Bitcoin Target Price Predictions for 2025

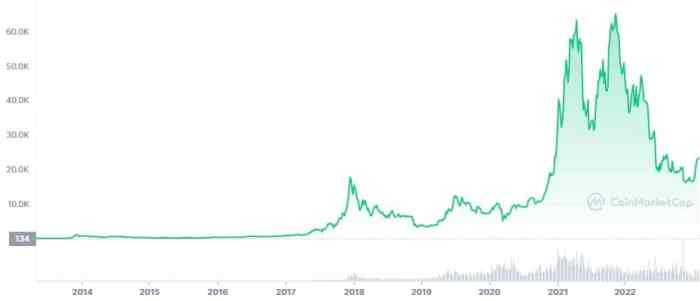

Predicting Bitcoin’s price in 2025 is inherently speculative, given the cryptocurrency’s volatility and susceptibility to various market forces. However, by analyzing historical trends, considering potential future events, and employing different forecasting models, we can establish a range of plausible price targets. This analysis will explore bullish, bearish, and neutral scenarios, highlighting the key factors driving these predictions.

Price Target Ranges for Bitcoin in 2025

Several factors contribute to the uncertainty surrounding Bitcoin’s price in 2025. These include regulatory developments, widespread adoption, macroeconomic conditions, and technological advancements. Considering these variables, we can Artikel a range of potential price targets. A bullish scenario could see Bitcoin reaching prices upwards of $200,000, driven by significant institutional adoption and positive regulatory developments. Conversely, a bearish scenario might see prices fall to as low as $30,000, influenced by adverse macroeconomic conditions or increased regulatory pressure. A neutral scenario would place Bitcoin somewhere in the middle, perhaps around $80,000-$100,000, reflecting a continuation of current market trends with moderate growth. These figures are illustrative and should not be interpreted as financial advice.

Factors Influencing Bitcoin’s Price in 2025

Numerous factors will significantly influence Bitcoin’s price trajectory in 2025. Regulatory clarity in major economies will play a crucial role; clear and favorable regulations could boost investor confidence and drive adoption, while stringent or unclear rules could stifle growth. The rate of adoption by both individuals and institutions will also be critical. Increased institutional investment, particularly from large financial firms, could significantly increase demand and drive prices higher. Conversely, decreased retail investor interest could lead to lower prices. Macroeconomic factors, such as inflation, interest rates, and global economic growth, will also impact Bitcoin’s price. Periods of high inflation might increase Bitcoin’s appeal as a hedge against inflation, while economic downturns could lead to investors selling their holdings to meet immediate needs.

Comparison of Bitcoin Price Prediction Models

Various models exist for predicting Bitcoin’s future value. These include technical analysis, which uses historical price charts and trading volume to identify patterns and predict future price movements; fundamental analysis, which assesses the underlying value of Bitcoin based on factors like adoption rate, network security, and scarcity; and quantitative models, which use statistical methods and machine learning algorithms to analyze large datasets and forecast future prices. Each model has its limitations and strengths. Technical analysis is subjective and prone to interpretation bias, while fundamental analysis can be challenging to quantify accurately. Quantitative models, while potentially more objective, are still dependent on the quality and completeness of the data used. No single model consistently provides accurate predictions, highlighting the inherent uncertainty in forecasting Bitcoin’s price. For example, a simple model extrapolating past growth rates would be highly inaccurate due to Bitcoin’s volatile nature and unpredictable events.

Impact of Technological Advancements on Bitcoin’s Price

Technological advancements could significantly influence Bitcoin’s price. Layer-2 scaling solutions, such as the Lightning Network, aim to improve transaction speed and reduce fees, potentially increasing Bitcoin’s usability and appeal for everyday transactions. This increased efficiency could drive adoption and, consequently, price appreciation. Furthermore, continued institutional adoption, facilitated by improved custody solutions and regulatory clarity, could significantly increase demand and push prices higher. Conversely, the emergence of competing cryptocurrencies with superior technology or features could negatively impact Bitcoin’s price. The development and adoption of quantum-resistant cryptography is also crucial for Bitcoin’s long-term viability and could influence investor sentiment and price. For example, the successful implementation of the Lightning Network has already demonstrated the potential for increased scalability and reduced transaction costs, leading to increased Bitcoin usage.

