Analyzing Market Trends Affecting Bitcoin

Predicting Bitcoin’s price in 2025 requires a nuanced understanding of various market forces. Its value isn’t solely determined by technological advancements; macroeconomic conditions, regulatory landscapes, and comparisons to traditional assets all play significant roles. This analysis explores these key influences.

Global Economic Conditions and Bitcoin’s Price

Bitcoin’s price often exhibits an inverse correlation with traditional market volatility. During periods of economic uncertainty, such as inflation spikes or geopolitical instability, investors may seek refuge in Bitcoin, perceiving it as a hedge against inflation or a store of value outside traditional financial systems. Conversely, during periods of economic growth and stability, investors might shift their focus towards more established assets, potentially leading to a decrease in Bitcoin’s demand. For example, the 2020-2021 bull run coincided with increased global uncertainty surrounding the COVID-19 pandemic and government stimulus packages. Conversely, periods of increased interest rate hikes by central banks often lead to a sell-off in risk assets, including Bitcoin.

Bitcoin’s Performance Compared to Other Assets

Bitcoin’s performance is often contrasted with that of gold, a traditional safe haven asset, and stocks, representing equity markets. While gold’s value tends to be relatively stable and less volatile than Bitcoin, its growth potential is generally considered lower. Stocks, on the other hand, offer potentially higher returns but come with higher risk. Bitcoin’s volatility is significantly higher than both gold and the average stock market index, making it a more speculative investment. However, its potential for growth surpasses that of both in certain periods. Comparing its historical performance against the S&P 500 or the price of gold reveals periods of both outperformance and underperformance, highlighting the inherent risks and rewards associated with this cryptocurrency.

Regulatory Changes and Bitcoin Adoption

Government regulations significantly impact Bitcoin’s adoption and price. Stringent regulations can hinder accessibility and adoption, potentially suppressing price growth. Conversely, supportive or clear regulatory frameworks can foster confidence and increase institutional investment, leading to higher prices. The ongoing debate surrounding Bitcoin’s classification as a security or a commodity, varying across different jurisdictions, exemplifies this influence. Countries like El Salvador, which have embraced Bitcoin as legal tender, have seen a different trajectory in adoption and price perception compared to countries with stricter regulations or outright bans.

Technological Advancements and Bitcoin’s Future

Technological advancements within the Bitcoin ecosystem can influence its price. Improvements in scalability, transaction speed, and security, such as the Lightning Network, can enhance its usability and appeal, potentially driving up demand. Conversely, the emergence of competing cryptocurrencies with superior technology could negatively impact Bitcoin’s market share and price. The development of Layer-2 solutions and ongoing research into improving Bitcoin’s energy efficiency are key factors to consider.

Bitcoin Price Fluctuations: A Historical Comparison

| Year | Start Price (USD) | End Price (USD) | % Change |

|---|---|---|---|

| 2017 | 998 | 14,000 | +1300% |

| 2018 | 14,000 | 3,800 | -73% |

| 2019 | 3,800 | 7,200 | +90% |

| 2020 | 7,200 | 29,000 | +300% |

| 2021 | 29,000 | 47,000 | +62% |

| 2022 | 47,000 | 16,500 | -65% |

| 2023 (YTD) | 16,500 | [Current Price] | [Current % Change] |

Exploring Technological Advancements and Bitcoin

Bitcoin’s future is inextricably linked to technological advancements that address its inherent limitations and unlock its full potential. Several key areas are driving innovation and shaping the trajectory of this cryptocurrency. These improvements focus on enhancing transaction speed, reducing fees, and bolstering security.

Layer-2 scaling solutions are crucial for improving Bitcoin’s scalability. The current base layer struggles to handle a large volume of transactions, resulting in congestion and high fees. These solutions process transactions off-chain, thereby relieving pressure on the main blockchain. This approach significantly improves transaction throughput and lowers costs.

