Long-Term Outlook for Bitcoin after the 2025 Halving: Cmc Bitcoin Halving 2025

The 2025 Bitcoin halving, reducing the rate of new Bitcoin creation by half, is a significant event with potentially profound long-term implications for the cryptocurrency’s price and market position. While predicting future price movements with certainty is impossible, analyzing historical trends and considering potential future factors allows for a reasoned outlook on Bitcoin’s trajectory.

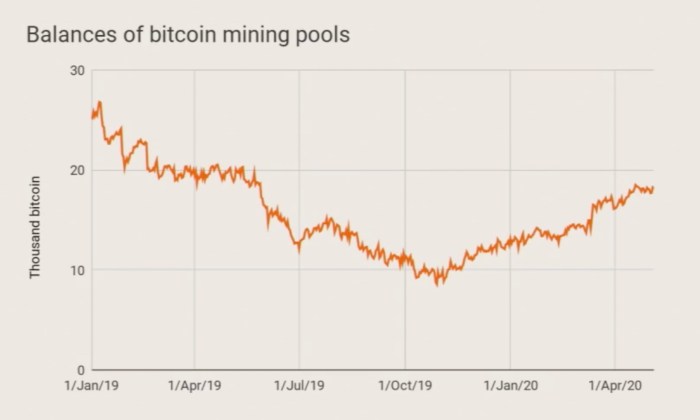

The halving historically has been correlated with periods of increased Bitcoin price appreciation, primarily due to the reduced supply coupled with persistent demand. This dynamic, however, is not guaranteed to repeat identically. Other factors, such as macroeconomic conditions, regulatory developments, and technological advancements, will significantly influence Bitcoin’s price and adoption rate.

Bitcoin’s Price and Market Position

Following previous halvings, Bitcoin’s price has generally experienced a period of growth, though the timing and magnitude of these increases have varied considerably. The 2012 and 2016 halvings were followed by significant bull runs, but the market landscape and overall economic context differed significantly from the current environment. For example, the 2020 halving coincided with a period of increasing institutional interest and a broader shift toward digital assets, leading to substantial price appreciation. However, the subsequent year witnessed a significant market correction, highlighting the complex interplay of factors influencing Bitcoin’s price. Projecting a specific price target after the 2025 halving is speculative, but a sustained period of price growth, driven by scarcity and increasing demand, remains a plausible scenario. The actual price will depend on a confluence of factors including global economic stability, regulatory clarity, and the overall sentiment within the cryptocurrency market.

Bitcoin’s Mainstream Adoption

The long-term prospects for Bitcoin’s mainstream adoption hinge on several key factors. Increased regulatory clarity and the development of user-friendly infrastructure are crucial. Widespread acceptance by institutional investors and the integration of Bitcoin into traditional financial systems are also key indicators of broader adoption. The evolution of Bitcoin’s Lightning Network and other layer-two scaling solutions could significantly enhance transaction speed and reduce fees, making it more practical for everyday transactions. Increased merchant adoption and the development of innovative applications built on the Bitcoin blockchain will also play a crucial role in its broader acceptance as a medium of exchange and a store of value. However, challenges remain, including volatility, scalability concerns, and the environmental impact of Bitcoin mining. Addressing these challenges effectively will be essential for fostering wider mainstream acceptance.

Technological Advancements and Bitcoin’s Future

Technological advancements have the potential to significantly shape Bitcoin’s long-term prospects. Improvements in mining efficiency and the development of more sustainable energy sources for mining operations could mitigate environmental concerns. The ongoing development of layer-two scaling solutions like the Lightning Network aims to address scalability issues and enhance transaction speed and efficiency. Furthermore, research into privacy-enhancing technologies for Bitcoin could improve its usability and appeal to a wider range of users. However, it’s important to note that any significant changes to the Bitcoin protocol must be carefully considered and implemented to maintain the integrity and security of the network. The balance between innovation and preserving Bitcoin’s core principles will be a critical factor in its future evolution.

FAQ

This section addresses frequently asked questions regarding the upcoming CoinMarketCap (CMC) Bitcoin halving in 2025. Understanding this event is crucial for anyone invested in or interested in the cryptocurrency market. The halving is a significant programmed event within Bitcoin’s protocol, and its impact is widely debated.

