Bitcoin Adoption

Despite its potential benefits, widespread Bitcoin adoption also presents challenges. The volatility of Bitcoin’s price poses a significant risk to its use as a medium of exchange. Its energy consumption is another major concern, prompting ongoing research into more sustainable mining methods. Furthermore, the regulatory landscape surrounding Bitcoin remains uncertain, varying significantly across different jurisdictions. This regulatory uncertainty could hinder its widespread adoption and create a fragmented market. The potential for Bitcoin to be used for illicit activities, such as money laundering, also remains a significant concern that requires ongoing monitoring and mitigation strategies.

Frequently Asked Questions (FAQs): Bitcoin Price Target 2030

This section addresses common queries regarding Bitcoin’s price trajectory and investment considerations. Understanding these factors is crucial for informed decision-making in the volatile cryptocurrency market.

Main Factors Driving Bitcoin’s Price Upward in 2030

Several interconnected factors could contribute to a potential increase in Bitcoin’s price by 2030. Increased adoption by institutional investors, coupled with growing mainstream acceptance and regulatory clarity, could significantly boost demand. Technological advancements, such as the scaling solutions improving transaction speeds and reducing fees, would enhance Bitcoin’s usability and attractiveness. Furthermore, a growing scarcity of Bitcoin, as the maximum supply of 21 million coins is approached, could drive up its value due to basic economic principles of supply and demand. Geopolitical instability and inflation in traditional fiat currencies could also increase the appeal of Bitcoin as a store of value and a hedge against economic uncertainty. Finally, the development and maturation of the Bitcoin ecosystem, including decentralized finance (DeFi) applications built on the Bitcoin blockchain, could broaden its utility and attract new users and investors. For example, the increasing integration of Bitcoin into payment systems of major companies or countries would signal increased confidence and drive demand.

Potential Downsides of Investing in Bitcoin

Investing in Bitcoin carries significant risks. Its price volatility is notorious, with substantial price swings occurring frequently. This inherent volatility makes it a high-risk investment, potentially leading to substantial losses. Regulatory uncertainty remains a concern, as governments worldwide grapple with how to regulate cryptocurrencies. Changes in regulatory frameworks could negatively impact Bitcoin’s price and accessibility. Furthermore, Bitcoin’s security, while generally robust, is not impervious to hacking or theft. Exchange hacks or individual wallet compromises can result in significant losses for investors. Lastly, the underlying technology of Bitcoin is complex and constantly evolving, making it challenging for some investors to fully understand the risks involved. The lack of intrinsic value, unlike traditional assets, adds to the uncertainty. Consider, for instance, the collapse of several cryptocurrency exchanges in the past, highlighting the risk of counterparty failure.

Reliability of Bitcoin Price Predictions

Bitcoin price predictions are inherently unreliable. The cryptocurrency market is influenced by a multitude of factors, many of which are unpredictable, including technological advancements, regulatory changes, market sentiment, and macroeconomic conditions. Predictions often rely on complex mathematical models or extrapolations of past trends, which may not accurately reflect future market behavior. While some models may offer plausible scenarios, they should not be considered guarantees. Many predictions, especially those making bold claims of specific price targets, should be viewed with considerable skepticism. It’s crucial to remember that past performance is not indicative of future results. For example, predictions made in 2017 about Bitcoin reaching $100,000 proved wildly inaccurate, demonstrating the limitations of forecasting in this volatile market.

Difference Between Technical and Fundamental Analysis in Predicting Bitcoin’s Price

Technical analysis focuses on historical price and volume data to identify patterns and trends that might predict future price movements. It uses charts, indicators, and other tools to analyze market sentiment and momentum. Fundamental analysis, on the other hand, examines the underlying factors that influence Bitcoin’s value, such as adoption rates, technological advancements, regulatory changes, and macroeconomic conditions. Technical analysts might look at moving averages or candlestick patterns to predict short-term price fluctuations, while fundamental analysts might assess the long-term prospects of Bitcoin based on its technological innovation and growing adoption. Both approaches have limitations; technical analysis can be prone to self-fulfilling prophecies, while fundamental analysis struggles to account for unpredictable events. A combination of both approaches, however, can provide a more comprehensive perspective, though it doesn’t guarantee accurate predictions.