Factors Affecting Bitcoin’s Trajectory to 2025

Predicting Bitcoin’s price is inherently complex, influenced by a confluence of macroeconomic conditions, regulatory landscapes, and technological advancements. Understanding these interacting factors is crucial for navigating the potential volatility and opportunities presented by this evolving asset. This section delves into the key drivers shaping Bitcoin’s trajectory towards 2025.

Macroeconomic Factors and Bitcoin’s Price

Macroeconomic conditions significantly impact Bitcoin’s price. High inflation, for example, can drive investors towards Bitcoin as a hedge against currency devaluation. Conversely, rising interest rates can make holding Bitcoin less attractive compared to higher-yielding assets. Strong global economic growth might lead to increased risk appetite, potentially boosting Bitcoin’s price, while a recession could trigger a flight to safety, potentially reducing demand for riskier assets like Bitcoin. The interplay between these factors creates a dynamic and unpredictable environment. For instance, the 2022 inflation surge saw a temporary increase in Bitcoin’s price as investors sought inflation hedges, but subsequent interest rate hikes by central banks dampened this effect.

Regulatory Hurdles and Market Impact

Regulatory uncertainty remains a significant headwind for Bitcoin’s widespread adoption. Varying regulatory approaches across different jurisdictions create challenges for both investors and businesses. Clear, consistent, and globally harmonized regulations could foster greater confidence and attract more institutional investment. Conversely, stringent regulations or outright bans in major economies could significantly curb Bitcoin’s growth. The recent crackdown on cryptocurrency exchanges in certain countries serves as a stark reminder of the potential impact of regulatory actions. This highlights the importance of navigating the evolving regulatory landscape.

Institutional Investment and Adoption

The growing involvement of institutional investors is a key factor shaping Bitcoin’s future. Large financial institutions, corporations, and pension funds are increasingly allocating a portion of their portfolios to Bitcoin, contributing to increased market stability and liquidity. This institutional adoption legitimizes Bitcoin as an asset class, attracting further investment and driving price appreciation. However, the extent of future institutional adoption remains uncertain and dependent on factors such as regulatory clarity and market volatility. Examples of institutional investment include MicroStrategy’s substantial Bitcoin holdings and Tesla’s previous foray into Bitcoin.

Bitcoin Halving Events and Price

Bitcoin’s halving events, which occur approximately every four years, reduce the rate at which new Bitcoins are mined. This reduction in supply is often associated with a subsequent price increase, as the scarcity of Bitcoin becomes more pronounced. Historically, Bitcoin’s price has seen significant rallies following halving events. However, the impact of halving events is not solely determined by the reduced supply; other macroeconomic and market factors also play a significant role. The next halving is expected in 2024, and its impact on Bitcoin’s price in 2025 will depend on the prevailing market conditions.

Impact of Macroeconomic Factors on Bitcoin’s Price

| Factor | Impact | Explanation | Potential Mitigation Strategies |

|---|---|---|---|

| Inflation | Bullish | High inflation can drive investors to Bitcoin as a hedge against currency devaluation. | Diversification of investments, hedging strategies. |

| Interest Rates | Bearish | Rising interest rates make holding Bitcoin less attractive compared to higher-yielding assets. | Focus on long-term investment strategies, understanding risk tolerance. |

| Global Economic Growth | Bullish (generally) | Strong growth often increases risk appetite, boosting demand for Bitcoin. | Careful risk management during periods of economic uncertainty. |

| Recession | Bearish (generally) | Recessions can trigger a flight to safety, reducing demand for riskier assets like Bitcoin. | Diversification, holding stable assets alongside Bitcoin. |

Bitcoin’s Technological Developments and Their Impact

Bitcoin’s ongoing technological evolution is crucial for its long-term viability and price appreciation. Improvements in scalability, security, and functionality directly impact transaction costs, user experience, and overall network resilience, all of which influence investor confidence and market valuation. The following sections detail key advancements and their potential consequences.