The Bitcoin Halving and its Importance

The Bitcoin halving is a programmed event that occurs approximately every four years. It reduces the rate at which new Bitcoins are created and added to the circulating supply by half. This is a fundamental part of Bitcoin’s design, intended to control inflation and maintain scarcity. The halving is important because it fundamentally alters the dynamics of Bitcoin’s supply and demand, potentially influencing its price. The reduction in newly minted coins directly impacts the rate of inflation, making Bitcoin potentially more valuable over time due to its decreasing supply.

The Bitcoin Halving’s Effect on Bitcoin’s Price

Historically, Bitcoin’s price has experienced periods of significant growth following previous halvings. This is largely attributed to the reduced supply combined with persistent demand. However, it’s crucial to remember that price is influenced by numerous factors beyond the halving, including regulatory changes, market sentiment, and macroeconomic conditions. The price increase isn’t guaranteed, and past performance is not indicative of future results. For example, the 2012 halving was followed by a substantial price increase, while the 2016 halving saw a more gradual rise. The 2020 halving saw a significant price surge, though this was followed by a correction.

Predictions for Bitcoin’s Price After the 2025 Halving

Predicting Bitcoin’s price after the 2025 halving is inherently speculative. Numerous analysts offer diverse predictions, ranging from modest increases to substantial price surges. These predictions are based on various models and assumptions, which may not always accurately reflect the complexities of the cryptocurrency market. For instance, some analysts use historical price data and on-chain metrics to project future price movements, while others incorporate macroeconomic factors and investor sentiment into their forecasts. Ultimately, no one can definitively predict the future price of Bitcoin.

Risks Associated with Investing in Bitcoin Around the Halving, Cmc Bitcoin Halving 2025

Investing in Bitcoin, especially around a halving event, carries inherent risks. The cryptocurrency market is highly volatile, and prices can fluctuate significantly in short periods. The hype surrounding a halving can lead to inflated expectations, potentially creating a bubble that bursts once the event has passed. Furthermore, regulatory uncertainty and potential security breaches remain significant risks. Diversification of investments and a thorough understanding of the risks involved are essential before investing in Bitcoin.

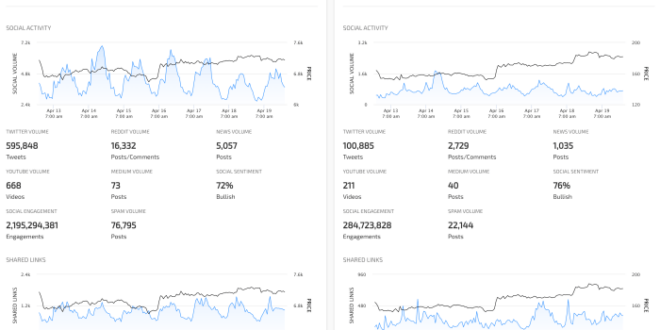

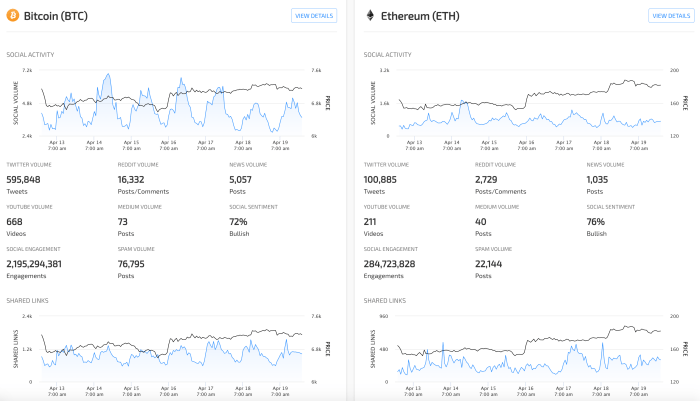

Using CoinMarketCap to Track Bitcoin’s Price Performance

CoinMarketCap (CMC) is a widely used platform providing real-time data on various cryptocurrencies, including Bitcoin. Users can track Bitcoin’s price, trading volume, and market capitalization on CMC’s website or mobile app. CMC offers historical price charts, allowing users to analyze past performance and identify trends. The platform also provides other relevant information, such as circulating supply and dominance within the cryptocurrency market. By regularly checking CMC, investors can monitor Bitcoin’s price and make informed decisions based on up-to-date information.

Illustrative Example

Understanding Bitcoin’s price movements is complex, influenced by numerous factors beyond the halving event. However, a visual representation can help illustrate potential price fluctuations before, during, and after the 2025 halving. This example aims to provide a conceptual framework, not a precise prediction.