Layer-2 Scaling Solutions and Bitcoin’s Transaction Speed and Fees

Layer-2 scaling solutions, such as the Lightning Network and the Liquid Network, aim to resolve Bitcoin’s scalability challenges. These networks operate on top of the Bitcoin blockchain, enabling faster and cheaper transactions. For example, the Lightning Network allows users to open payment channels, conduct numerous transactions within the channel, and then settle the net balance on the main blockchain only when necessary. This drastically reduces transaction fees and increases processing speed, making Bitcoin more suitable for everyday transactions. The Liquid Network, on the other hand, is a sidechain that offers faster confirmation times and improved privacy. Both examples showcase the significant improvements possible through off-chain scaling solutions.

The Lightning Network’s Impact on Bitcoin’s Usability

The Lightning Network (LN) is a particularly impactful layer-2 solution. Its implementation offers micropayment capabilities, enabling extremely small transactions that are otherwise impractical on the main Bitcoin blockchain due to high fees. This opens up numerous use cases, including point-of-sale payments, micro-donations, and subscription services. The LN’s increasing adoption rate and user-friendly interfaces are further enhancing Bitcoin’s usability, bringing it closer to becoming a widely accepted form of digital currency. Imagine a future where you can seamlessly pay for a cup of coffee using Bitcoin through a Lightning Network-enabled app – this is the vision that LN strives to achieve.

Taproot and Other Upgrades: Enhancing Bitcoin’s Security and Functionality

Taproot, activated in November 2021, is a significant upgrade to the Bitcoin protocol. It improves transaction privacy, reduces transaction sizes, and enhances the efficiency of smart contracts. By simplifying the structure of transactions, Taproot makes them less computationally expensive, thereby increasing transaction speed and lowering fees. Other upgrades, such as SegWit (Segregated Witness), have also played crucial roles in improving Bitcoin’s scalability and security. These upgrades represent ongoing efforts to continuously improve the Bitcoin network, ensuring its resilience and adaptability to evolving technological landscapes.

Potential Future Technological Developments

Several technological advancements could further enhance Bitcoin. Research into improved consensus mechanisms could potentially lead to faster block times and enhanced security. Furthermore, advancements in cryptography may improve transaction privacy and security even further. The exploration of interoperability with other blockchain networks could facilitate seamless transfer of value between different cryptocurrencies. These potential developments underscore the dynamic and evolving nature of Bitcoin’s technological landscape, highlighting its potential for future growth and adaptation.

Assessing Adoption and Institutional Investment

Bitcoin’s future trajectory hinges significantly on its adoption rate and the level of institutional investment it attracts. Understanding the global landscape of Bitcoin adoption and the influence of large-scale investors is crucial for predicting its potential value in 2025. This section will examine these key factors, analyzing their impact on Bitcoin’s price and liquidity.

Bitcoin adoption varies considerably across different geographic regions. While some countries have embraced cryptocurrency wholeheartedly, others maintain a more cautious or even hostile stance. This disparity significantly influences the overall growth and market capitalization of Bitcoin.

Bitcoin Adoption Across Countries and Regions

Several factors contribute to the varying levels of Bitcoin adoption globally. Regulatory frameworks play a crucial role; countries with clear, supportive regulations often see higher adoption rates. Conversely, nations with restrictive or unclear laws tend to witness lower levels of Bitcoin usage. Economic conditions also influence adoption; in regions experiencing high inflation or economic instability, Bitcoin can be seen as a hedge against currency devaluation, leading to increased adoption. Finally, technological access and digital literacy play a critical role; areas with limited internet access or lower levels of digital literacy may have lower Bitcoin adoption rates. For example, El Salvador’s national adoption of Bitcoin as legal tender stands in stark contrast to the more restrictive approaches taken by many European nations. The United States, while exhibiting significant institutional interest, has a fragmented regulatory landscape impacting individual adoption.

Institutional Investors and Bitcoin’s Price

Institutional investors, including hedge funds, investment firms, and corporations, exert a considerable influence on Bitcoin’s price. Their large-scale investments can drive significant price increases, while mass sell-offs can trigger substantial market corrections. The entry of major players like MicroStrategy and Tesla into the Bitcoin market has demonstrably impacted its price, showcasing the power of institutional investment. These entities often employ sophisticated trading strategies, influencing market sentiment and liquidity. Their decisions are often based on macroeconomic factors, regulatory changes, and technological advancements, making them key drivers of Bitcoin’s price volatility.