Layer-2 Scaling Solutions and Their Impact on Transaction Speed and Fees

Layer-2 scaling solutions address Bitcoin’s inherent limitations in processing a high volume of transactions on its base layer. These solutions, such as the Lightning Network (discussed in more detail below), operate on top of the main Bitcoin blockchain, handling transactions off-chain before settling them on the main chain. This significantly reduces congestion and lowers transaction fees. For example, while Bitcoin transactions on the main chain can take minutes to confirm and incur substantial fees during periods of high network activity, Layer-2 solutions can achieve near-instantaneous transactions with minimal fees, making Bitcoin more practical for everyday use. The widespread adoption of efficient Layer-2 solutions is expected to significantly improve Bitcoin’s scalability and accessibility, potentially driving price appreciation as it becomes more suitable for microtransactions and everyday commerce.

The Lightning Network’s Role in Improving Bitcoin’s Scalability and Usability

The Lightning Network is a prime example of a Layer-2 scaling solution. It utilizes a network of micropayment channels between users, enabling off-chain transactions. These channels allow for near-instantaneous and low-cost transactions, significantly enhancing Bitcoin’s usability. Imagine a scenario where you could easily use Bitcoin for everyday purchases, such as coffee or groceries, without facing high fees or lengthy confirmation times. The Lightning Network makes this a reality. As the Lightning Network matures and adoption grows, Bitcoin’s transactional capacity increases dramatically, fostering greater adoption and potentially driving price growth. The increased usability and lower transaction costs make Bitcoin a more competitive payment option.

The Potential of Taproot and Future Upgrades on Security and Functionality

The Taproot upgrade, implemented in late 2021, significantly improved Bitcoin’s privacy and efficiency. It streamlined transaction scripts, making them smaller and more efficient, thus reducing transaction fees and improving privacy. This upgrade represents a step towards enhancing Bitcoin’s overall functionality and security. Future upgrades, while still under development or in the proposal stage, are expected to further enhance these aspects, potentially introducing features such as improved privacy mechanisms or more sophisticated smart contract capabilities. These advancements reinforce Bitcoin’s long-term security and adaptability, contributing to a more robust and resilient network, which in turn, can positively impact its price.

Visual Representation of Bitcoin’s Technological Evolution and Price Impact

“`

Bitcoin Technological Evolution & Price Impact

Year | Technology Advancement | Impact on Price |

—————————————————————————————

2009 | Bitcoin Genesis Block | Initial Price: ~$0, Gradual Growth |

2010-2012 | Early Adoption, Limited Scalability | Moderate Price Fluctuations, Increasing Awareness |

2013-2017 | Growing Adoption, Scaling Challenges | Significant Price Volatility, Major Bull and Bear Markets |

2017-2021 | SegWit, Lightning Network Development | Increased Transaction Capacity, Price Growth, Maturation |

2021-Present| Taproot Upgrade, Layer-2 Expansion | Improved Security & Efficiency, Ongoing Price Fluctuations, Increased Institutional Interest |

2025+ | Future Upgrades (e.g., improved privacy, smart contracts) | Potential for increased adoption and price appreciation, dependent on market conditions and technological success |

“`

This table illustrates the correlation between technological advancements in Bitcoin and its price trajectory. It highlights that while technological improvements generally contribute to long-term price growth, short-term price fluctuations are influenced by various market factors.