This visual representation would take the form of a line graph. The x-axis would represent time, spanning several years, including the period leading up to, encompassing, and extending beyond the 2025 Bitcoin halving. The y-axis would represent the Bitcoin price in US dollars, using a logarithmic scale to better visualize the large price swings typical of Bitcoin.

Bitcoin Price Fluctuation Graph

The graph would show a general upward trend in Bitcoin’s price over the long term, reflecting the overall adoption and scarcity of Bitcoin. However, the line would not be smooth. Before the halving, we might see a period of relative price stability or even a slight downturn, as anticipation builds but uncertainty remains. This period could be depicted as a relatively flat section of the line, perhaps with some minor oscillations. As the halving approaches, the line would likely show increasing volatility, with potentially sharper upward and downward movements reflecting the heightened speculation and trading activity. The halving itself could be marked by a distinct point on the graph.

Immediately following the halving, the graph could depict a period of significant price increase, potentially exceeding the pre-halving price, driven by the reduced supply of newly mined Bitcoin. However, this increase would likely not be linear; instead, it would probably exhibit a series of peaks and troughs, reflecting market sentiment and external factors. After an initial surge, the graph might show a period of consolidation or even a correction, before resuming a generally upward trend, though the rate of increase might slow down compared to the immediate post-halving period. The long-term trend would, however, remain positive, reflecting the continued growth of the cryptocurrency market and the increasing scarcity of Bitcoin. This long-term trend could be visualized as a gradual upward slope extending beyond the initial post-halving volatility. The overall shape would resemble a series of upward-sloping waves, with varying degrees of amplitude reflecting the market’s fluctuating response to the halving event and other external factors. Importantly, this graph should not be interpreted as a prediction, but rather a visual representation of potential price behavior based on historical trends. Previous halvings have shown similar patterns of volatility and subsequent price increases, though the magnitude and timing of these movements can vary significantly.

Cmc Bitcoin Halving 2025 – CoinMarketCap’s (CMC) projections for the Bitcoin halving in 2025 are eagerly anticipated by investors. Understanding the potential impact requires a thorough analysis of the event’s historical precedent and predicted consequences, which you can find detailed information on at Halving 2025 Bitcoin. Ultimately, CMC’s Bitcoin Halving 2025 predictions will likely influence market sentiment leading up to and following the event.

The upcoming CMC Bitcoin Halving in 2025 is a significant event for the cryptocurrency market, expected to impact Bitcoin’s price and mining dynamics. Understanding the precise date is crucial for strategic planning, and you can find detailed information about the specific day on this helpful resource: Bitcoin Halving 2025 Day. Returning to the CMC data, we can anticipate further analysis of the halving’s effects on Bitcoin’s market capitalization and trading volume in the months following the event.

The upcoming CMC Bitcoin Halving in 2025 is a significant event for the cryptocurrency market, expected to impact Bitcoin’s price and mining dynamics. Understanding the precise timing is crucial, and to clarify this, you might find the answer to the question “When Was Bitcoin Halving 2025” helpful by checking this resource: When Was Bitcoin Halving 2025. Knowing the exact date allows for better prediction of the CMC Bitcoin Halving 2025 effects on the broader crypto landscape.

The upcoming CMC Bitcoin Halving in 2025 is a significant event for the cryptocurrency market, expected to impact Bitcoin’s price and mining dynamics. Precise timing is crucial for investors, and to understand the predictions surrounding this event, it’s helpful to consult resources like this one: When Is Bitcoin Halving 2025 Prediction. Understanding these predictions helps better prepare for the potential market shifts associated with the CMC Bitcoin Halving 2025.

The upcoming CMC Bitcoin halving in 2025 is a significant event for the cryptocurrency market, expected to impact Bitcoin’s price and mining dynamics. It’s interesting to compare this to the concurrent halving of another cryptocurrency; for context, you might find information on the Bitcoin Cash Halving 2025 useful. Understanding both events helps provide a broader perspective on the potential market shifts surrounding these halvings and their impact on the overall cryptocurrency landscape.

The upcoming CMC Bitcoin Halving in 2025 is a significant event for the cryptocurrency market, impacting Bitcoin’s inflation rate and potentially its price. To stay informed about the precise timeframe leading up to this event, it’s helpful to utilize a reliable countdown clock, such as the one provided here: Bitcoin Halving 2025 Countdown Clock. Keeping track of this countdown is crucial for anyone interested in understanding the CMC Bitcoin Halving 2025’s implications.