Impact of Bitcoin ETFs and Investment Vehicles

The introduction of Bitcoin exchange-traded funds (ETFs) and other investment vehicles has the potential to significantly increase market liquidity and accessibility. ETFs allow investors to gain exposure to Bitcoin through traditional brokerage accounts, lowering the barrier to entry for a wider range of investors. Increased liquidity leads to greater price stability and reduces the potential for extreme price swings. The approval of a Bitcoin ETF in a major market like the United States is anticipated to have a substantial, positive impact on Bitcoin’s price and adoption. This would represent a significant step towards mainstream acceptance and institutional legitimacy.

Potential for Increased Mainstream Adoption in 2025

Several factors suggest a potential for increased mainstream adoption of Bitcoin by 2025. Continued technological advancements, such as the development of the Lightning Network, are improving Bitcoin’s scalability and transaction speed, making it more user-friendly for everyday transactions. Growing regulatory clarity in key markets is also expected to foster greater confidence among investors and consumers. Furthermore, increased media coverage and public awareness are contributing to a more positive perception of Bitcoin, paving the way for broader acceptance. However, challenges remain, including volatility, scalability limitations, and ongoing regulatory uncertainty in various jurisdictions. The level of mainstream adoption in 2025 will likely depend on the interplay of these factors. For instance, if regulatory clarity increases significantly in major global markets, alongside continued technological improvements, mainstream adoption could surge beyond current levels.

Addressing Potential Risks and Challenges: Chatgpt Bitcoin Prediction 2025

Investing in Bitcoin, while potentially lucrative, carries inherent risks that potential investors must carefully consider. Understanding these risks is crucial for making informed decisions and managing expectations. The volatile nature of the cryptocurrency market, coupled with evolving regulatory landscapes and environmental concerns, presents a complex picture that requires thorough analysis.

Bitcoin Volatility and Security Breaches, Chatgpt Bitcoin Prediction 2025

Bitcoin’s price is notoriously volatile, experiencing significant fluctuations in short periods. This volatility stems from various factors, including market sentiment, regulatory announcements, technological developments, and macroeconomic conditions. For example, the price of Bitcoin dropped dramatically in 2022, highlighting the potential for substantial losses. Furthermore, the decentralized nature of Bitcoin, while a strength, also makes it susceptible to security breaches. Exchanges holding large amounts of Bitcoin have been targeted by hackers in the past, resulting in significant losses for users. Robust security measures, including strong passwords and two-factor authentication, are essential for mitigating this risk.

Regulatory Hurdles and Their Impact

Government regulations play a significant role in shaping the future of Bitcoin. Different countries have adopted varying approaches, ranging from outright bans to comprehensive regulatory frameworks. Uncertainty regarding future regulations can create volatility and hinder wider adoption. For instance, the differing regulatory stances of the US and China have historically influenced Bitcoin’s price. The lack of a globally unified regulatory approach adds complexity and risk for investors. Changes in regulatory landscapes can significantly impact Bitcoin’s price and accessibility.

Environmental Concerns of Bitcoin Mining

Bitcoin mining, the process of verifying and adding transactions to the blockchain, requires substantial computing power, leading to significant energy consumption. This energy consumption raises environmental concerns, particularly regarding greenhouse gas emissions. While some mining operations utilize renewable energy sources, a large portion relies on fossil fuels, contributing to carbon emissions. The environmental impact of Bitcoin mining is a growing area of concern and is subject to ongoing debate and technological advancements aimed at improving energy efficiency. For example, the transition to proof-of-stake consensus mechanisms in some cryptocurrencies is presented as a more energy-efficient alternative.

Comparison of Bitcoin Risks with Traditional Investments

Compared to traditional investments like stocks and bonds, Bitcoin carries a higher degree of risk. Stocks and bonds, while subject to market fluctuations, generally offer more established regulatory frameworks and investor protections. Diversification within a portfolio of traditional assets can help mitigate risk, whereas Bitcoin’s high volatility makes it a riskier asset to hold on its own. However, Bitcoin also offers the potential for higher returns than traditional investments, attracting investors seeking higher risk, higher reward opportunities. The decision to invest in Bitcoin versus traditional assets depends on individual risk tolerance and investment goals.