Bitcoin’s Role in the Global Financial System: Bitcoin Target 2025

Bitcoin’s emergence has sparked significant debate regarding its potential to reshape the global financial landscape. Its decentralized nature and cryptographic security offer a compelling alternative to traditional financial systems, challenging established norms and prompting discussions about the future of money and finance. This section explores Bitcoin’s disruptive potential, its comparative advantages and disadvantages against other digital assets, and its multifaceted roles within the evolving financial ecosystem.

Bitcoin’s Potential to Disrupt Traditional Financial Systems

Bitcoin’s decentralized architecture directly challenges the centralized control of traditional financial institutions. Banks and other intermediaries are bypassed, reducing transaction fees and processing times. This disintermediation empowers individuals and businesses, offering greater financial autonomy and potentially reducing reliance on institutions perceived as opaque or unreliable. For example, international remittances, often burdened by high fees and lengthy processing times, could be significantly streamlined using Bitcoin, offering a more efficient and cost-effective solution for migrants sending money home. The potential for increased financial inclusion, particularly in underserved regions with limited access to traditional banking services, is also a significant factor. However, it’s crucial to acknowledge the challenges related to regulatory uncertainty, volatility, and scalability that need to be addressed for widespread adoption.

Comparison with Other Cryptocurrencies and Digital Assets

Bitcoin, while the first and most well-known cryptocurrency, is not alone. A vast ecosystem of alternative cryptocurrencies and digital assets exists, each with its own unique features and functionalities. Unlike Bitcoin’s focus on decentralization and a fixed supply, some altcoins prioritize scalability, smart contract functionality (like Ethereum), or enhanced privacy features (like Monero). Stablecoins, pegged to fiat currencies like the US dollar, aim to mitigate Bitcoin’s volatility, offering a more stable alternative for everyday transactions. The differences in technology, design, and intended use cases make a direct comparison complex, but understanding these nuances is critical for appreciating Bitcoin’s unique position within this broader landscape. For instance, Ethereum’s smart contract capabilities allow for the creation of decentralized applications (dApps), a functionality currently not directly integrated into Bitcoin.

Bitcoin as a Store of Value, Medium of Exchange, and Unit of Account

Bitcoin’s role in the global financial system is multifaceted. Its limited supply of 21 million coins has led some to view it as a store of value, similar to gold, hedging against inflation and economic uncertainty. However, its high volatility makes its suitability as a reliable store of value debatable. As a medium of exchange, Bitcoin faces challenges due to its price fluctuations and limited merchant acceptance. While some businesses accept Bitcoin, its widespread adoption as a means of payment remains limited. Finally, Bitcoin’s role as a unit of account is even more nascent. While prices can be denominated in Bitcoin, its volatility makes it an unreliable unit of account for widespread economic transactions. The lack of stable price makes it less suitable for setting prices and accounting for transactions in the same way that stable currencies are used.

Potential Use Cases for Bitcoin

Bitcoin’s potential applications extend beyond simple transactions. Its unique properties offer several compelling use cases across various sectors.

The potential for increased financial inclusion, particularly in underserved regions with limited access to traditional banking services, is also a significant factor.

- Finance: Cross-border payments, micro-financing, decentralized finance (DeFi) applications.

- Supply Chain: Tracking goods and verifying authenticity through blockchain technology.

- Gaming: In-game assets and transactions, providing secure and transparent ownership.

- Real Estate: Fractional ownership and secure title transfer.

These are just a few examples of how Bitcoin’s underlying technology can be leveraged to create innovative solutions and potentially disrupt established practices in various industries. The future development and adoption of Bitcoin will depend on technological advancements, regulatory clarity, and the overall acceptance by individuals and institutions.

Risks and Opportunities Associated with Bitcoin Investment

Investing in Bitcoin presents a unique blend of substantial risks and potentially significant rewards. Its decentralized nature and volatile price movements make it a high-risk, high-reward asset unlike traditional investments. Understanding these inherent risks and developing appropriate mitigation strategies is crucial for any investor considering exposure to Bitcoin.