Illustrative Examples

To better understand the potential price trajectories and market capitalization of Bitcoin in 2030, let’s visualize two possible scenarios. These scenarios are not predictions but rather illustrative examples based on different assumptions about adoption, regulation, and technological advancements. Remember that these are hypothetical and should not be taken as financial advice.

Bitcoin Price Trajectory Scenario

This graph depicts a possible Bitcoin price trajectory from 2024 to 2030. The x-axis represents the year, and the y-axis represents the Bitcoin price in USD. The line starts at approximately $30,000 in 2024, reflecting a plausible starting point. It then shows a period of moderate growth until 2026, followed by a steeper incline driven by increased institutional adoption and positive regulatory developments. Around 2028, the line plateaus slightly, reflecting a potential market correction. However, the overall trend remains upward, culminating in a price of approximately $250,000 by the end of 2030. The visual cues include a smooth, generally upward-sloping line with minor fluctuations representing market corrections, showcasing a bullish but realistic long-term growth pattern. Data points would be included to mark the price at the beginning and end of each year, along with key inflection points like the 2028 plateau. The visual representation emphasizes the long-term growth potential while acknowledging the inherent volatility of the cryptocurrency market.

Bitcoin Market Capitalization Scenario

This chart illustrates a possible Bitcoin market capitalization trajectory from 2024 to 2030. The x-axis again represents the year, while the y-axis represents the market capitalization in trillions of USD. The chart starts at approximately $600 billion in 2024, reflecting a realistic market cap at that time. The line shows a consistent upward trend, accelerating slightly after 2026, reflecting increased adoption and growing investor confidence. By 2030, the market capitalization reaches approximately $10 trillion. The visual cues include a steadily rising line, illustrating exponential growth. Key data points would mark the market cap at the beginning and end of each year, emphasizing the significant growth over the period. The visual representation is intended to highlight the potential for Bitcoin’s market capitalization to increase substantially over the next several years, comparable to the growth of established asset classes like gold. This growth is predicated on increasing mainstream adoption and institutional investment.

Bitcoin Price Target 2030 – Predicting the Bitcoin price target for 2030 involves considering numerous factors, including technological advancements and regulatory changes. Understanding the potential trajectory of altcoins can also offer insights; for example, exploring predictions for other cryptocurrencies like Bitcoin Gold is helpful, such as those found in this analysis: Bitcoin Gold Price Prediction 2025. Ultimately, these analyses contribute to a more comprehensive understanding when forming a Bitcoin price target for 2030.

Predicting the Bitcoin price target for 2030 is challenging, requiring consideration of numerous factors influencing its value. A key element in such forecasting involves understanding the broader cryptocurrency market trends in the lead-up to that year. For insights into potential market movements before 2030, refer to this informative piece on Cryptocurrency Price In 2025 , which can provide valuable context for long-term Bitcoin price projections.

Ultimately, the Bitcoin price target in 2030 will depend on various technological, regulatory, and economic developments.

Predicting the Bitcoin price target for 2030 involves considerable uncertainty, relying heavily on various factors influencing market trends. To gain a clearer perspective on shorter-term market behavior, understanding current predictions is crucial; for example, checking out this resource on Crypto Price Prediction Today 2025 can offer valuable insights. Ultimately, these shorter-term analyses can inform, but not definitively predict, the long-term Bitcoin price target in 2030.

Predicting the Bitcoin price target for 2030 is a complex undertaking, relying heavily on numerous factors and speculative models. A key component in any such projection involves understanding intermediate milestones, such as the anticipated value in 2025. To gain insight into this crucial stepping stone, it’s helpful to consult resources focusing on the Bitcoin Price 2025 Usd, like this analysis: Bitcoin Price 2025 Usd.

Ultimately, the 2025 price will significantly influence any realistic 2030 Bitcoin price target forecast.

Predicting the Bitcoin price target for 2030 is a complex endeavor, requiring consideration of numerous factors. A useful starting point, however, might be to analyze shorter-term predictions; for example, checking out the discussions on Bitcoin Prediction 2025 Reddit can offer insights into potential market trends that could influence the longer-term trajectory. Ultimately, extrapolating from these shorter-term analyses can help inform a more comprehensive Bitcoin Price Target 2030 projection.