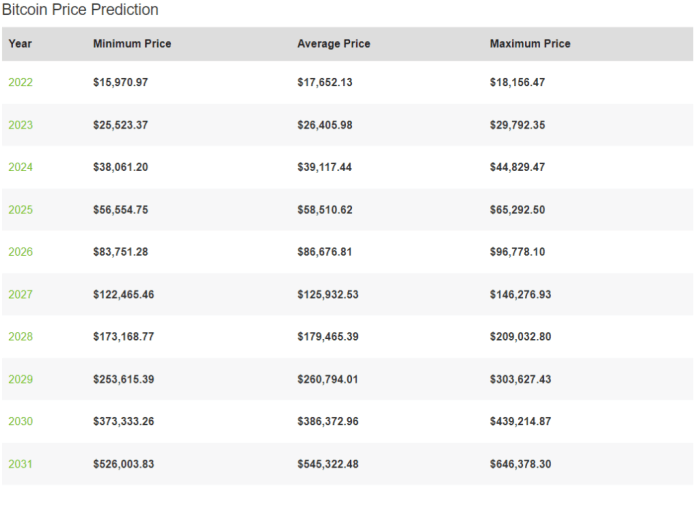

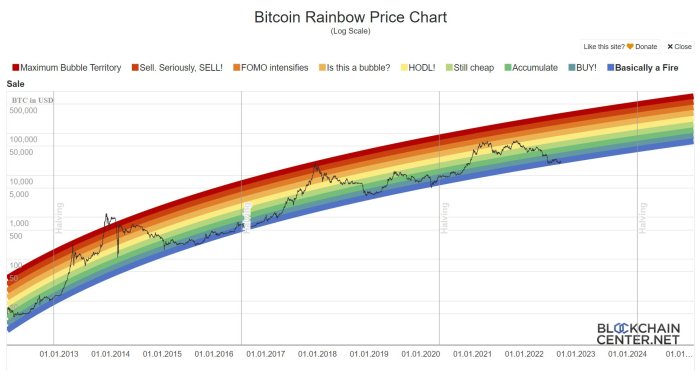

Potential Bitcoin Price Scenarios for 2025

Predicting Bitcoin’s price is inherently speculative, dependent on a complex interplay of factors including regulatory changes, technological advancements, macroeconomic conditions, and market sentiment. The following scenarios represent plausible, yet not definitive, price trajectories for Bitcoin in 2025, based on the analysis of market trends, technological developments, and adoption rates discussed previously. It’s crucial to remember that these are just possibilities, and the actual price could deviate significantly.

Bullish Scenario: Bitcoin Surges to New Highs

This scenario envisions a significantly bullish market for Bitcoin by 2025. Several factors contribute to this possibility. Widespread institutional adoption, coupled with increasing regulatory clarity in key markets, could drive substantial demand. Further technological advancements, such as the maturation of the Lightning Network, could enhance Bitcoin’s scalability and usability, attracting a wider range of users. Positive macroeconomic conditions, such as sustained economic growth or a flight to safety during periods of uncertainty, could also boost Bitcoin’s appeal as a store of value. This scenario anticipates a substantial increase in Bitcoin’s price, driven by a confluence of positive factors. For example, if these positive conditions were to prevail, Bitcoin could potentially reach price ranges similar to the peak of the previous bull market, adjusted for inflation and considering further growth. This could translate to a price significantly above $100,000, perhaps even exceeding $150,000.

Bearish Scenario: Bitcoin Faces Significant Price Correction

Conversely, a bearish scenario involves several potential headwinds that could significantly impact Bitcoin’s price. Increased regulatory scrutiny, leading to stricter regulations or even outright bans in some jurisdictions, could dampen investor enthusiasm and limit market growth. A prolonged period of macroeconomic instability, such as a global recession or a prolonged crypto winter, could lead to widespread selling pressure and a significant price decline. Furthermore, the emergence of competing cryptocurrencies with superior technological features or broader adoption could divert investment away from Bitcoin. In this scenario, Bitcoin’s price could experience a considerable correction, potentially falling below its current price, perhaps even dipping to levels seen in previous bear markets, adjusted for inflation. A price range below $20,000 is a possibility under this pessimistic outlook.