Key Risks Associated with Bitcoin Investment

Bitcoin’s price is notoriously volatile, experiencing dramatic swings in short periods. This volatility stems from factors including market sentiment, regulatory changes, and technological developments. For example, the price of Bitcoin plummeted significantly in 2022, demonstrating the potential for substantial losses. Regulatory uncertainty poses another significant risk. Governments worldwide are still grappling with how to regulate cryptocurrencies, leading to potential restrictions on trading, taxation, or even outright bans. This uncertainty can create unpredictable market conditions. Furthermore, security risks, such as hacking of exchanges or individual wallets, represent a considerable threat to Bitcoin investors. Losses from theft or fraud can be substantial and difficult to recover.

Strategies for Mitigating Bitcoin Investment Risks, Bitcoin Target 2025

Diversification is a fundamental risk management strategy. Instead of investing a significant portion of one’s portfolio in Bitcoin, investors should allocate only a small percentage they are comfortable potentially losing. Dollar-cost averaging, a strategy of investing a fixed amount of money at regular intervals, helps to mitigate the impact of price volatility. This reduces the risk of investing a large sum at a market peak. Thorough research and due diligence are also essential. Understanding the technology behind Bitcoin, the market forces affecting its price, and the regulatory landscape are crucial for making informed investment decisions. Finally, securing one’s Bitcoin holdings through the use of reputable hardware wallets and robust security practices is vital to minimizing the risk of theft or loss.

Potential Long-Term Growth Opportunities for Bitcoin

Despite the risks, Bitcoin’s potential for long-term growth remains a compelling factor for many investors. Its limited supply of 21 million coins creates inherent scarcity, potentially driving up its value over time, particularly as adoption increases. The growing adoption of Bitcoin as a store of value, a hedge against inflation, and a means of payment in certain sectors suggests a potential for continued growth. The increasing integration of Bitcoin into the global financial system, as evidenced by the growing number of companies accepting it as payment and institutional investors adding it to their portfolios, further strengthens its long-term growth prospects. For example, companies like MicroStrategy have made significant Bitcoin investments, demonstrating confidence in its long-term potential.

Advantages and Disadvantages of Investing in Bitcoin in 2025

Before investing in Bitcoin, carefully weigh the potential advantages and disadvantages:

- Advantages: Potential for high returns, decentralization and censorship resistance, growing adoption, scarcity, potential hedge against inflation.

- Disadvantages: High volatility, regulatory uncertainty, security risks, potential for complete loss of investment, complexity.

Frequently Asked Questions about Bitcoin in 2025

Predicting the future of Bitcoin is inherently speculative, but by analyzing current trends and historical data, we can attempt to answer some frequently asked questions about its potential trajectory in 2025. The following sections address key concerns regarding Bitcoin’s price, risks, regulation, and technological advancements.

Bitcoin’s Price Target of $100,000 by 2025

Reaching a price of $100,000 by 2025 is a significant target, dependent on several converging factors. Positive factors include increasing institutional adoption, growing global awareness, and the potential for further technological advancements enhancing Bitcoin’s scalability and efficiency. However, significant headwinds exist. These include regulatory uncertainty in various jurisdictions, potential macroeconomic instability impacting investor sentiment, and the inherent volatility associated with cryptocurrencies. The realization of $100,000 hinges on a sustained bull market fueled by positive news and broad market confidence, coupled with a lack of major negative events like a significant security breach or regulatory crackdown. Historical precedent shows that Bitcoin’s price has experienced dramatic fluctuations, making any prediction uncertain. For example, Bitcoin’s price surged to over $60,000 in late 2021 before experiencing a significant correction. Therefore, while $100,000 is possible, it’s not guaranteed and depends on a confluence of favorable conditions.

Major Risks of Investing in Bitcoin

Investing in Bitcoin carries substantial risks. Price volatility is a primary concern, with the potential for rapid and significant price swings. Market manipulation, though less prevalent with Bitcoin’s increasing maturity, remains a possibility. Regulatory uncertainty poses a significant threat, as changing government policies can dramatically impact Bitcoin’s value and accessibility. Security risks, such as hacking or loss of private keys, can lead to irreversible financial losses. Furthermore, Bitcoin’s decentralized nature means there’s limited recourse in case of fraud or theft. To mitigate these risks, investors should diversify their portfolios, only invest what they can afford to lose, and employ secure storage solutions for their Bitcoin holdings. Thorough due diligence and understanding of the technology are also crucial.

Regulation’s Impact on Bitcoin’s Price

Regulatory frameworks around the world are evolving rapidly, and their impact on Bitcoin’s price is substantial. Favorable regulations, such as clear guidelines for cryptocurrency exchanges and tax treatments, could boost investor confidence and drive up prices. Conversely, stringent regulations, including outright bans or excessive restrictions on trading and usage, could severely depress the price. The development of comprehensive and consistent regulatory frameworks across major economies is likely to be a key determinant of Bitcoin’s future price trajectory. For example, clear regulatory frameworks in countries like the US and the EU could lead to increased institutional investment, positively impacting the price, while inconsistent or overly restrictive policies in other regions could dampen growth. The evolving regulatory landscape is a significant uncertainty that investors need to closely monitor.

Key Technological Advancements Expected by 2025

Several technological advancements are expected to shape Bitcoin’s future by 2025. Layer-2 scaling solutions, such as the Lightning Network, aim to significantly increase transaction throughput and reduce fees, making Bitcoin more practical for everyday use. Taproot, a significant upgrade to Bitcoin’s scripting language, enhances privacy and efficiency. Other developments, such as improved wallet security and more user-friendly interfaces, will likely contribute to wider adoption. These advancements address some of Bitcoin’s current limitations, such as scalability and transaction speed, potentially driving increased adoption and price appreciation. However, the successful implementation and widespread adoption of these technologies are crucial for realizing their full potential.

Bitcoin Target 2025 – Predicting Bitcoin’s price is always challenging, and setting a Bitcoin Target for 2025 requires careful consideration of various factors. To understand potential price points, exploring resources like this article on What Will Bitcoin Cost In 2025 is helpful. Ultimately, any Bitcoin Target for 2025 remains speculative, depending heavily on market adoption and regulatory developments.

Speculating on Bitcoin’s target price for 2025 involves considering various factors, including technological advancements and overall market sentiment. For a diverse range of opinions and predictions, it’s helpful to consult online communities; you can find a wealth of discussion on this very topic at Bitcoin Prediction 2025 Reddit. Ultimately, reaching a definitive Bitcoin target for 2025 remains challenging, requiring careful consideration of multiple perspectives.

Predicting Bitcoin’s target for 2025 involves considering various factors, including technological advancements and regulatory changes. A key element in this prediction is understanding the potential price fluctuations, which can be explored further by checking out this insightful resource on Bitcoin Price In 2025. Ultimately, achieving the projected Bitcoin target for 2025 hinges on the interplay of these market dynamics and overall adoption rate.

Speculating on Bitcoin’s target for 2025 involves considering various factors, including adoption rates and technological advancements. To gain a clearer perspective on potential price movements, it’s helpful to consult resources like this one providing the Latest Bitcoin Price Prediction 2025 , which can inform projections for the Bitcoin target in 2025. Ultimately, reaching any specific Bitcoin target depends on a confluence of market forces and unforeseen events.

Speculation around Bitcoin’s target price for 2025 is rife, with various analysts offering differing predictions. Understanding these diverse outlooks requires a broader understanding of the overall cryptocurrency market, which is why consulting resources like this Crypto Price Forecast 2025 report can be beneficial. Ultimately, the Bitcoin 2025 target hinges on numerous factors, making precise prediction challenging.