Neutral Scenario: Bitcoin Consolidates and Experiences Moderate Growth

This scenario represents a more moderate outlook, anticipating neither a dramatic surge nor a significant correction. Bitcoin’s price could experience periods of consolidation, with relatively stable price movements punctuated by smaller fluctuations. This scenario assumes a balance between positive and negative factors. While some regulatory clarity and institutional adoption might occur, they may not be sufficient to trigger a major bull run. Similarly, macroeconomic conditions might remain relatively stable, neither significantly boosting nor hindering Bitcoin’s growth. Technological advancements would continue, but their impact on price might be less dramatic than in the bullish scenario. Under this neutral scenario, Bitcoin’s price in 2025 might remain within a relatively narrow range, potentially fluctuating between $30,000 and $60,000.

Potential Bitcoin Price Ranges for 2025

| Scenario | Price Range (USD) | Justification Summary |

|---|---|---|

| Bullish | >$100,000 (potentially exceeding $150,000) | High institutional adoption, regulatory clarity, technological advancements, positive macroeconomic conditions. |

| Bearish | <$20,000 | Increased regulatory scrutiny, macroeconomic instability, competition from other cryptocurrencies. |

| Neutral | $30,000 – $60,000 | Balanced positive and negative factors; moderate growth and consolidation. |

Frequently Asked Questions (FAQ)

This section addresses common queries regarding Bitcoin’s price, investment risks, and comparative analysis with other investment options. Understanding these aspects is crucial for making informed decisions.

Main Factors Influencing Bitcoin’s Price

Bitcoin’s price is a complex interplay of various factors. Supply and demand dynamics are fundamental, with increased demand driving prices upward and vice versa. Regulatory announcements and government policies significantly impact investor sentiment and market volatility. Technological advancements, such as upgrades to the Bitcoin network or the emergence of competing cryptocurrencies, can also influence price. Furthermore, macroeconomic conditions, including inflation rates and overall market sentiment, play a crucial role. News events, both positive and negative, related to Bitcoin or the broader cryptocurrency market, can cause significant short-term price fluctuations. Finally, the actions of large institutional investors and whales (individuals or entities holding significant Bitcoin amounts) can exert considerable influence on price movements. For example, a large institutional purchase can create a buying frenzy, while a significant sell-off can trigger a market downturn.

Accuracy of Bitcoin Price Prediction

Accurately predicting Bitcoin’s price is exceptionally challenging due to its inherent volatility and the multitude of interacting factors. Unlike traditional assets with established valuation models, Bitcoin’s price is driven by speculative demand, technological developments, and regulatory uncertainty. Predictive models often rely on historical data, which may not accurately reflect future market behavior. External events, such as geopolitical instability or unexpected technological breakthroughs, can dramatically alter price trajectories. Even sophisticated algorithms and quantitative analysis struggle to account for the unpredictable nature of human behavior and market sentiment, making precise price predictions unreliable. While analysts may offer price forecasts, these should be viewed as educated guesses rather than guaranteed outcomes. For example, many analysts predicted a price surge in 2021, but the market experienced significant corrections later in the year.

Risks Associated with Investing in Bitcoin

Investing in Bitcoin carries substantial risks. Its high volatility means prices can fluctuate dramatically in short periods, leading to significant losses. The cryptocurrency market is relatively young and lacks the regulatory oversight and investor protections of traditional markets. This increases the risk of scams, fraud, and hacking. Bitcoin’s price is susceptible to manipulation by large investors or coordinated market activity. Technological vulnerabilities in the Bitcoin network, while rare, could have serious consequences. Finally, the regulatory landscape surrounding Bitcoin is constantly evolving, and changes in government policies can have a significant impact on its price and legality. For example, China’s ban on cryptocurrency trading in 2021 caused a significant price drop.

Comparison of Bitcoin with Other Investment Options

Bitcoin differs significantly from traditional investment options like stocks, bonds, and real estate. It offers the potential for higher returns but also carries substantially higher risk. Unlike stocks, which represent ownership in a company, Bitcoin has no intrinsic value tied to underlying assets or earnings. Its value is entirely driven by market demand and speculation. Compared to bonds, Bitcoin offers no guaranteed returns or fixed income. Real estate investments typically provide more stable returns and tangible assets, whereas Bitcoin’s value is entirely digital. Diversification is key; Bitcoin should be considered as part of a broader investment portfolio, rather than a sole investment strategy. Its inclusion depends on an investor’s risk tolerance and financial goals. For instance, a young investor with a higher risk tolerance might allocate a small percentage of their portfolio to Bitcoin, while a more risk-averse investor might choose to avoid it altogether.

Chatgpt Bitcoin Prediction 2025 – ChatGPT’s Bitcoin predictions for 2025 often vary depending on the input data, making it hard to pinpoint a single figure. However, comparing these AI-generated forecasts with established figures in the field provides valuable context. For a contrasting perspective, consider the insights offered by Michael Saylor’s Bitcoin price prediction for 2025, detailed in this insightful analysis: Michael Saylor Bitcoin Price Prediction 2025.

Ultimately, both ChatGPT’s projections and Saylor’s views contribute to a broader understanding of potential future Bitcoin valuations.

ChatGPT’s Bitcoin predictions for 2025 are varied, often referencing factors influencing price volatility. A key event to consider when analyzing these predictions is the Bitcoin Halving, scheduled for sometime in 2024; you can find precise details on the timing by checking this resource: Bitcoin Halving 2025 Wann. This halving significantly impacts Bitcoin’s inflation rate and subsequently influences ChatGPT’s overall price projections for 2025.

ChatGPT’s Bitcoin predictions for 2025 vary widely depending on the input data and model parameters used. To gain a broader perspective on potential price movements, it’s helpful to consult other analyses, such as those found on dedicated cryptocurrency prediction sites; for example, you can check out this detailed forecast: Bitcoin Price Usd Prediction 2025. Ultimately, comparing different predictions, including those generated by ChatGPT, provides a more well-rounded view when considering the future of Bitcoin.

ChatGPT’s Bitcoin predictions for 2025 are varied, often focusing on factors influencing price volatility. A key event impacting these predictions is the Bitcoin halving, which significantly alters the rate of new Bitcoin creation. To understand the timeline and potential impact, it’s crucial to know precisely when this halving will occur; you can find that information here: When Is Halving Bitcoin 2025.

Ultimately, the halving’s timing directly influences ChatGPT’s overall 2025 Bitcoin price forecast.

ChatGPT’s Bitcoin predictions for 2025 are varied, often focusing on factors influencing price volatility. A key event impacting these predictions is the Bitcoin halving, which significantly alters the rate of new Bitcoin creation. To understand the timeline and potential impact, it’s crucial to know precisely when this halving will occur; you can find that information here: When Is Halving Bitcoin 2025.

Ultimately, the halving’s timing directly influences ChatGPT’s overall 2025 Bitcoin price forecast.

ChatGPT’s Bitcoin predictions for 2025 are varied, often focusing on factors influencing price volatility. A key event impacting these predictions is the Bitcoin halving, which significantly alters the rate of new Bitcoin creation. To understand the timeline and potential impact, it’s crucial to know precisely when this halving will occur; you can find that information here: When Is Halving Bitcoin 2025.

Ultimately, the halving’s timing directly influences ChatGPT’s overall 2025 Bitcoin price forecast.

ChatGPT’s Bitcoin predictions for 2025 are varied, often focusing on factors influencing price volatility. A key event impacting these predictions is the Bitcoin halving, which significantly alters the rate of new Bitcoin creation. To understand the timeline and potential impact, it’s crucial to know precisely when this halving will occur; you can find that information here: When Is Halving Bitcoin 2025.

Ultimately, the halving’s timing directly influences ChatGPT’s overall 2025 Bitcoin price forecast.